This version of the form is not currently in use and is provided for reference only. Download this version of

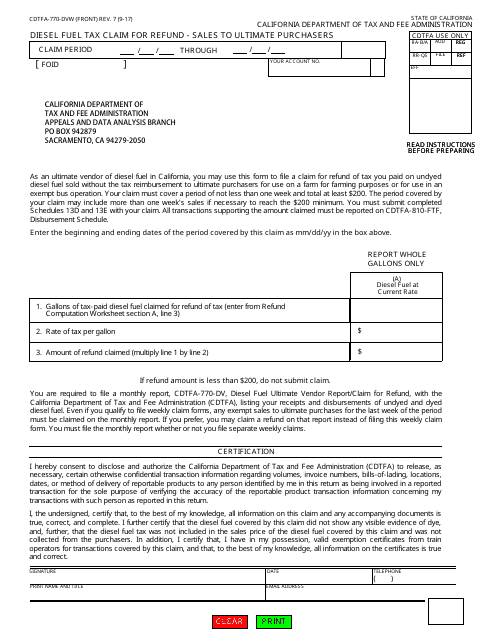

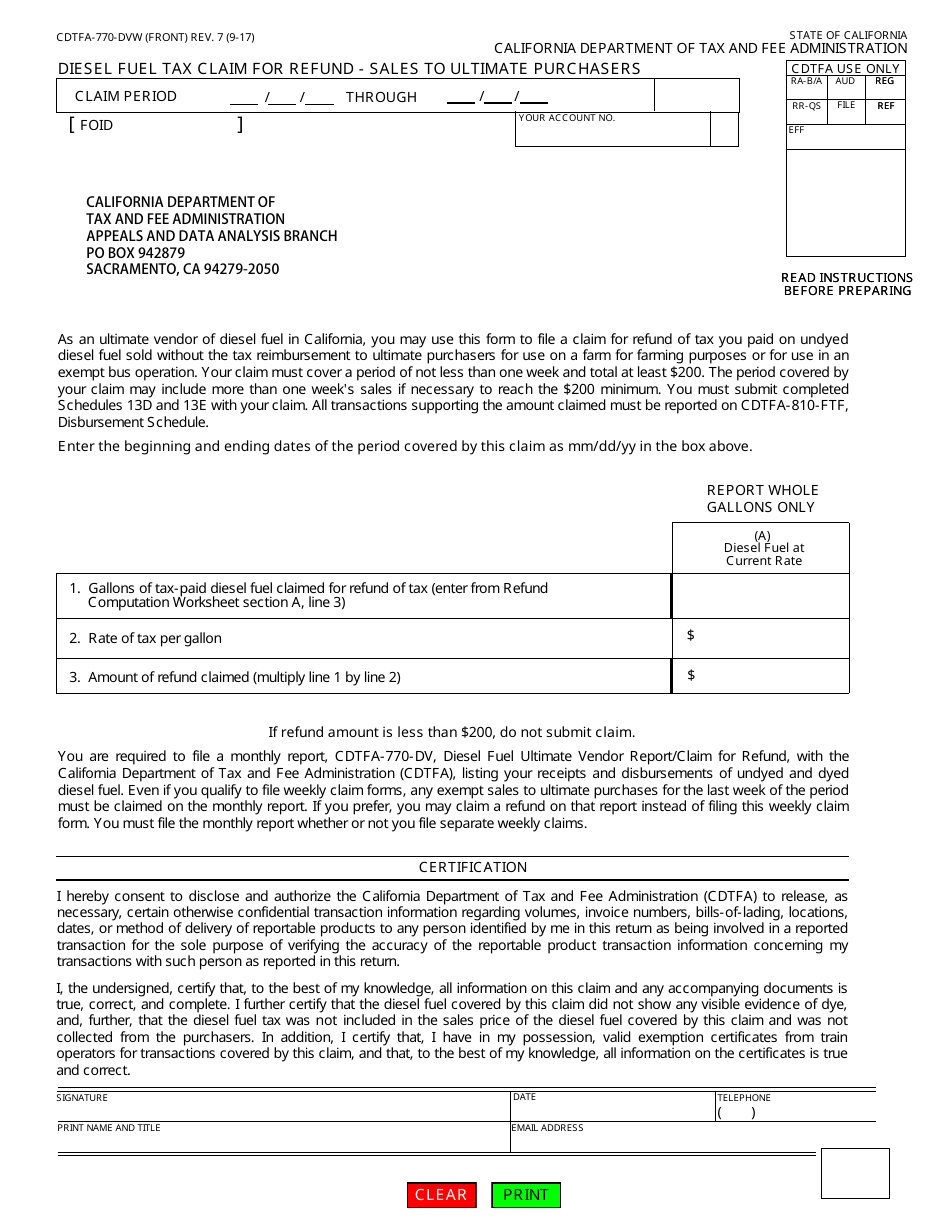

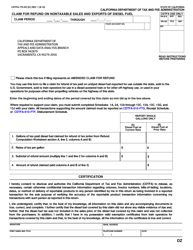

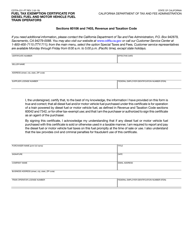

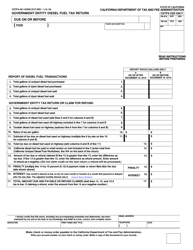

Form CDTFA-770-DVW

for the current year.

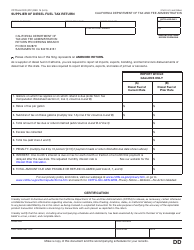

Form CDTFA-770-DVW Diesel Fuel Tax Claim for Refund - Sales to Ultimate Purchasers - California

What Is Form CDTFA-770-DVW?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CDTFA-770-DVW?

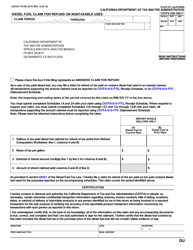

A: The Form CDTFA-770-DVW is a form used to claim a refund of diesel fuel tax in California.

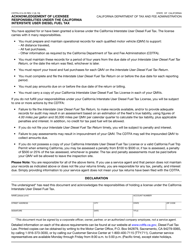

Q: Who can use the Form CDTFA-770-DVW?

A: The Form CDTFA-770-DVW can be used by sellers or suppliers of diesel fuel in California.

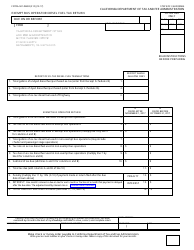

Q: What is the purpose of Form CDTFA-770-DVW?

A: The purpose of this form is to report sales of diesel fuel to ultimate purchasers and claim a refund of the diesel fuel tax.

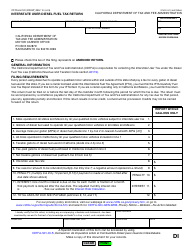

Q: When should I file Form CDTFA-770-DVW?

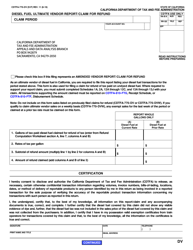

A: You should file this form within three years from the date of the sale.

