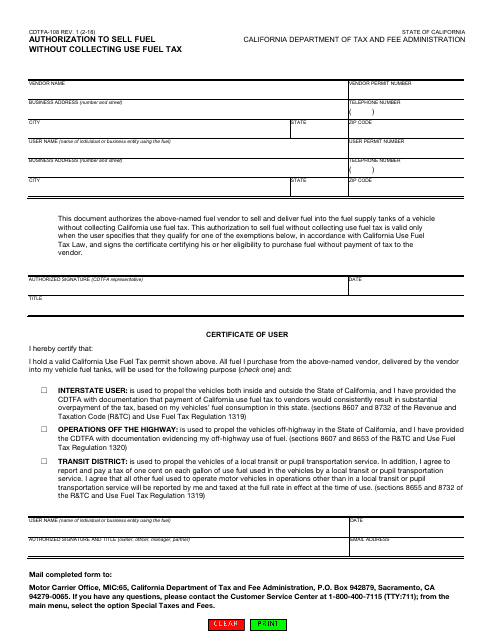

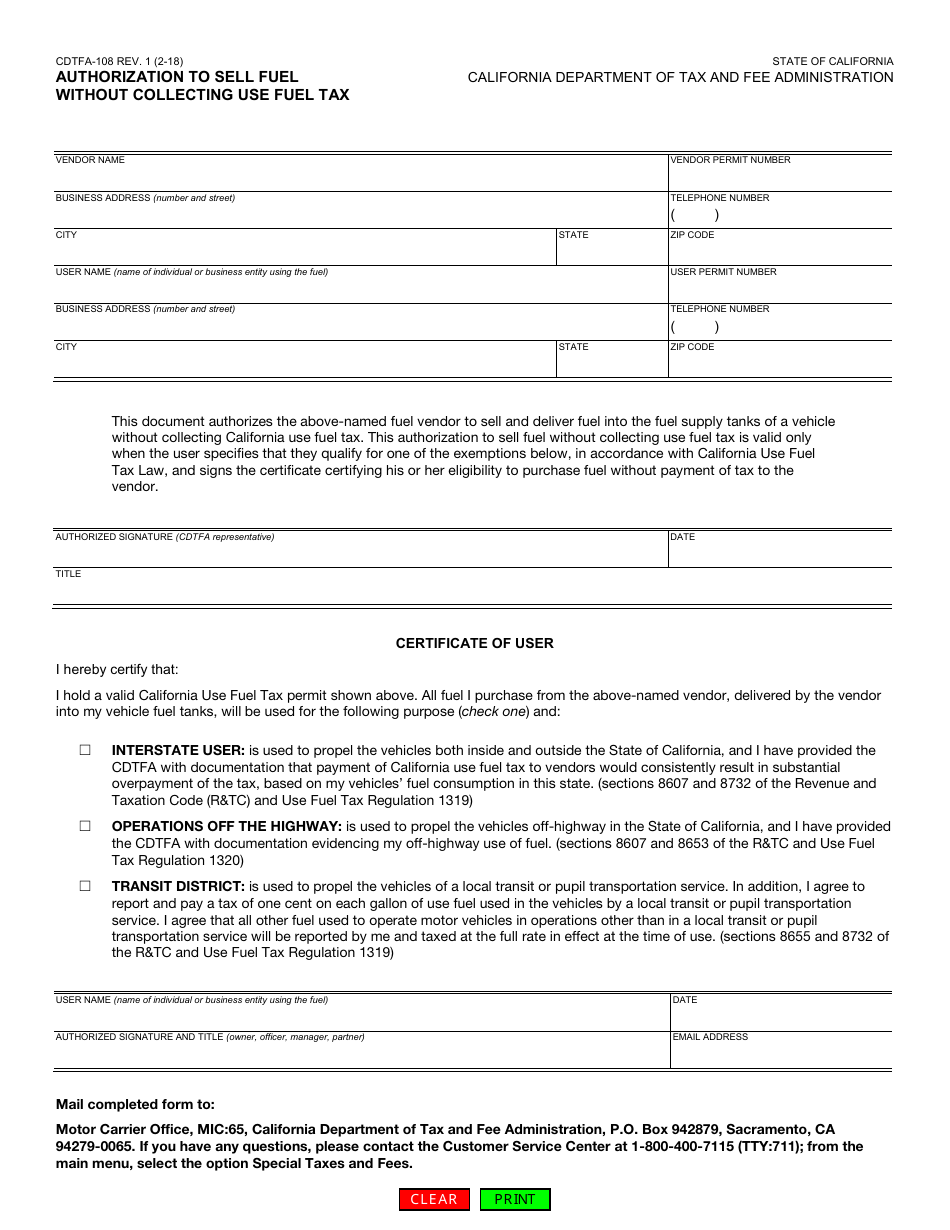

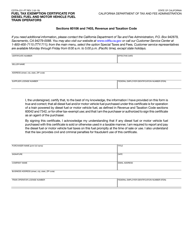

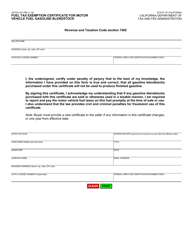

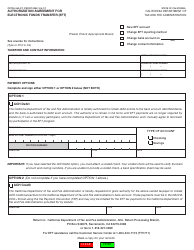

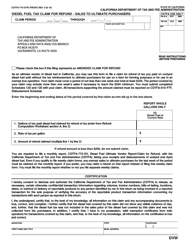

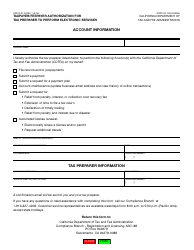

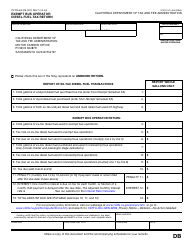

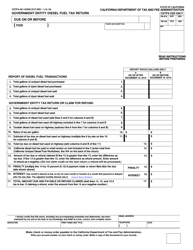

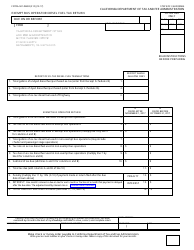

Form CDTFA-108 Authorization to Sell Fuel Without Collecting Use Fuel Tax - California

What Is Form CDTFA-108?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

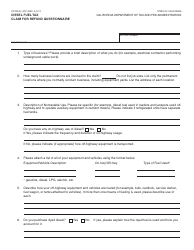

Q: What is Form CDTFA-108?

A: Form CDTFA-108 is a document used in California to authorize the selling of fuel without collecting use fuel tax.

Q: What is the purpose of Form CDTFA-108?

A: The purpose of Form CDTFA-108 is to allow certain businesses to sell fuel without collecting use fuel tax.

Q: Who uses Form CDTFA-108?

A: Businesses in California that meet specific requirements can use Form CDTFA-108.

Q: What does it mean to sell fuel without collecting use fuel tax?

A: Selling fuel without collecting use fuel tax means that the business is not required to charge and collect the tax from the buyer.

Q: What are the requirements to use Form CDTFA-108?

A: To use Form CDTFA-108, businesses must meet specific criteria set by the California Department of Tax and Fee Administration (CDTFA).

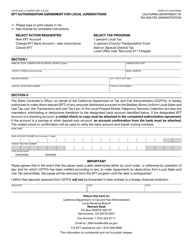

Q: Is there a fee to submit Form CDTFA-108?

A: No, there is no fee to submit Form CDTFA-108.

Q: How often do I need to submit Form CDTFA-108?

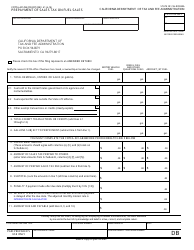

A: Form CDTFA-108 must be submitted annually.

Q: Are there any penalties for not submitting Form CDTFA-108?

A: Yes, there can be penalties for failure to timely file Form CDTFA-108.

Q: What should I do if my business no longer qualifies for exemption?

A: If your business no longer qualifies for exemption, you must notify the CDTFA within 10 days and begin collecting the use fuel tax.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-108 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.