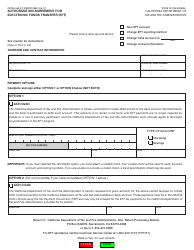

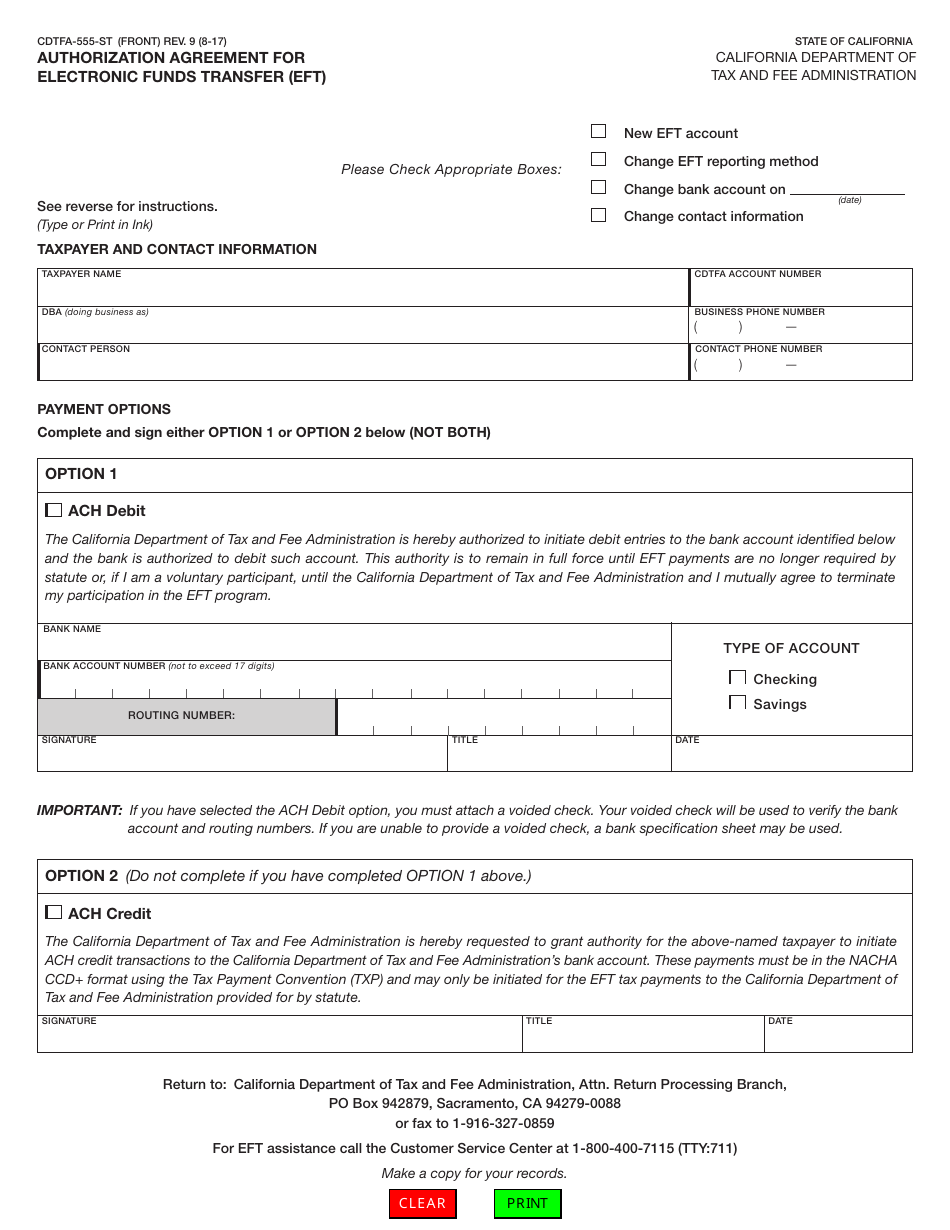

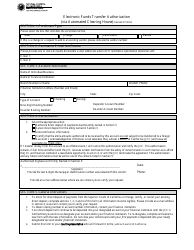

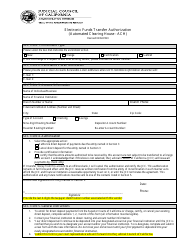

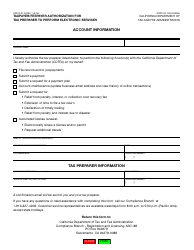

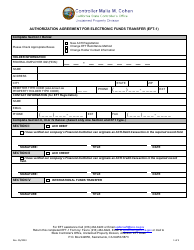

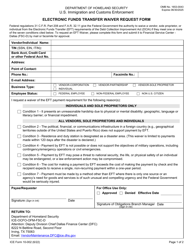

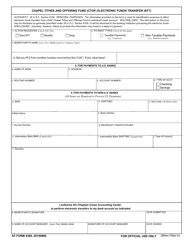

Form CDTFA-555-ST Authorization Agreement for Electronic Funds Transfer (Eft) - California

What Is Form CDTFA-555-ST?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-555-ST?

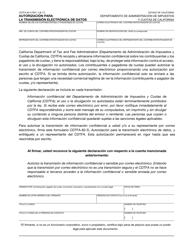

A: Form CDTFA-555-ST is the Authorization Agreement for Electronic Funds Transfer (EFT) in California.

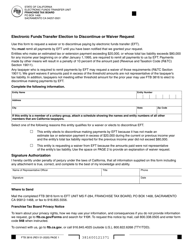

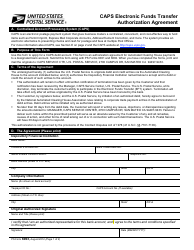

Q: What is EFT?

