This version of the form is not currently in use and is provided for reference only. Download this version of

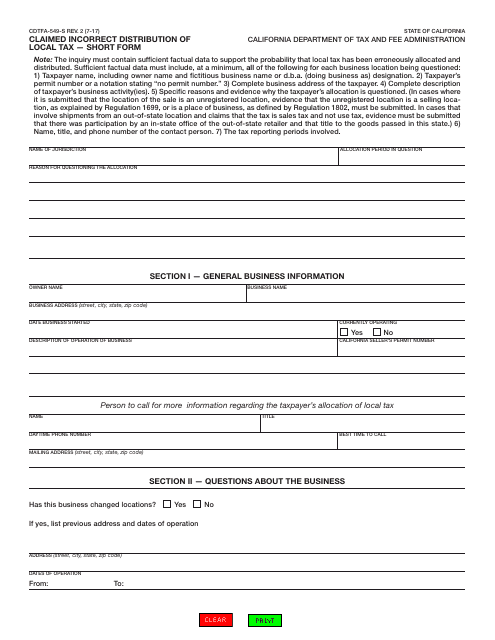

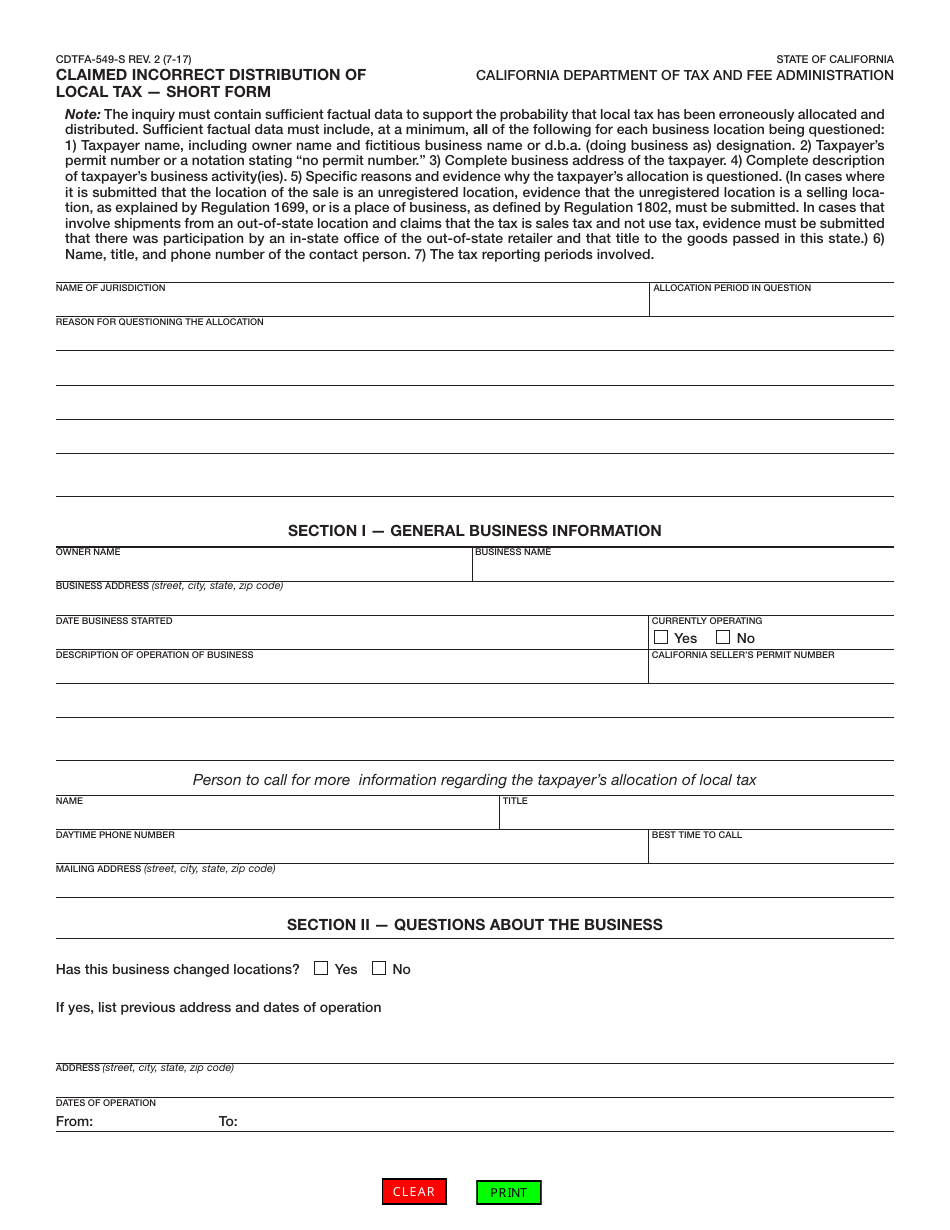

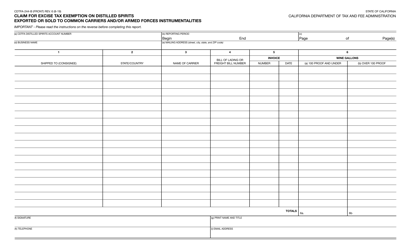

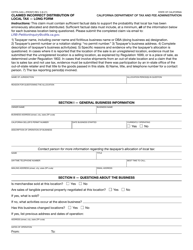

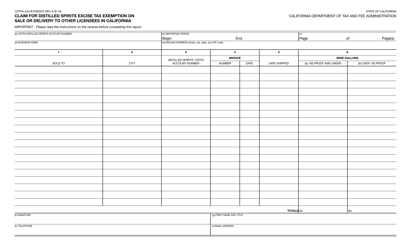

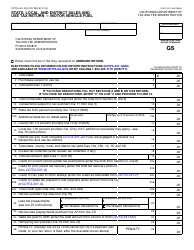

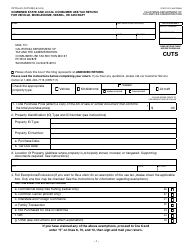

Form CDTFA-549-S

for the current year.

Form CDTFA-549-S Claimed Incorrect Distribution of Local Tax - Short Form - California

What Is Form CDTFA-549-S?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

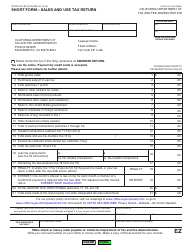

Q: What is Form CDTFA-549-S?

A: Form CDTFA-549-S is the Short Form for Claiming Incorrect Distribution of Local Tax in California.

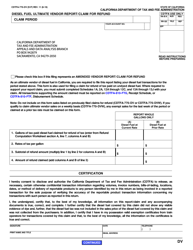

Q: When should I use Form CDTFA-549-S?

A: You should use Form CDTFA-549-S when you want to claim an incorrect distribution of local tax in California.

Q: What is the purpose of Form CDTFA-549-S?

A: The purpose of Form CDTFA-549-S is to report and correct any errors or discrepancies in the distribution of local taxes.

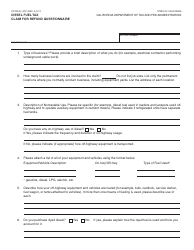

Q: Do I need to include any supporting documentation with Form CDTFA-549-S?

