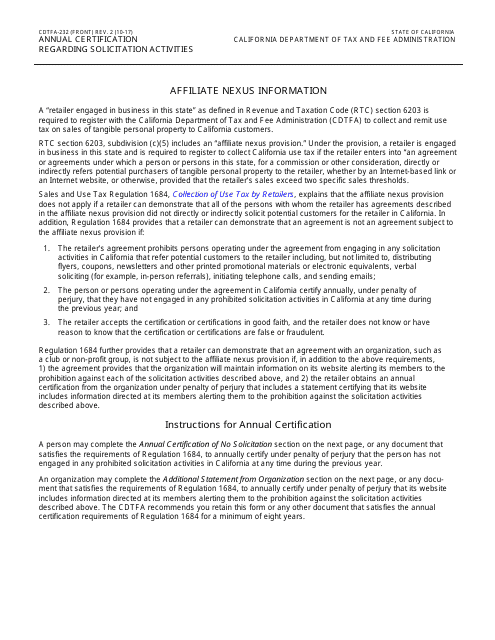

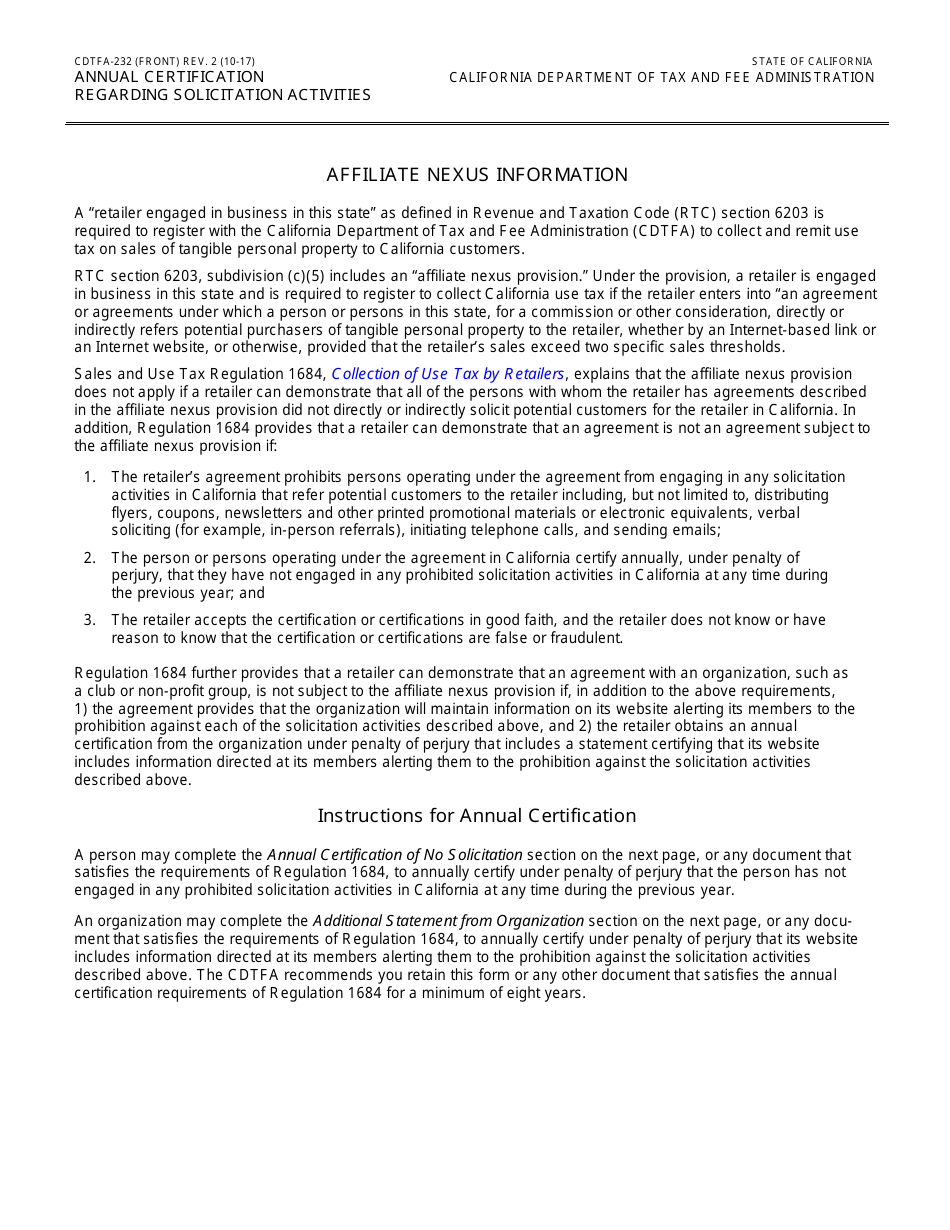

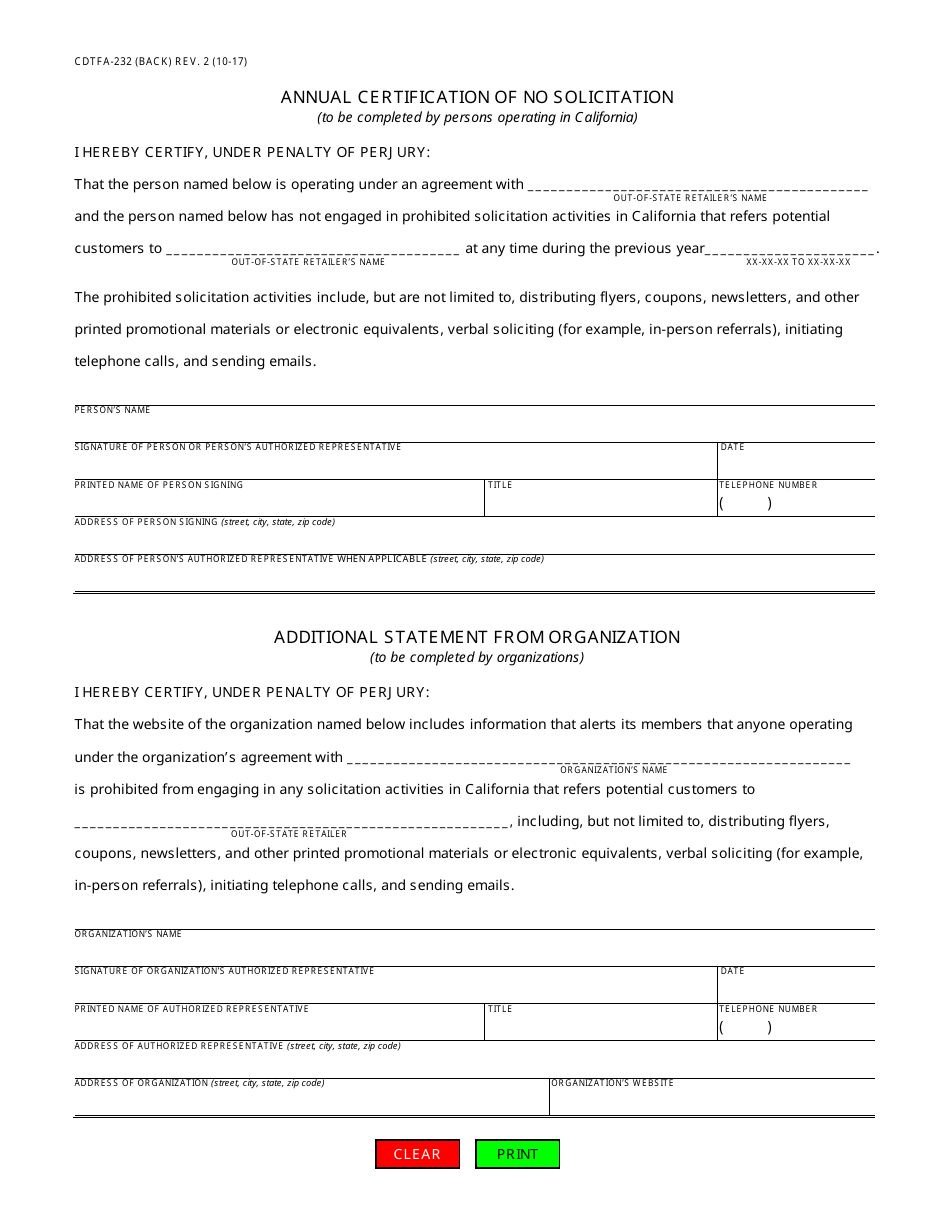

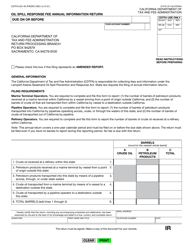

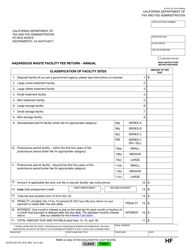

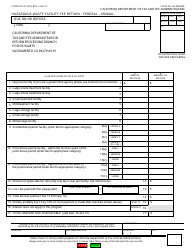

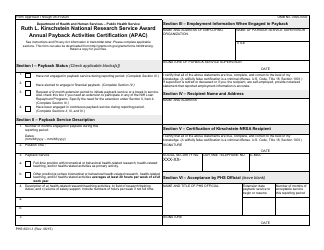

Form CDTFA-232 Annual Certification Regarding Solicitation Activities - California

What Is Form CDTFA-232?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CDTFA-232?

A: The Form CDTFA-232 is an annual certification form used in California for reporting solicitation activities.

Q: Who needs to file Form CDTFA-232?

A: Any person or organization engaged in solicitation activities in California must file Form CDTFA-232.

Q: What are solicitation activities?

A: Solicitation activities refer to any efforts made to request or obtain orders for tangible personal property.

Q: What information is required on Form CDTFA-232?

A: The form requires information about the types of solicitation activities, gross sales amounts, and any exempt or nontaxable sales.

Q: When is Form CDTFA-232 due?

A: Form CDTFA-232 is due annually on or before January 31st.

Q: Are there any penalties for not filing Form CDTFA-232?

A: Yes, failure to file Form CDTFA-232 may result in penalties and interest charges.

Q: Is Form CDTFA-232 specific to California?

A: Yes, Form CDTFA-232 is specific to California and its requirements for reporting solicitation activities.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-232 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.