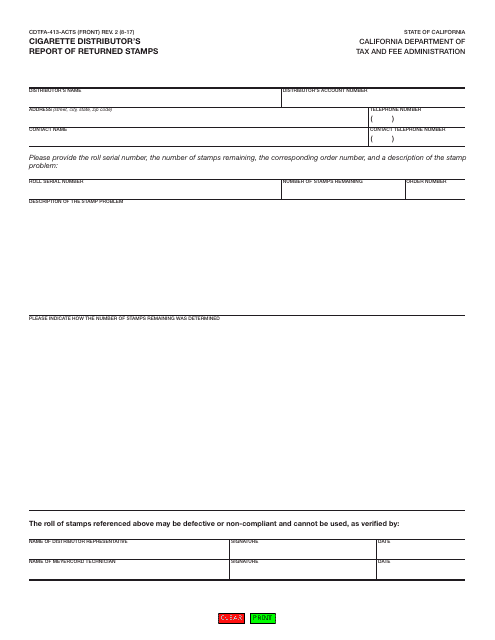

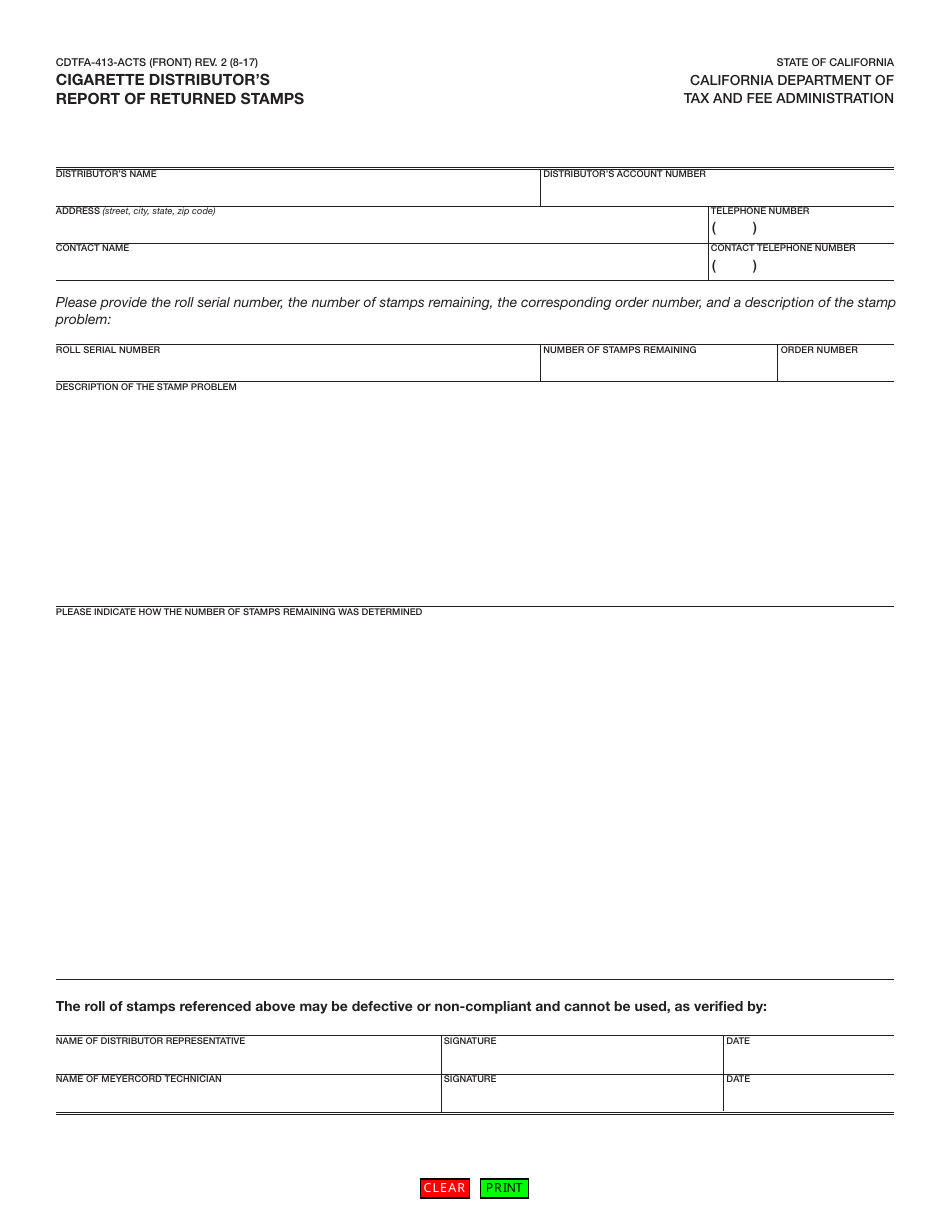

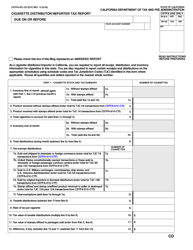

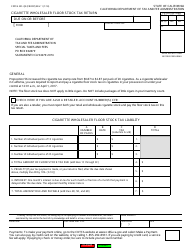

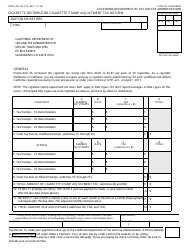

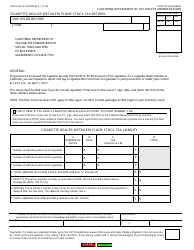

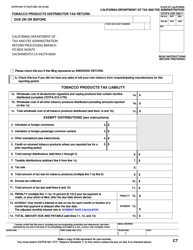

Form CDTFA-413-ACTS Cigarette Distributor's Report of Returned Stamps - California

What Is Form CDTFA-413-ACTS?

