This version of the form is not currently in use and is provided for reference only. Download this version of

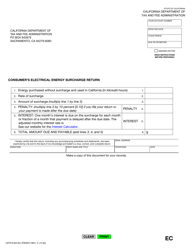

Form CDTFA-501-EU

for the current year.

Form CDTFA-501-EU Electrical Energy Surcharge Return - California

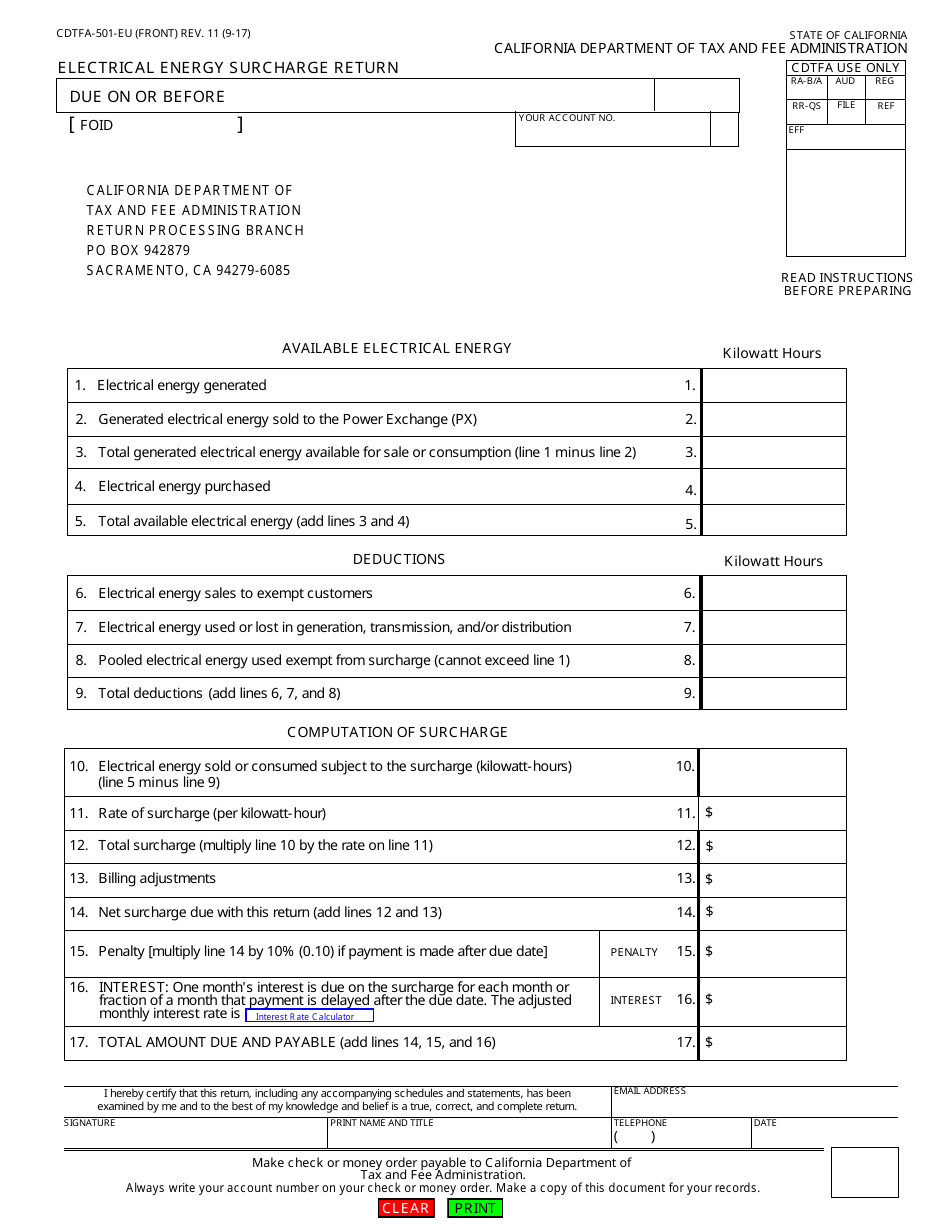

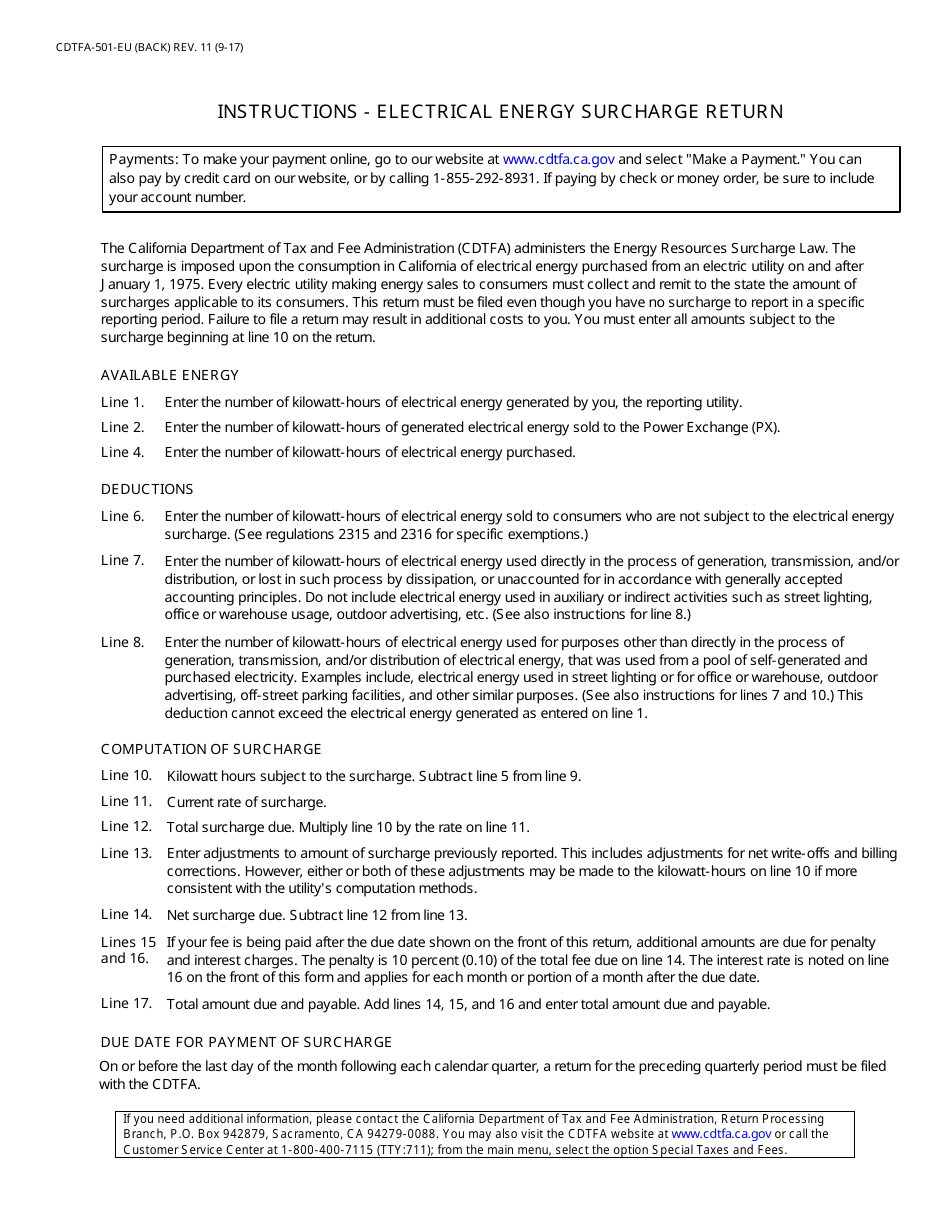

What Is Form CDTFA-501-EU?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-EU?

A: Form CDTFA-501-EU is the Electrical Energy Surcharge Return form used in California.

Q: What is the purpose of Form CDTFA-501-EU?

A: The purpose of Form CDTFA-501-EU is to report and remit the electrical energy surcharge collected from customers.

Q: Who needs to file Form CDTFA-501-EU?

A: Businesses that are required to collect electrical energy surcharge from customers in California need to file Form CDTFA-501-EU.

Q: How often should Form CDTFA-501-EU be filed?

A: Form CDTFA-501-EU should be filed on a quarterly basis.

Q: When is Form CDTFA-501-EU due?

A: Form CDTFA-501-EU is due on the last day of the month following the end of the quarter.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-EU by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.