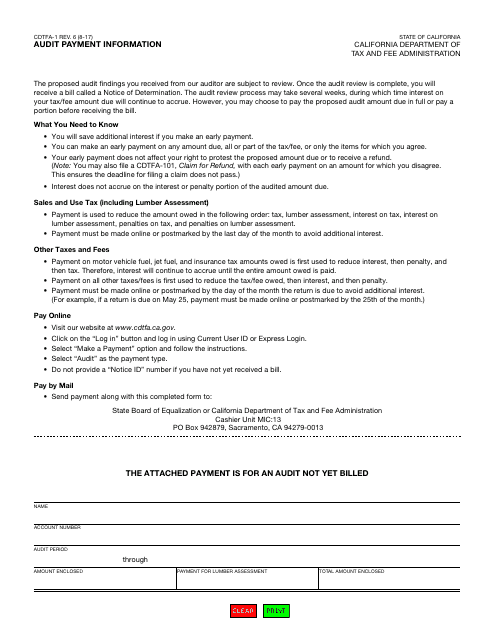

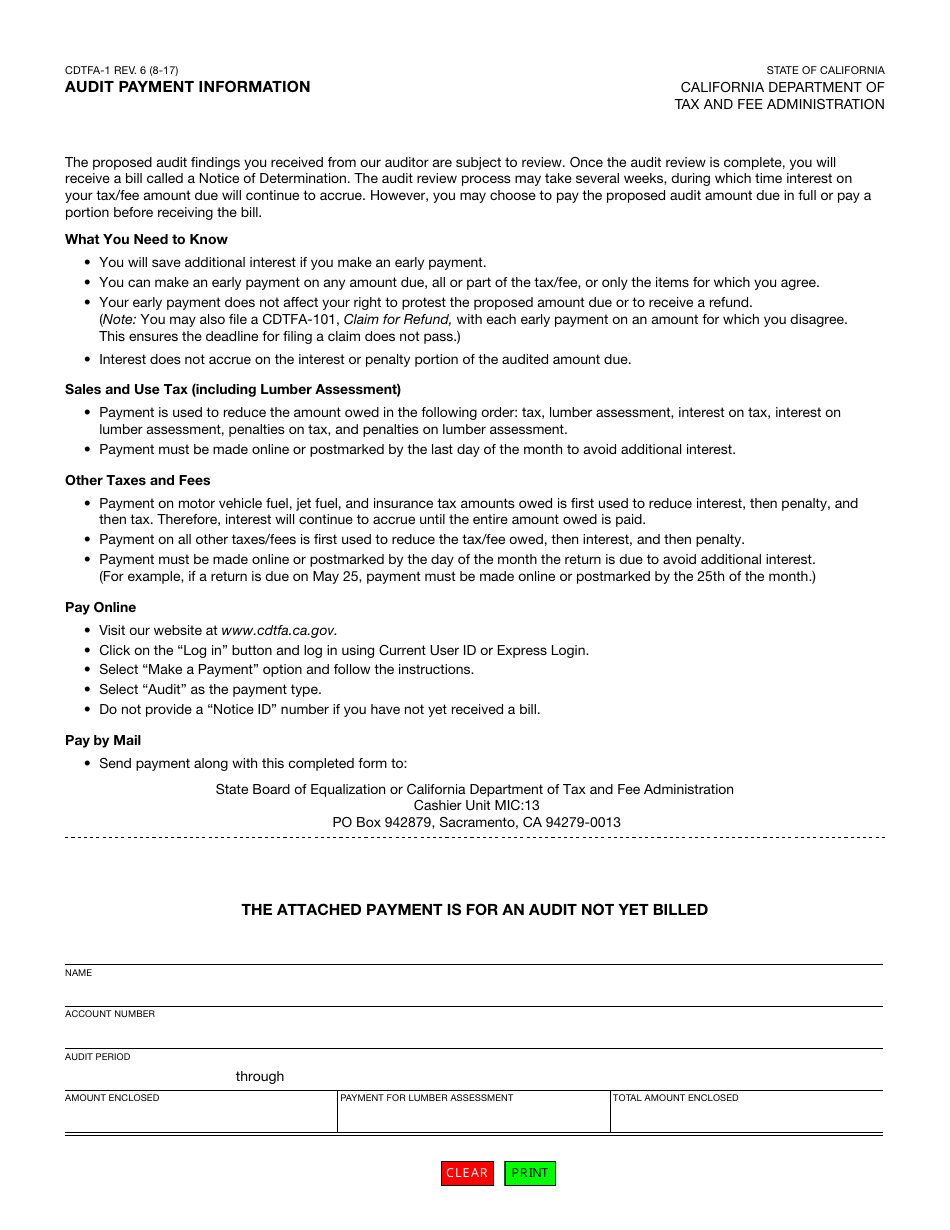

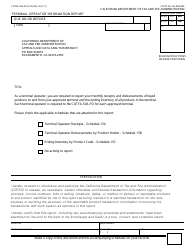

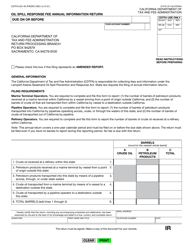

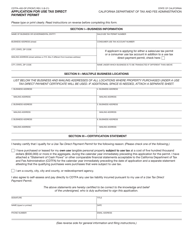

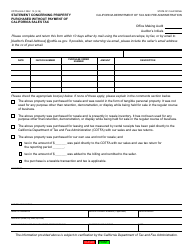

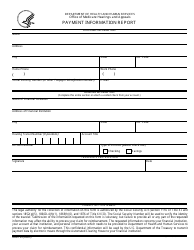

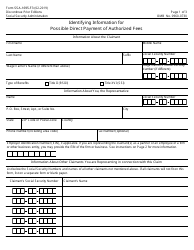

Form CDTFA-1 Audit Payment Information - California

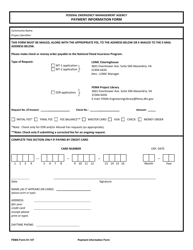

What Is Form CDTFA-1?

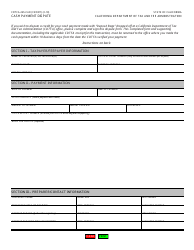

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-1?

A: Form CDTFA-1 is a document used to provide payment information related to an audit in California.

Q: What is an audit?

A: An audit is a process in which the California Department of Tax and Fee Administration (CDTFA) reviews a taxpayer's records and financial information to ensure compliance with tax obligations.

Q: Who needs to complete Form CDTFA-1?

A: Taxpayers who are undergoing an audit in California may need to complete Form CDTFA-1 to provide payment information.

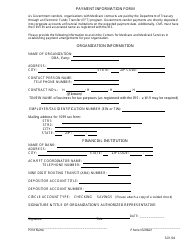

Q: What information is required on Form CDTFA-1?

A: Form CDTFA-1 requires the taxpayer to provide their name, address, taxpayer identification number, audit period, audit number, and payment details.

Q: What should I do if I have questions about Form CDTFA-1?

A: If you have questions about Form CDTFA-1, you should contact the California Department of Tax and Fee Administration (CDTFA) for assistance.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-1 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.