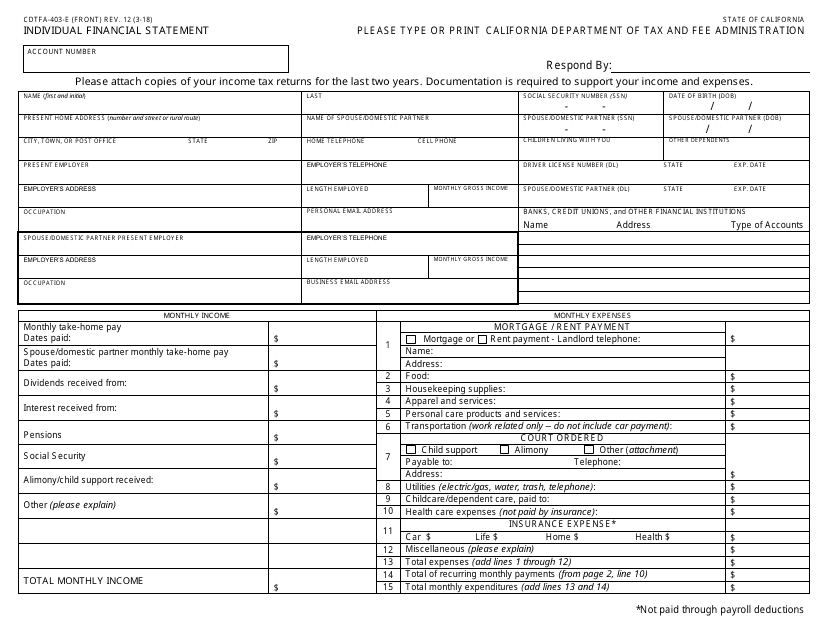

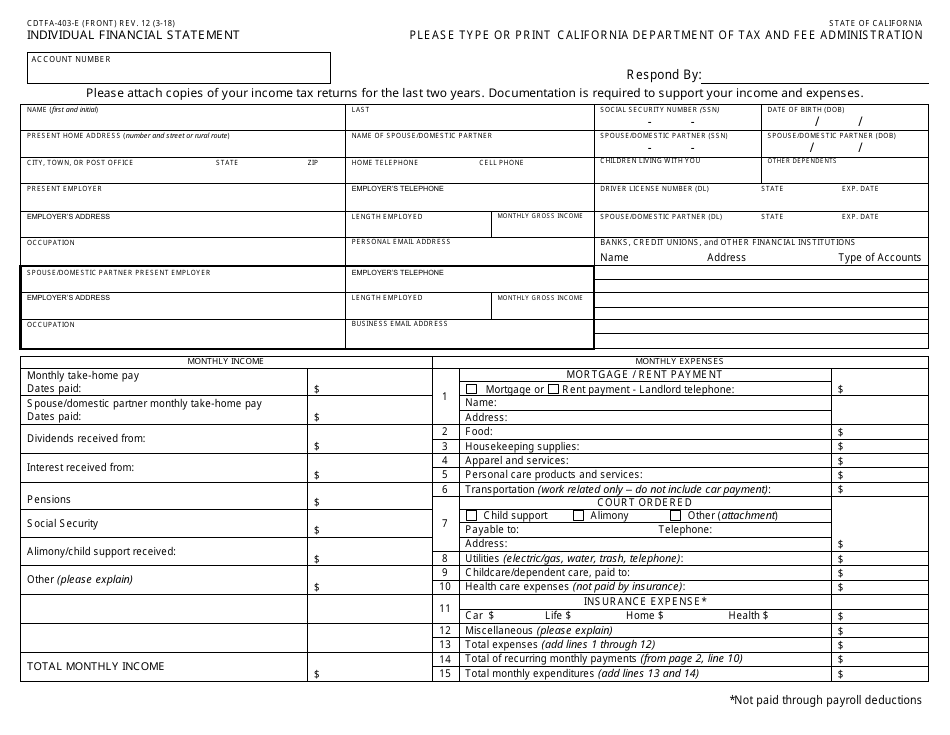

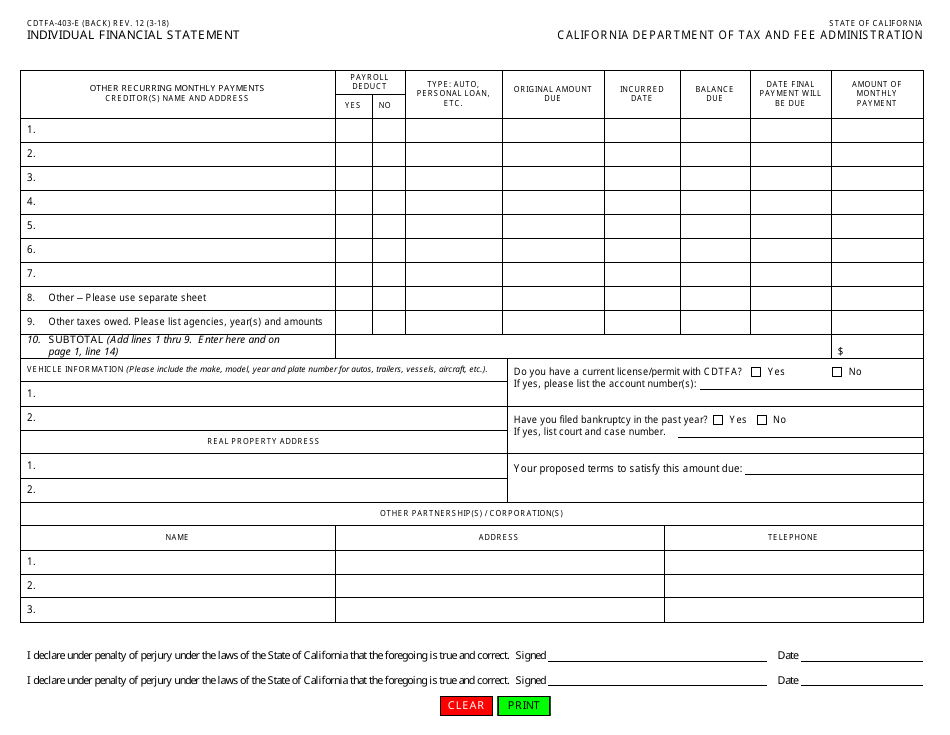

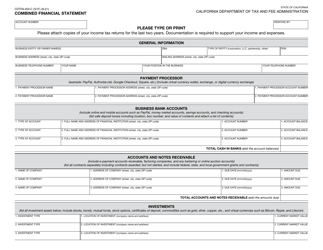

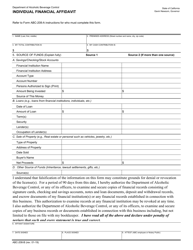

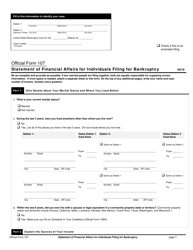

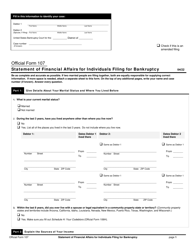

Form CDTFA-403-E Individual Financial Statement - California

What Is Form CDTFA-403-E?

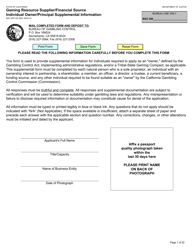

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-403-E?

A: Form CDTFA-403-E, Individual Financial Statement, is a document used in California to assess the financial position of individuals.

Q: Who needs to file Form CDTFA-403-E?

A: Form CDTFA-403-E must be filed by individuals who are applying for a California State Board of Equalization license or permit.

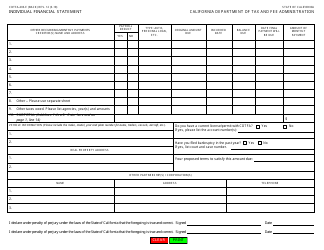

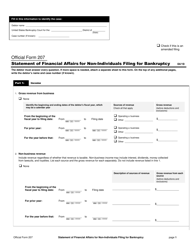

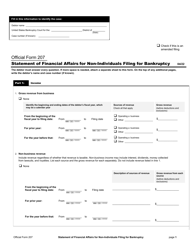

Q: What information is required on Form CDTFA-403-E?

A: Form CDTFA-403-E requires individuals to provide detailed financial information, including assets, liabilities, income, and expenses.

Q: Are there any fees for filing Form CDTFA-403-E?

A: No, there are no fees for filing Form CDTFA-403-E.

Q: When is the deadline to file Form CDTFA-403-E?

A: The deadline to file Form CDTFA-403-E is determined by the California State Board of Equalization.

Q: What happens if I don't file Form CDTFA-403-E?

A: Failure to file Form CDTFA-403-E may result in delays or denial of your application for a California State Board of Equalization license or permit.

Q: Is Form CDTFA-403-E confidential?

A: Yes, the information provided on Form CDTFA-403-E is confidential and protected by law.

Q: Can I amend Form CDTFA-403-E if I made a mistake?

A: Yes, you can amend Form CDTFA-403-E if you made a mistake by submitting a corrected form to the California Department of Tax and Fee Administration (CDTFA).

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-403-E by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.