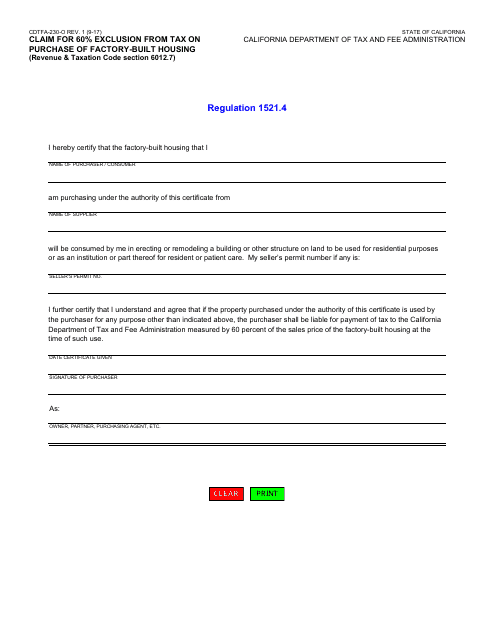

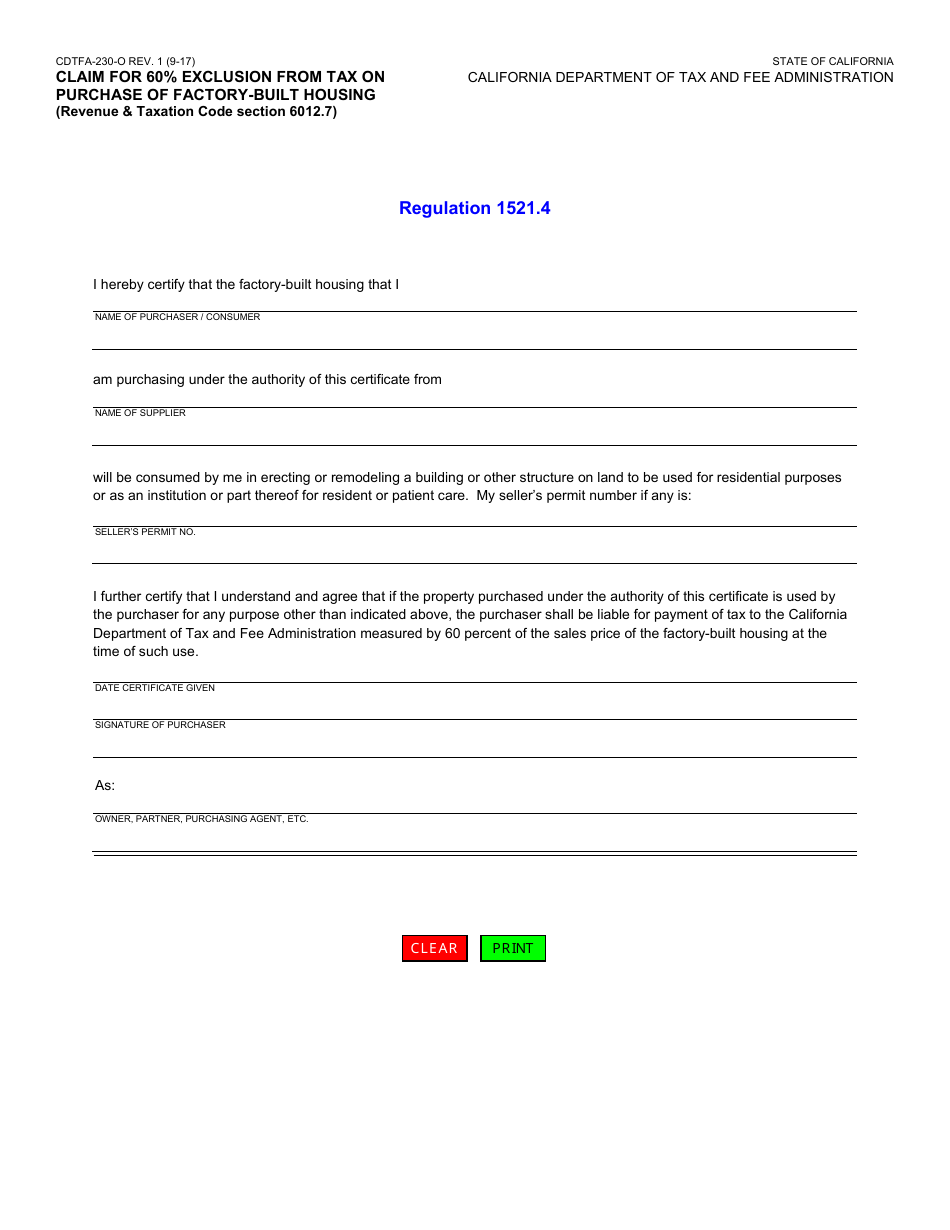

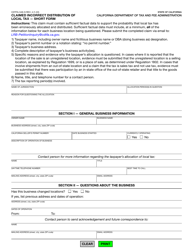

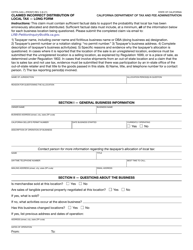

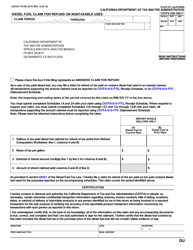

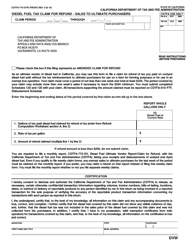

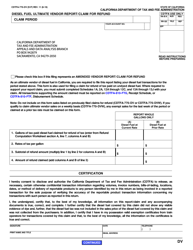

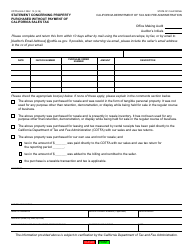

Form CDTFA-230-O Claim for 60% Exclusion From Tax on Purchase of Factory-Built Housing - California

What Is Form CDTFA-230-O?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

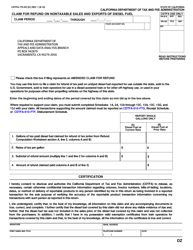

Q: What is Form CDTFA-230-O?

A: Form CDTFA-230-O is a claim for 60% exclusion from tax on the purchase of factory-built housing in California.

Q: What does the form allow for?

A: The form allows individuals to claim a 60% tax exclusion on the purchase of factory-built housing.

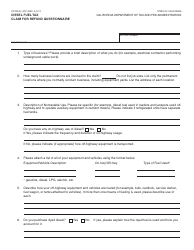

Q: Who can use this form?

A: This form can be used by individuals who are purchasing factory-built housing in California.

Q: What is the purpose of the form?

A: The purpose of the form is to provide individuals with a tax exclusion on the purchase of factory-built housing.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

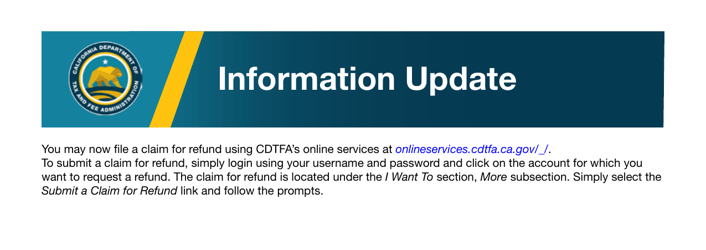

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-O by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.