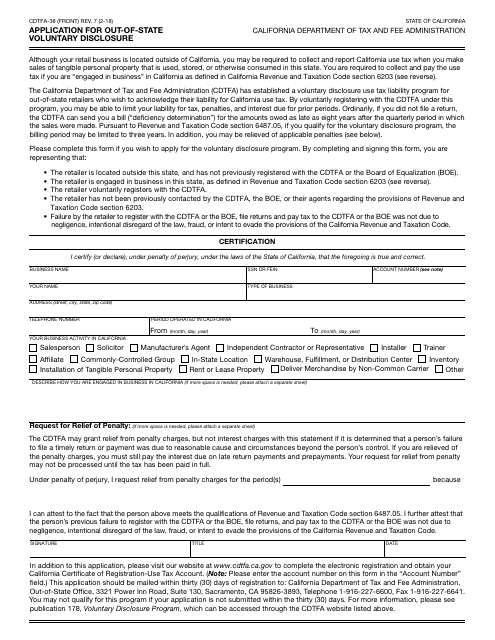

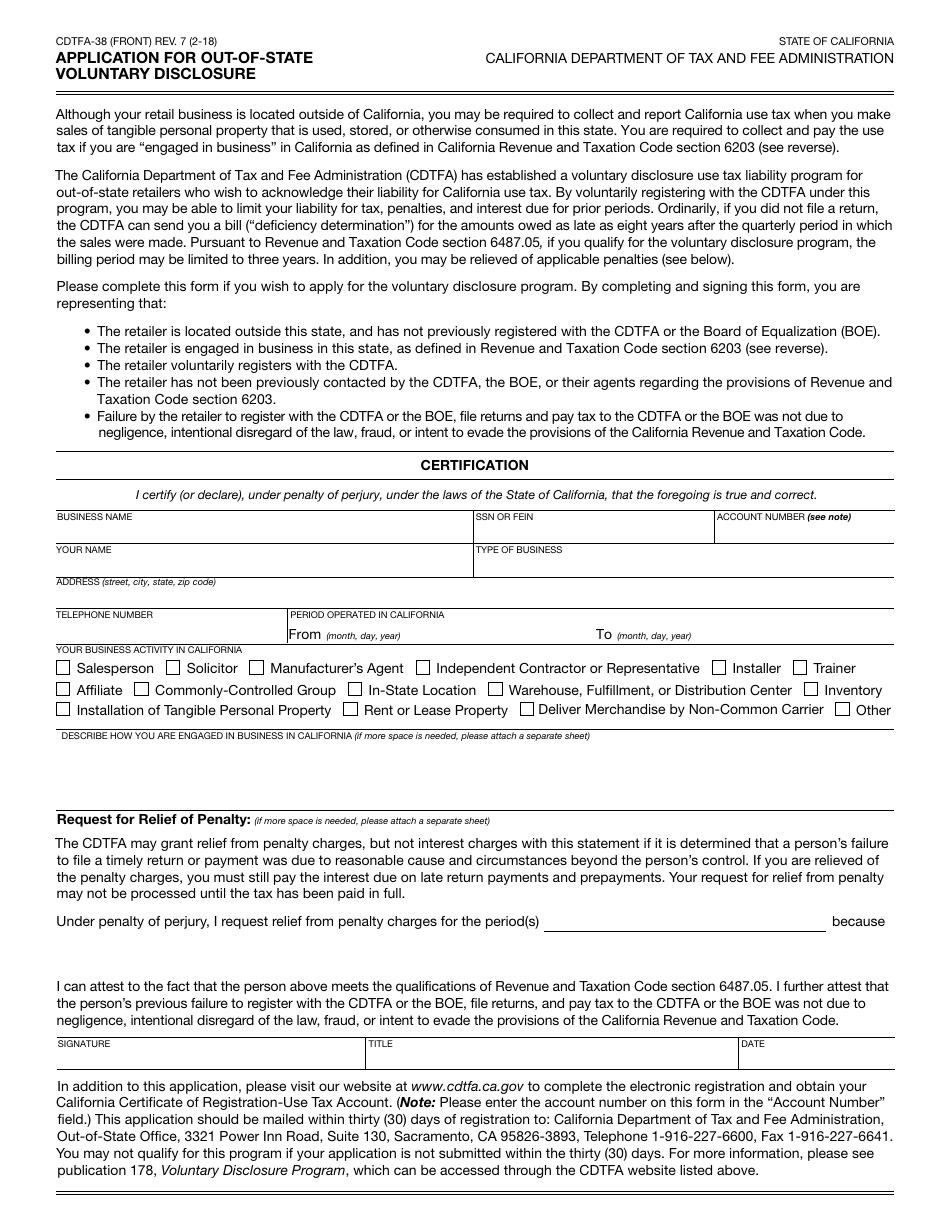

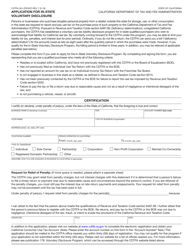

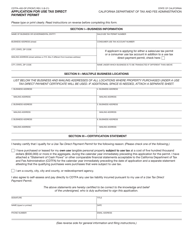

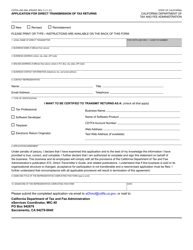

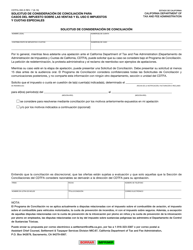

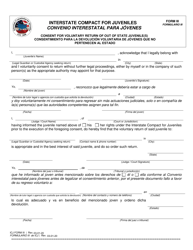

Form CDTFA-38 Application for Out-of-State Voluntary Disclosure - California

What Is Form CDTFA-38?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

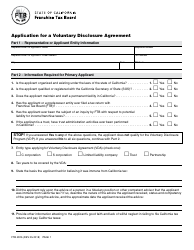

Q: What is Form CDTFA-38?

A: Form CDTFA-38 is the application for out-of-state voluntary disclosure in California.

Q: Who needs to fill out Form CDTFA-38?

A: Anyone who is located outside of California and wants to voluntarily disclose their California tax liabilities.

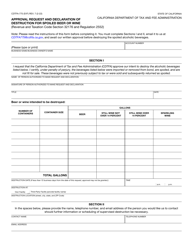

Q: What is the purpose of Form CDTFA-38?

A: The purpose of Form CDTFA-38 is to allow out-of-state taxpayers to come forward and voluntarily disclose any unpaid taxes they may owe in California.

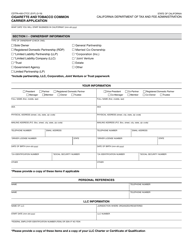

Q: What information do I need to provide on Form CDTFA-38?

A: You will need to provide your business information, details about the taxes you owe, and any supporting documentation.

Q: Are there any penalties for late payment?

A: Yes, if you have unpaid taxes, you may be subject to penalties and interest.

Q: Can I make a partial payment with my application?

A: Yes, you can make a partial payment with your application, but you will still need to pay the remaining balance.

Q: Is there a deadline for submitting Form CDTFA-38?

A: There is no specific deadline for submitting Form CDTFA-38; however, it is recommended to submit it as soon as possible to avoid additional penalties and interest.

Q: Can I request a payment plan?

A: Yes, you can request a payment plan to pay off any owed taxes in installments.

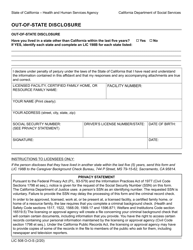

Q: Is the information on Form CDTFA-38 confidential?

A: Yes, the information you provide on Form CDTFA-38 is confidential and protected by law.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-38 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.