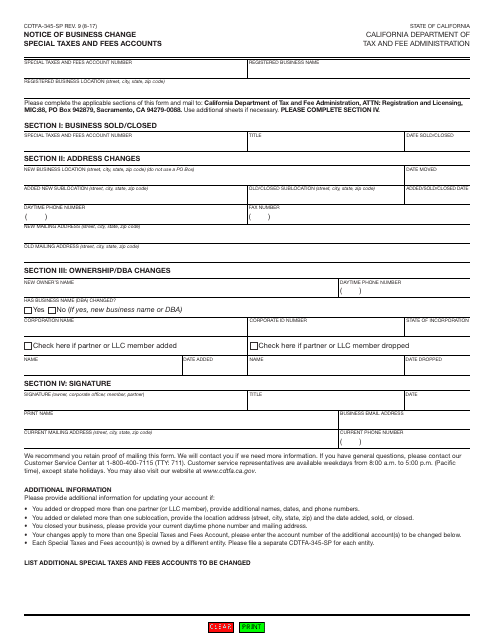

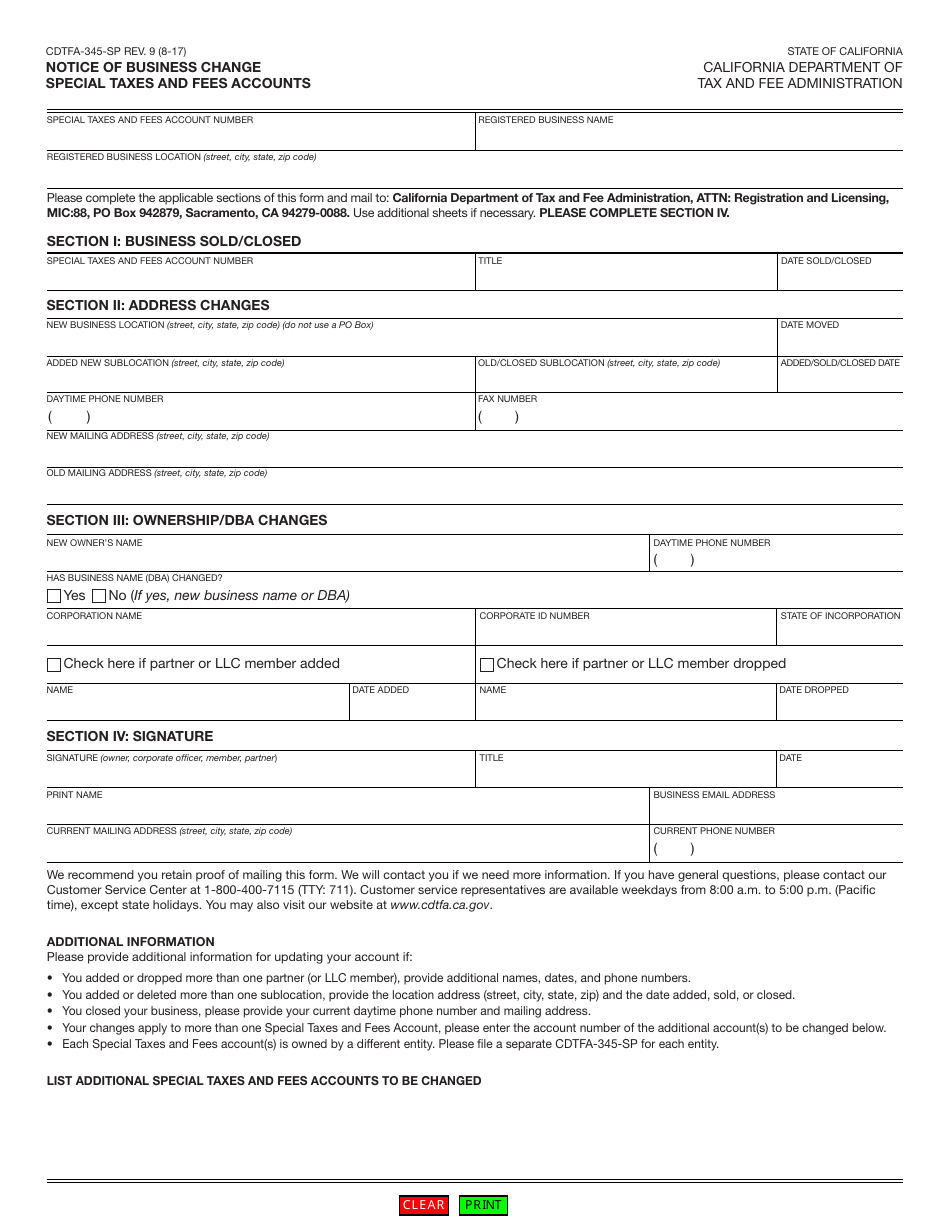

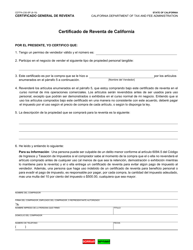

Form CDTFA-345-SP Notice of Business Change - Special Taxes and Fees Accounts - California

What Is Form CDTFA-345-SP?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form CDTFA-345-SP?

A: Form CDTFA-345-SP is a notice of business change for special taxes and fees accounts in California.

Q: What is the purpose of form CDTFA-345-SP?

A: The purpose of form CDTFA-345-SP is to notify the California Department of Tax and Fee Administration (CDTFA) about changes in a business's special taxes and fees account.

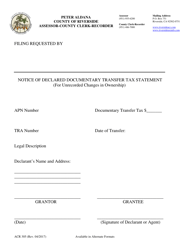

Q: Who needs to file form CDTFA-345-SP?

A: Businesses with special taxes and fees accounts in California need to file form CDTFA-345-SP when there are changes in their business.

Q: What changes should be reported using form CDTFA-345-SP?

A: Form CDTFA-345-SP should be used to report changes such as a change in business ownership, change in business address, or closure of the business.

Q: Are there any filing fees for form CDTFA-345-SP?

A: No, there are no filing fees for form CDTFA-345-SP.

Q: What is the deadline for filing form CDTFA-345-SP?

A: The deadline for filing form CDTFA-345-SP is within 30 days of the change in the business.

Q: What happens if I don't file form CDTFA-345-SP?

A: Failure to file form CDTFA-345-SP or providing false information can result in penalties or other legal consequences.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-345-SP by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.