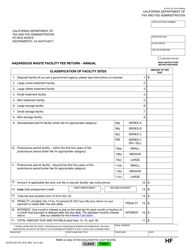

This version of the form is not currently in use and is provided for reference only. Download this version of

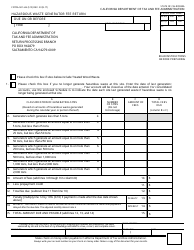

Form CDTFA-501-EF

for the current year.

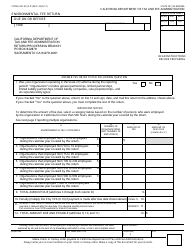

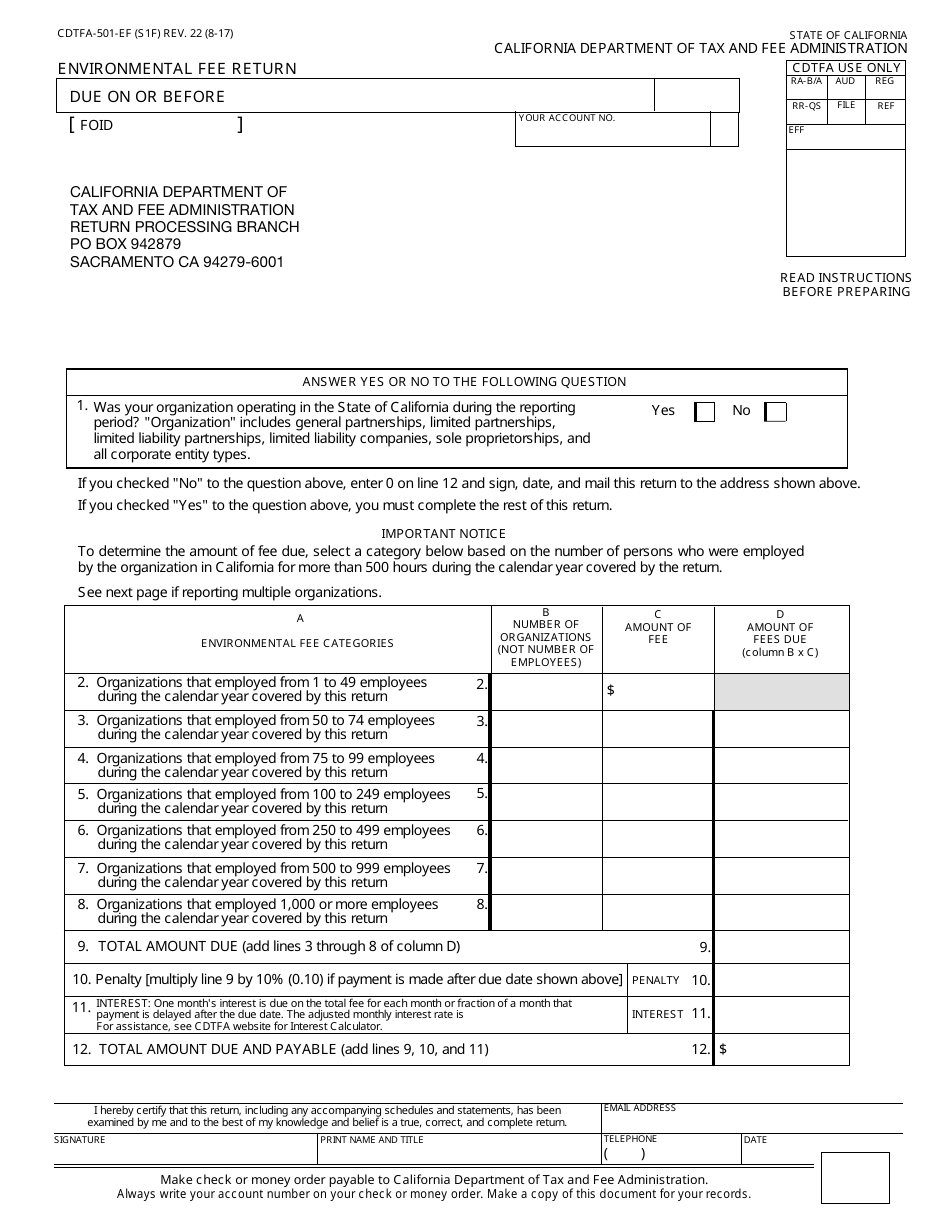

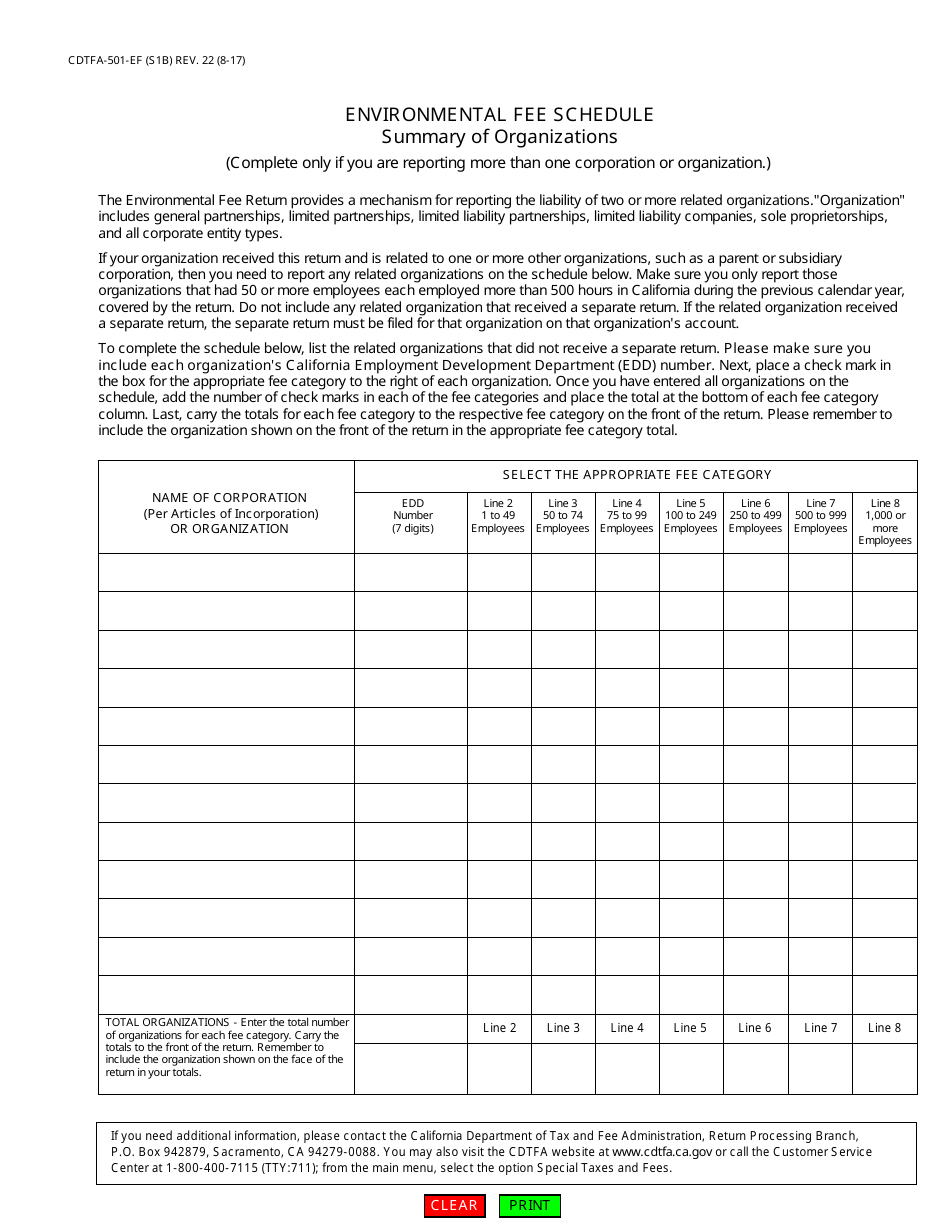

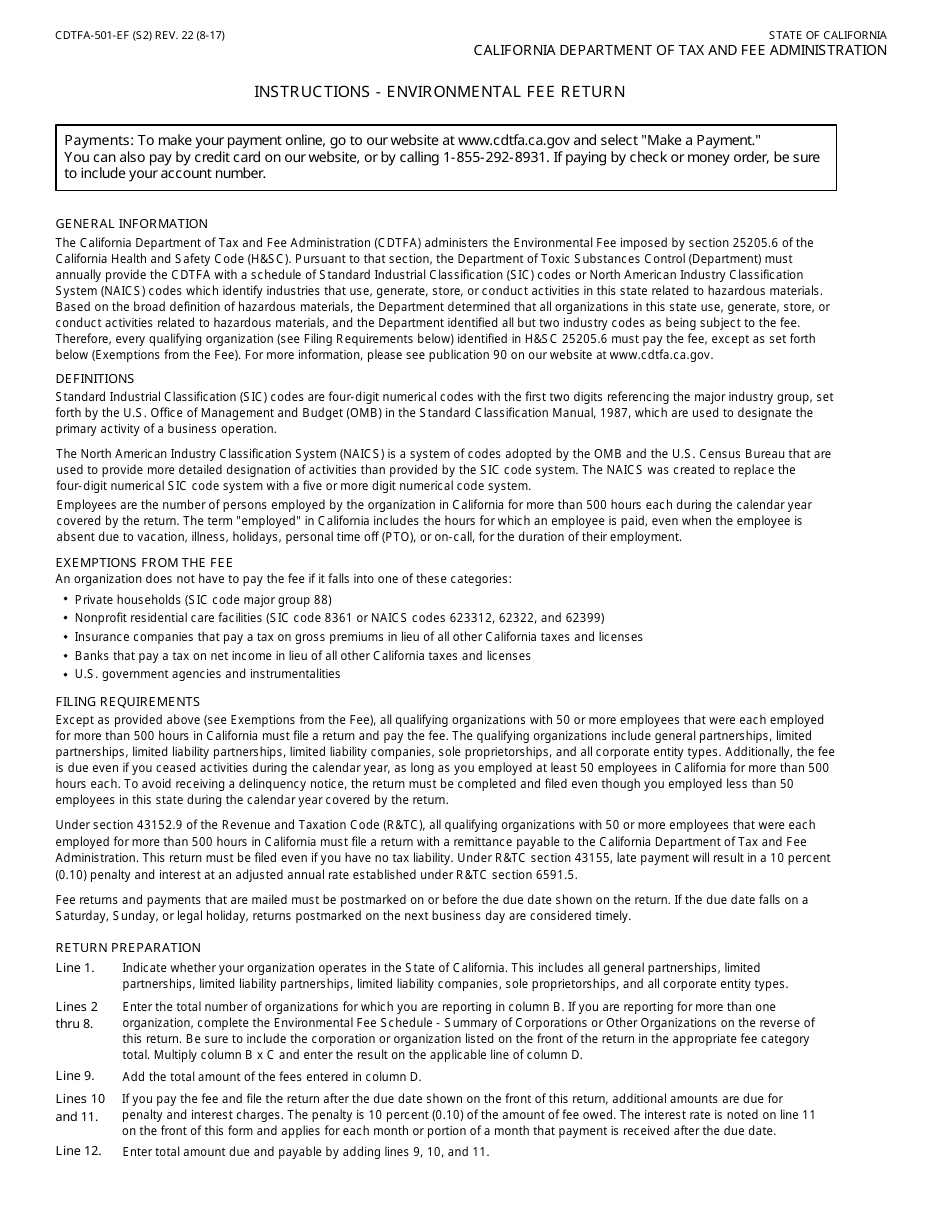

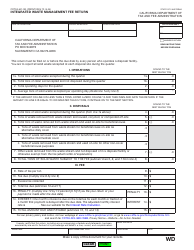

Form CDTFA-501-EF Environmental Fee Return - California

What Is Form CDTFA-501-EF?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-EF?

A: Form CDTFA-501-EF is the Environmental Fee Return form for California.

