This version of the form is not currently in use and is provided for reference only. Download this version of

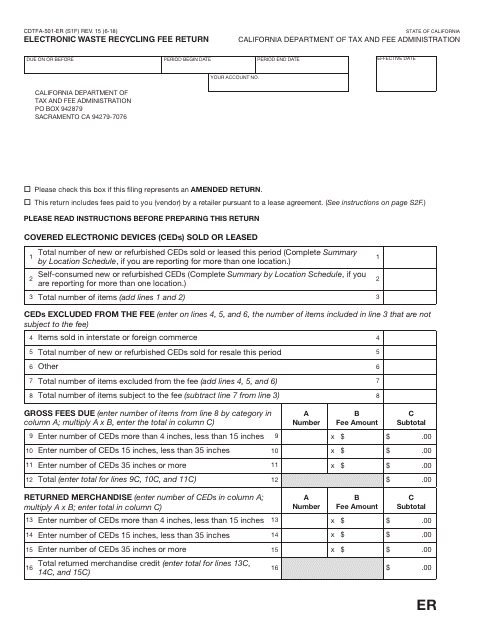

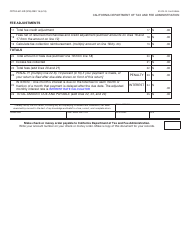

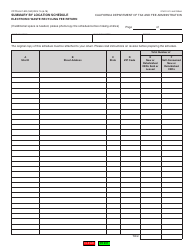

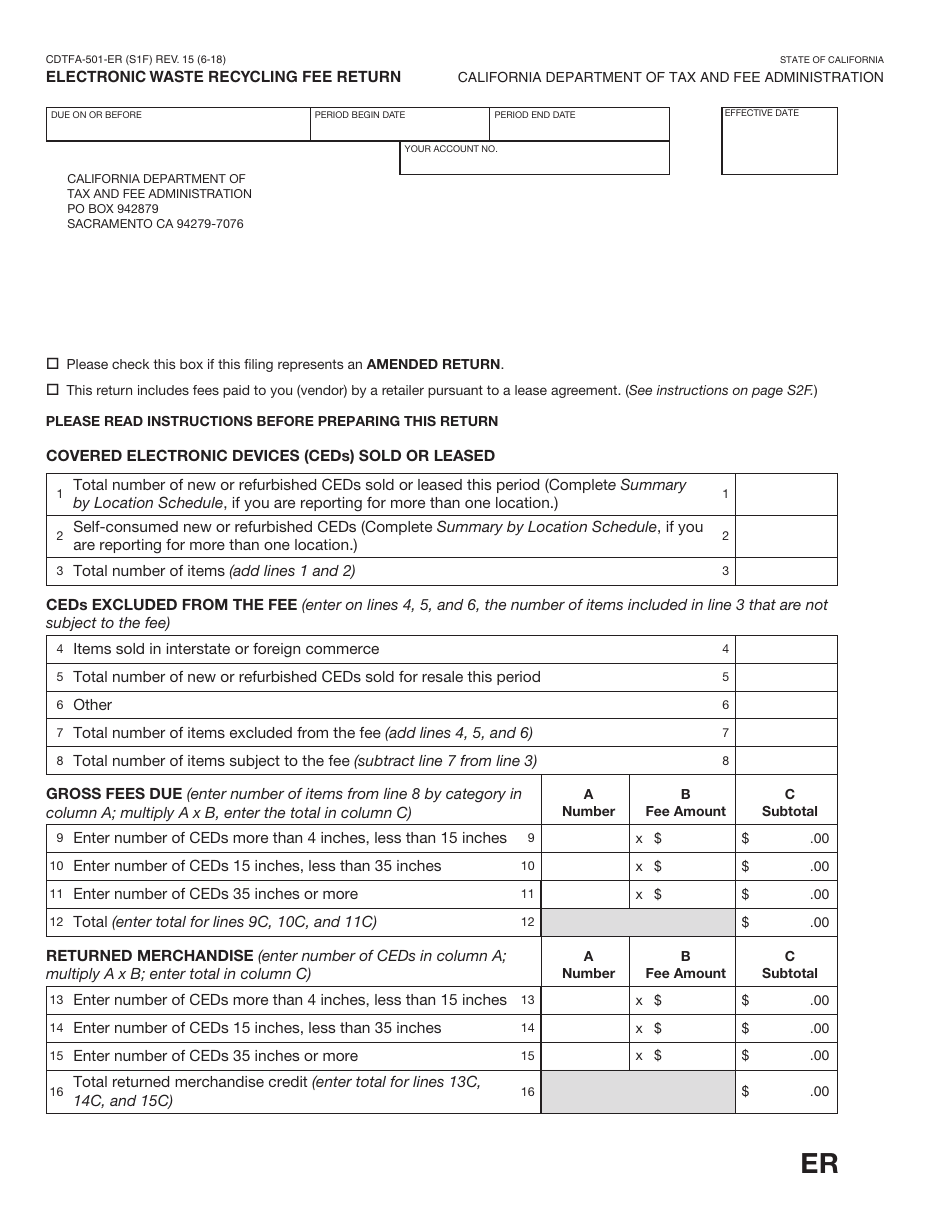

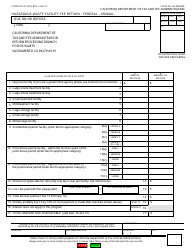

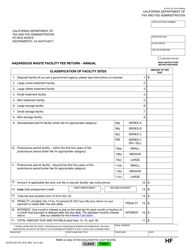

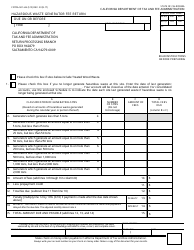

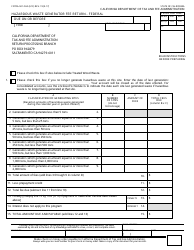

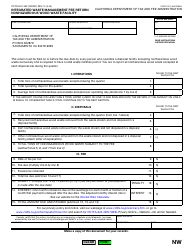

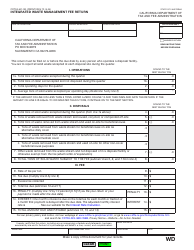

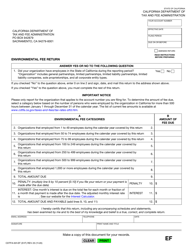

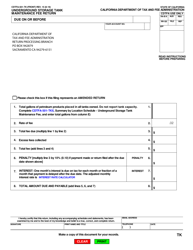

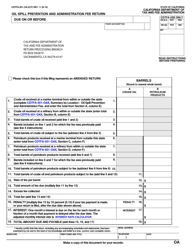

Form CDTFA-501-ER

for the current year.

