This version of the form is not currently in use and is provided for reference only. Download this version of

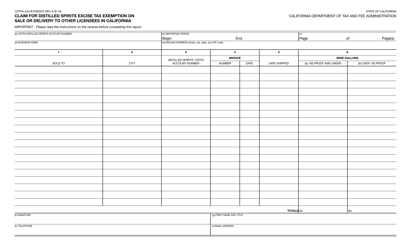

Form CDTFA-770-DZ

for the current year.

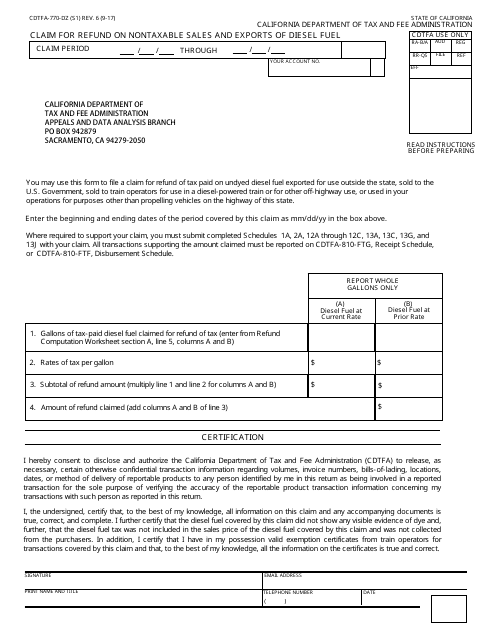

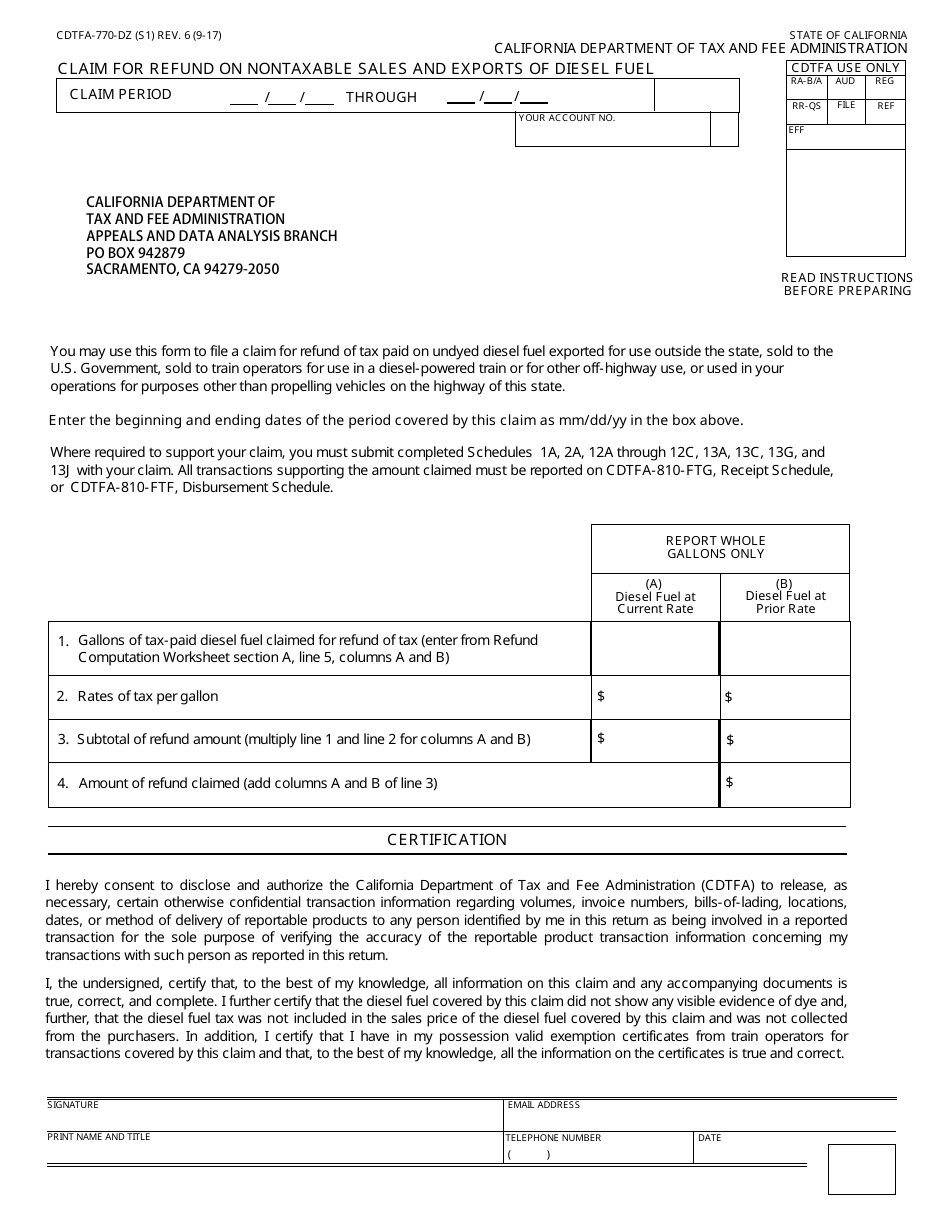

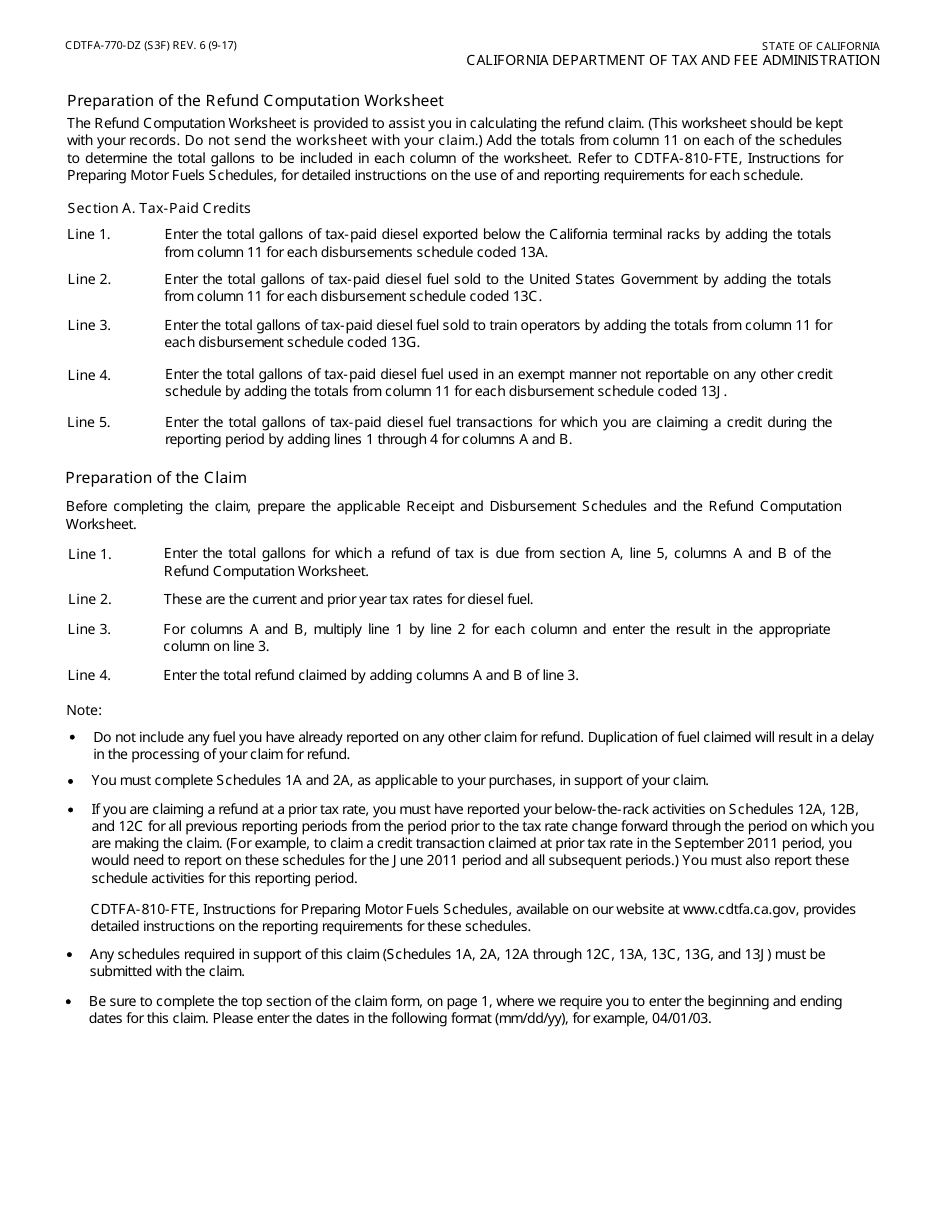

