This version of the form is not currently in use and is provided for reference only. Download this version of

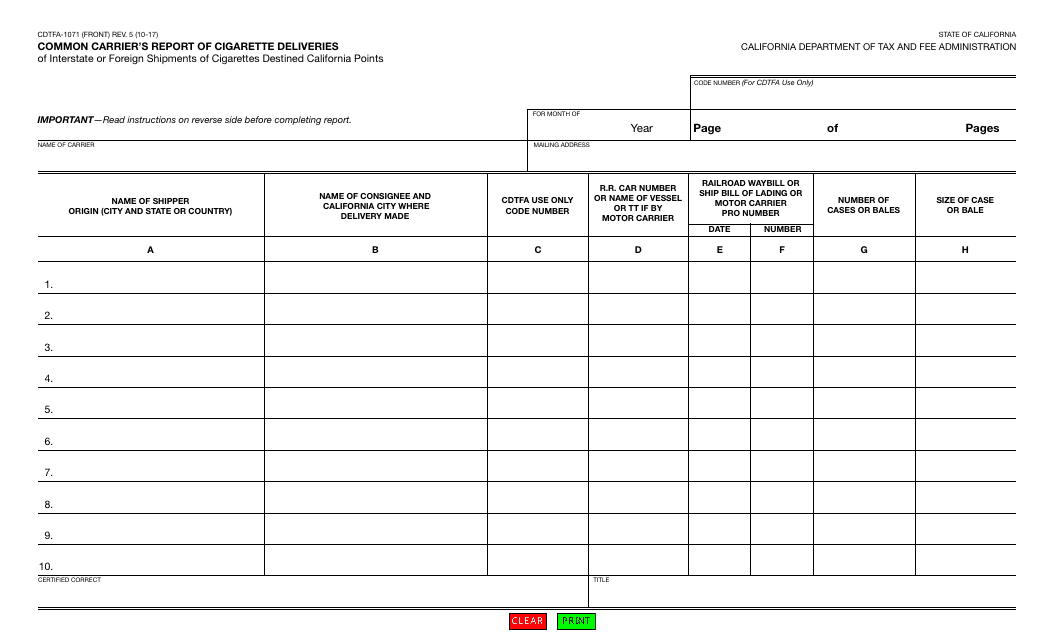

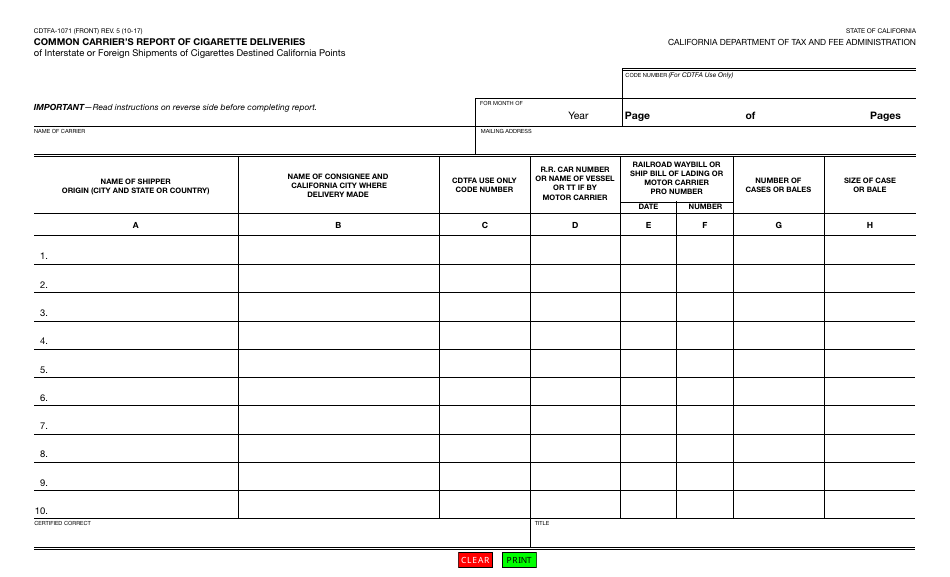

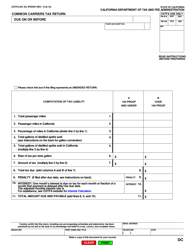

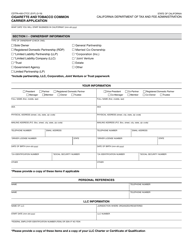

Form CDTFA-1071

for the current year.

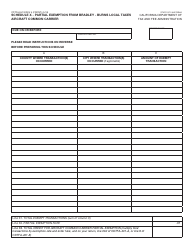

Form CDTFA-1071 Common Carrier's Report of Cigarette Deliveries - California

What Is Form CDTFA-1071?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-1071?

A: Form CDTFA-1071 is the Common Carrier's Report of Cigarette Deliveries for California.

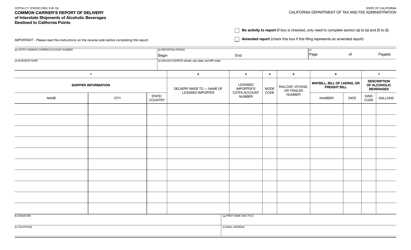

Q: Who needs to file Form CDTFA-1071?

A: Common carriers delivering cigarettes in California need to file Form CDTFA-1071.

Q: What information is required on Form CDTFA-1071?

A: Form CDTFA-1071 requires information about the quantity of cigarettes delivered, the date and location of delivery, and the name of the person receiving the cigarettes.

Q: When is Form CDTFA-1071 due?

A: Form CDTFA-1071 is due on a monthly basis and should be filed by the 25th day of the month following the reporting period.

Q: Are there any penalties for not filing Form CDTFA-1071?

A: Yes, there are penalties for not filing Form CDTFA-1071, including potential fines and penalties for non-compliance with California cigarette tax laws.

Q: Is Form CDTFA-1071 required for deliveries of other tobacco products?

A: No, Form CDTFA-1071 is specifically for reporting cigarette deliveries and not for other tobacco products.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-1071 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.