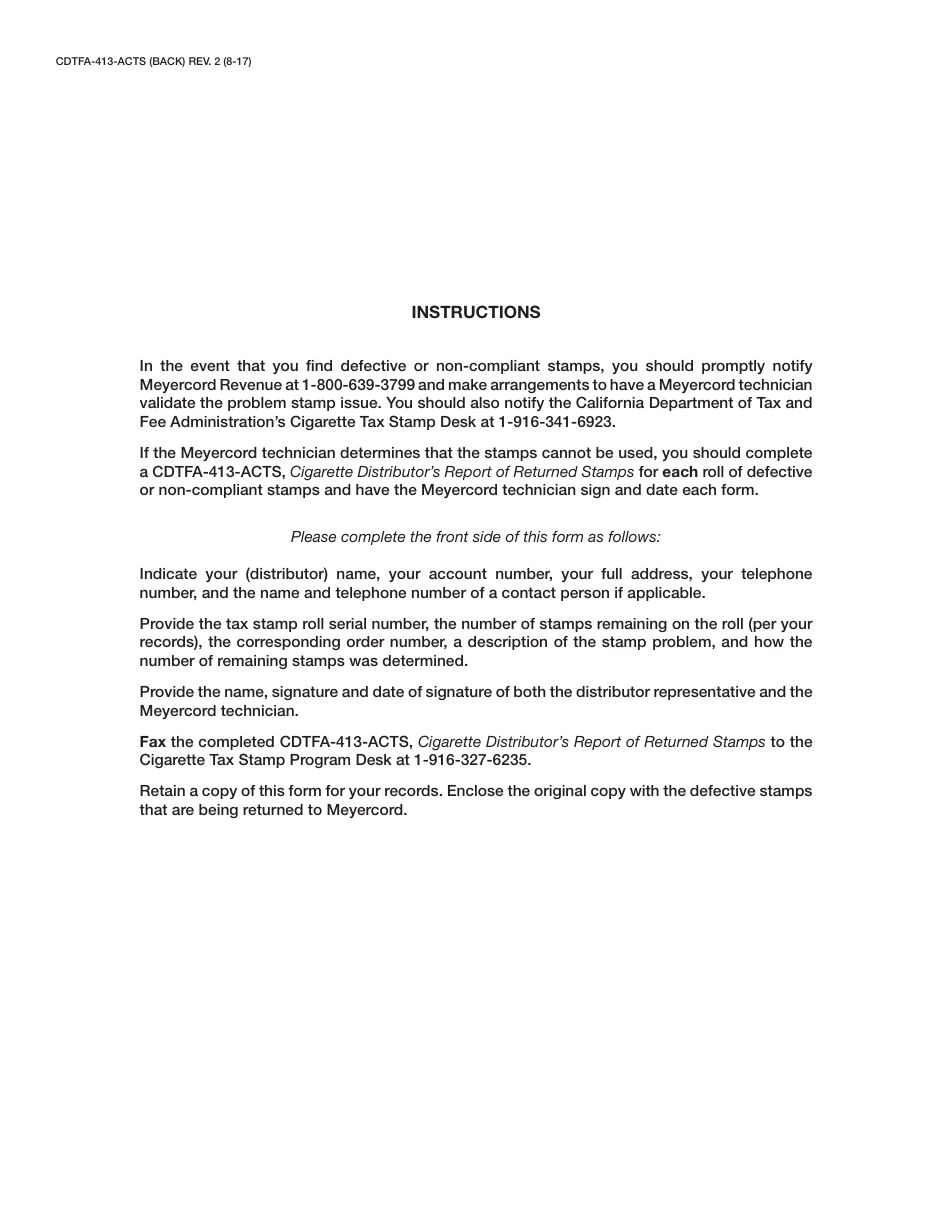

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-413-ACTS?

A: Form CDTFA-413-ACTS is the Cigarette Distributor's Report of Returned Stamps in California.

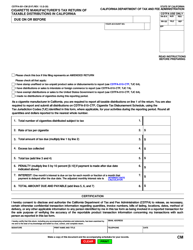

Q: Who needs to file Form CDTFA-413-ACTS?

A: Cigarette distributors in California need to file Form CDTFA-413-ACTS.

Q: What is the purpose of Form CDTFA-413-ACTS?

A: The purpose of Form CDTFA-413-ACTS is to report returned cigarette tax stamps.

Q: Is Form CDTFA-413-ACTS mandatory?

A: Yes, Cigarette distributors in California are required to file Form CDTFA-413-ACTS.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-413-ACTS by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.