This version of the form is not currently in use and is provided for reference only. Download this version of

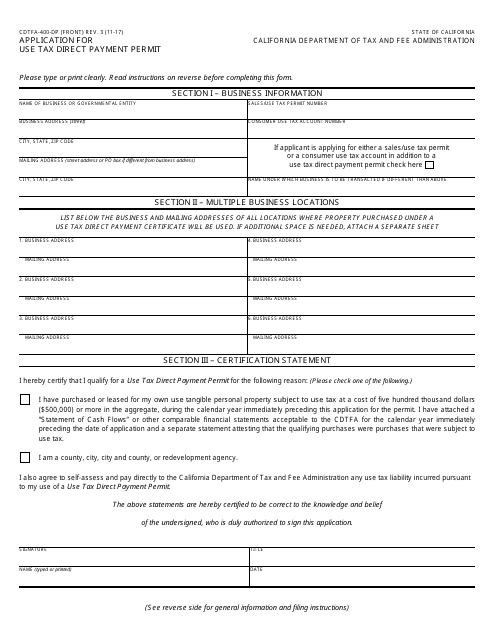

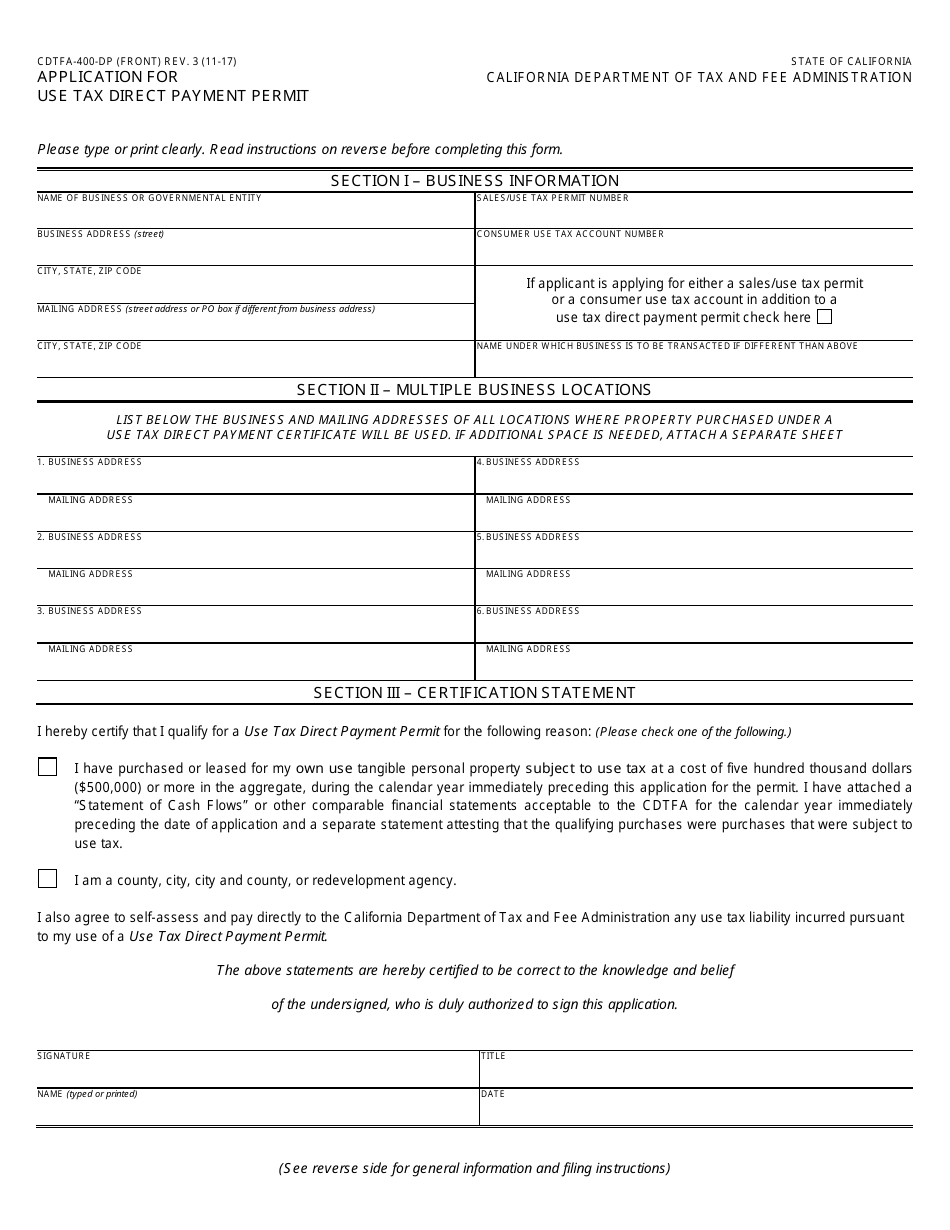

Form CDTFA-400-DP

for the current year.

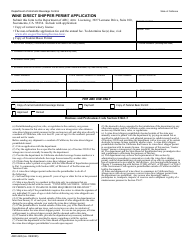

Form CDTFA-400-DP Application for Use Tax Direct Payment Permit - California

What Is Form CDTFA-400-DP?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-400-DP?

