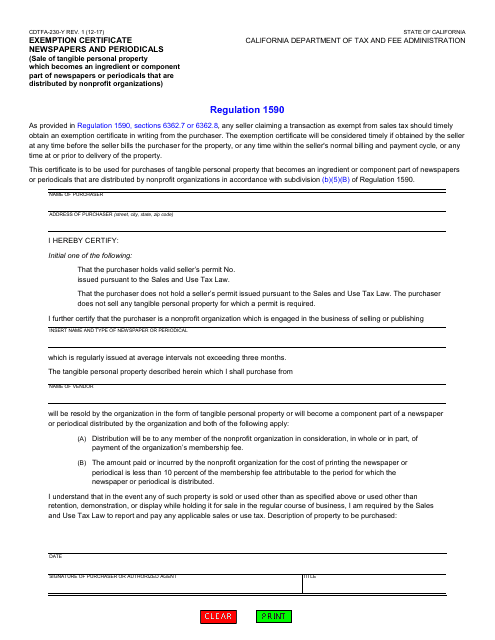

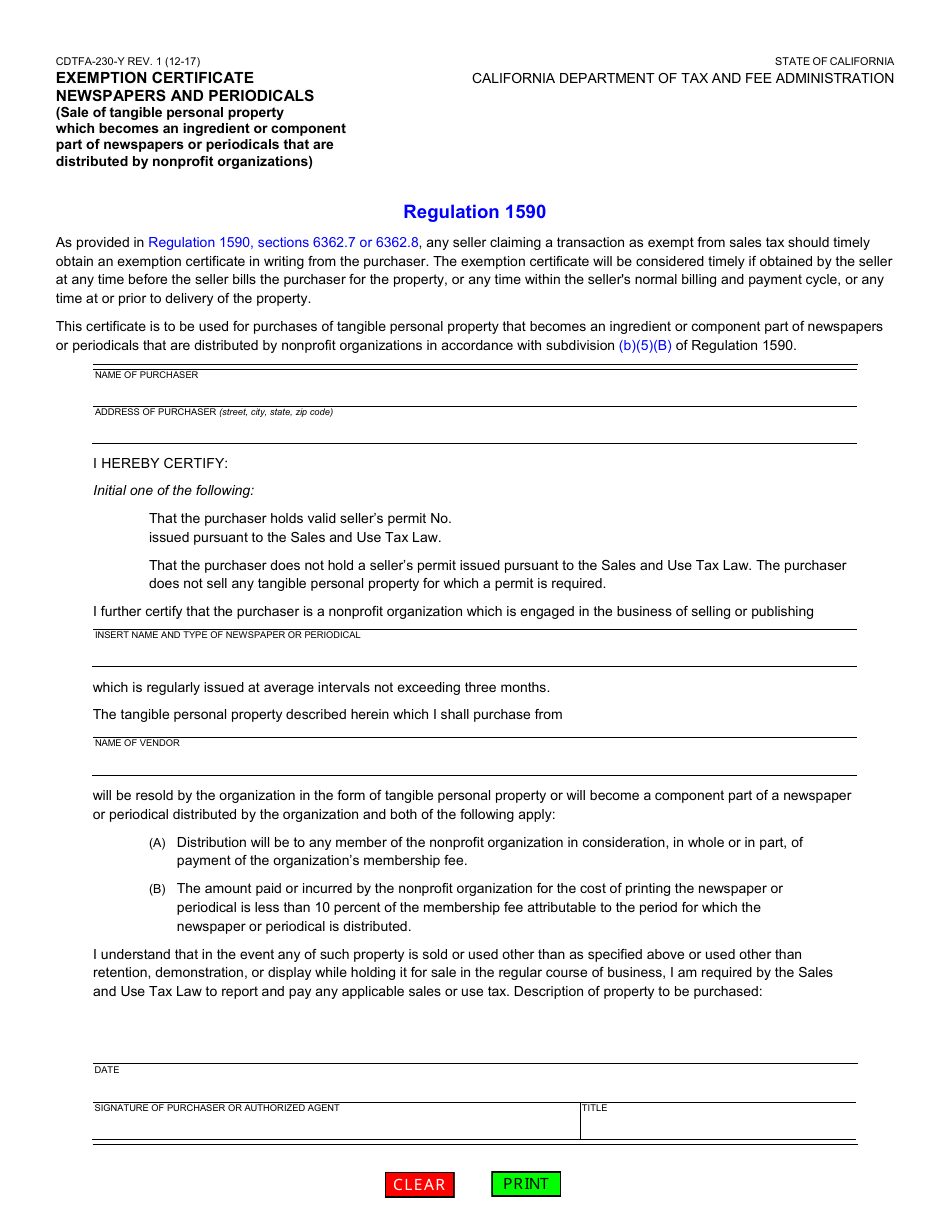

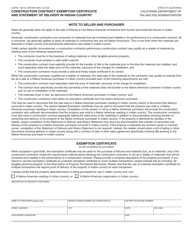

Form CDTFA-230-Y Exemption Certificate Newspapers and Periodicals (Sale of Tangible Personal Property Which Becomes an Ingredient or Component Part of Newspapers or Periodicals That Are Distributed by Nonprofit Organizations) - California

What Is Form CDTFA-230-Y?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-Y?

A: Form CDTFA-230-Y is an exemption certificate for the sale of tangible personal property that becomes an ingredient or component part of newspapers or periodicals distributed by nonprofit organizations in California.

Q: Who can use Form CDTFA-230-Y?

A: Nonprofit organizations in California can use Form CDTFA-230-Y if they are purchasing tangible personal property that will become an ingredient or component part of newspapers or periodicals they distribute.

Q: What is the purpose of Form CDTFA-230-Y?

A: The purpose of Form CDTFA-230-Y is to claim an exemption from sales tax on the purchase of tangible personal property used in the production of newspapers or periodicals distributed by nonprofit organizations.

Q: How can Form CDTFA-230-Y be used?

A: Form CDTFA-230-Y should be given to the seller when purchasing tangible personal property that will become an ingredient or component part of newspapers or periodicals. The seller will keep the form for their records.

Q: Are there any special requirements for using Form CDTFA-230-Y?

A: Yes, there are certain requirements that must be met in order to claim the exemption. These include being a nonprofit organization, distributing newspapers or periodicals, and using the purchased property as an ingredient or component part.

Q: What should I do if I have additional questions about Form CDTFA-230-Y?

A: If you have additional questions about Form CDTFA-230-Y, you can contact the California Department of Tax and Fee Administration (CDTFA) for assistance.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-Y by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.