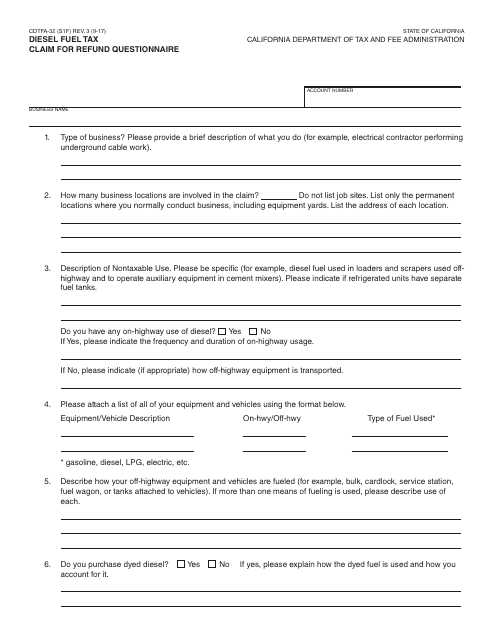

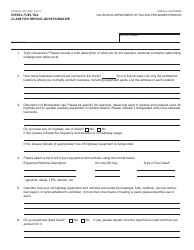

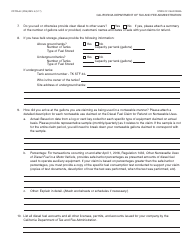

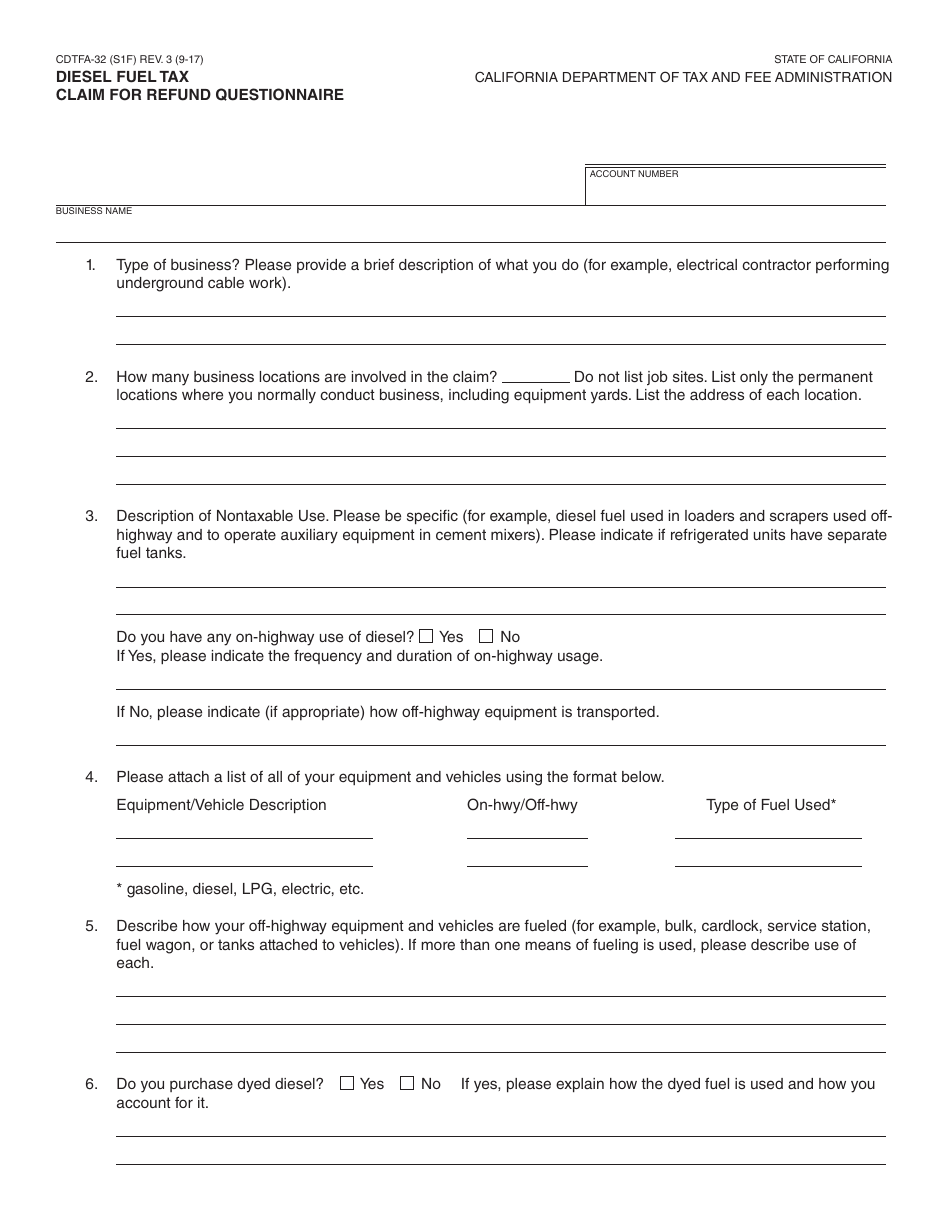

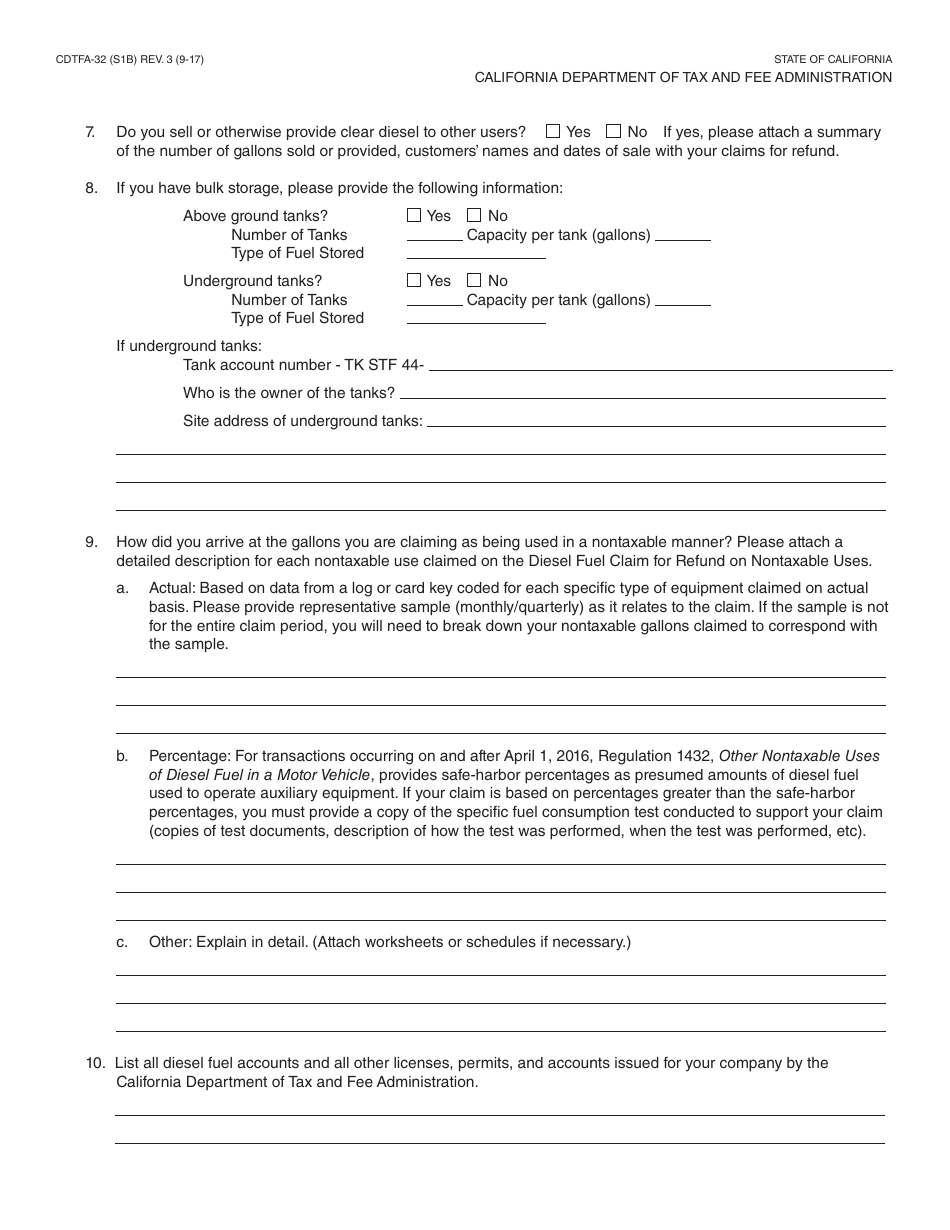

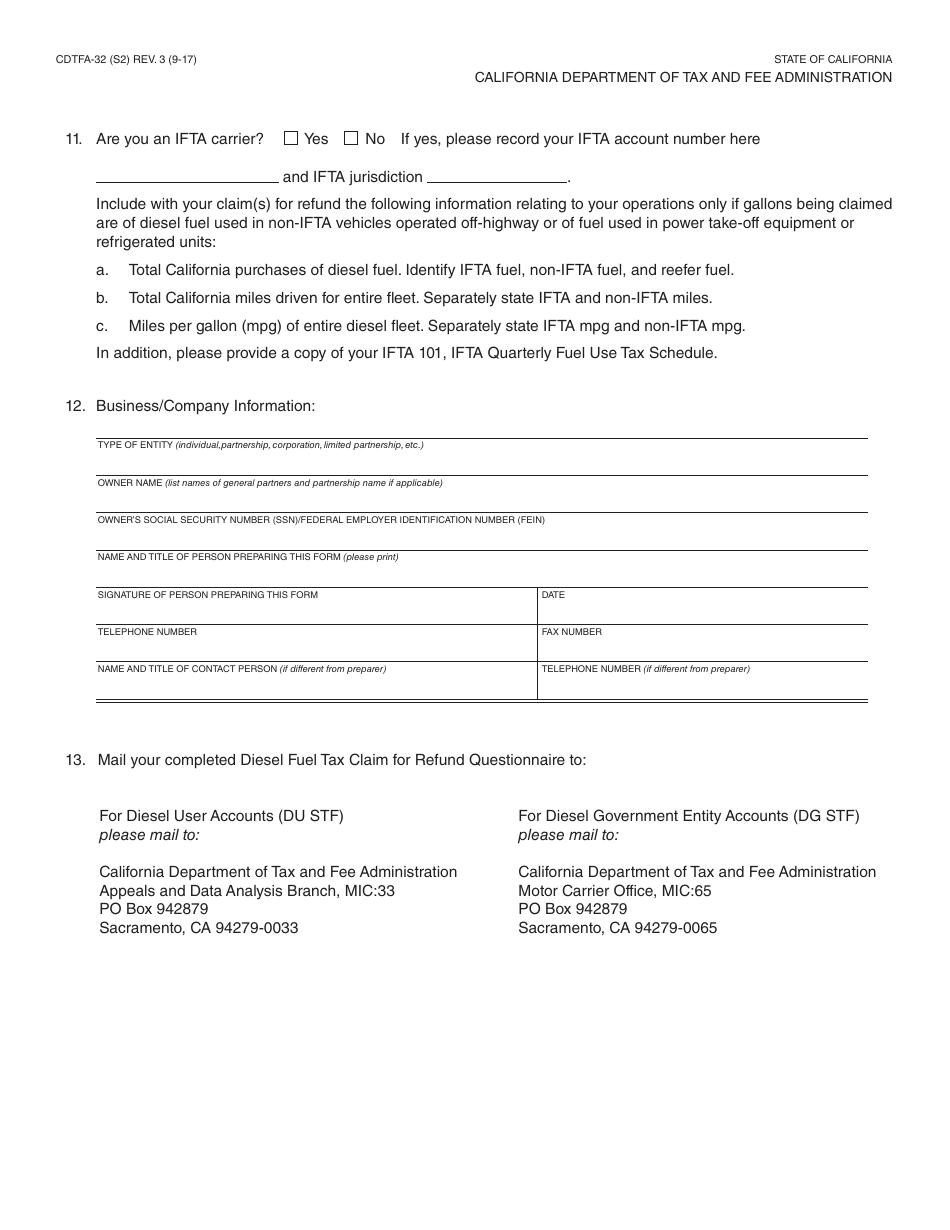

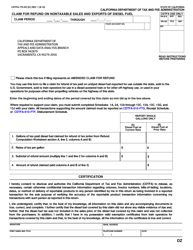

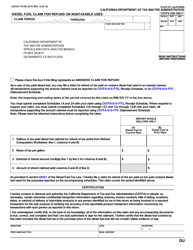

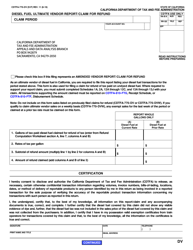

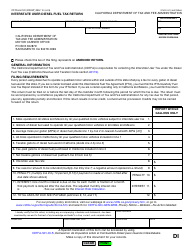

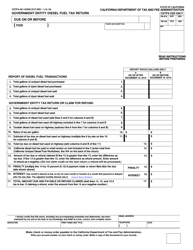

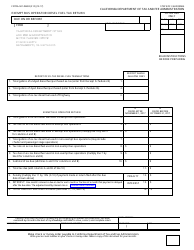

Form CDTFA-32 Diesel Fuel Tax Claim for Refund Questionnaire - California

What Is Form CDTFA-32?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-32?