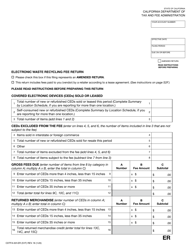

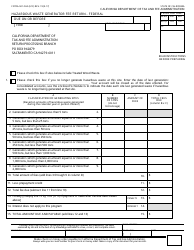

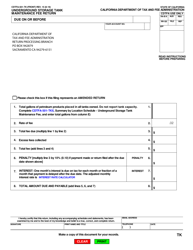

Q: What is the purpose of Form CDTFA-501-EF?

A: The purpose of Form CDTFA-501-EF is to report and remit environmental fees for designated products sold or used in California.

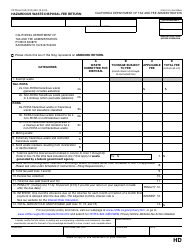

Q: Who needs to file Form CDTFA-501-EF?

A: Businesses that sell or use designated products in California may need to file Form CDTFA-501-EF.

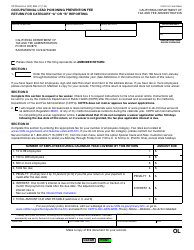

Q: What are designated products?

A: Designated products are products that are subject to environmental fees in California, such as batteries, mattresses, and paint.

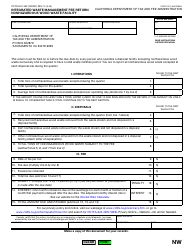

Q: When is Form CDTFA-501-EF due?

A: Form CDTFA-501-EF is generally due quarterly, with specific due dates provided by the California Department of Tax and Fee Administration (CDTFA).

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there can be penalties for late filing or non-compliance with the California Environmental Fee requirements. It is important to timely file and remit the fees to avoid penalties.

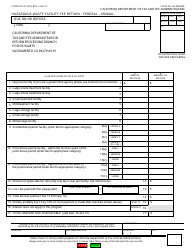

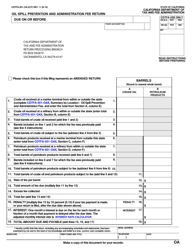

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-EF by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.