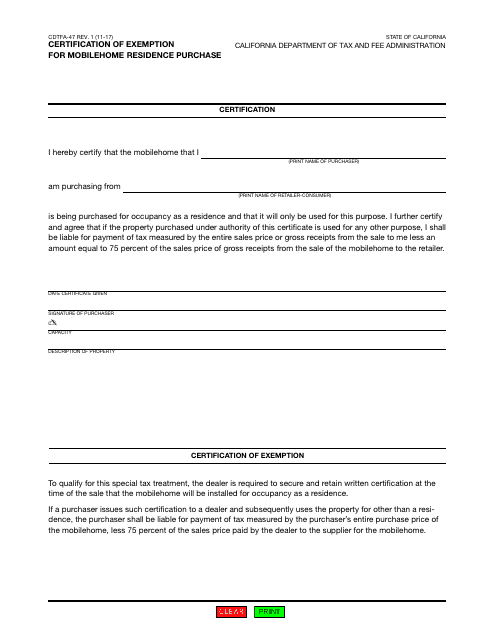

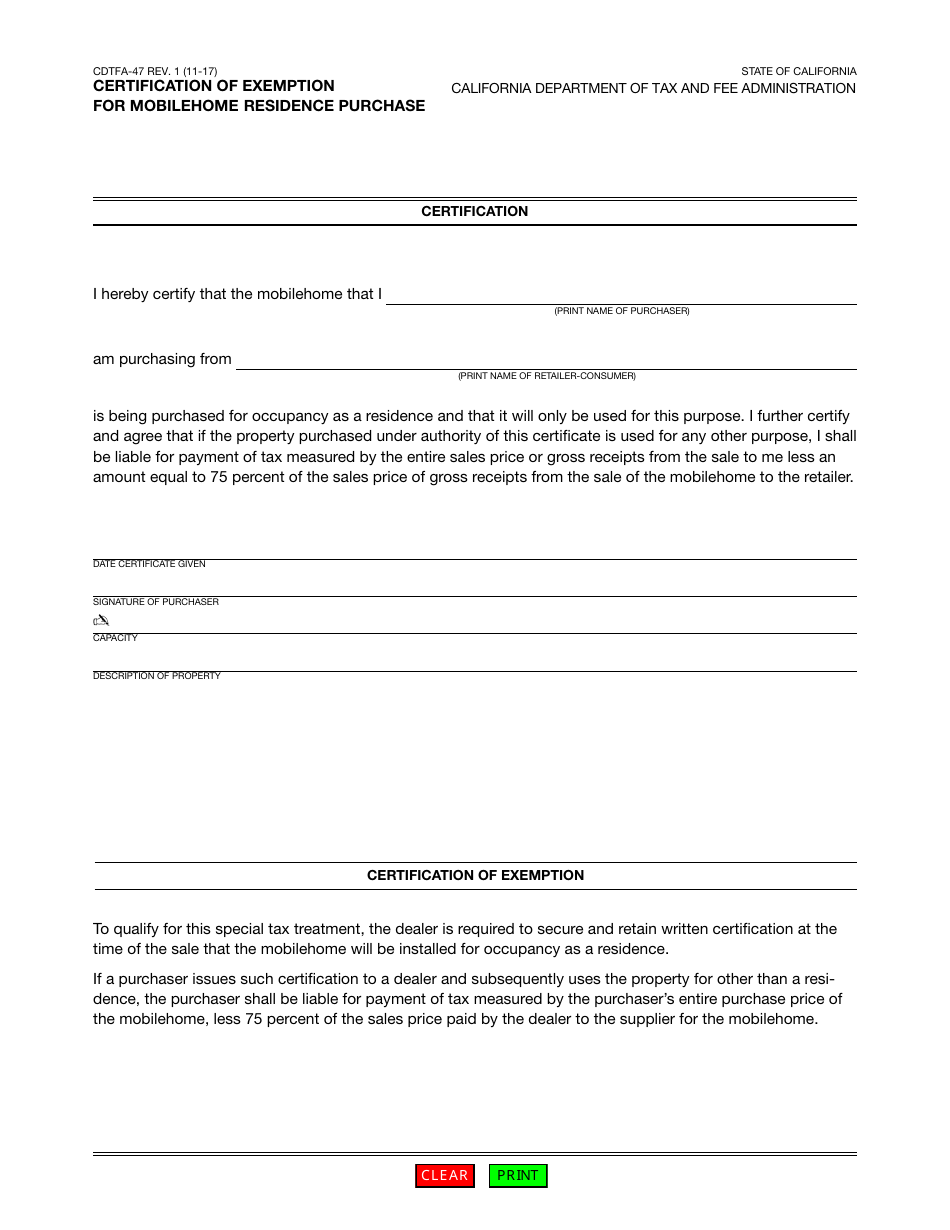

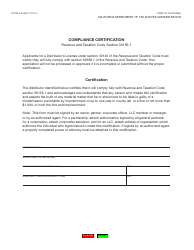

Form CDTFA-47 Certification of Exemption for Mobilehome Residence Purchase - California

What Is Form CDTFA-47?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

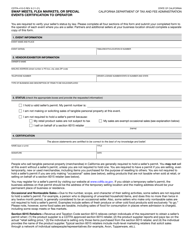

Q: What is Form CDTFA-47?

A: Form CDTFA-47 is a certification of exemption for a mobilehome residence purchase in California.

Q: Who needs to fill out Form CDTFA-47?

A: Buyers of mobilehome residences in California who are claiming an exemption.

Q: What is the purpose of Form CDTFA-47?

A: The form is used to certify that a buyer is eligible for an exemption from California sales and use tax when purchasing a mobilehome residence.

Q: How do I fill out Form CDTFA-47?

A: You need to provide your personal information, details about the mobilehome residence purchase, and the reason for claiming the exemption.

Q: Are there any fees associated with Form CDTFA-47?

A: No, there are no fees associated with filing Form CDTFA-47.

Q: Are there any supporting documents required for Form CDTFA-47?

A: Yes, you may need to provide supporting documents such as the purchase agreement or lease agreement.

Q: Is Form CDTFA-47 only applicable in California?

A: Yes, Form CDTFA-47 is only applicable for mobilehome residence purchases in the state of California.

Q: Can I claim multiple exemptions on Form CDTFA-47?

A: Yes, you can claim multiple exemptions on Form CDTFA-47 if you are eligible for them.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-47 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.