A: EFT stands for Electronic Funds Transfer, a method of electronically transferring funds between bank accounts.

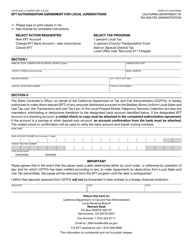

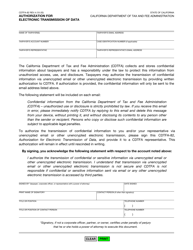

Q: What is the purpose of Form CDTFA-555-ST?

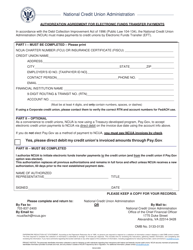

A: The purpose of Form CDTFA-555-ST is to authorize the California Department of Tax and Fee Administration (CDTFA) to electronically transfer funds from your bank account for tax payments.

Q: Who needs to fill out Form CDTFA-555-ST?

A: Any taxpayer who wishes to make tax payments to the CDTFA through Electronic Funds Transfer (EFT) needs to fill out Form CDTFA-555-ST.

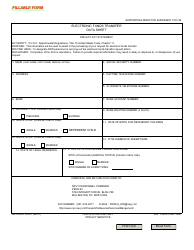

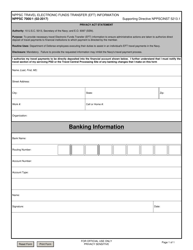

Q: What information is required on Form CDTFA-555-ST?

