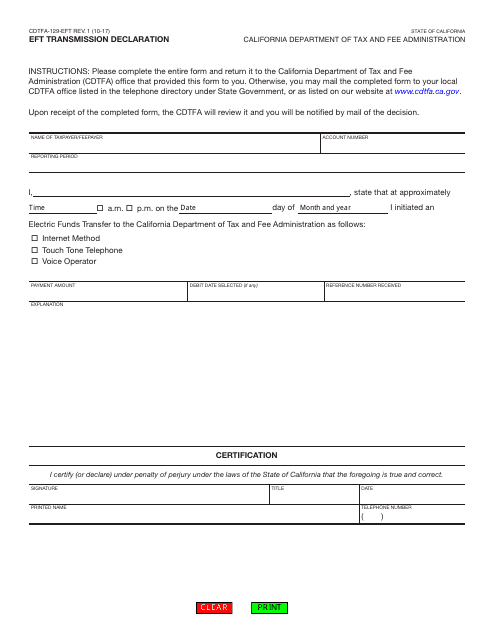

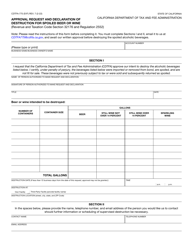

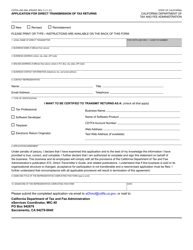

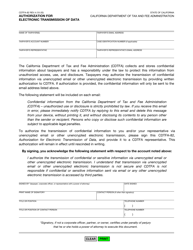

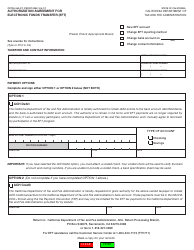

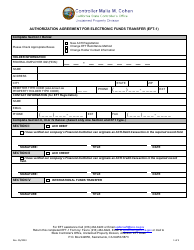

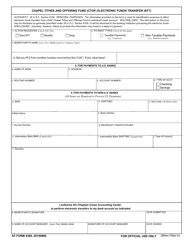

Form CDTFA-129-EFT Eft Transmission Declaration - California

What Is Form CDTFA-129-EFT?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-129-EFT?

A: Form CDTFA-129-EFT is a declaration form used for electronic funds transfer (EFT) transmission in California.

Q: Who uses Form CDTFA-129-EFT?

A: Businesses and individuals who need to transmit funds electronically to the California Department of Tax and Fee Administration (CDTFA) use Form CDTFA-129-EFT.

Q: What is the purpose of Form CDTFA-129-EFT?

A: The purpose of Form CDTFA-129-EFT is to provide the CDTFA with the necessary information for the electronic transfer of funds.

Q: How do I fill out Form CDTFA-129-EFT?

A: To fill out Form CDTFA-129-EFT, you will need to provide your taxpayer information, the payment amount, and the banking information for the EFT transfer.

Q: Is there a deadline for submitting Form CDTFA-129-EFT?

A: Yes, the deadline for submitting Form CDTFA-129-EFT is determined by the CDTFA and can vary depending on the tax or fee being paid.

Q: Are there any fees associated with using Form CDTFA-129-EFT?

A: There are no fees associated with using Form CDTFA-129-EFT for electronic funds transfer to the CDTFA.

Q: What should I do after submitting Form CDTFA-129-EFT?

A: After submitting Form CDTFA-129-EFT, it is recommended to keep a copy of the form and any accompanying documentation for your records.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-129-EFT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.