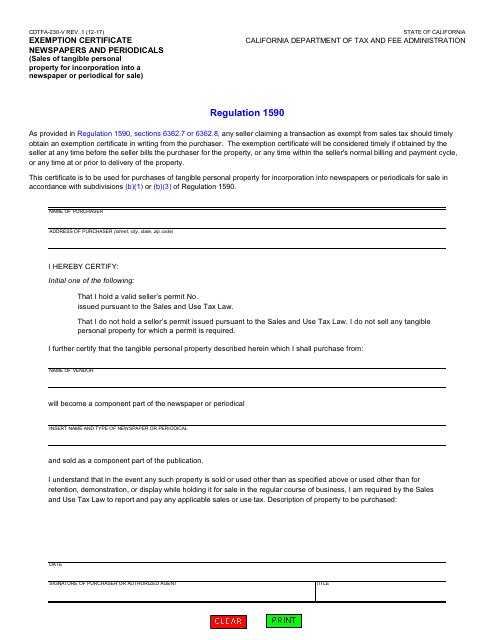

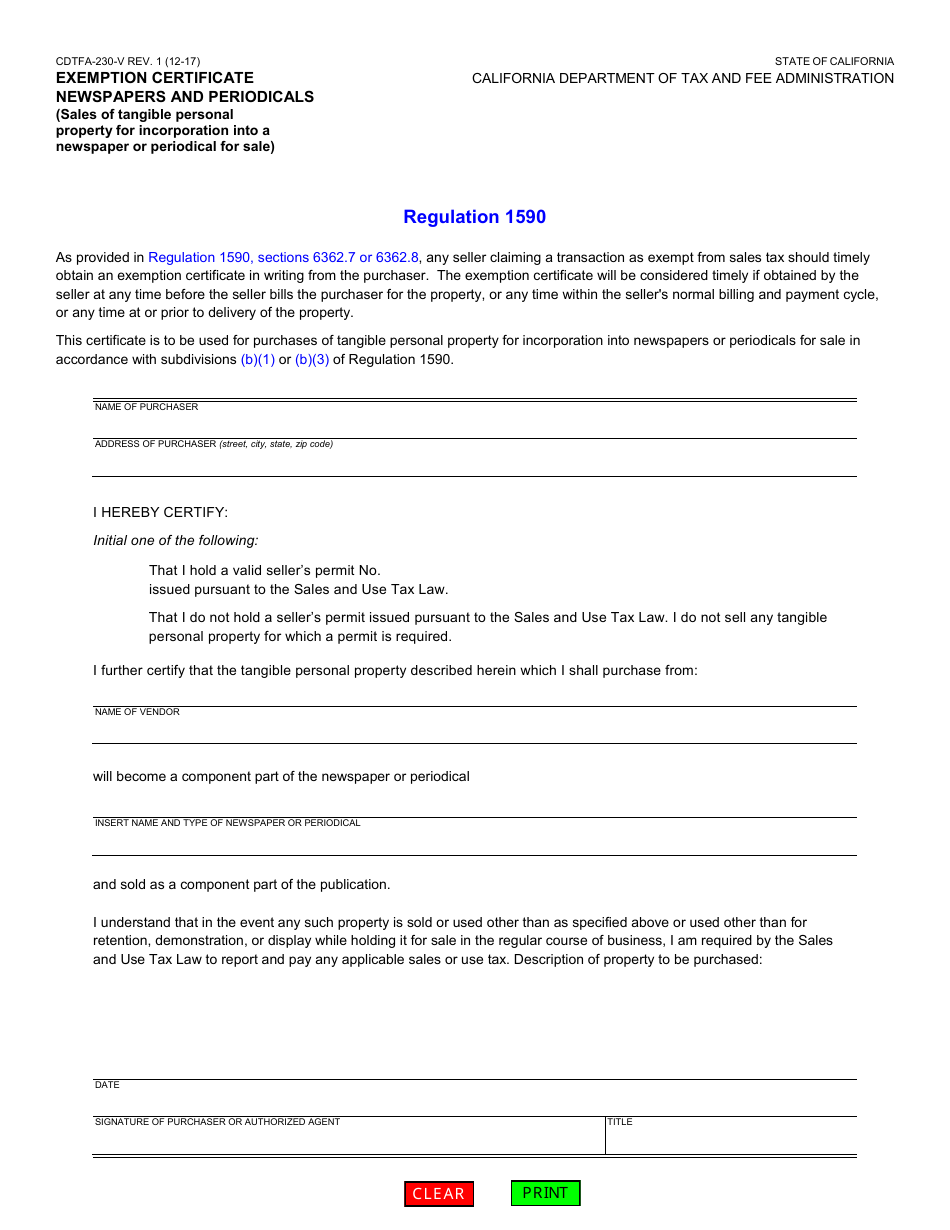

Form CDTFA-230-V Exemption Certificate Newspapers and Periodicals (Sales of Tangible Personal Property for Incorporation Into a Newspaper or Periodical for Sale) - California

What Is Form CDTFA-230-V?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-V?

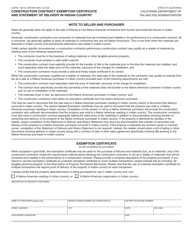

A: Form CDTFA-230-V is an exemption certificate used for sales of tangible personal property for incorporation into a newspaper or periodical for sale in California.

Q: What is the purpose of Form CDTFA-230-V?

A: The purpose of Form CDTFA-230-V is to certify that the purchaser of tangible personal property intends to incorporate it into a newspaper or periodical for sale.

Q: Who should use Form CDTFA-230-V?

A: Form CDTFA-230-V should be used by purchasers who are buying tangible personal property for the purpose of incorporating it into a newspaper or periodical for sale in California.

Q: What information is required on Form CDTFA-230-V?

A: Form CDTFA-230-V requires the purchaser's contact information, seller's information, description of the property, and a certification statement.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-V by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.