This version of the form is not currently in use and is provided for reference only. Download this version of

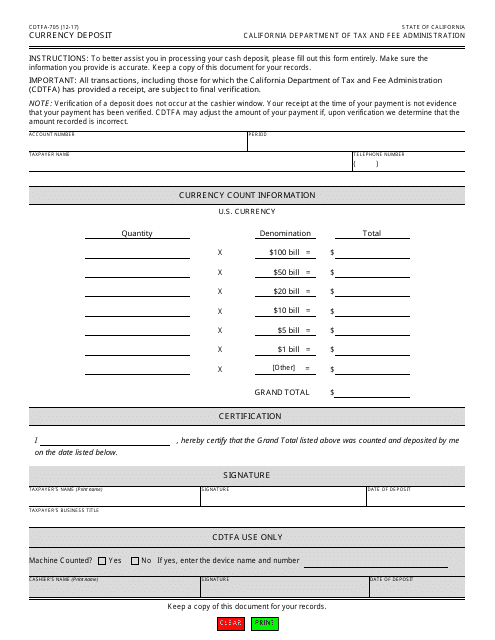

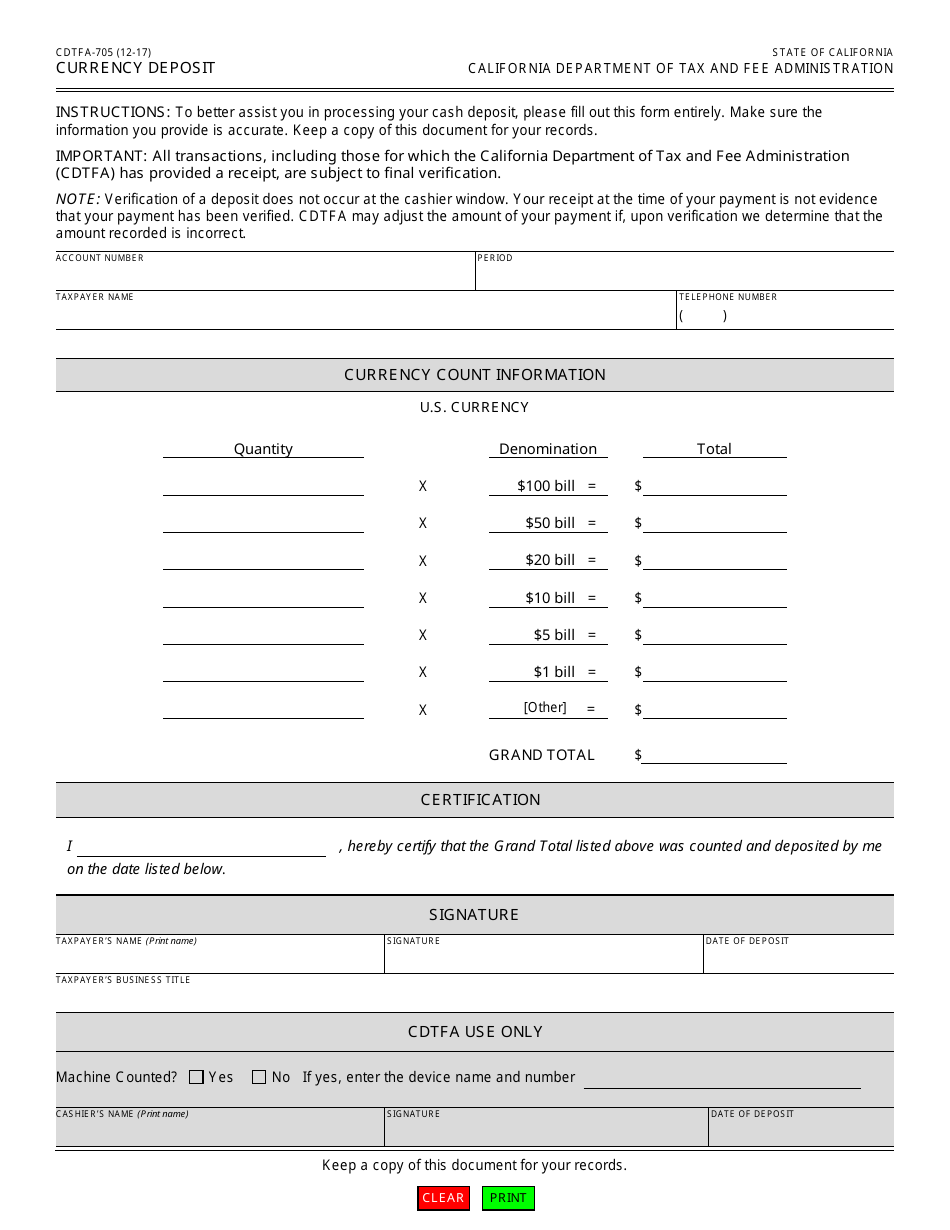

Form CDTFA-705

for the current year.

Form CDTFA-705 Currency Deposit - California

What Is Form CDTFA-705?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-705?

A: Form CDTFA-705 is a form used for reporting currency deposits made in California.

Q: Who needs to file Form CDTFA-705?

A: Any individual or business that makes currency deposits in California needs to file Form CDTFA-705.

Q: What is the purpose of Form CDTFA-705?

A: The purpose of Form CDTFA-705 is to report currency deposits to the California Department of Tax and Fee Administration (CDTFA).

Q: When should Form CDTFA-705 be filed?

A: Form CDTFA-705 should be filed within 30 days after the end of the calendar quarter in which the currency deposits were made.

Q: Are there any penalties for not filing Form CDTFA-705?

A: Yes, there can be penalties for not filing or late filing of Form CDTFA-705. It is important to timely and accurately file the form to avoid any penalties.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-705 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.