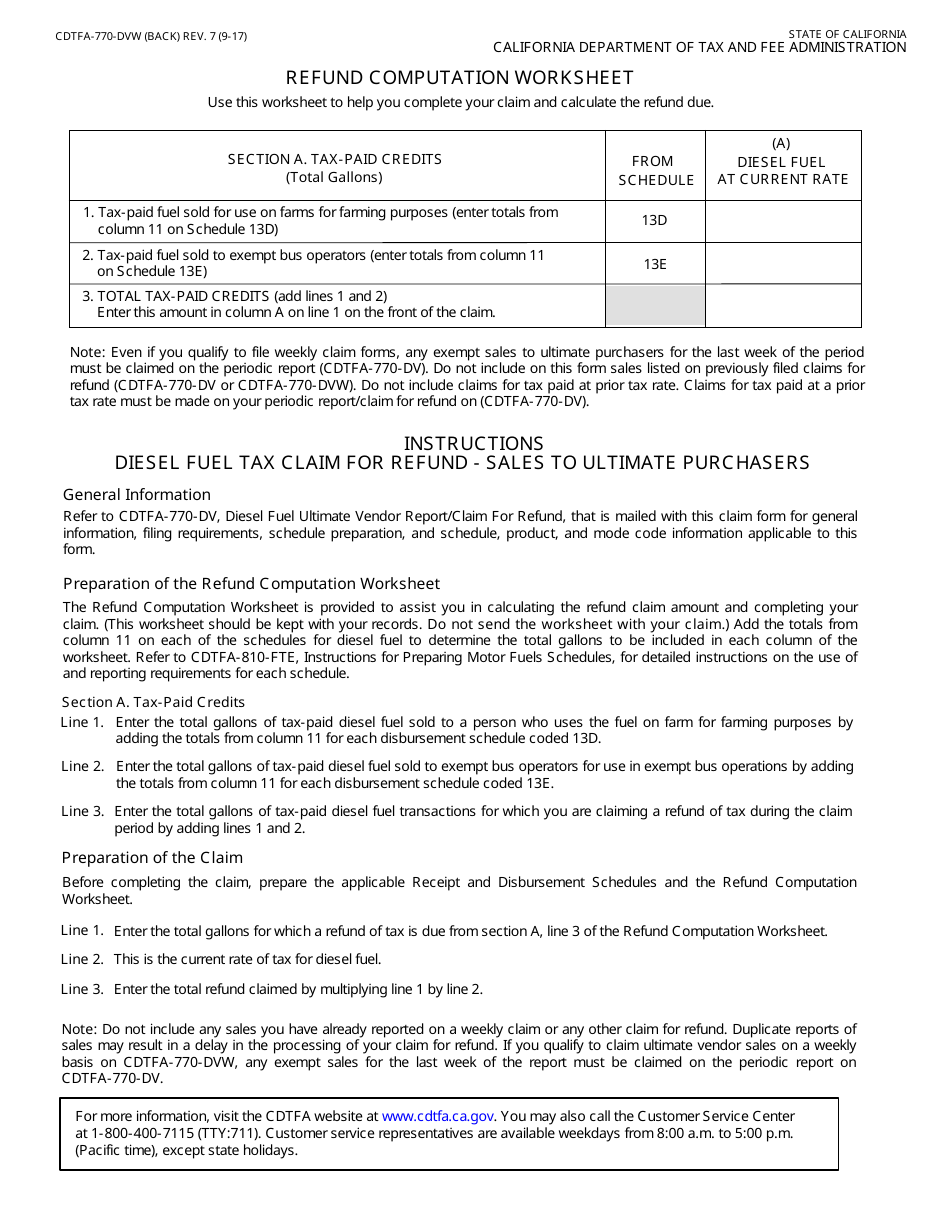

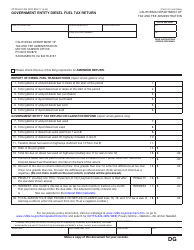

Q: Are there any specific requirements for filing this form?

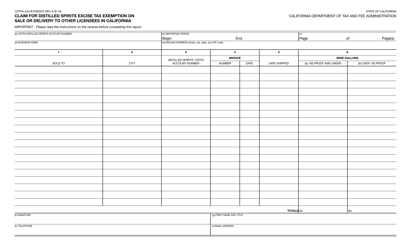

A: Yes, you must provide detailed information about the sales, including the name and address of the ultimate purchaser, the quantity of diesel fuel sold, and the amount of tax refund claimed for each sale.

Q: What supporting documentation should I include with the form?

A: You should include invoices or other documents that support the sales reported on the form.

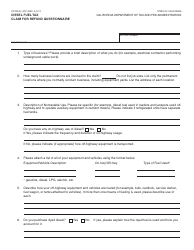

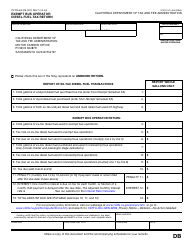

Q: How long does it take to process the refund claim?

A: It can take up to six to eight weeks for the CDTFA to process a refund claim.

Q: Are there any penalties for late or incorrect filings?

A: Yes, there may be penalties for late or incorrect filings. It is important to file the form accurately and on time to avoid penalties.

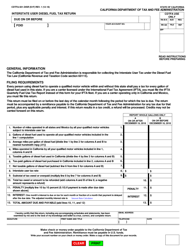

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-770-DVW by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.