This version of the form is not currently in use and is provided for reference only. Download this version of

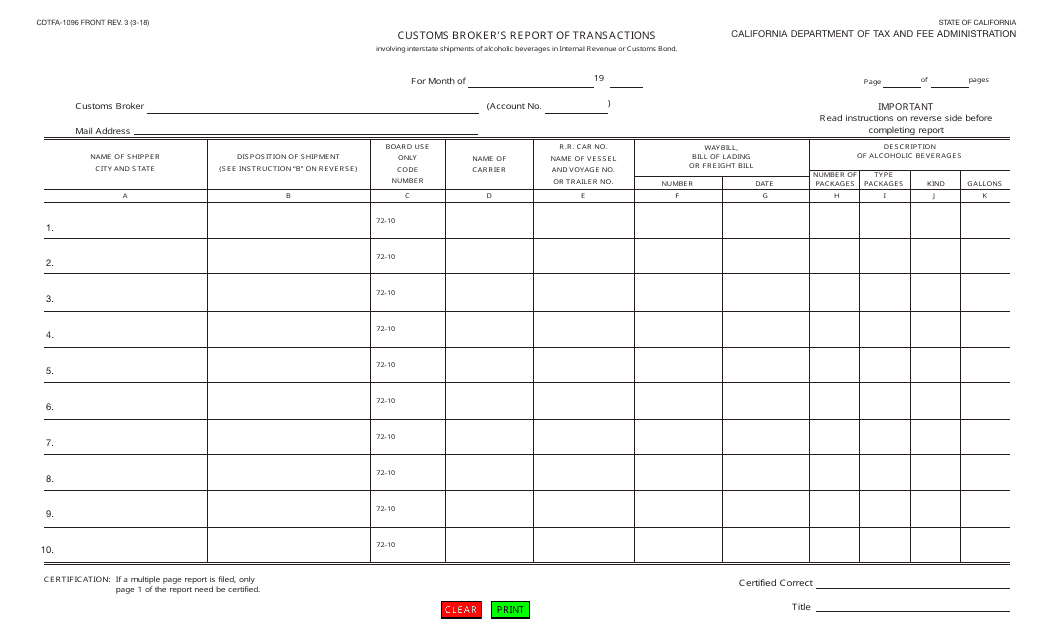

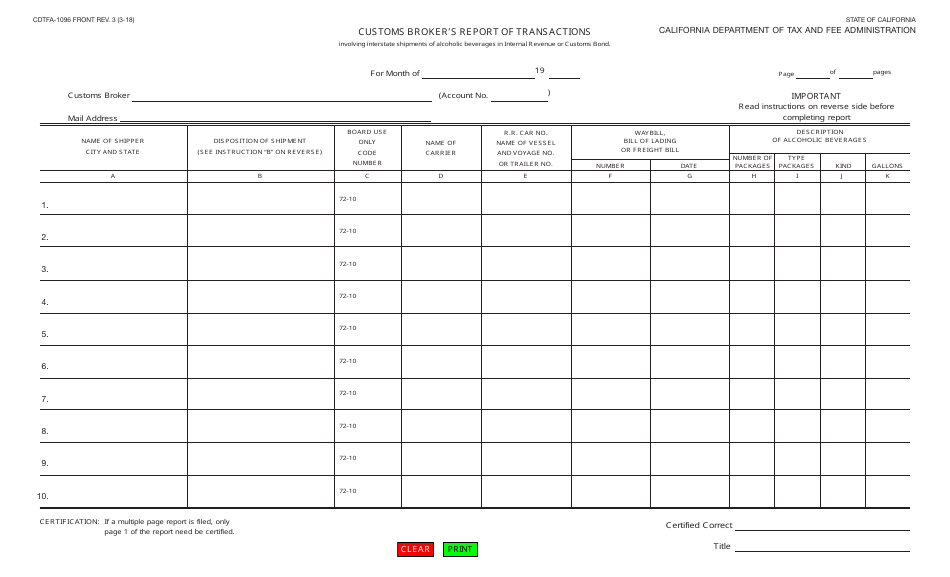

Form CDTFA-1096

for the current year.

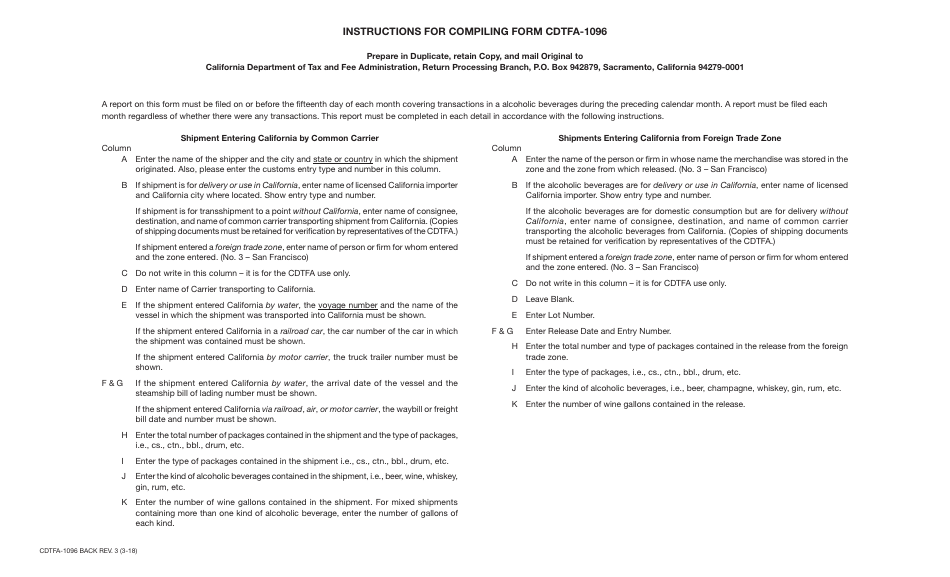

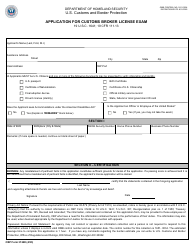

Form CDTFA-1096 Customs Broker's Report of Transactions - California

What Is Form CDTFA-1096?

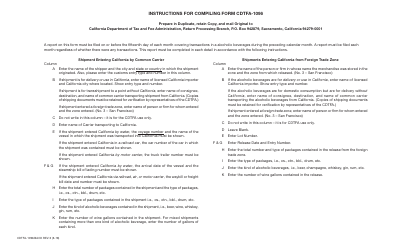

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-1096?

A: Form CDTFA-1096 is the Customs Broker's Report of Transactions for the state of California.

Q: Who is required to file Form CDTFA-1096?

A: Customs brokers operating in California are required to file Form CDTFA-1096.

Q: What information is required to be reported on Form CDTFA-1096?

A: Form CDTFA-1096 requires customs brokers to report detailed information about their client's import and export transactions.

Q: When is Form CDTFA-1096 due?

A: Form CDTFA-1096 is generally due on a quarterly basis, with specific due dates noted on the form.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-1096 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.