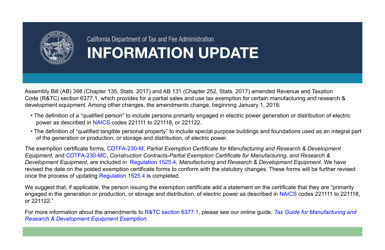

This version of the form is not currently in use and is provided for reference only. Download this version of

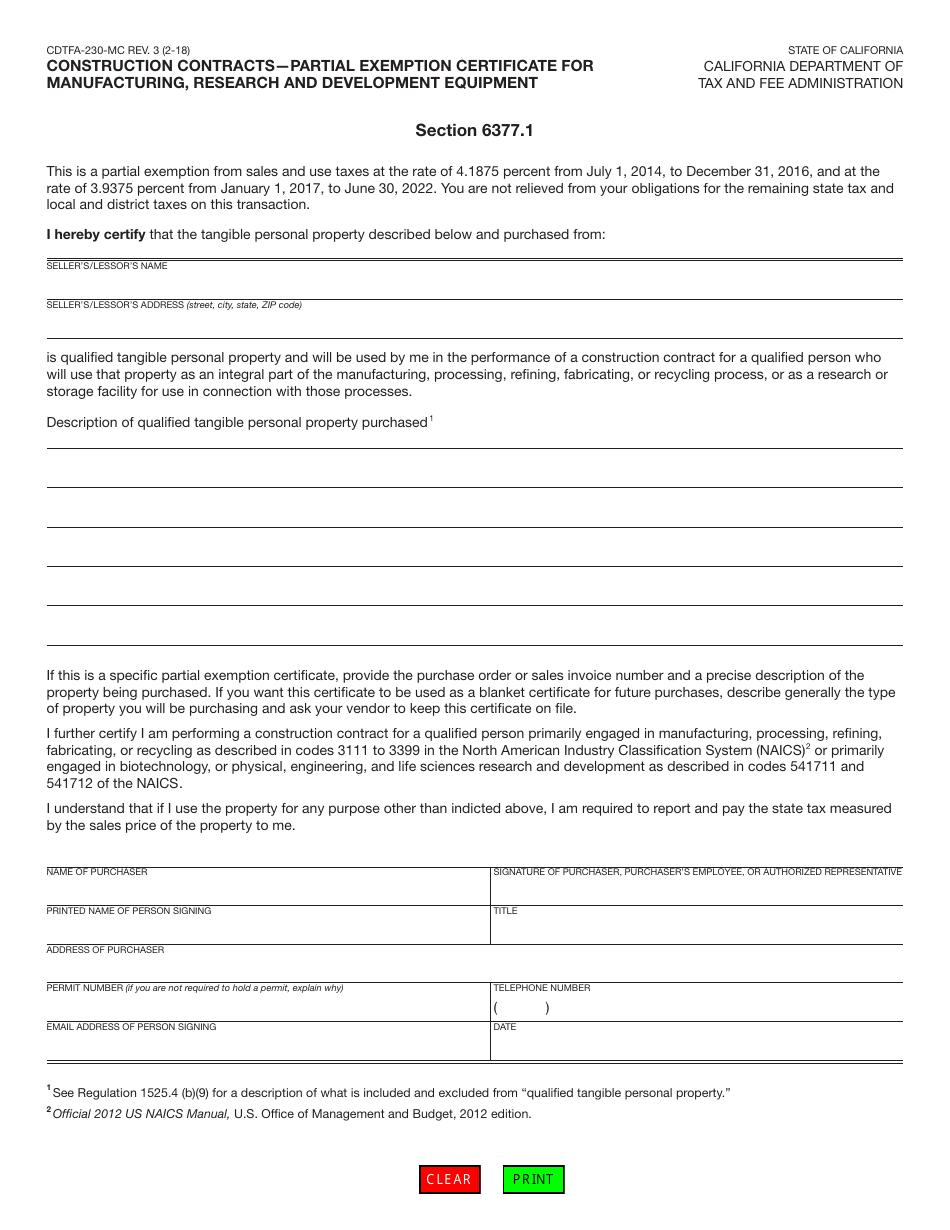

Form CDTFA-230-MC

for the current year.

Form CDTFA-230-MC Construction Contracts - Partial Exemption Certificate for Manufacturing, Research and Development Equipment - California

What Is Form CDTFA-230-MC?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CDTFA-230-MC?

A: Form CDTFA-230-MC is a partial exemption certificate used in California for construction contracts related to manufacturing, research, and development equipment.

Q: What is a partial exemption certificate?

A: A partial exemption certificate is a document that allows for a reduced tax rate or exemption on certain types of transactions.

Q: What is the purpose of Form CDTFA-230-MC?

A: The purpose of Form CDTFA-230-MC is to certify that a construction contract is eligible for a partial exemption on sales and use tax when it involves manufacturing, research, and development equipment in California.

Q: Who should use Form CDTFA-230-MC?

A: Contractors or subcontractors who are engaged in construction contracts related to manufacturing, research, and development equipment in California should use Form CDTFA-230-MC.

Q: What is the benefit of using Form CDTFA-230-MC?

A: Using Form CDTFA-230-MC allows contractors and subcontractors to claim a partial exemption on sales and use tax for qualifying construction contracts involving manufacturing, research, and development equipment.

Q: Are there any eligibility requirements to use Form CDTFA-230-MC?

A: Yes, there are specific eligibility requirements that must be met in order to use Form CDTFA-230-MC. These requirements are outlined in the instructions accompanying the form.

Q: Can Form CDTFA-230-MC be used for other types of construction contracts?

A: No, Form CDTFA-230-MC is specifically designed for construction contracts related to manufacturing, research, and development equipment in California.

Q: Is there a fee to submit Form CDTFA-230-MC?

A: No, there is no fee to submit Form CDTFA-230-MC. It is a certificate used to claim a partial exemption on sales and use tax, not a financial transaction.

Q: How long is Form CDTFA-230-MC valid?

A: Form CDTFA-230-MC is valid until it is either revoked or superseded by the California Department of Tax and Fee Administration.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-MC by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.