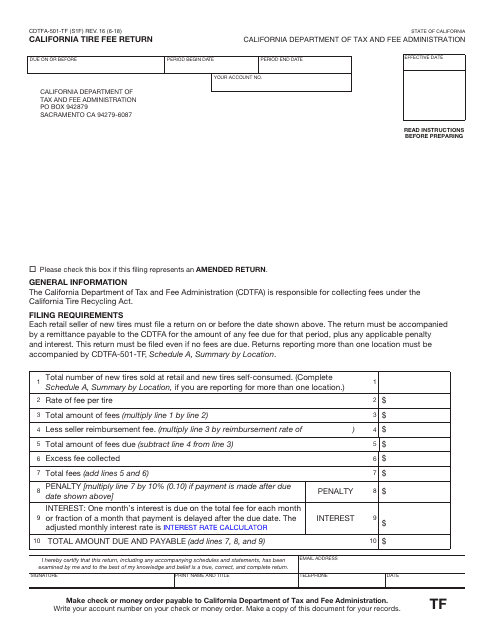

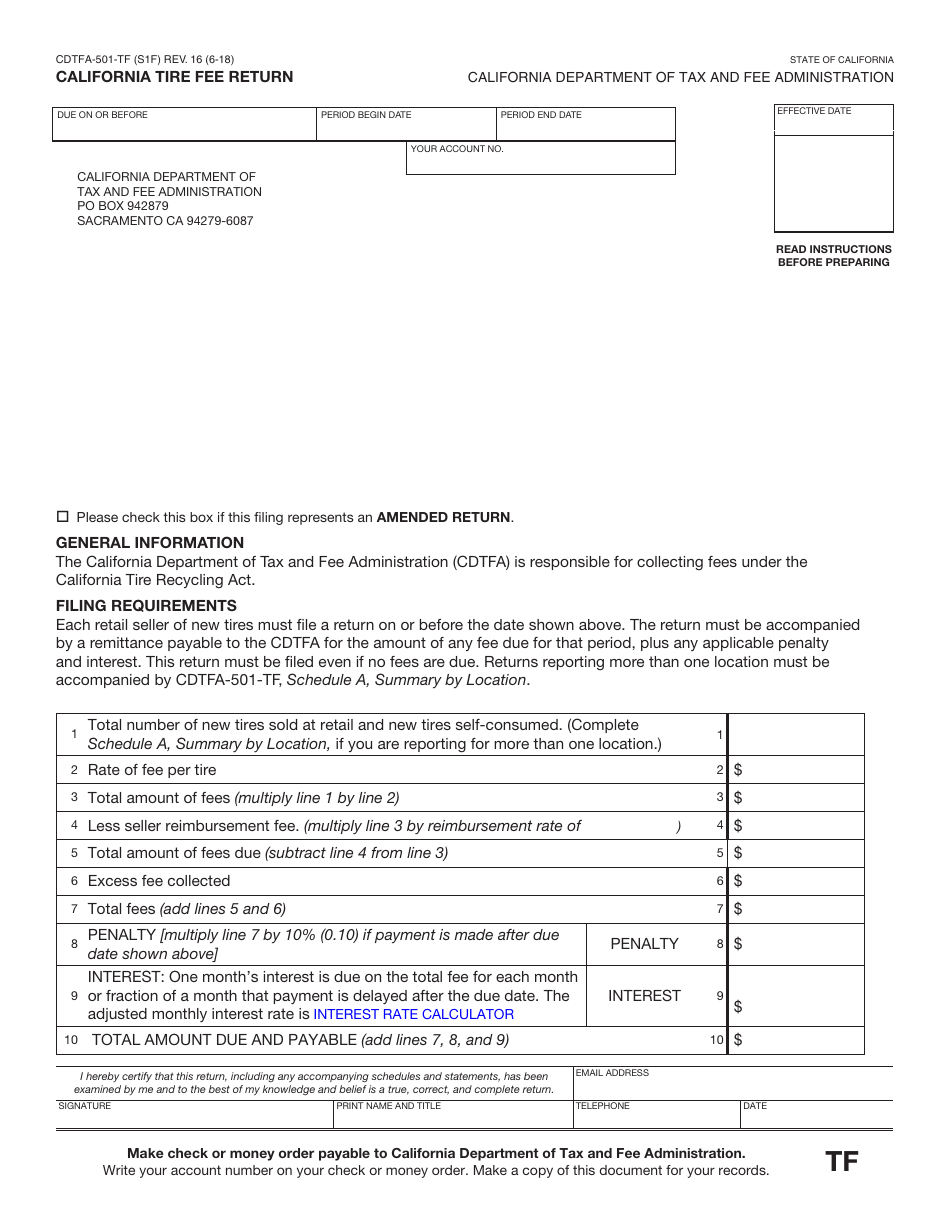

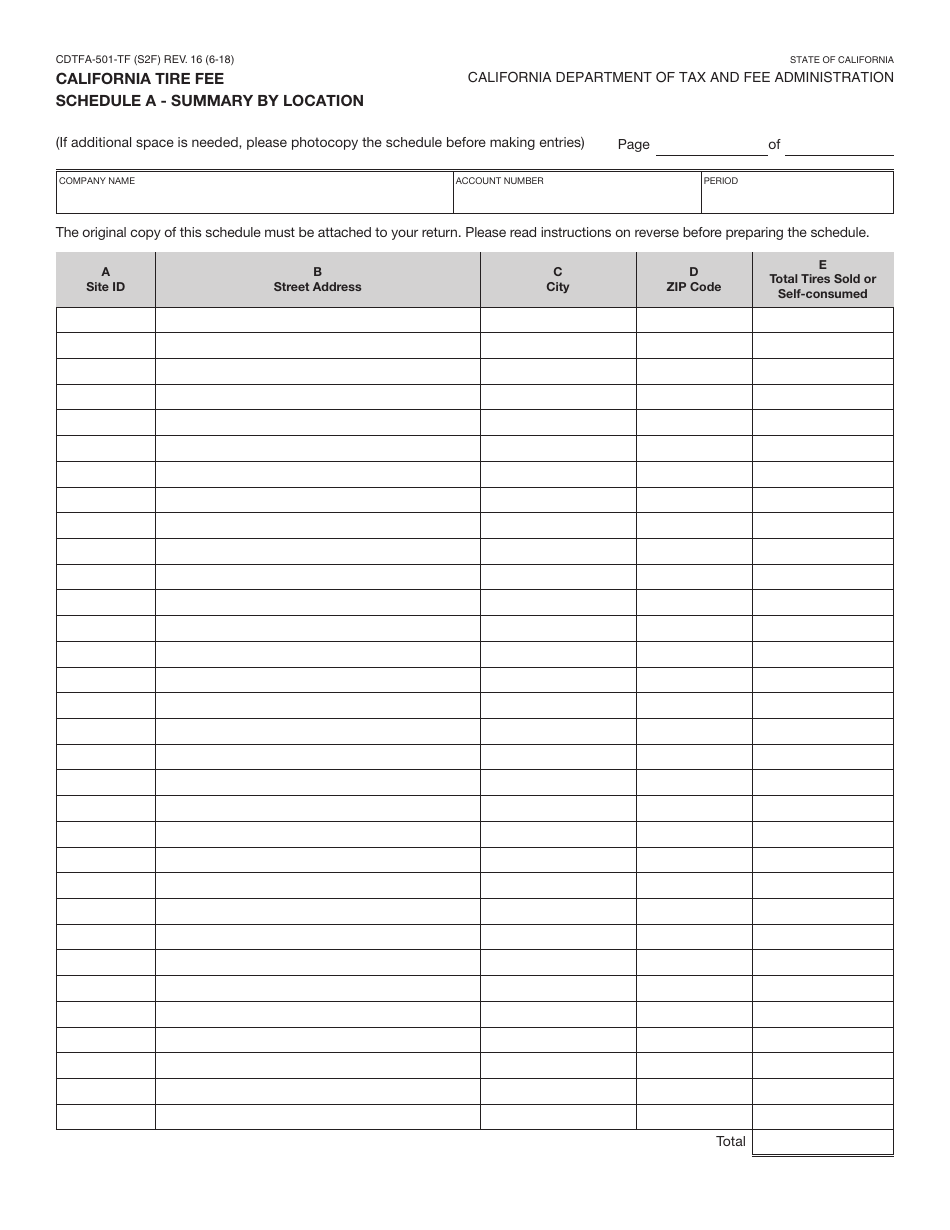

