This version of the form is not currently in use and is provided for reference only. Download this version of

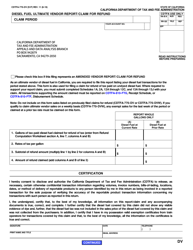

Form CDTFA-101-DMV

for the current year.

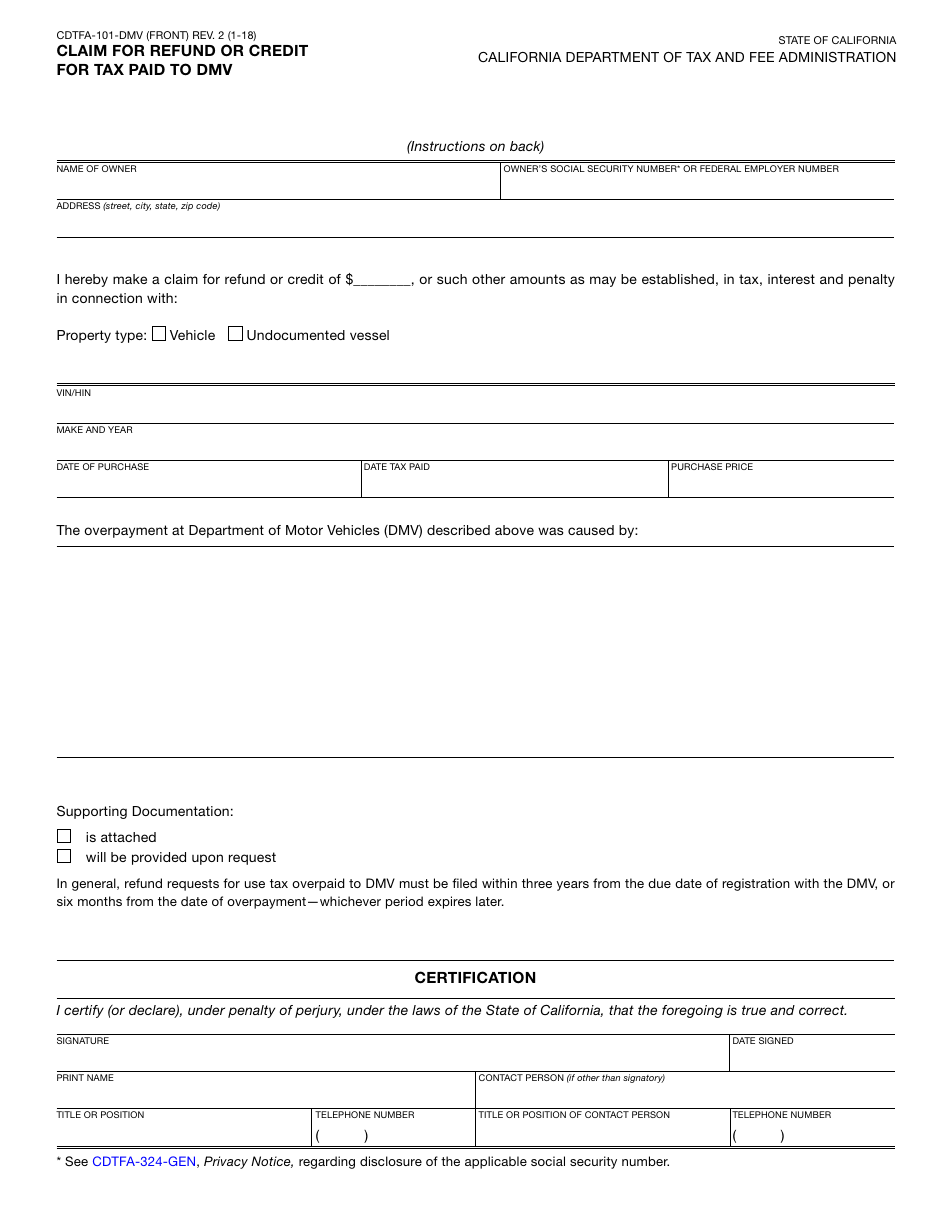

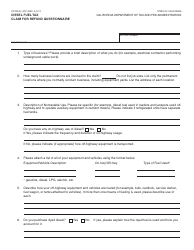

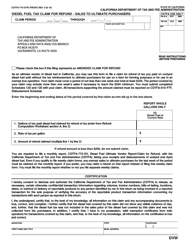

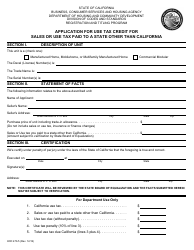

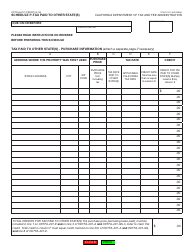

Form CDTFA-101-DMV Claim for Refund or Credit for Tax Paid to Dmv - California

What Is Form CDTFA-101-DMV?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CDTFA-101-DMV form?

A: The CDTFA-101-DMV form is a Claim for Refund or Credit for Tax Paid to DMV in California.

Q: What is the purpose of the form?

A: The purpose of the form is to claim a refund or credit for taxes paid to the California Department of Motor Vehicles (DMV).