A: Form CDTFA-32 is the Diesel FuelTax Claim for Refund Questionnaire used in California.

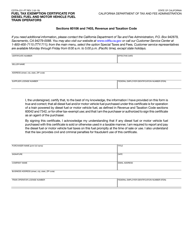

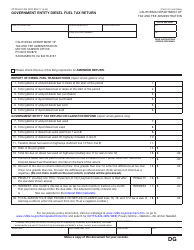

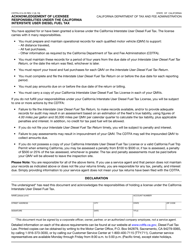

Q: Who needs to file Form CDTFA-32?

A: Anyone who wants to claim a refund of diesel fuel tax in California needs to file Form CDTFA-32.

Q: What is the purpose of Form CDTFA-32?

A: The purpose of Form CDTFA-32 is to gather information about the claimant and the diesel fuel usage in order to process a refund.

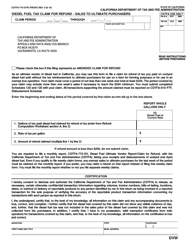

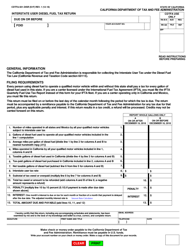

Q: Is there a deadline for filing Form CDTFA-32?

A: Yes, Form CDTFA-32 must be filed within 3 years from the date the tax was due or paid, or within 6 months after an overpayment was made.

Q: What supporting documents are required to be submitted with Form CDTFA-32?

A: Supporting documents may include invoices, fuel records, and any other relevant documents that substantiate the claimed refund.

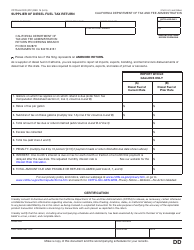

Q: How long does it take to process a refund claim filed using Form CDTFA-32?

A: The processing time may vary, but the CDTFA aims to issue refunds within 90 days of receiving a complete and accurate claim.

Q: Are there any penalties for filing an incorrect or fraudulent claim using Form CDTFA-32?

A: Yes, there are penalties for filing an incorrect or fraudulent claim, including potential criminal prosecution.

Q: Can I file an amended claim using Form CDTFA-32?

A: Yes, you can file an amended claim within 3 years from the date the original claim was filed or within 3 years from the date the tax was due or paid, whichever is later.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

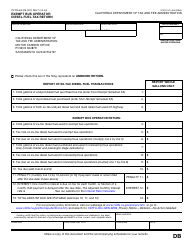

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-32 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.