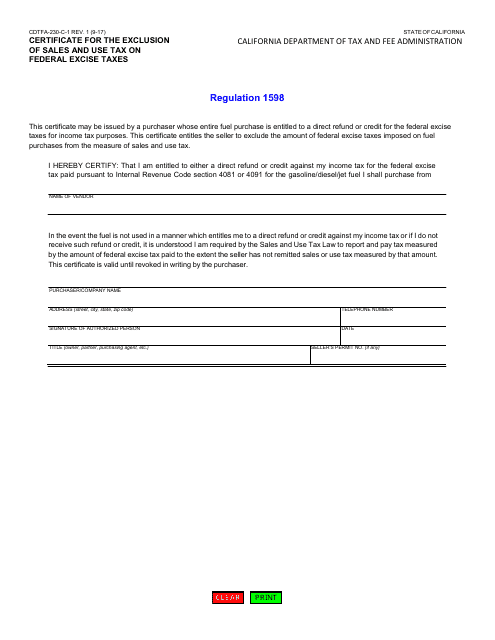

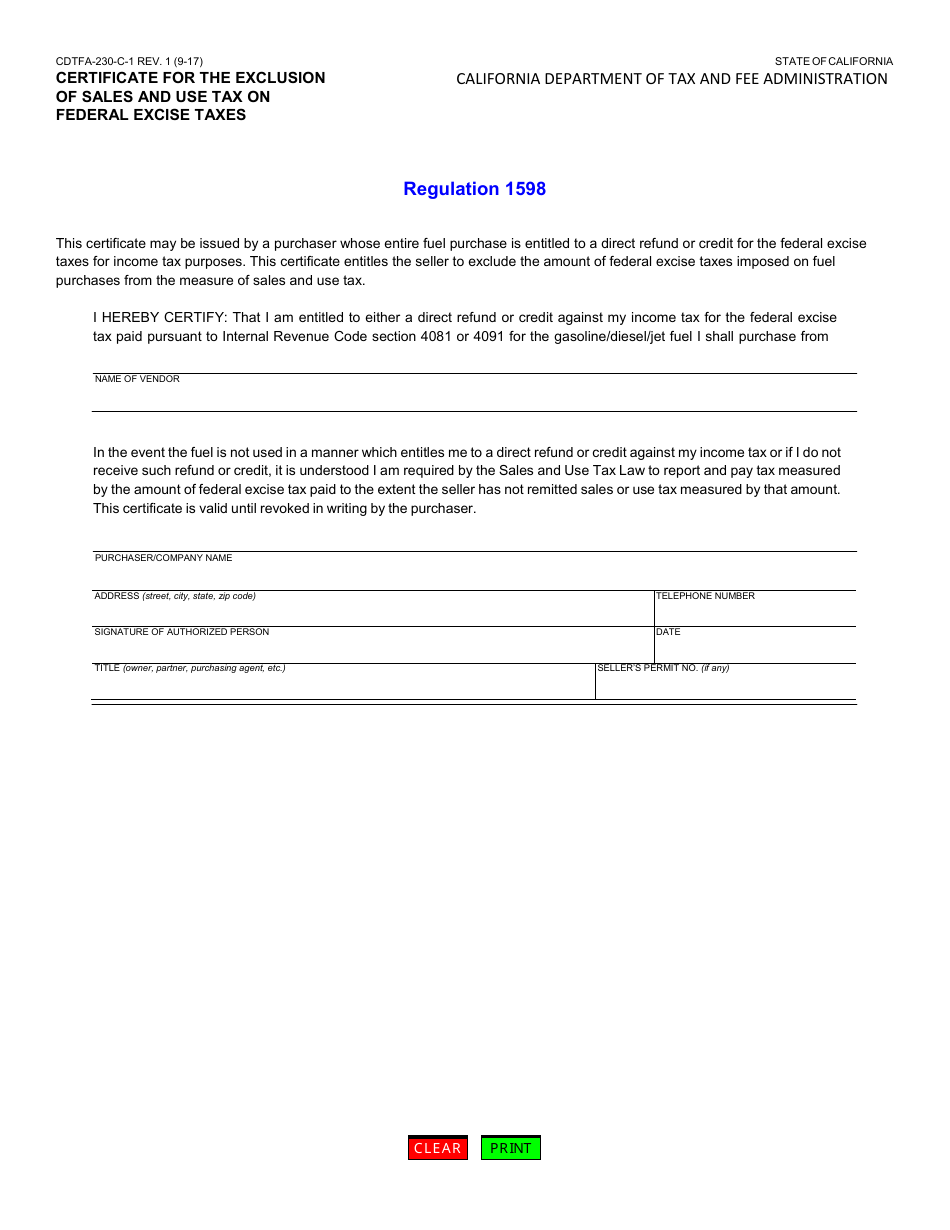

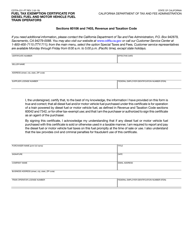

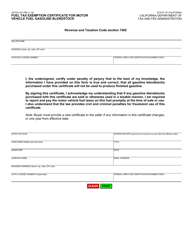

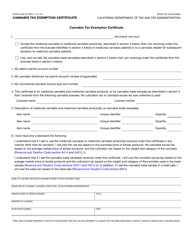

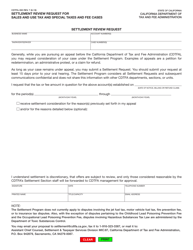

Form CDTFA-230-C-1 Certificate for the Exclusion of Sales and Use Tax on Federal Excise Taxes - California

What Is Form CDTFA-230-C-1?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

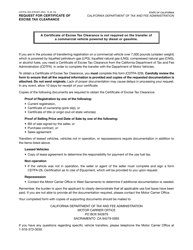

Q: What is Form CDTFA-230-C-1?

A: Form CDTFA-230-C-1 is a certificate used in California to request the exclusion of sales and use tax on federal excise taxes.

Q: What is the purpose of Form CDTFA-230-C-1?

A: The purpose of Form CDTFA-230-C-1 is to claim an exclusion for sales and use tax on federal excise taxes in California.

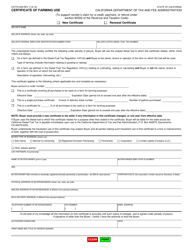

Q: Who should use Form CDTFA-230-C-1?

A: Any individual or business in California who wants to exclude sales and use tax on federal excise taxes should use Form CDTFA-230-C-1.

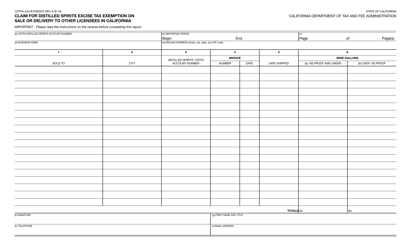

Q: What information is required on Form CDTFA-230-C-1?

A: Form CDTFA-230-C-1 requires information such as the taxpayer's name, address, federal excise tax details, and a declaration of eligibility for the exclusion.

Q: Is there a deadline for submitting Form CDTFA-230-C-1?

A: There is no specific deadline mentioned for submitting Form CDTFA-230-C-1. However, it is recommended to file it as soon as possible to avoid any potential penalties or interest.

Q: Are there any fees associated with Form CDTFA-230-C-1?

A: There are no fees mentioned for Form CDTFA-230-C-1.

Q: Can I file Form CDTFA-230-C-1 electronically?

A: As of now, there is no mention of electronic filing options for Form CDTFA-230-C-1. It should be filed by mail or in person.

Q: Is Form CDTFA-230-C-1 required for every federal excise tax payment?

A: No, Form CDTFA-230-C-1 is not required for every federal excise tax payment. It is only required if you want to exclude sales and use tax on those federal excise taxes in California.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-C-1 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.