This version of the form is not currently in use and is provided for reference only. Download this version of

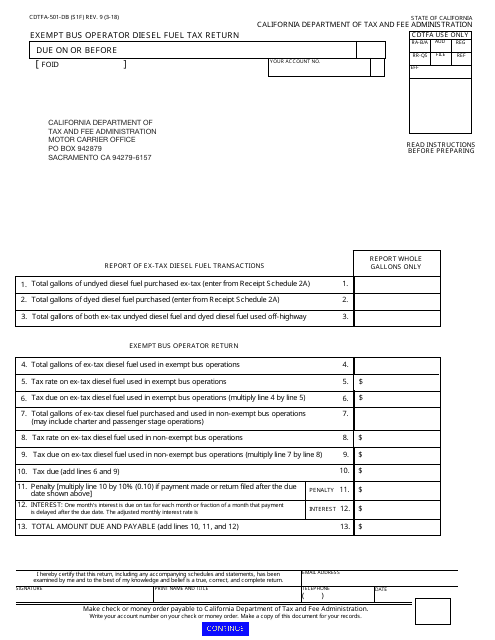

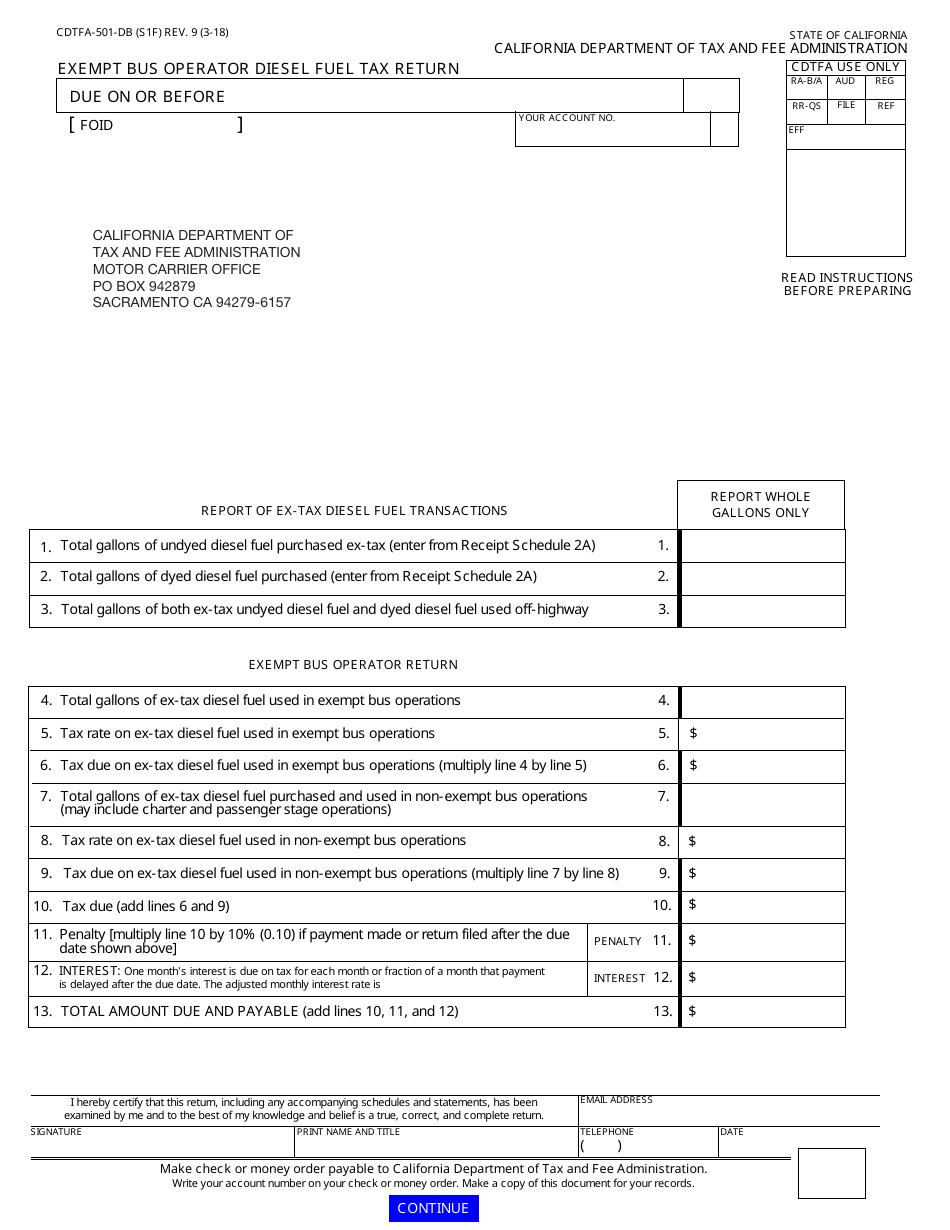

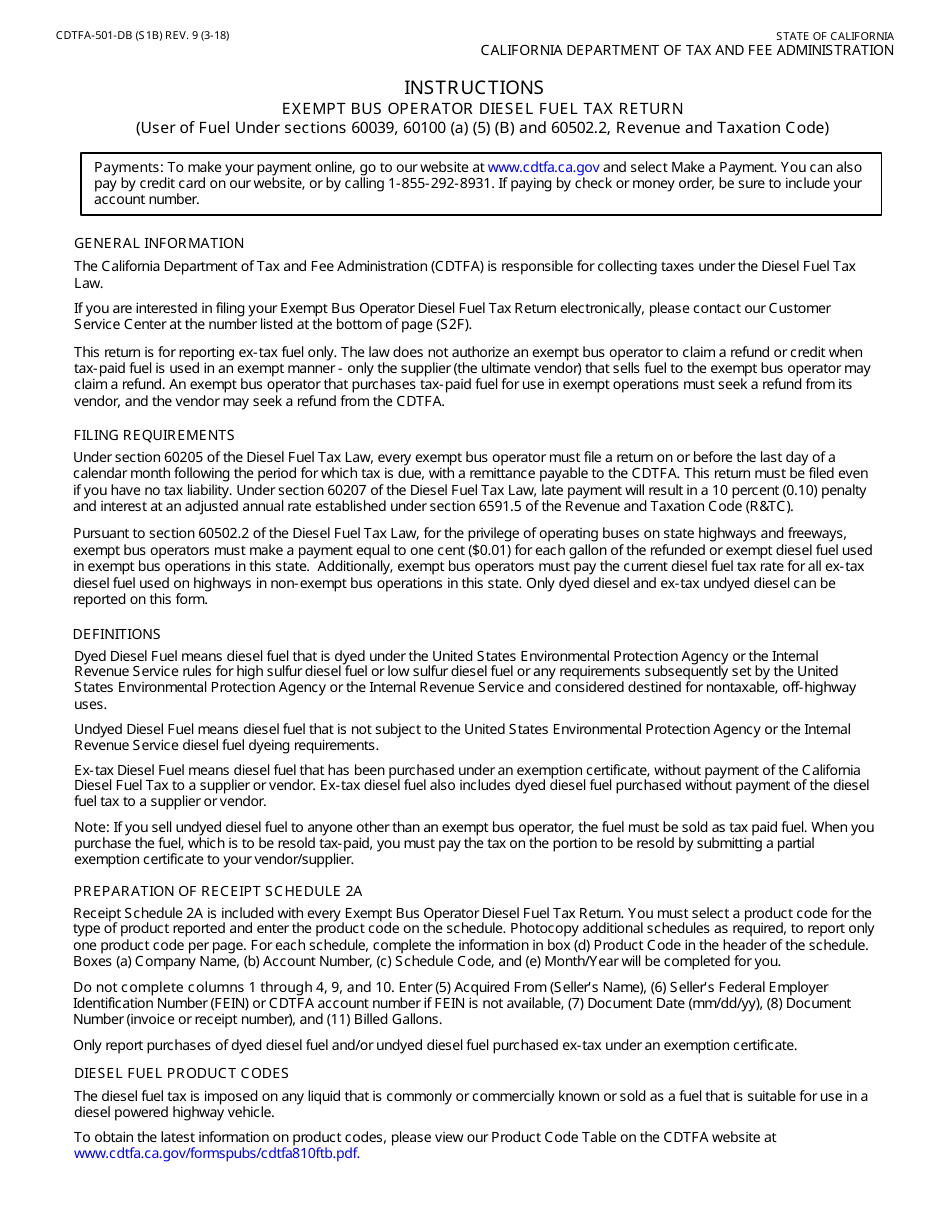

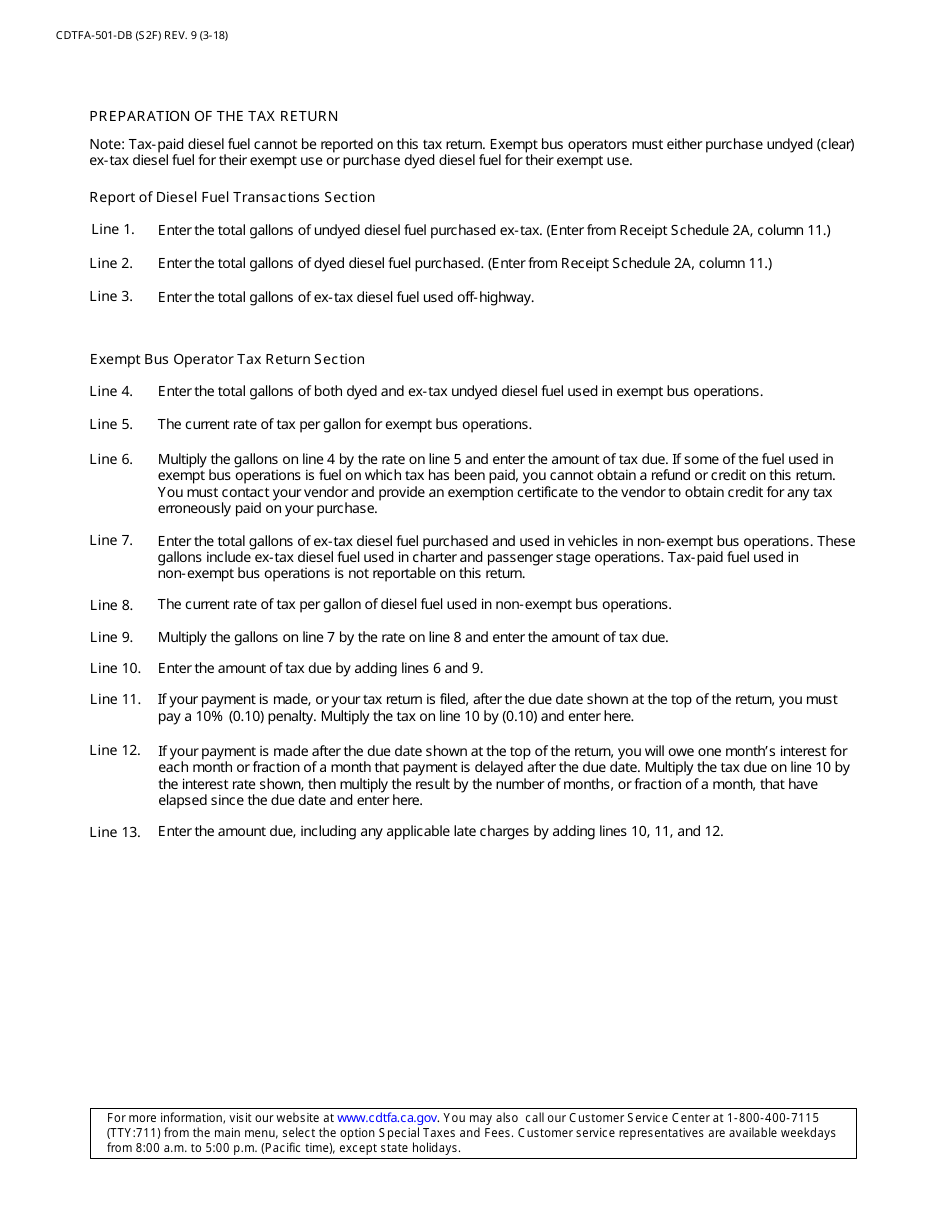

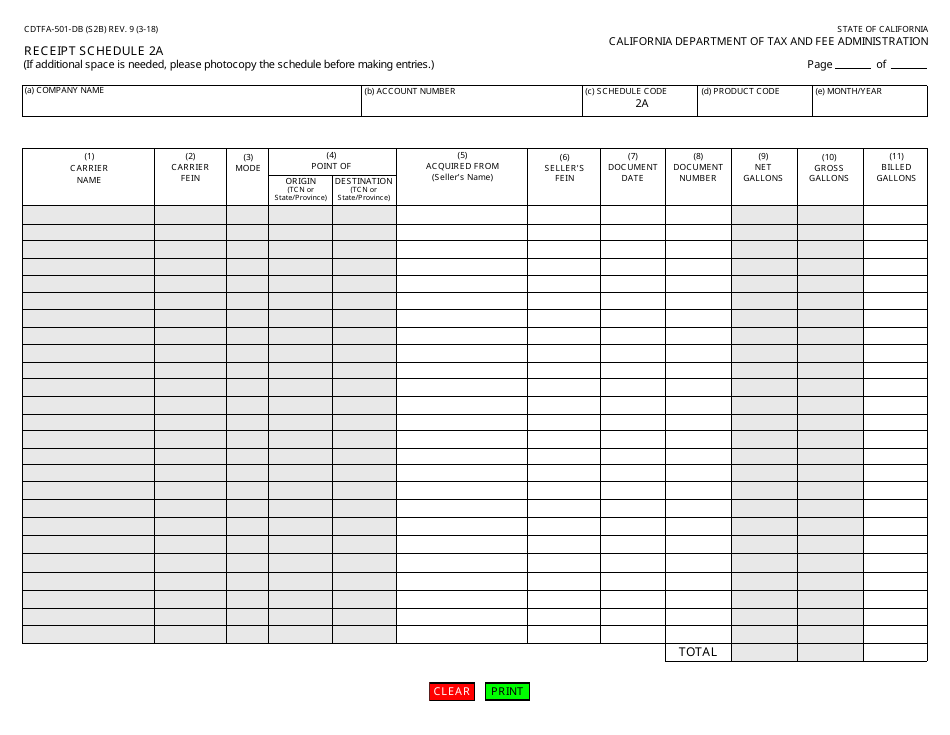

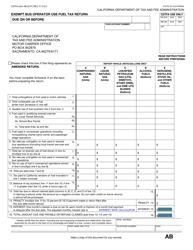

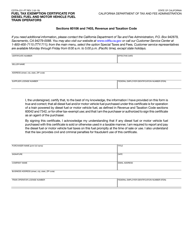

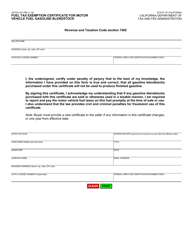

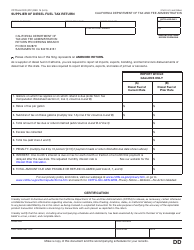

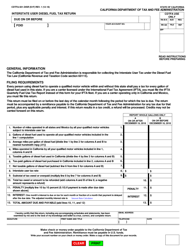

