This version of the form is not currently in use and is provided for reference only. Download this version of

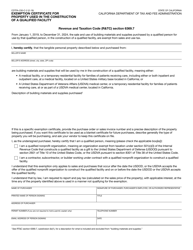

Form CDTFA-146-TSG

for the current year.

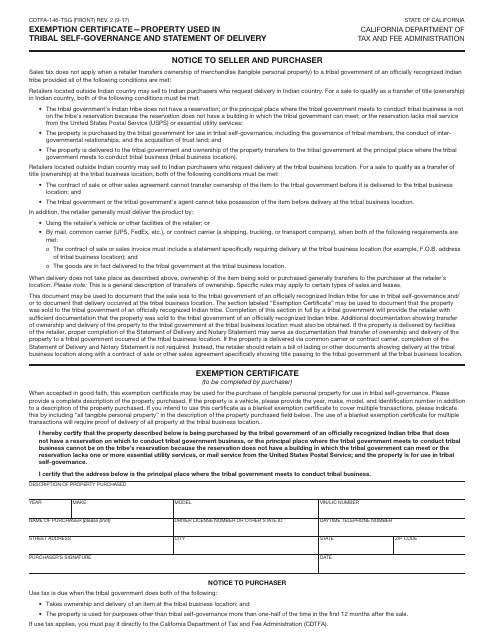

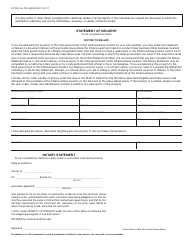

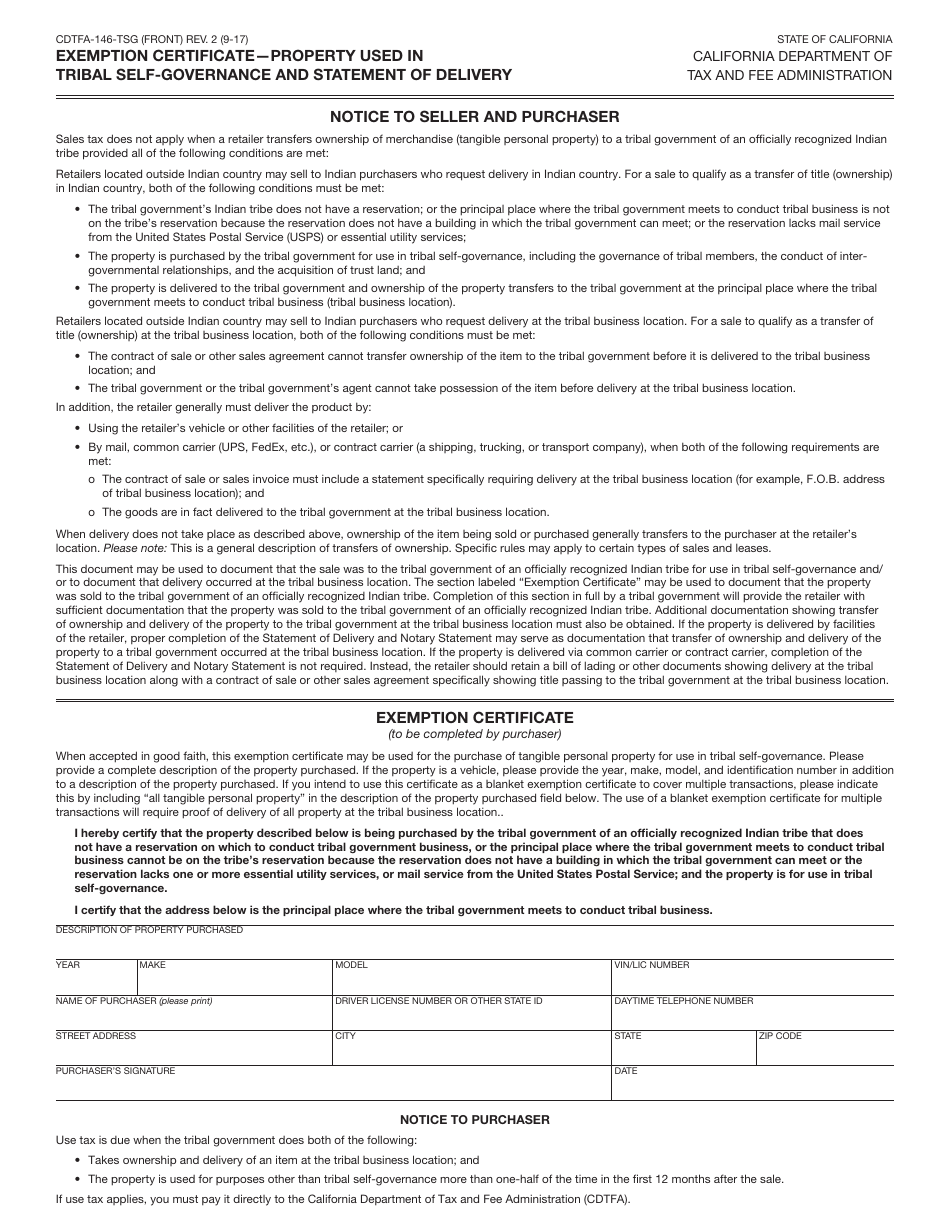

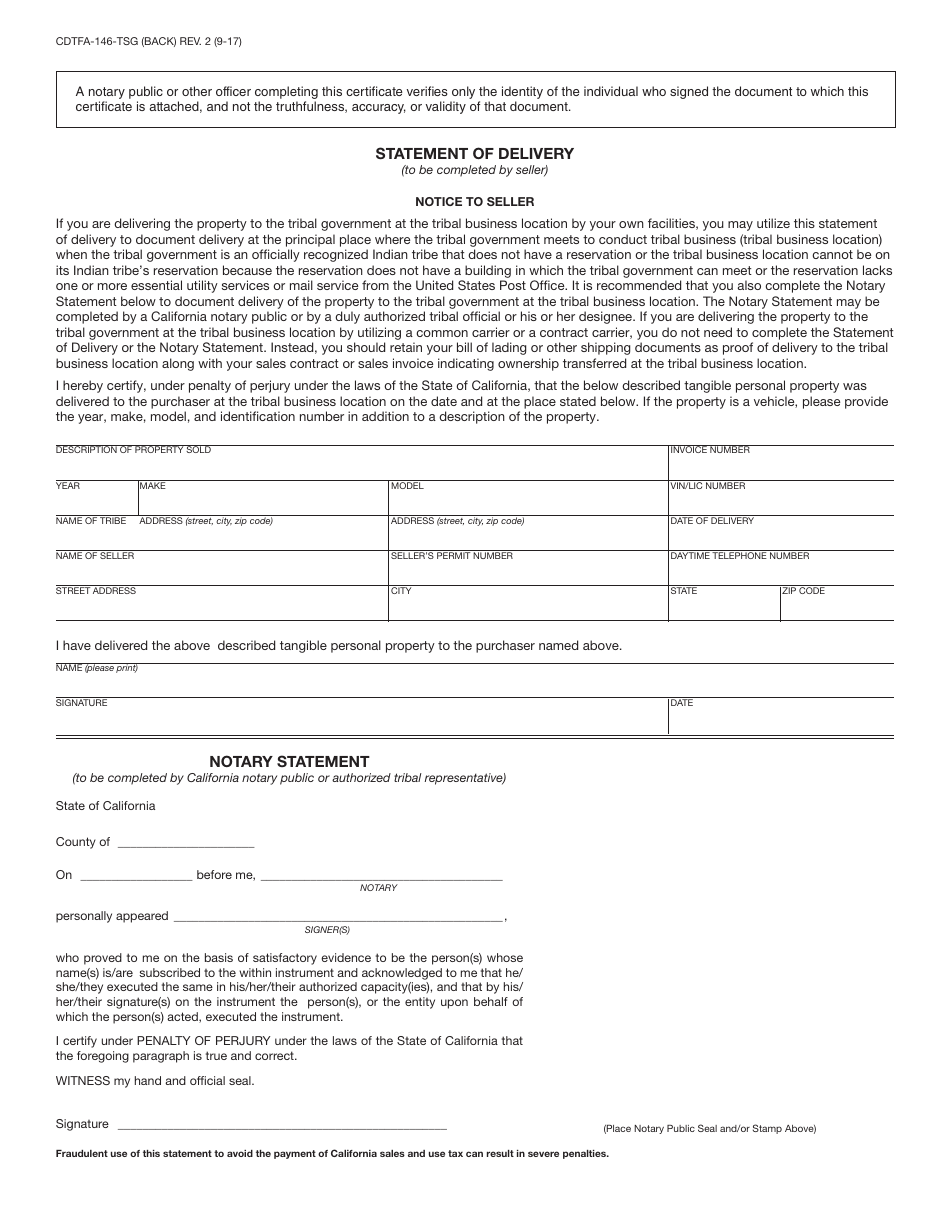

Form CDTFA-146-TSG Exemption Certificate - Property Used in Tribal Self-governance and Statement of Delivery - California

What Is Form CDTFA-146-TSG?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

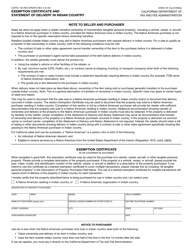

Q: What is Form CDTFA-146-TSG?

A: Form CDTFA-146-TSG is an exemption certificate for property used in tribal self-governance and statement of delivery.

Q: Who can use Form CDTFA-146-TSG?

A: This form can be used by individuals or businesses who are eligible for exemption from certain taxes on property used in tribal self-governance.

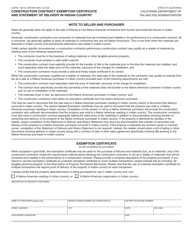

Q: What is tribal self-governance?

A: Tribal self-governance refers to the self-determination and self-management of tribal governments.

Q: What taxes are exempted by Form CDTFA-146-TSG?

A: This form exempts the possessory interest tax and state-assessed property tax.

Q: What is a possessory interest tax?

A: Possessory interest tax is a tax that is imposed on individuals or entities who possess or use government-owned property.

Q: What is state-assessed property tax?

A: State-assessed property tax is a tax on certain types of property that are assessed by the state rather than local governments.

Q: How is Form CDTFA-146-TSG used?

A: This form is used to certify the eligibility for tax exemption and to provide a statement of delivery for property used in tribal self-governance.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-146-TSG by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.