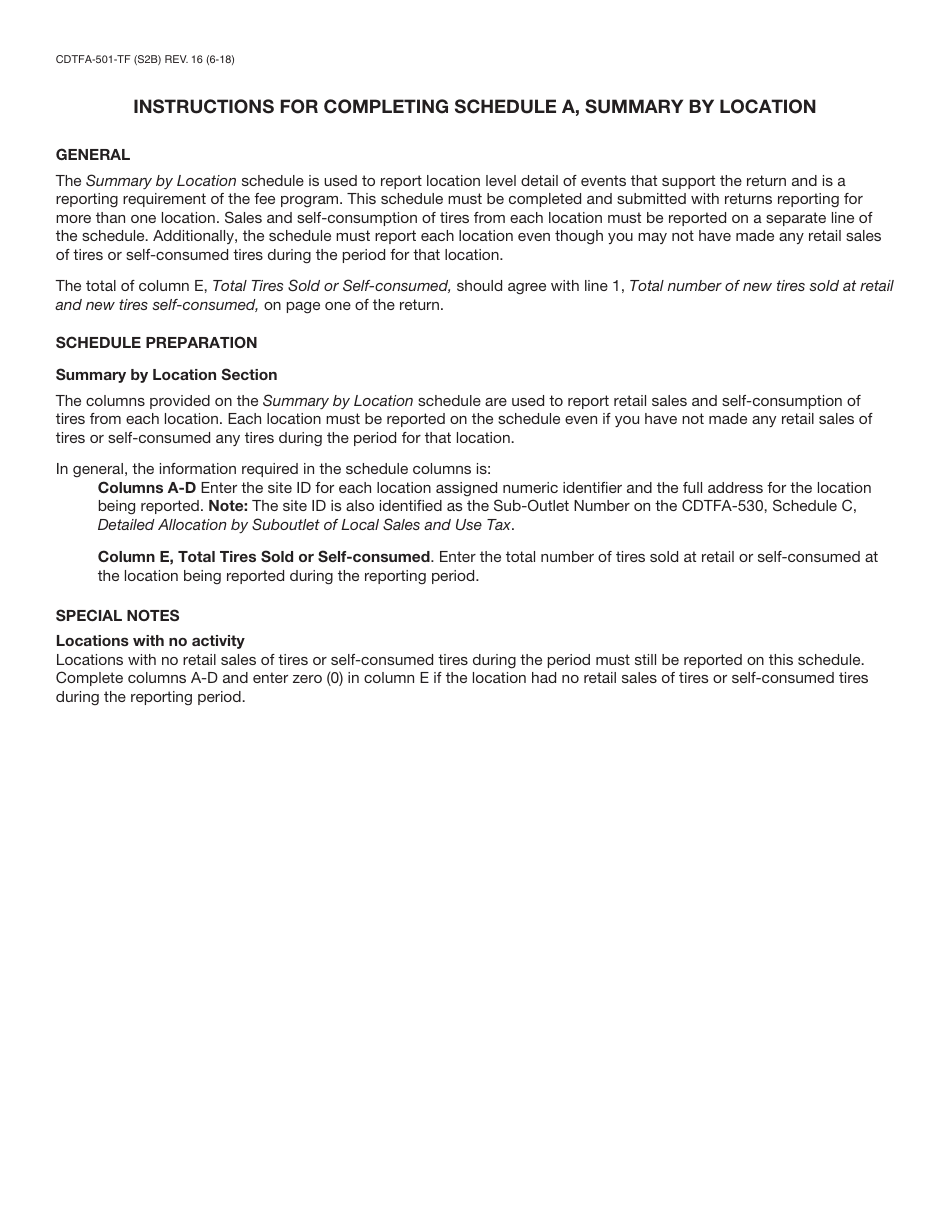

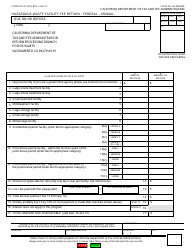

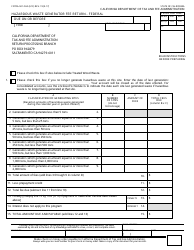

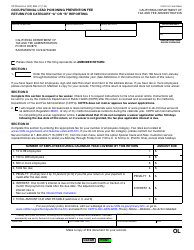

Form CDTFA-501-TF California Tire Fee Return - California

What Is Form CDTFA-501-TF?

