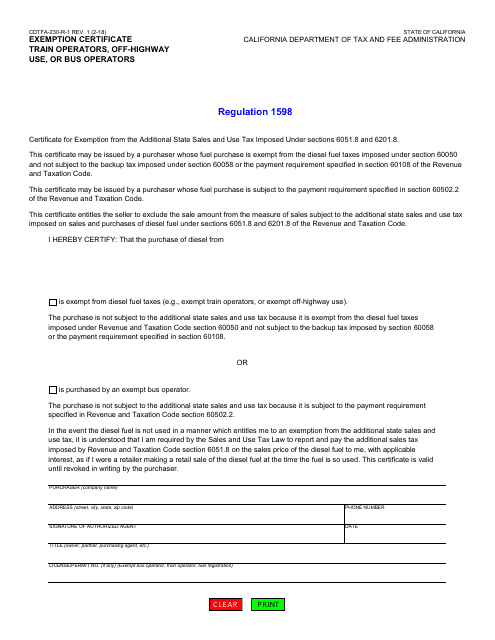

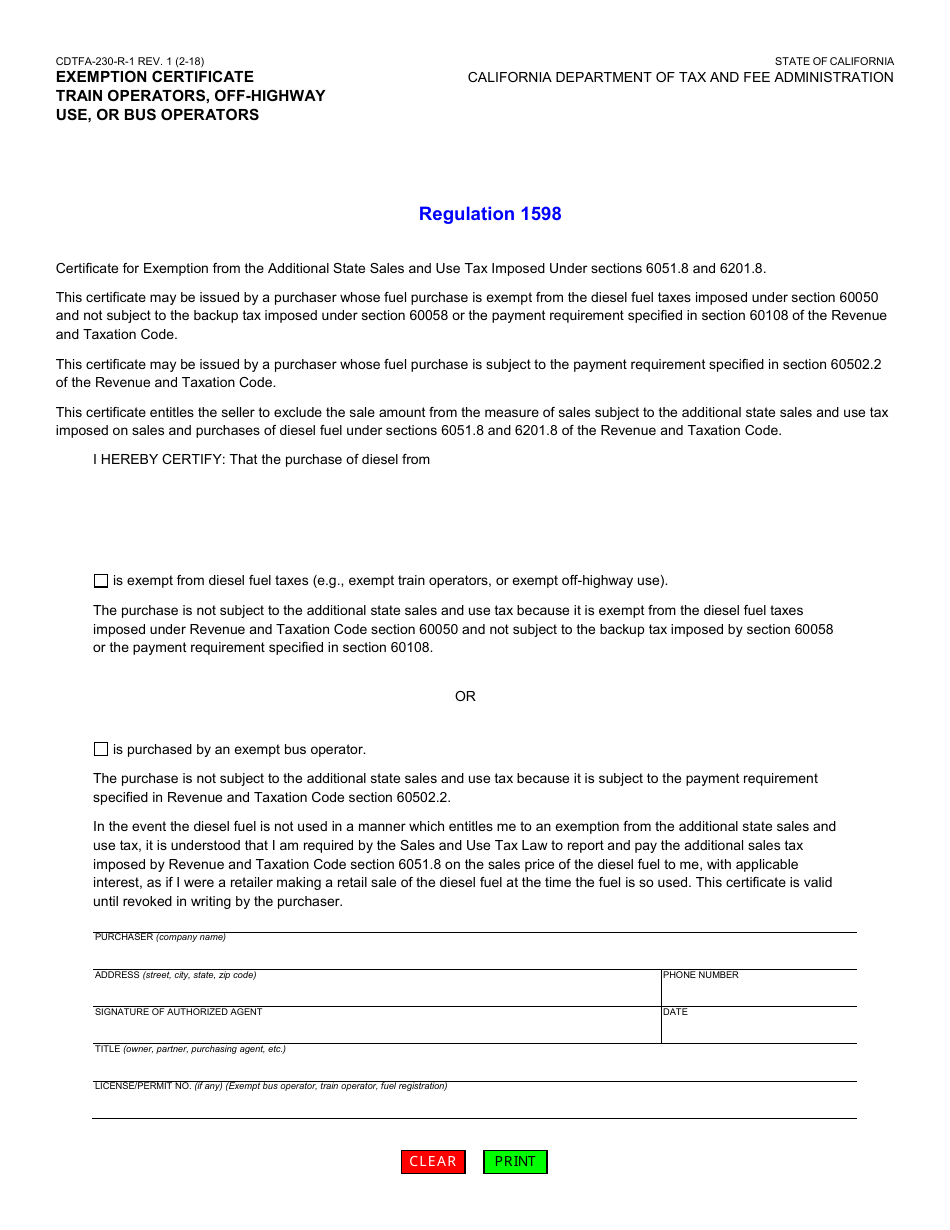

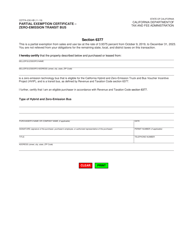

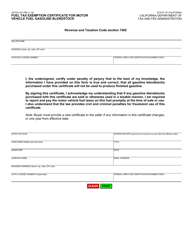

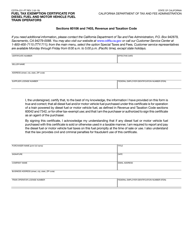

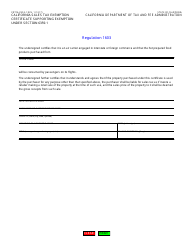

Form CDTFA-230-R-1 Exemption Certificate - Train Operators, Off-Highway Use, or Bus Operators - California

What Is Form CDTFA-230-R-1?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-R-1?

A: Form CDTFA-230-R-1 is an Exemption Certificate for Train Operators, Off-Highway Use, or Bus Operators in California.

Q: Who is eligible to use Form CDTFA-230-R-1?

A: Train Operators, Off-Highway Use, or Bus Operators in California are eligible to use Form CDTFA-230-R-1.

Q: What is the purpose of Form CDTFA-230-R-1?

A: The purpose of Form CDTFA-230-R-1 is to claim exemption from certain taxes and fees for Train Operators, Off-Highway Use, or Bus Operators in California.

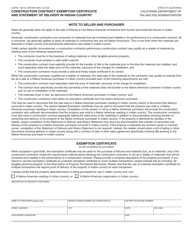

Q: Are there any specific requirements to use Form CDTFA-230-R-1?

A: Yes, there are certain requirements that must be met to use Form CDTFA-230-R-1. You should refer to the instructions provided with the form for detailed information.

Q: How do I fill out Form CDTFA-230-R-1?

A: You need to provide the required information and certify your eligibility for the exemption on Form CDTFA-230-R-1. Follow the instructions provided with the form for proper completion.

Q: Is there a deadline to submit Form CDTFA-230-R-1?

A: Yes, you should submit Form CDTFA-230-R-1 to the California Department of Tax and Fee Administration (CDTFA) before the expiration date mentioned on the form.

Q: Can I use Form CDTFA-230-R-1 for multiple transactions?

A: Yes, you can use Form CDTFA-230-R-1 for multiple transactions until the expiration date mentioned on the form, as long as you remain eligible for the exemption.

Q: What should I do if my eligibility for the exemption changes?

A: If your eligibility for the exemption changes, you should notify the California Department of Tax and Fee Administration (CDTFA) and provide any necessary updates or documentation.

Q: Can I use Form CDTFA-230-R-1 for any other purposes?

A: No, Form CDTFA-230-R-1 is specifically for claiming exemption for Train Operators, Off-Highway Use, or Bus Operators in California. It cannot be used for any other purposes.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-R-1 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.