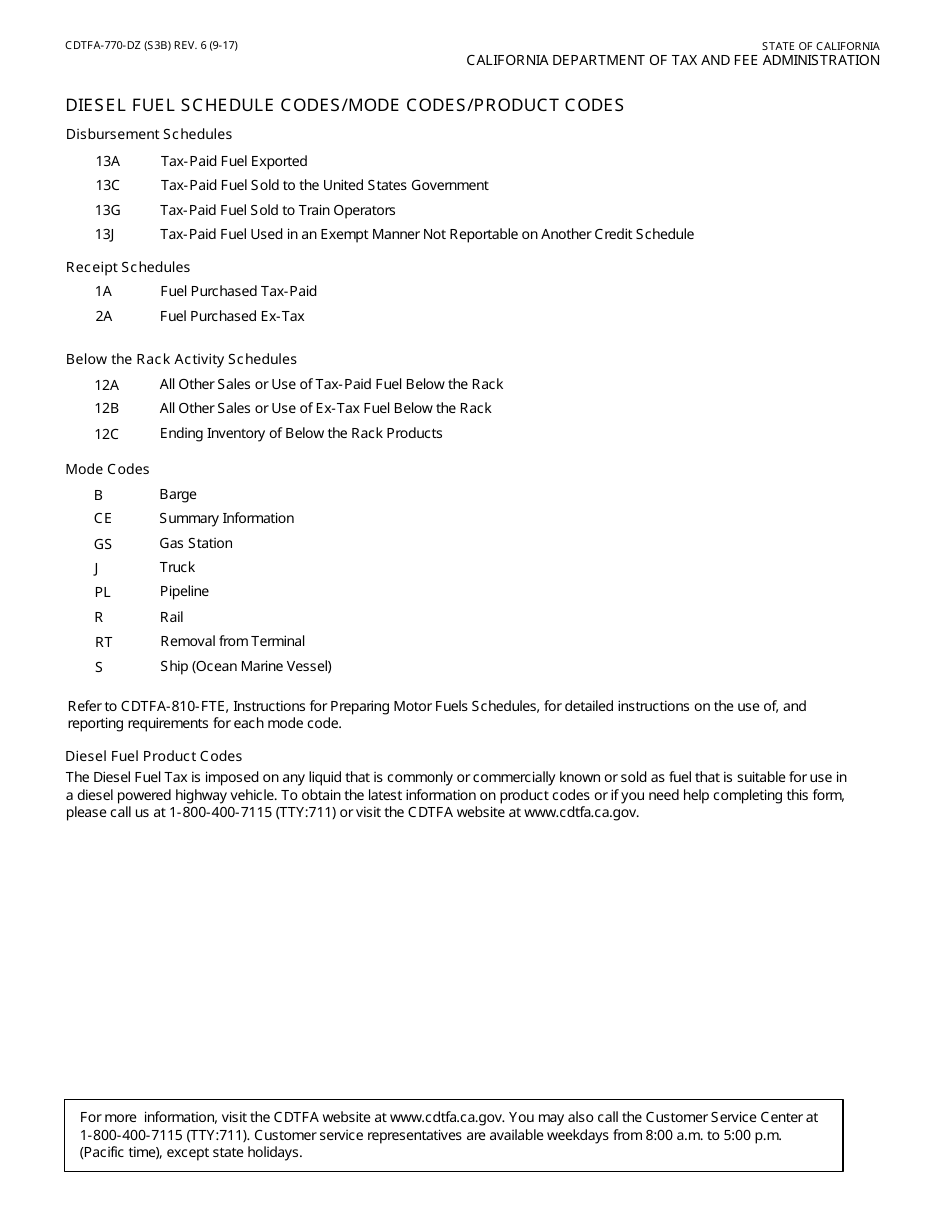

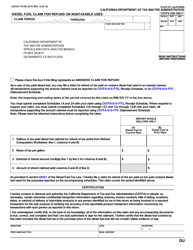

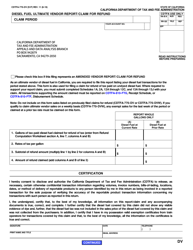

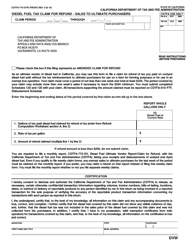

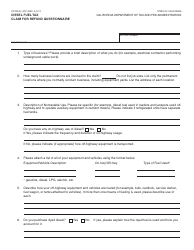

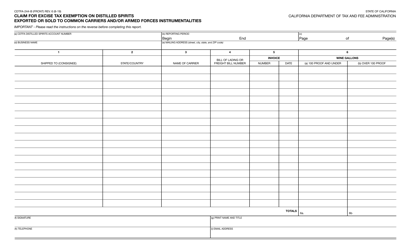

Form CDTFA-770-DZ Claim for Refund on Nontaxable Sales and Exports of Diesel Fuel - California

What Is Form CDTFA-770-DZ?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CDTFA-770-DZ?

A: Form CDTFA-770-DZ is a claim for refund specifically for nontaxable sales and exports of diesel fuel in California.

Q: Who can use this form?

A: This form can be used by individuals or companies who have made nontaxable sales or exports of diesel fuel in California.

Q: What is the purpose of this form?

A: The purpose of this form is to claim a refund for the taxes paid on nontaxable sales and exports of diesel fuel in California.