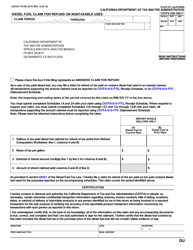

Q: Who can use the CDTFA-101-DMV form?

A: Anyone who has paid taxes to the California DMV and wants to request a refund or credit can use this form.

Q: What taxes can be claimed for refund or credit?

A: The form can be used to claim refunds or credits for various taxes paid to the California DMV, such as vehicle registration fees and use taxes.

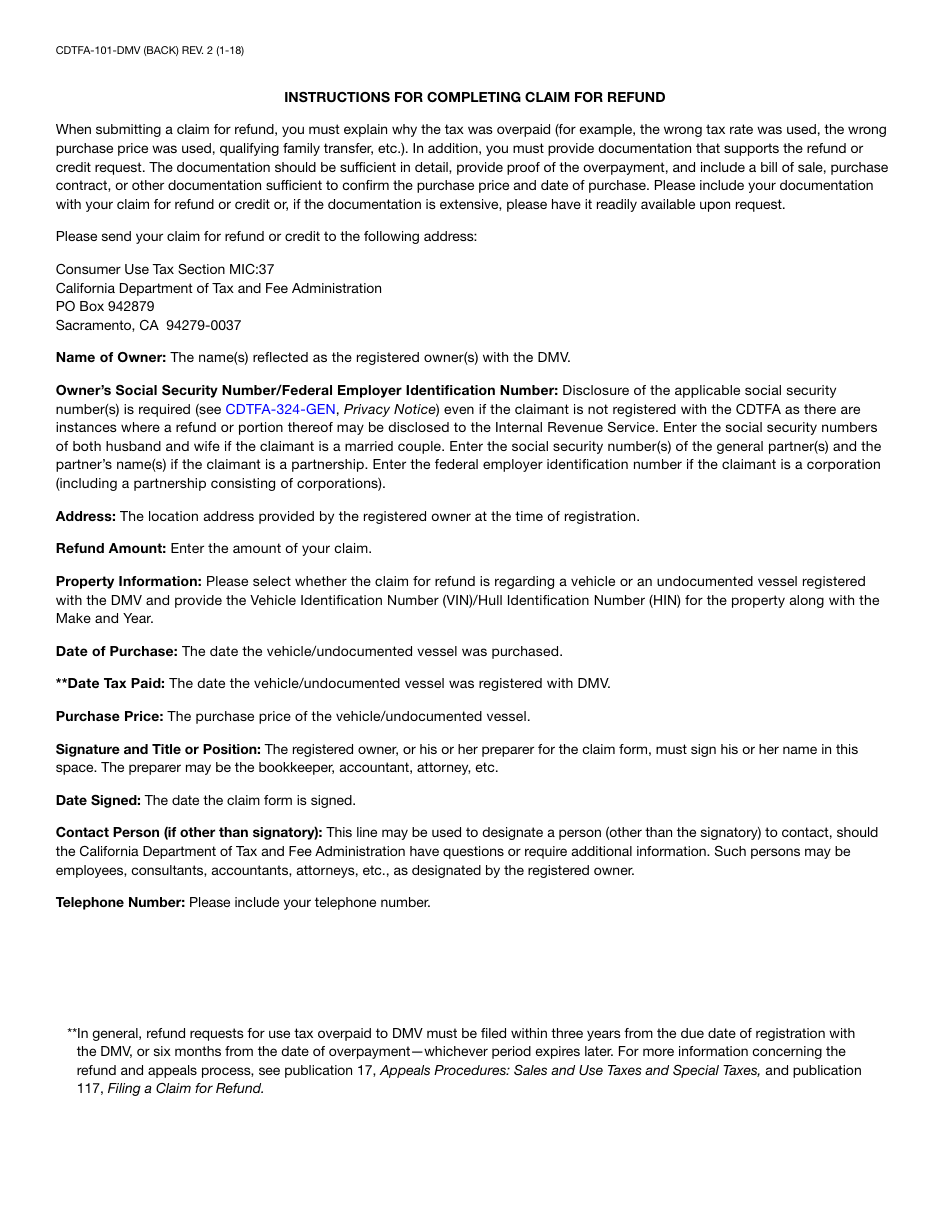

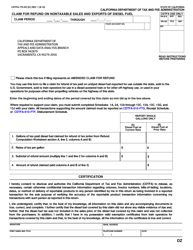

Q: How do I fill out the form?

A: You need to provide your personal and vehicle information, details of the taxes paid, and the reason for the refund or credit request.

Q: What supporting documents should I attach?

A: You should attach copies of relevant DMV documents, such as vehicle registration receipts or tax payment receipts, to support your claim.

Q: What is the processing time for the refund or credit?

A: The processing time may vary, but generally, it takes around 8-12 weeks for the CDTFA to review and process the claim.

Q: Is there a deadline to submit the form?

A: Yes, there is a deadline. You must submit the form within three years from the date of the tax payment for which you are requesting a refund or credit.

Form Details:

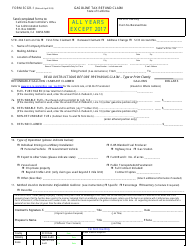

- Released on January 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-101-DMV by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.