A: Form CDTFA-400-DP is the Application for Use Tax Direct Payment Permit in California.

Q: What is the purpose of Form CDTFA-400-DP?

A: The purpose of Form CDTFA-400-DP is to apply for a Use Tax Direct Payment Permit in California.

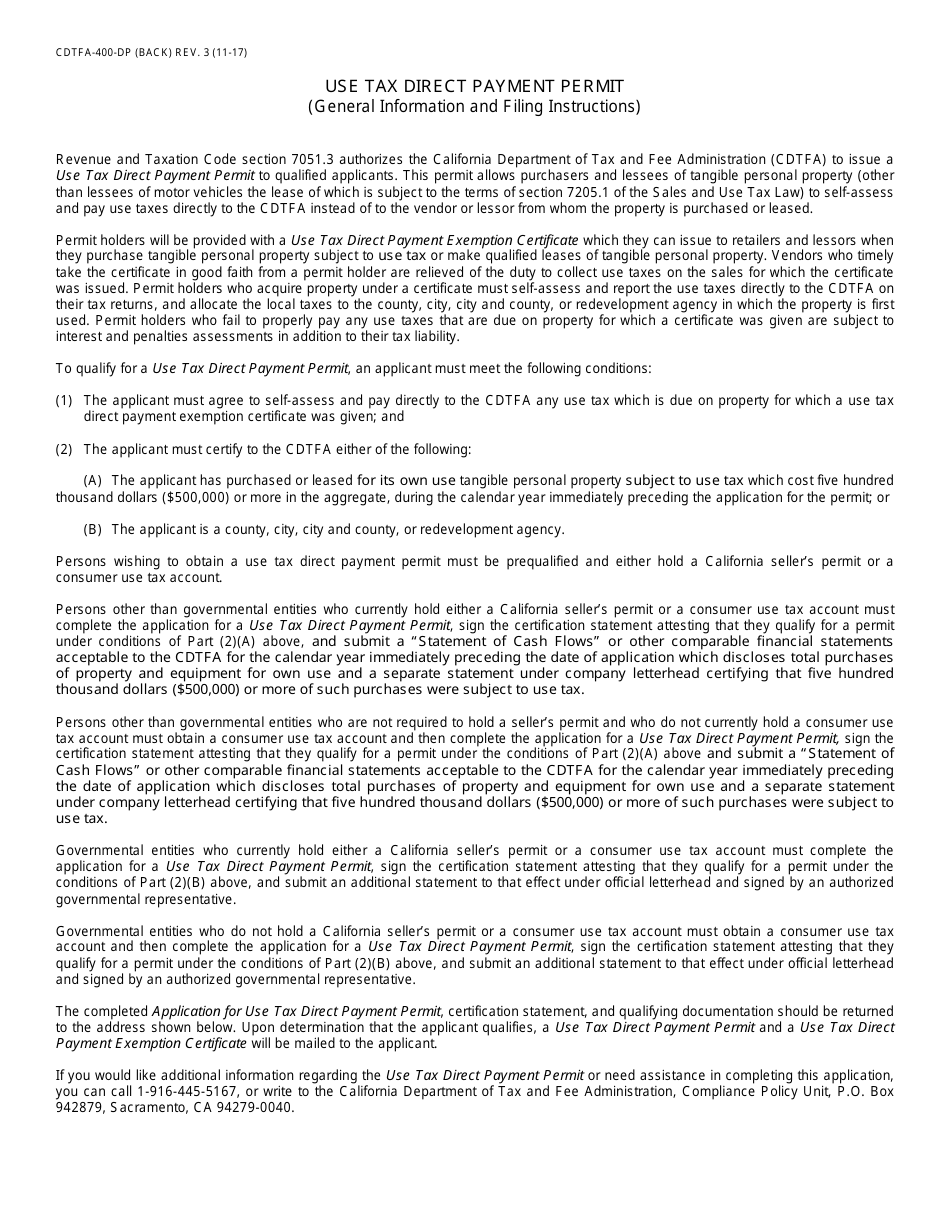

Q: What is a Use Tax Direct Payment Permit?

A: A Use Tax Direct Payment Permit allows businesses in California to remit use tax directly to the California Department of Tax and Fee Administration (CDTFA).

Q: Who needs to file Form CDTFA-400-DP?

A: Businesses in California that want to remit use tax directly to the CDTFA need to file Form CDTFA-400-DP.

Q: Are there any fees associated with obtaining a Use Tax Direct Payment Permit?

A: No, there are no fees associated with obtaining a Use Tax Direct Payment Permit in California.

Q: How long does it take to process Form CDTFA-400-DP?

A: The processing time for Form CDTFA-400-DP can vary, but it generally takes 4-6 weeks.

Q: What if I need to make changes to my Use Tax Direct Payment Permit?

A: If you need to make changes to your Use Tax Direct Payment Permit, you must submit a new application using Form CDTFA-400-DP.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-400-DP by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.