This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-146-CC

for the current year.

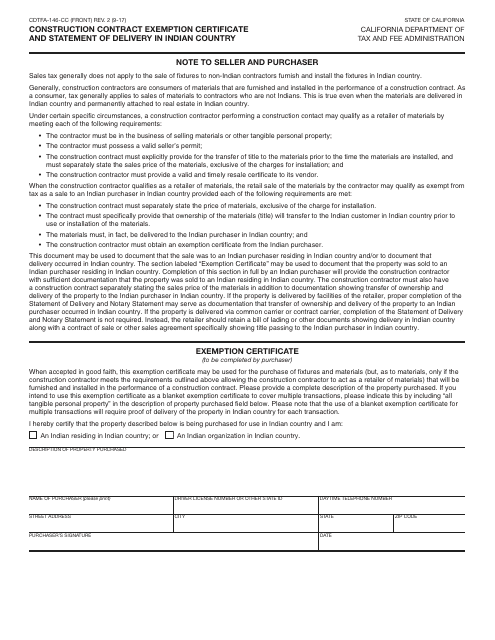

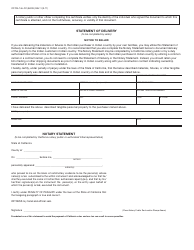

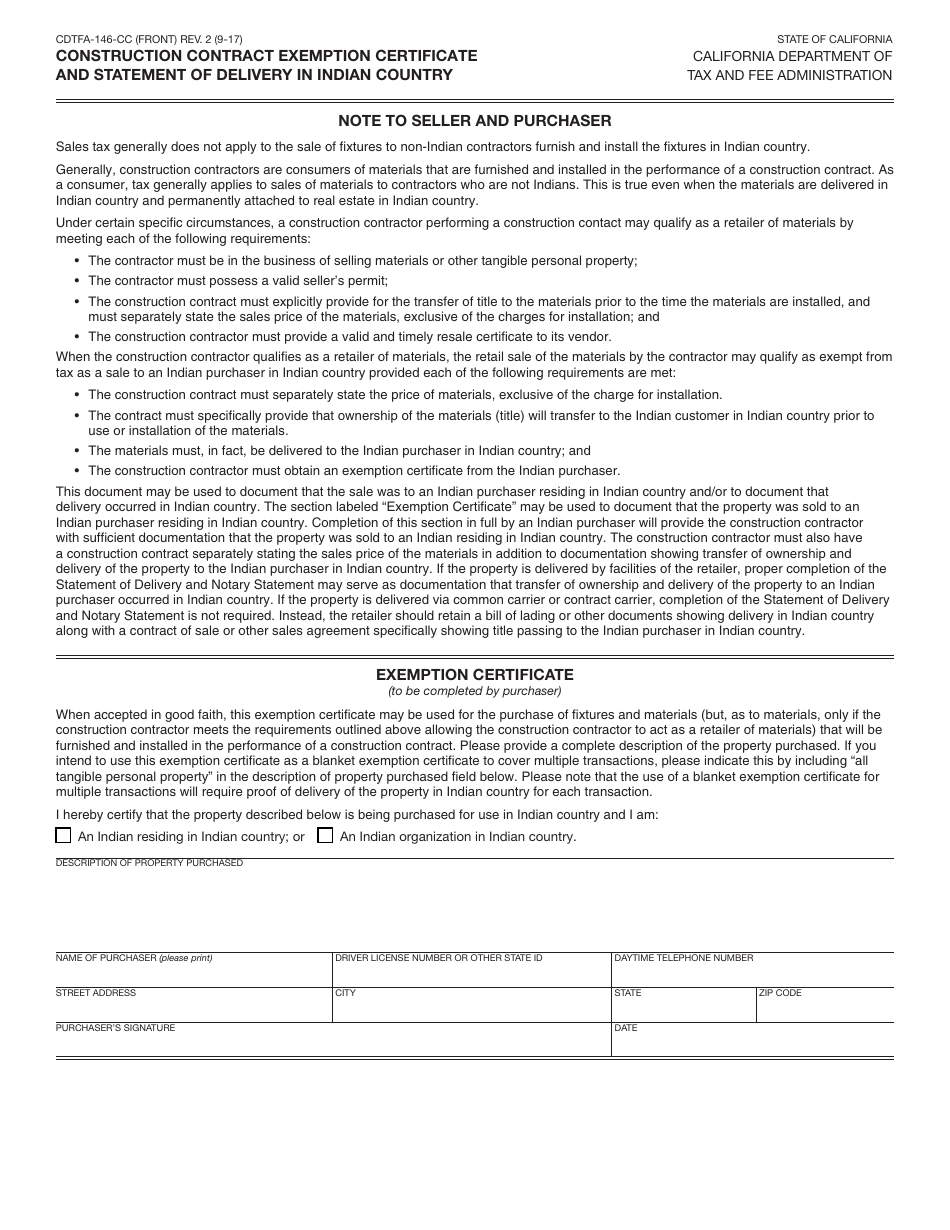

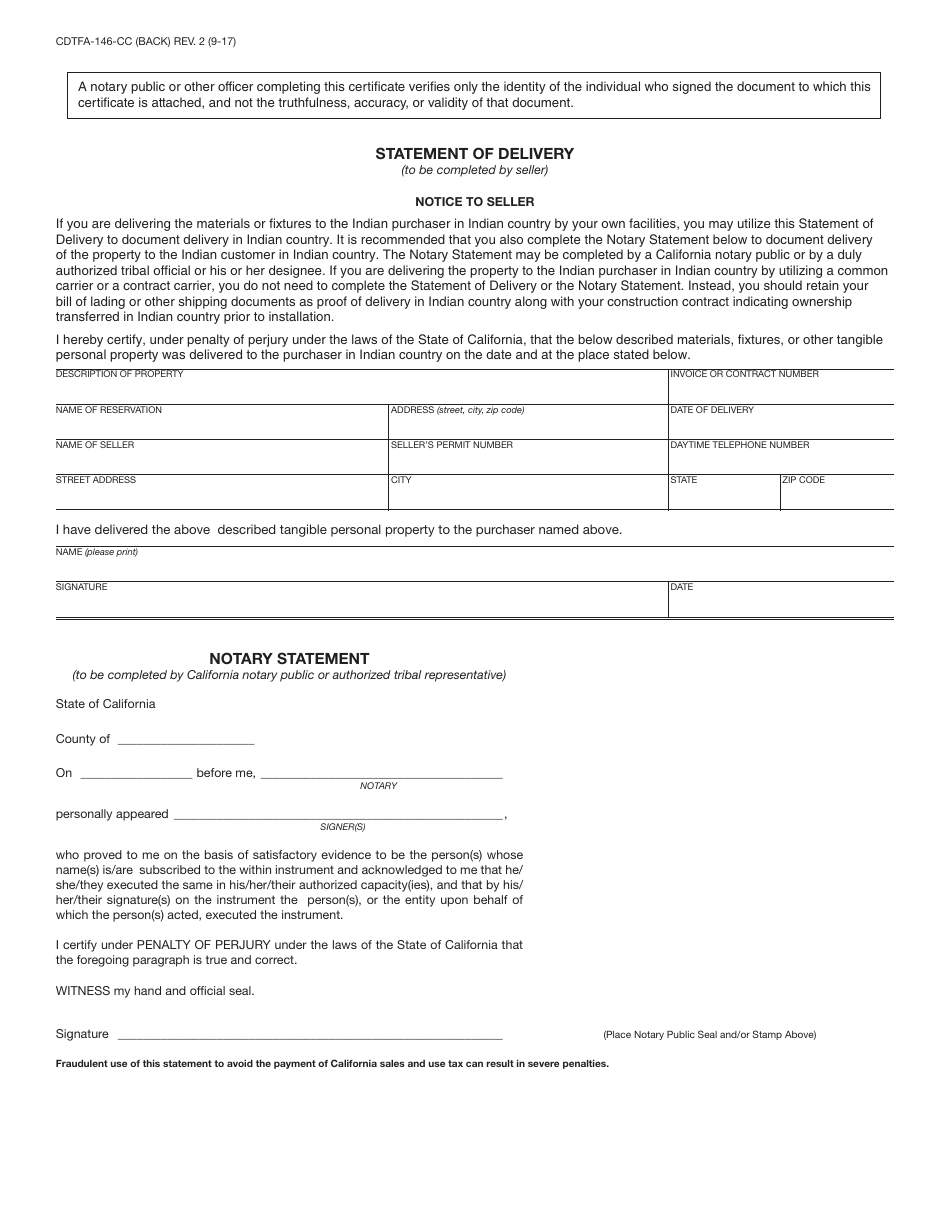

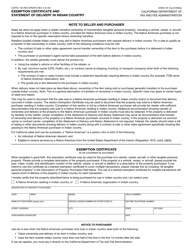

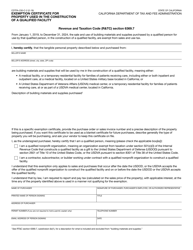

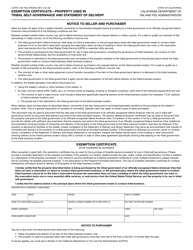

Form CDTFA-146-CC Construction Contract Exemption Certificate and Statement of Delivery in Indian Country - California

What Is Form CDTFA-146-CC?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-146-CC?

A: Form CDTFA-146-CC is a Construction Contract Exemption Certificate and Statement of Delivery in Indian Country form in California.

Q: What is the purpose of Form CDTFA-146-CC?

A: The purpose of Form CDTFA-146-CC is to claim an exemption from California sales and use tax for construction contracts and deliveries of tangible personal property in federally recognized Indian country.

Q: Who needs to use Form CDTFA-146-CC?

A: Contractors and vendors engaged in construction contracts or deliveries of tangible personal property in federally recognized Indian country in California need to use Form CDTFA-146-CC.

Q: What is the exemption claimed on Form CDTFA-146-CC?

A: The exemption claimed on Form CDTFA-146-CC is from California sales and use tax for construction contracts and deliveries of tangible personal property in Indian country.

Q: Are there any filing fees for Form CDTFA-146-CC?

A: No, there are no filing fees for Form CDTFA-146-CC.

Q: What supporting documents should be attached to Form CDTFA-146-CC?

A: Supporting documents such as contracts, invoices, and receipts should be attached to Form CDTFA-146-CC.

Q: When should I submit Form CDTFA-146-CC?

A: Form CDTFA-146-CC should be submitted before the construction contract or delivery of tangible personal property takes place.

Q: Are there any penalties for not submitting Form CDTFA-146-CC?

A: Failure to submit Form CDTFA-146-CC may result in the imposition of California sales and use tax on the construction contract or delivery of tangible personal property.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-146-CC by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.