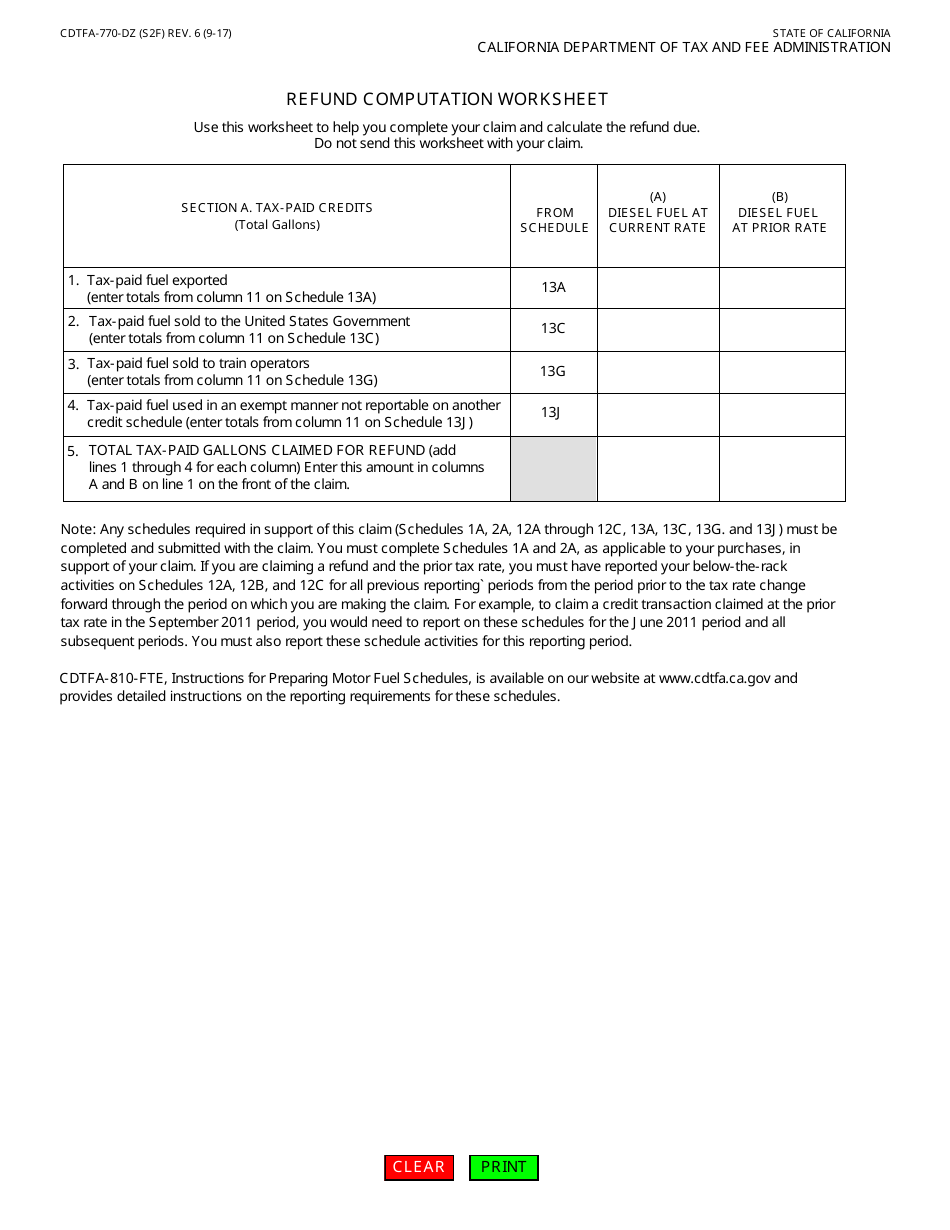

Q: What information do I need to fill out this form?

A: You will need to provide details about the nontaxable sales and exports of diesel fuel, including the amount, location, and any supporting documentation.

Q: Is there a deadline for submitting this form?

A: Yes, there is a deadline for submitting this form. Generally, it must be filed within three years from the date of purchase or export.

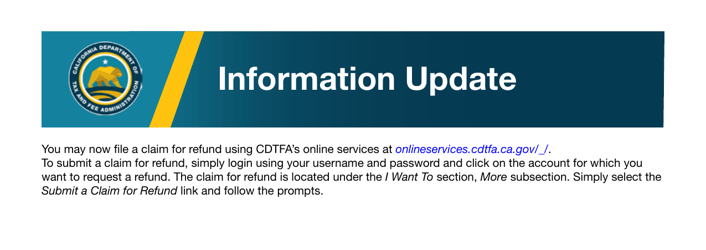

Q: What should I do with the completed form?

A: Once completed, the form should be submitted to the California Department of Tax and Fee Administration (CDTFA) along with any required supporting documents.

Q: How long does it take to receive a refund?

A: The processing time for refund claims can vary, but the CDTFA aims to process them within 90 days from the date of receipt.

Q: Are there any fees associated with filing this form?

A: No, there are no fees associated with filing Form CDTFA-770-DZ.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-770-DZ by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.