This version of the form is not currently in use and is provided for reference only. Download this version of

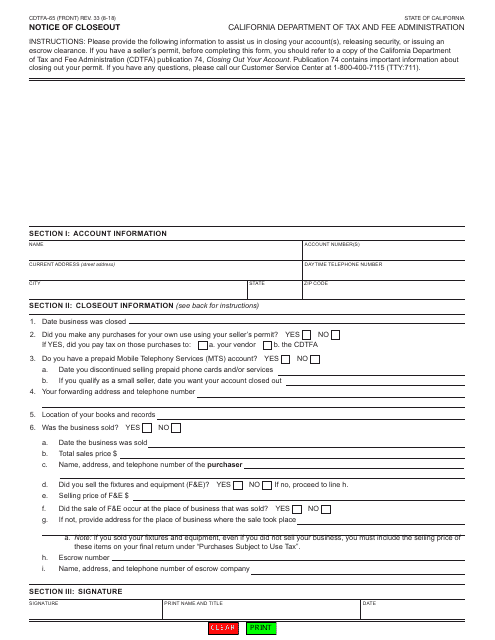

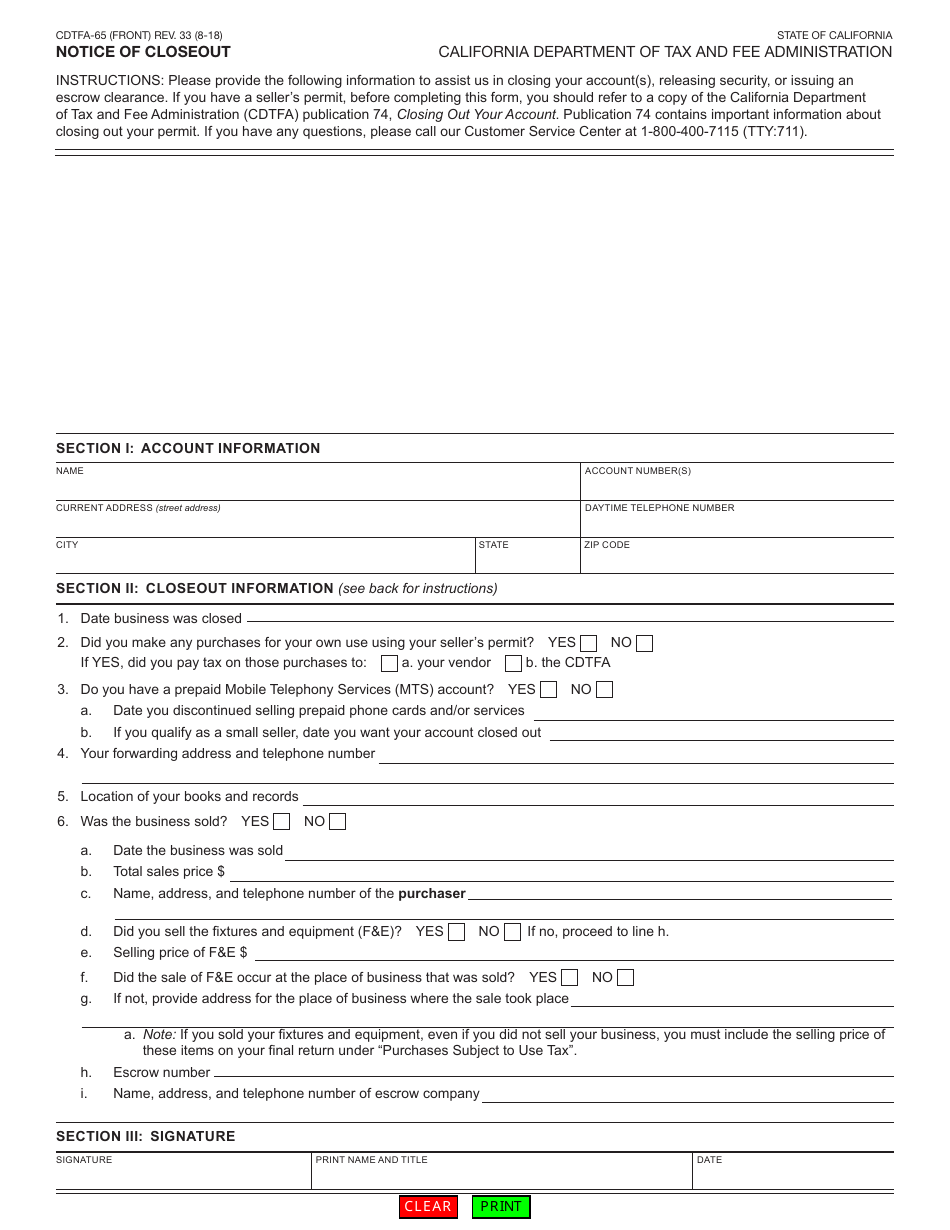

Form CDTFA-65

for the current year.