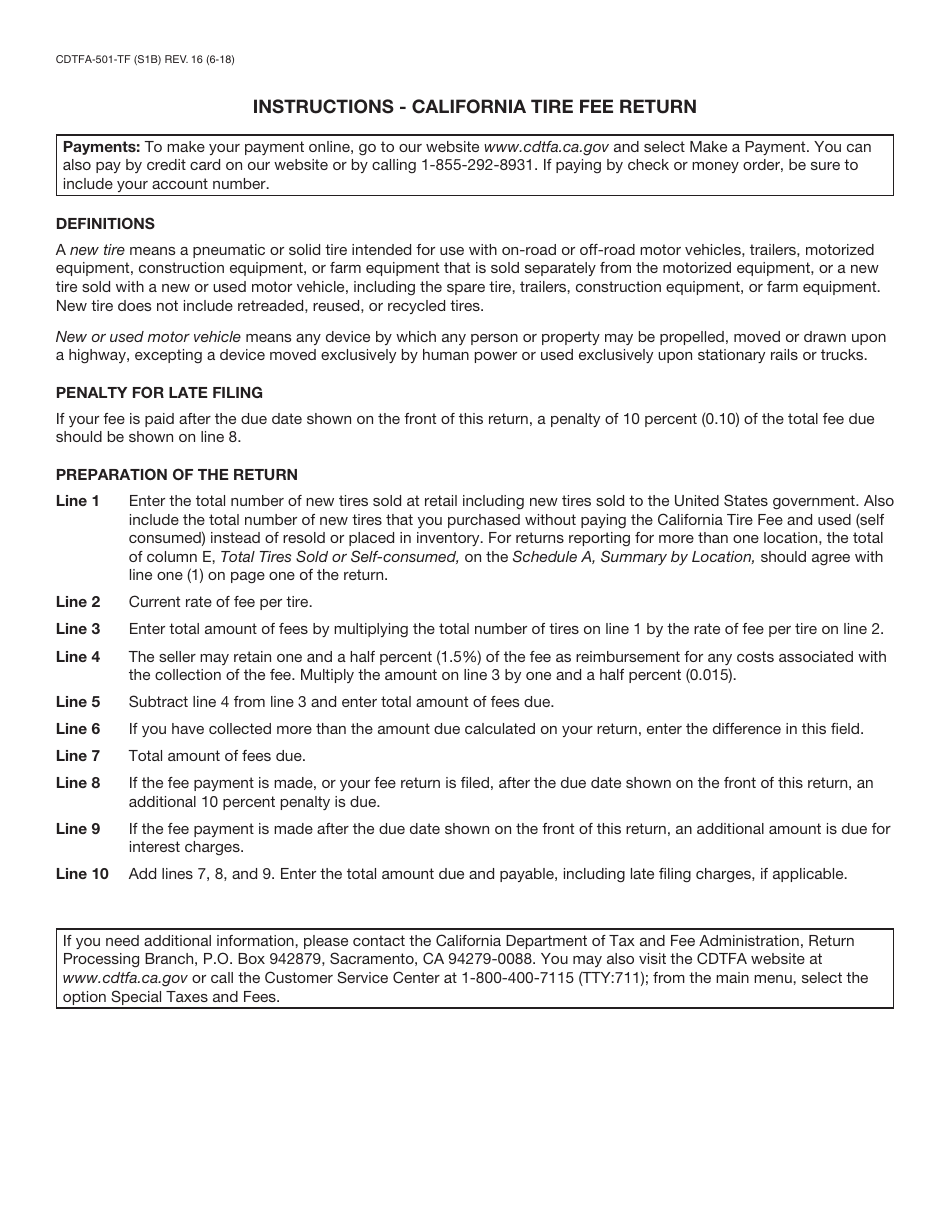

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

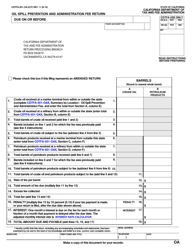

Q: What is the CDTFA-501-TF form?

A: The CDTFA-501-TF form is the California Tire Fee Return.

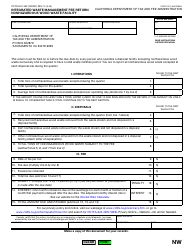

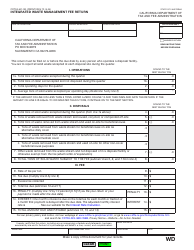

Q: What is the purpose of the California Tire Fee Return?

A: The purpose of the California Tire Fee Return is to report and remit tire fees.

Q: Who needs to file the CDTFA-501-TF form?

A: Businesses in California that sell new tires are required to file the CDTFA-501-TF form.

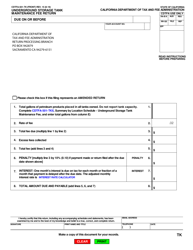

Q: When is the CDTFA-501-TF form due?

A: The CDTFA-501-TF form is due quarterly, by the last day of the month following the quarter.

Q: Are there any penalties for late filing or non-filing of the CDTFA-501-TF form?

A: Yes, there are penalties for late filing or non-filing of the CDTFA-501-TF form, including fines and interest.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-TF by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.