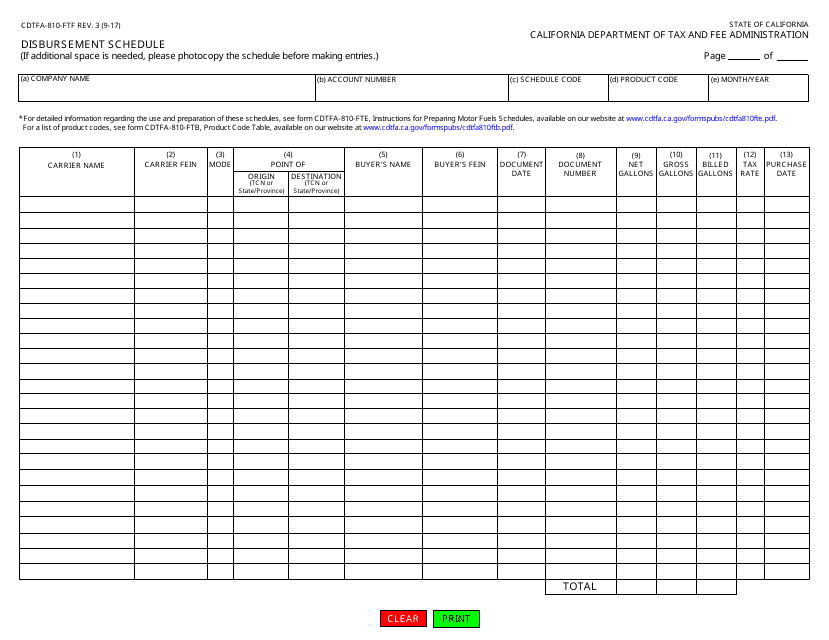

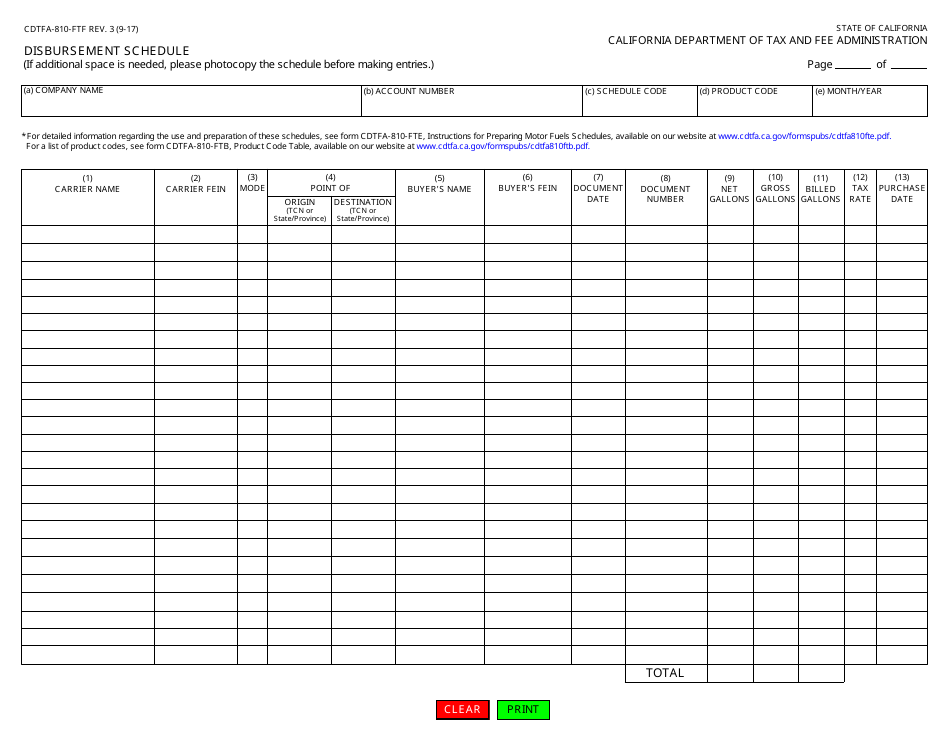

Form CDTFA-810-FTF Disbursement Schedule - California

What Is Form CDTFA-810-FTF?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-810-FTF?

A: Form CDTFA-810-FTF is a disbursement schedule used in California.

Q: What is the purpose of Form CDTFA-810-FTF?

A: The purpose of Form CDTFA-810-FTF is to provide information about disbursements made by the California Department of Tax and Fee Administration (CDTFA).

Q: Who needs to use Form CDTFA-810-FTF?

A: Form CDTFA-810-FTF is used by the California Department of Tax and Fee Administration (CDTFA) to report disbursements.

Q: What information do I need to provide on Form CDTFA-810-FTF?

A: On Form CDTFA-810-FTF, you need to provide details about the disbursements made, including the payee information and payment amounts.

Q: Are there any fees associated with Form CDTFA-810-FTF?

A: No, there are no fees associated with Form CDTFA-810-FTF.

Q: What should I do if I have questions about Form CDTFA-810-FTF?

A: If you have questions about Form CDTFA-810-FTF, you should contact the California Department of Tax and Fee Administration (CDTFA) for assistance.

Q: Can I make changes to Form CDTFA-810-FTF after submitting it?

A: Yes, you can make changes to Form CDTFA-810-FTF after submitting it. However, you should contact the California Department of Tax and Fee Administration (CDTFA) to request any changes.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-810-FTF by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.