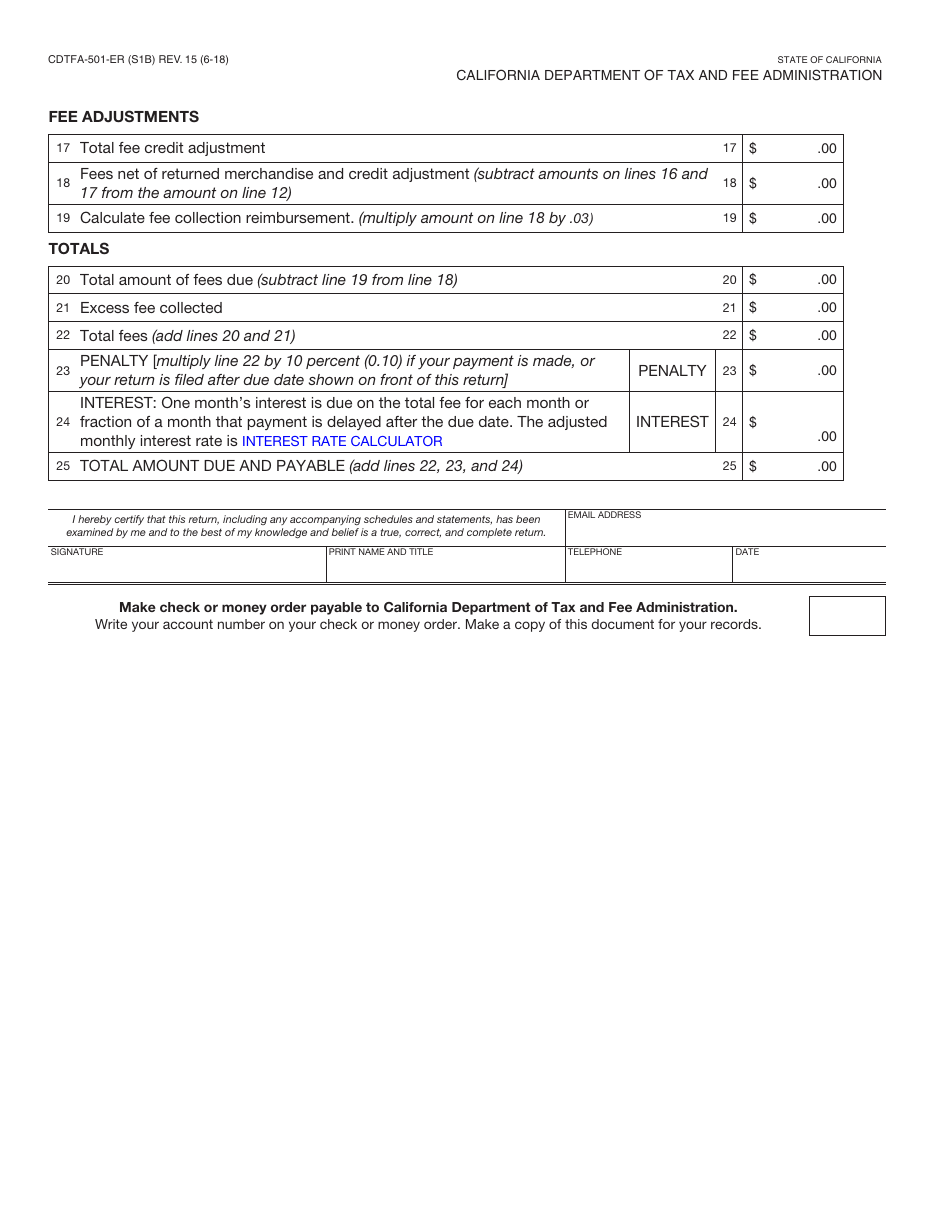

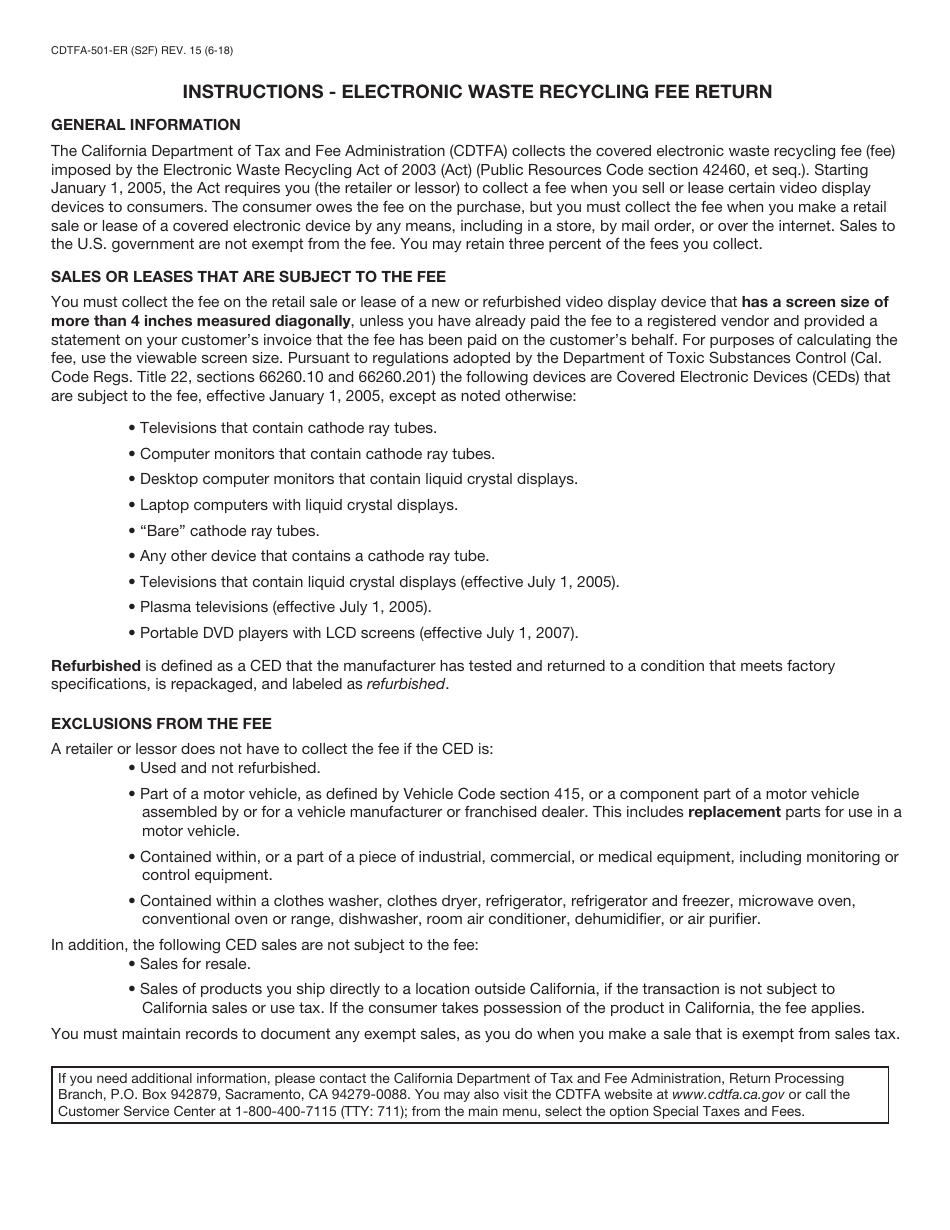

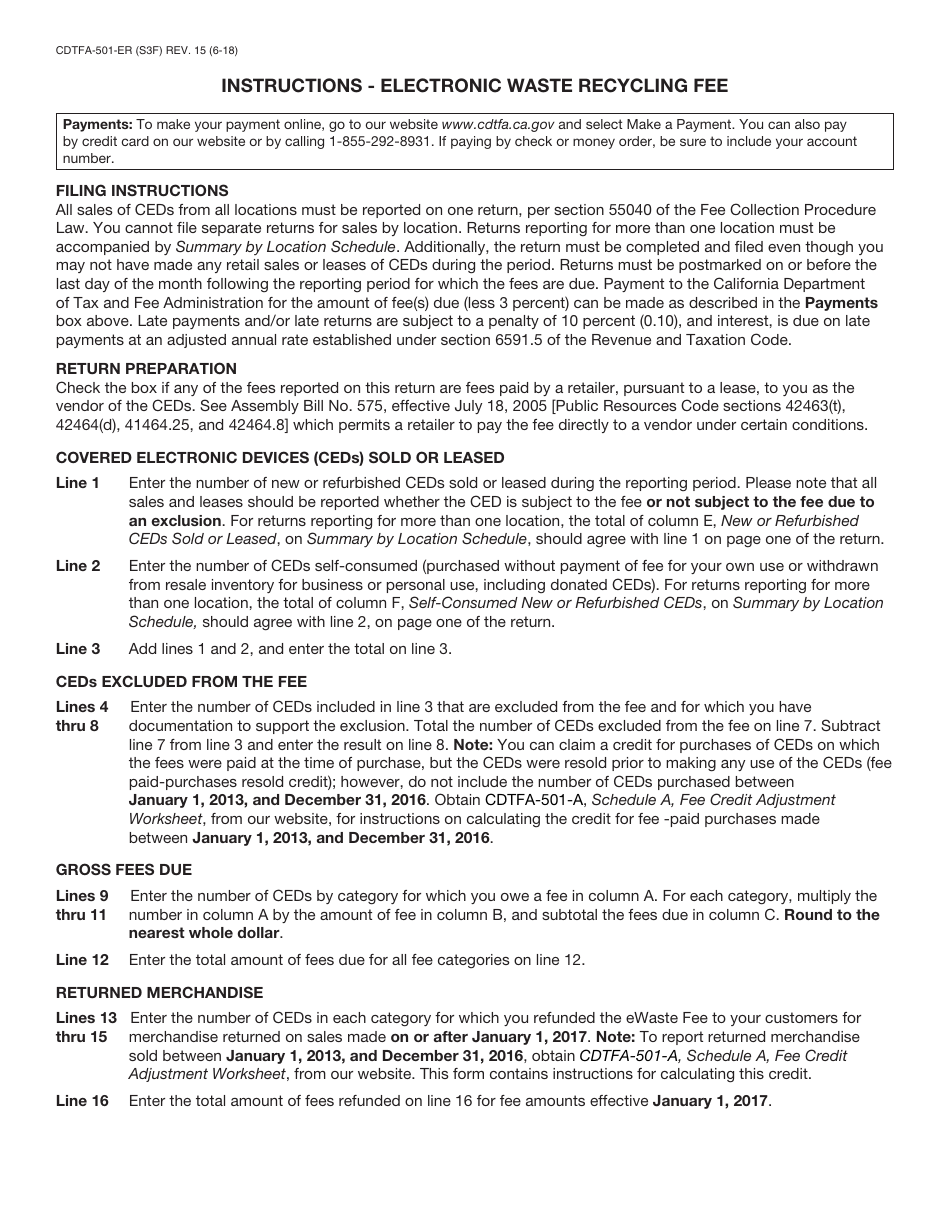

Form CDTFA-501-ER Electronic Waste Recycling Fee Return - California

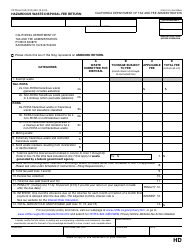

What Is Form CDTFA-501-ER?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-ER?

A: Form CDTFA-501-ER is the Electronic Waste Recycling Fee Return form used in California.

Q: Who needs to file Form CDTFA-501-ER?

A: Any person or business that sells or leases covered electronic devices in California is required to file Form CDTFA-501-ER.

Q: What is the purpose of Form CDTFA-501-ER?

A: The purpose of Form CDTFA-501-ER is to report and pay the Electronic Waste Recycling Fee.

Q: How often should Form CDTFA-501-ER be filed?

A: Form CDTFA-501-ER should be filed on a quarterly basis.

Q: What is the due date for filing Form CDTFA-501-ER?

A: Form CDTFA-501-ER is due on the last day of the month following the end of the calendar quarter.

Q: What happens if I fail to file Form CDTFA-501-ER?

A: Failure to file Form CDTFA-501-ER may result in penalties and interest charges.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-ER by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.