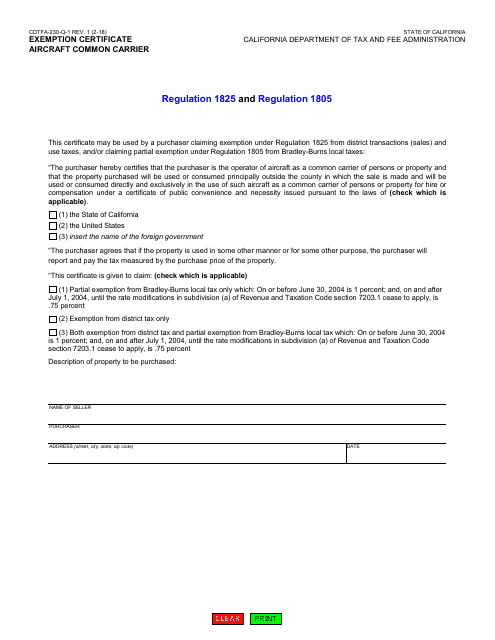

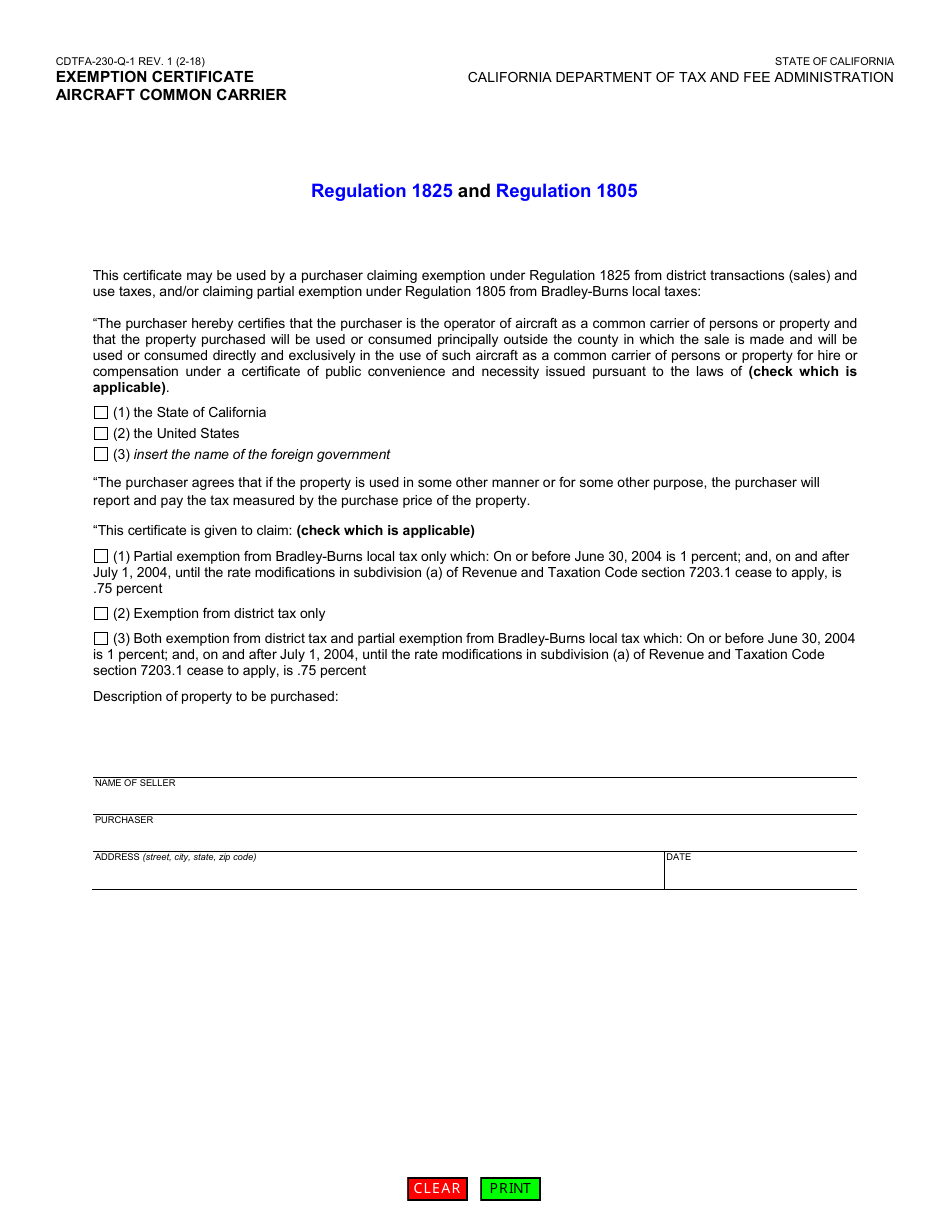

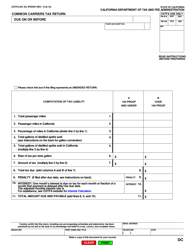

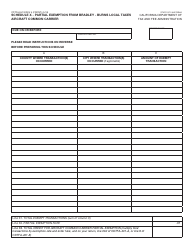

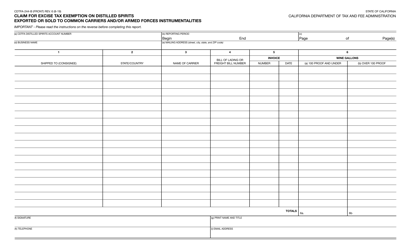

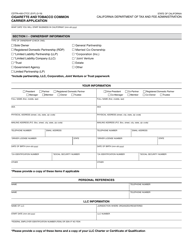

Form CDTFA-230-Q-1 Exemption Certificate - Aircraft Common Carrier - California

What Is Form CDTFA-230-Q-1?

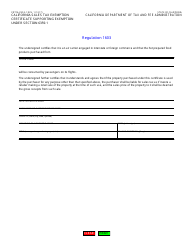

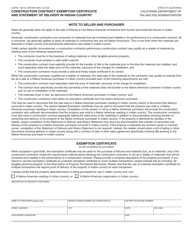

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-Q-1?

A: Form CDTFA-230-Q-1 is an exemption certificate for aircraft common carriers in California.

Q: Who can use Form CDTFA-230-Q-1?

A: Aircraft common carriers can use Form CDTFA-230-Q-1 in California.

Q: What is the purpose of Form CDTFA-230-Q-1?

A: The purpose of Form CDTFA-230-Q-1 is to claim an exemption from certain taxes for aircraft common carriers in California.

Q: Which taxes can be exempted using Form CDTFA-230-Q-1?

A: Using Form CDTFA-230-Q-1, aircraft common carriers can claim exemption from sales and use tax, as well as certain fees.

Q: Is there a deadline for filing Form CDTFA-230-Q-1?

A: Yes, Form CDTFA-230-Q-1 should be filed quarterly by the last day of the month following the end of the quarter.

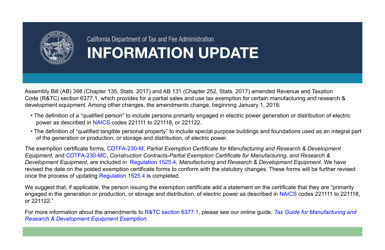

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-Q-1 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.