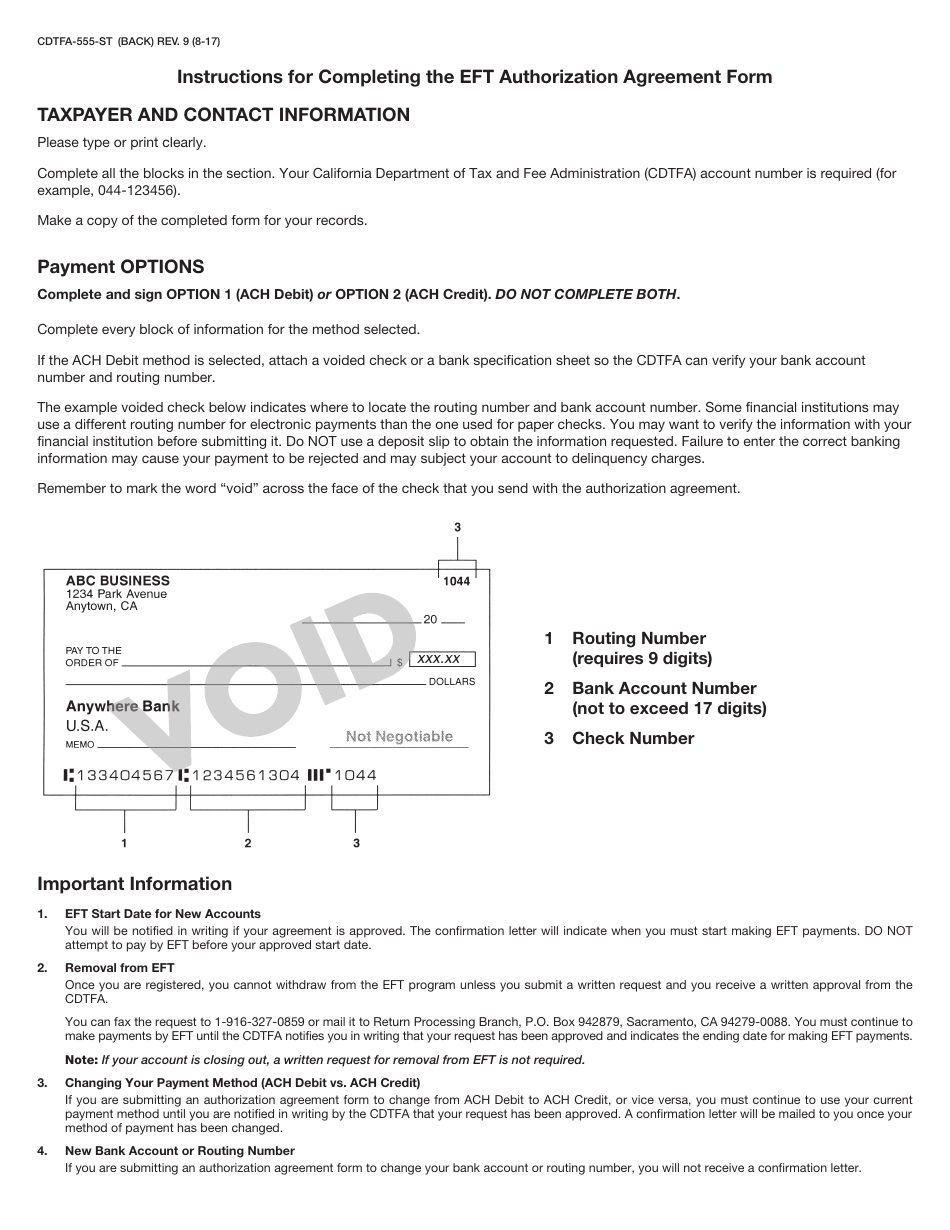

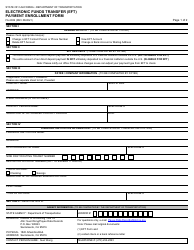

A: Form CDTFA-555-ST requires the taxpayer's name, mailing address, electronic funds transfer information, and the tax programs for which the EFT authorization is being requested.

Q: Is there a fee for using EFT?

A: No, there is no fee for using EFT for tax payments to the CDTFA.

Q: Is Form CDTFA-555-ST optional?

A: No, if you want to make tax payments to the CDTFA through EFT, you must fill out Form CDTFA-555-ST to authorize the electronic transfer of funds.

Q: Are there any specific requirements for the bank account used for EFT?

A: Yes, the bank account used for EFT must be located in the United States and must be able to accept ACH (Automated Clearing House) transactions.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-555-ST by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.