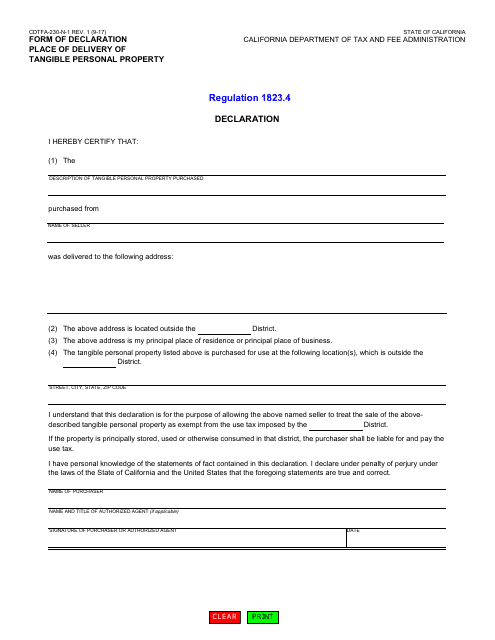

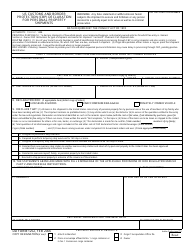

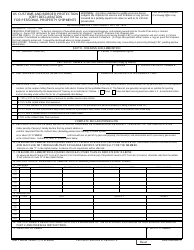

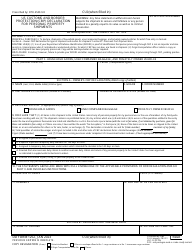

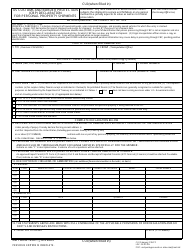

Form CDTFA-230-N-1 Form of Declaration - Place of Delivery of Tangible Personal Property - California

What Is Form CDTFA-230-N-1?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CDTFA-230-N-1 form?

A: CDTFA-230-N-1 is the Form of Declaration - Place of Delivery of Tangible Personal Property in California.

Q: What is the purpose of CDTFA-230-N-1 form?

A: The purpose of CDTFA-230-N-1 form is to declare the place of delivery of tangible personal property in California.

Q: Do I need to submit CDTFA-230-N-1 form?

A: You may need to submit CDTFA-230-N-1 form if you are engaged in the sale or lease of tangible personal property in California.

Q: Is CDTFA-230-N-1 form specific to California?

A: Yes, CDTFA-230-N-1 form is specific to California and is used to declare the place of delivery within the state.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-N-1 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.