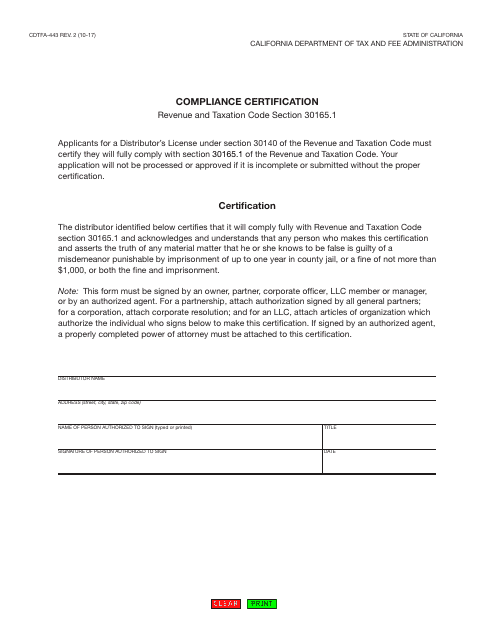

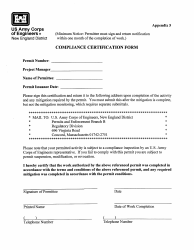

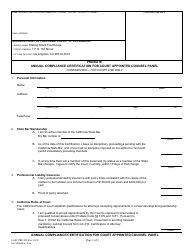

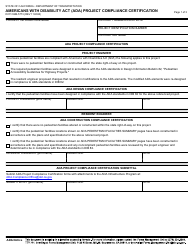

Form CDTFA-443 Compliance Certification - California

What Is Form CDTFA-443?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CDTFA-443?

A: Form CDTFA-443 is a Compliance Certification form in California.

Q: What is the purpose of Form CDTFA-443?

A: The purpose of Form CDTFA-443 is to certify compliance with California tax requirements.

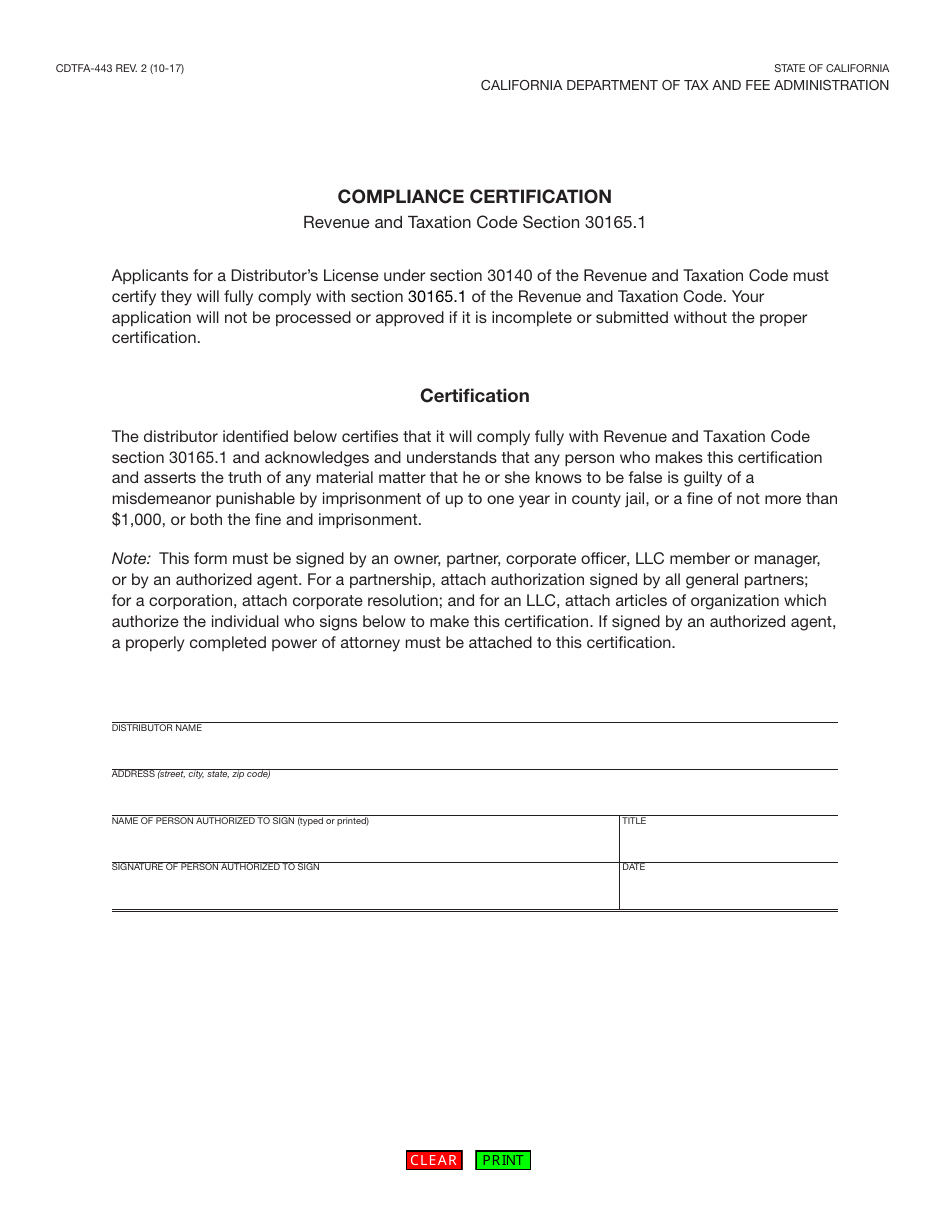

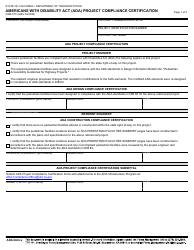

Q: Who needs to file Form CDTFA-443?

A: Businesses operating in California that are required to collect and remit sales and use tax must file Form CDTFA-443.

Q: When should Form CDTFA-443 be filed?

A: Form CDTFA-443 should be filed annually, on or before a specified due date.

Q: Are there any penalties for not filing Form CDTFA-443?

A: Yes, failure to file Form CDTFA-443 or filing a false or incomplete form may result in penalties and interest.

Q: Is Form CDTFA-443 required for all businesses?

A: No, Form CDTFA-443 is only required for businesses that meet certain criteria, such as those engaging in taxable sales exceeding a specified threshold.

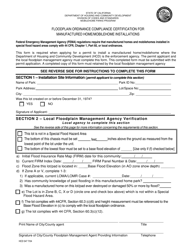

Q: What information is required on Form CDTFA-443?

A: Form CDTFA-443 requires the business name, address, California seller's permit number, and information on taxable sales and tax liability.

Q: Are there any other forms related to Form CDTFA-443?

A: Yes, businesses may be required to file other related forms, such as the sales and use tax return (Form CDTFA-401) and the Annual Return (Form CDTFA-401-A).

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-443 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.