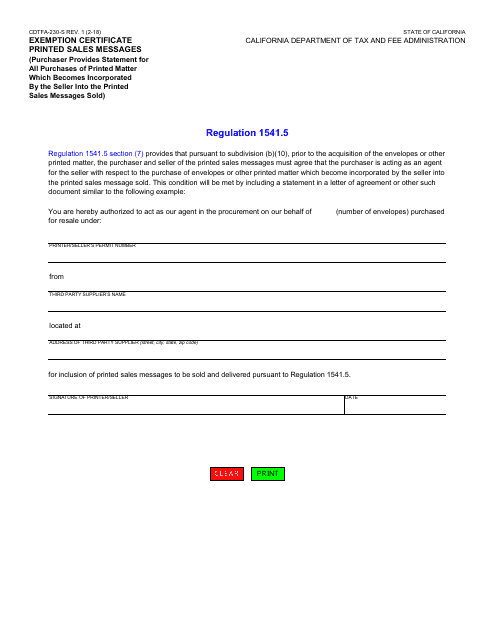

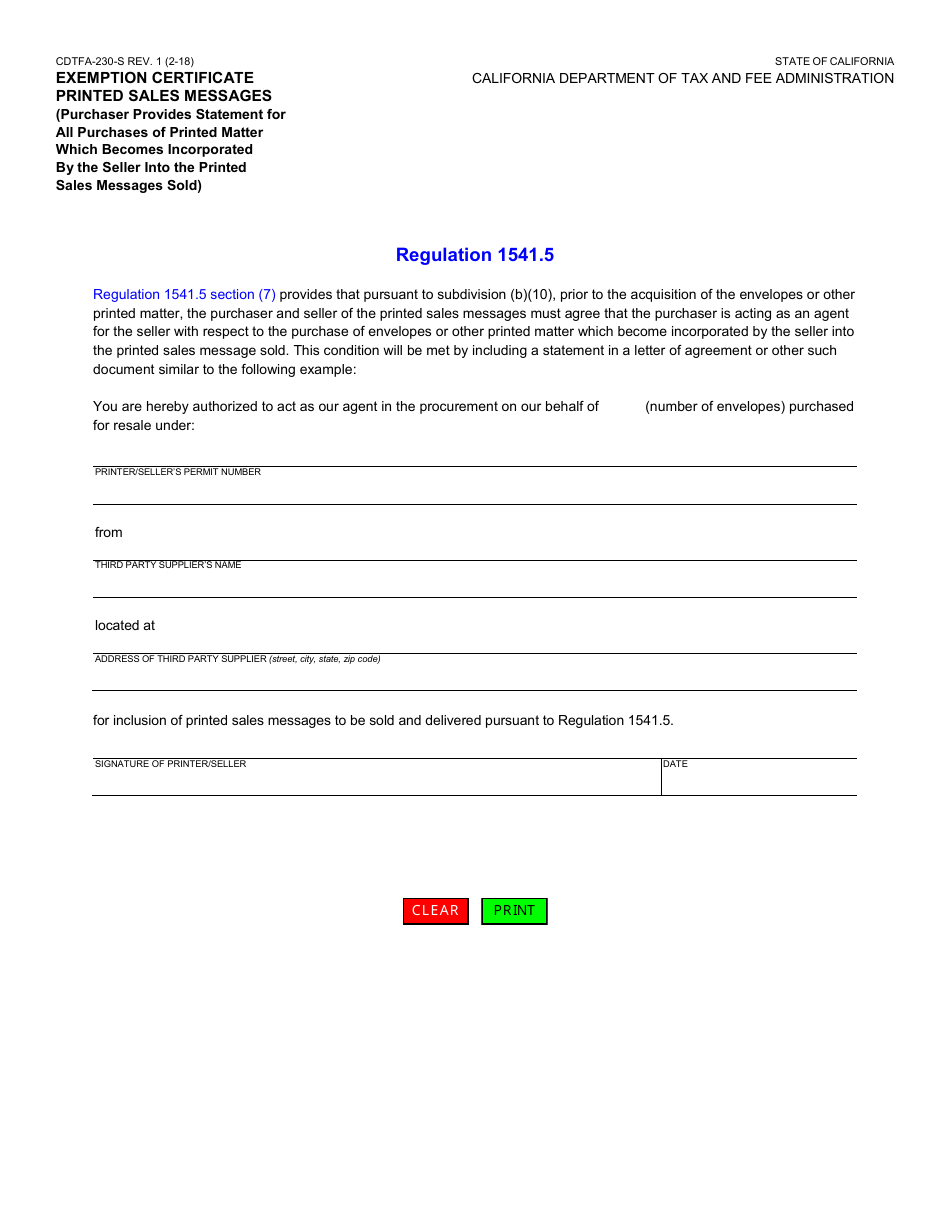

Form CDTFA-230-S Exemption Certificate - Printed Sales Messages - California

What Is Form CDTFA-230-S?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-S?

A: Form CDTFA-230-S is an Exemption Certificate.

Q: What is the purpose of Form CDTFA-230-S?

A: Form CDTFA-230-S is used for providing exemption from sales tax on printed sales messages in California.

Q: Who should use Form CDTFA-230-S?

A: Businesses or individuals who are engaged in the production or distribution of printed sales messages and are seeking an exemption from sales tax in California should use Form CDTFA-230-S.

Q: What are printed sales messages?

A: Printed sales messages include catalogs, brochures, periodicals, newspapers, flyers, and similar printed materials that are used for advertising or promotional purposes.

Q: Are there any requirements to claim exemption using Form CDTFA-230-S?

A: Yes, there are certain requirements that need to be met in order to claim exemption using Form CDTFA-230-S. These requirements include the type of printed sales messages, the use of the printed sales messages, and the method of distribution.

Q: How should I complete Form CDTFA-230-S?

A: Form CDTFA-230-S should be completed by providing the required information, including the name and address of the person claiming the exemption, a description of the printed sales messages, and other relevant details.

Q: Is there a deadline for submitting Form CDTFA-230-S?

A: There is no specific deadline mentioned for submitting Form CDTFA-230-S. However, it is recommended to submit the form at least 10 days before the distribution of the printed sales messages.

Q: What should I do after completing Form CDTFA-230-S?

A: After completing Form CDTFA-230-S, you should retain a copy of the form for your records and provide a copy to the retailer or printer who is distributing the printed sales messages on your behalf.

Q: Are there any fees associated with Form CDTFA-230-S?

A: No, there are no fees associated with Form CDTFA-230-S.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-S by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.