Form CDTFA-65 Notice of Closeout - California

What Is Form CDTFA-65?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

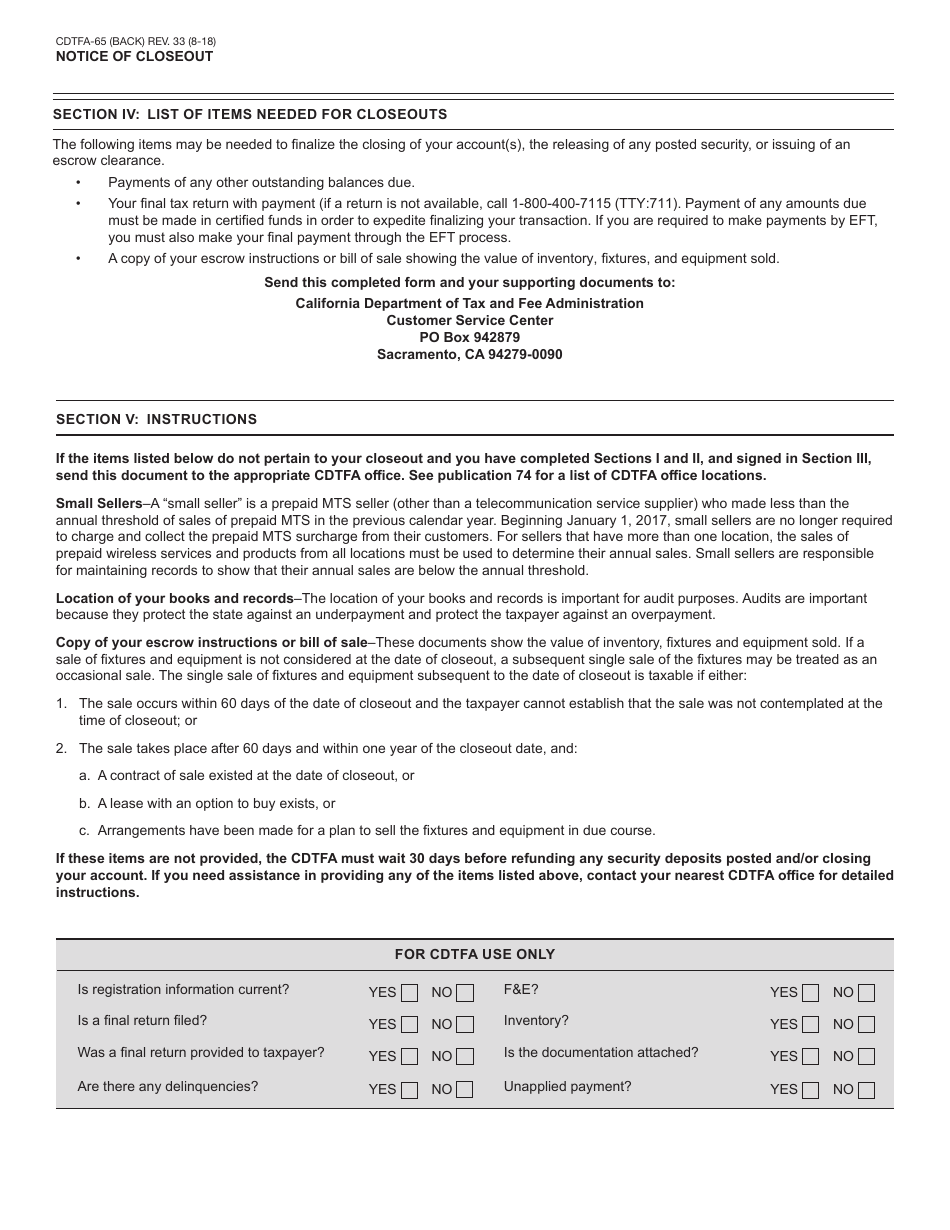

Q: What is Form CDTFA-65 Notice of Closeout?

A: Form CDTFA-65 Notice of Closeout is a document used in California to notify the California Department of Tax and Fee Administration (CDTFA) of the closure of a business.

Q: When should I file Form CDTFA-65 Notice of Closeout?

A: Form CDTFA-65 should be filed within 30 days of the closure of your business.

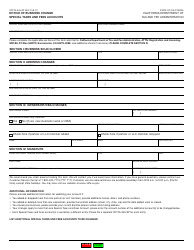

Q: What information is required on Form CDTFA-65?

A: Some of the information required on Form CDTFA-65 includes your business name, account number, closure date, reason for closure, and contact information.

Q: Are there any fees associated with filing Form CDTFA-65?

A: No, there are no fees associated with filing Form CDTFA-65.

Q: What should I do after filing Form CDTFA-65?

A: After filing Form CDTFA-65, you should ensure that all necessary taxes and fees are paid and any required final returns are filed.

Q: What if I need assistance with Form CDTFA-65?

A: If you need assistance with Form CDTFA-65, you can contact the California Department of Tax and Fee Administration for guidance.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-65 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.