A: Yes, you may need to provide supporting documentation such as sales and use tax returns, invoices, or receipts to substantiate your claim.

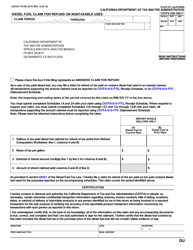

Q: Is there a deadline for filing Form CDTFA-549-S?

A: Yes, Form CDTFA-549-S must be filed within three years from the due date of the return on which the distribution error first occurred.

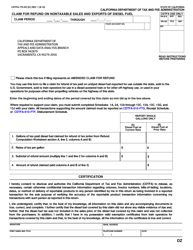

Q: What happens after I submit Form CDTFA-549-S?

A: After submitting Form CDTFA-549-S, the CDTFA will review your claim and may request additional information or documentation. They will then determine if an adjustment is necessary.

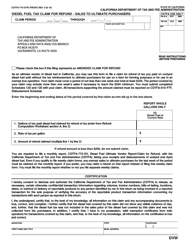

Q: Can I claim a refund if my claim on Form CDTFA-549-S is approved?

A: Yes, if your claim is approved, you may be eligible for a refund or credit of the overpaid local tax amount.

Q: What should I do if my claim on Form CDTFA-549-S is denied?

A: If your claim is denied, you have the right to appeal the decision by following the guidelines provided by the CDTFA.

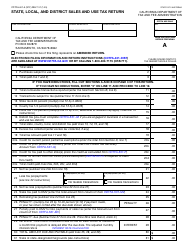

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

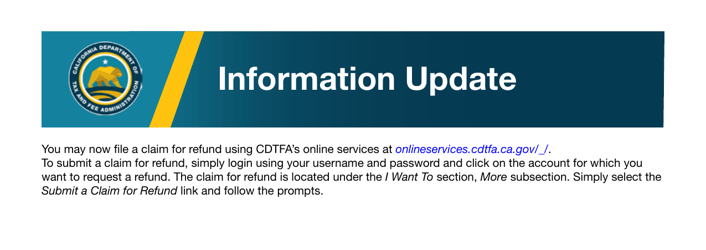

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-549-S by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.