This version of the form is not currently in use and is provided for reference only. Download this version of

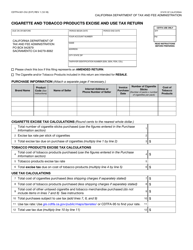

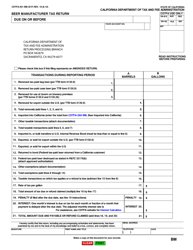

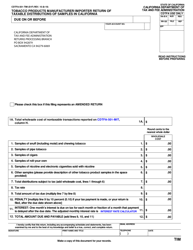

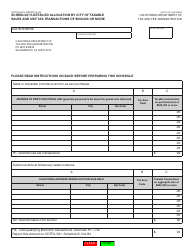

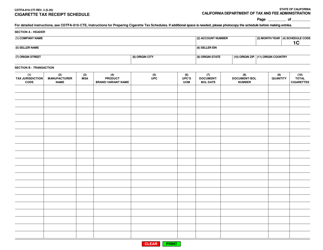

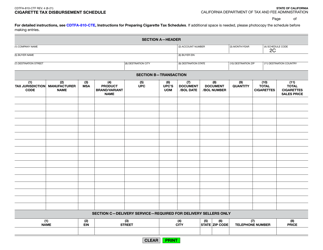

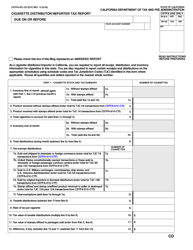

Form CDTFA-501-CM

for the current year.

Form CDTFA-501-CM Cigarette Manufacturer's Tax Return of Taxable Distributions in California - California

What Is Form CDTFA-501-CM?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

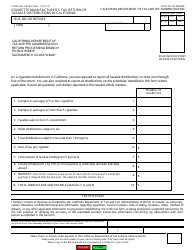

Q: What is Form CDTFA-501-CM?

A: Form CDTFA-501-CM is the Cigarette Manufacturer's Tax Return of Taxable Distributions in California.

Q: Who needs to file Form CDTFA-501-CM?

A: Cigarette manufacturers who make taxable distributions in California need to file Form CDTFA-501-CM.

Q: What is the purpose of Form CDTFA-501-CM?

A: The purpose of Form CDTFA-501-CM is to report and pay taxes on cigarette distributions made in California.

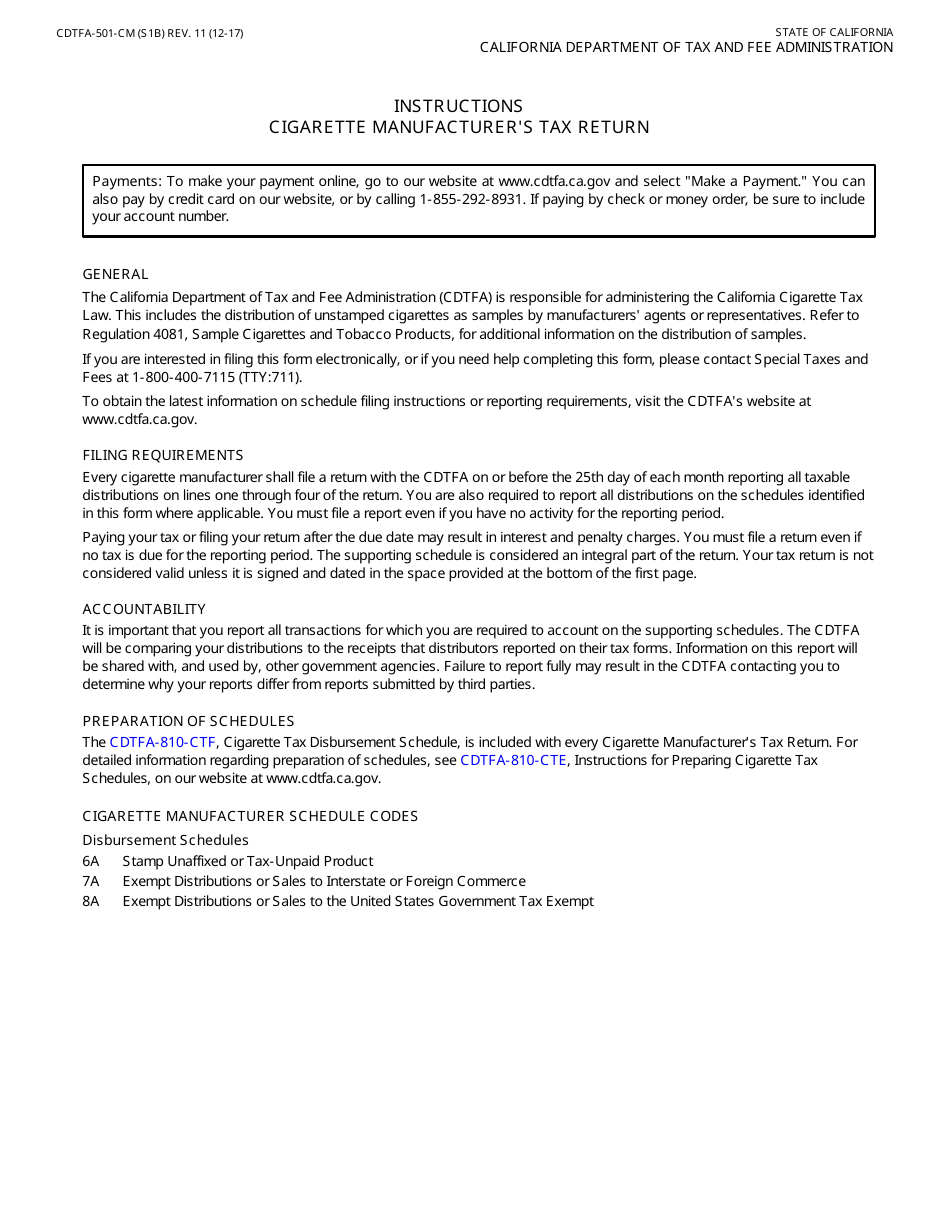

Q: When is Form CDTFA-501-CM due?

A: Form CDTFA-501-CM is due on a quarterly basis and must be filed by the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for not filing Form CDTFA-501-CM?

A: Yes, there are penalties for not filing Form CDTFA-501-CM, including late filing penalties and interest on any unpaid taxes.

Q: What should I do if I have questions about Form CDTFA-501-CM?

A: If you have questions about Form CDTFA-501-CM, you should contact the CDTFA directly for assistance.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-CM by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.