Form CDTFA-501-DB

for the current year.

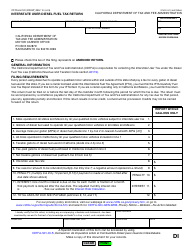

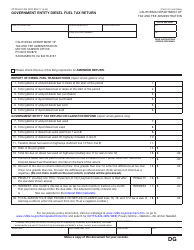

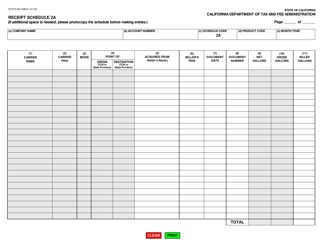

Form CDTFA-501-DB Exempt Bus Operator Diesel Fuel Tax Return - California

What Is Form CDTFA-501-DB?

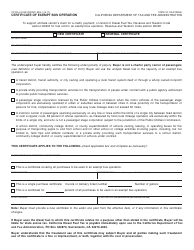

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-DB?

A: Form CDTFA-501-DB is the Exempt Bus Operator Diesel Fuel Tax Return in California.

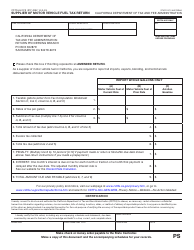

Q: Who needs to file Form CDTFA-501-DB?

A: Exempt bus operators in California need to file Form CDTFA-501-DB.

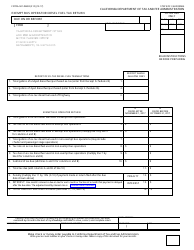

Q: What is the purpose of Form CDTFA-501-DB?

A: The purpose of Form CDTFA-501-DB is to report and pay the diesel fuel tax for exempt bus operators in California.

Q: When is Form CDTFA-501-DB due?

A: Form CDTFA-501-DB is due on a quarterly basis, with specific due dates listed on the form.

Q: Is Form CDTFA-501-DB only for residents of California?

A: No, Form CDTFA-501-DB is specifically for bus operators who are exempt from the diesel fuel tax in California, regardless of their residency.

Q: What should I do if I have questions about Form CDTFA-501-DB?

A: If you have any questions or need assistance with Form CDTFA-501-DB, you can contact the California Department of Tax and Fee Administration for guidance.

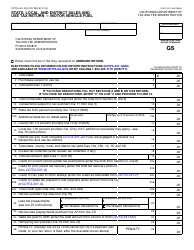

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-DB by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.