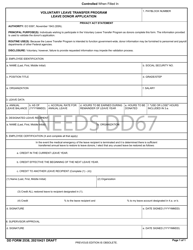

This version of the form is not currently in use and is provided for reference only. Download this version of

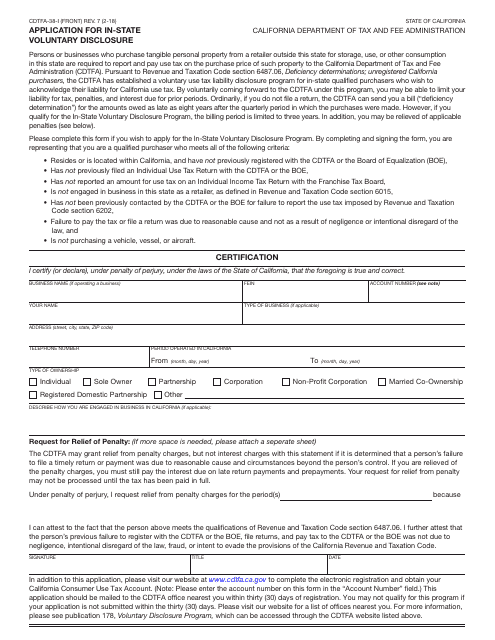

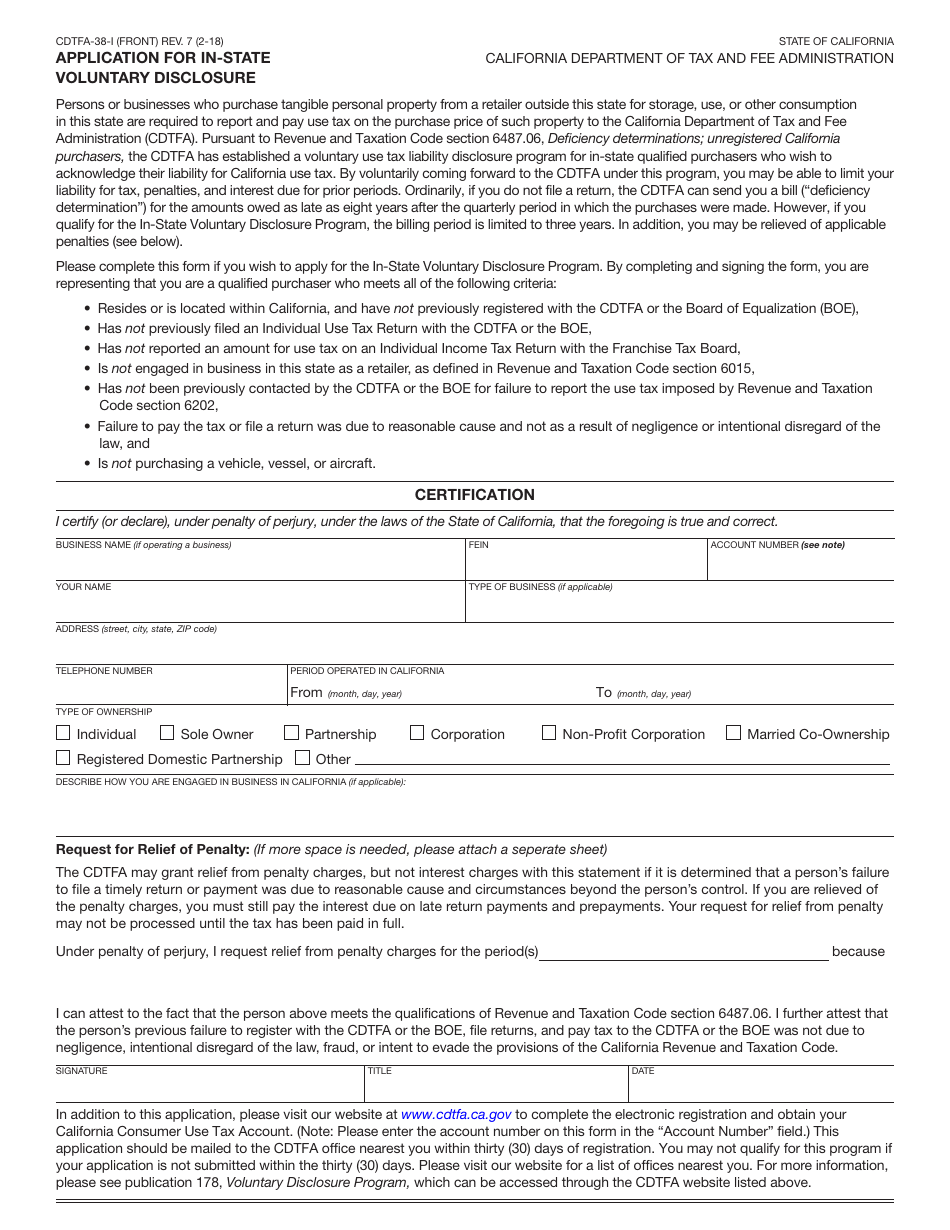

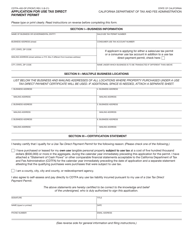

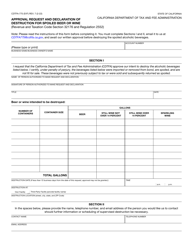

Form CDTFA-38-I

for the current year.

Form CDTFA-38-I Application for in-State Voluntary Disclosure - California

What Is Form CDTFA-38-I?

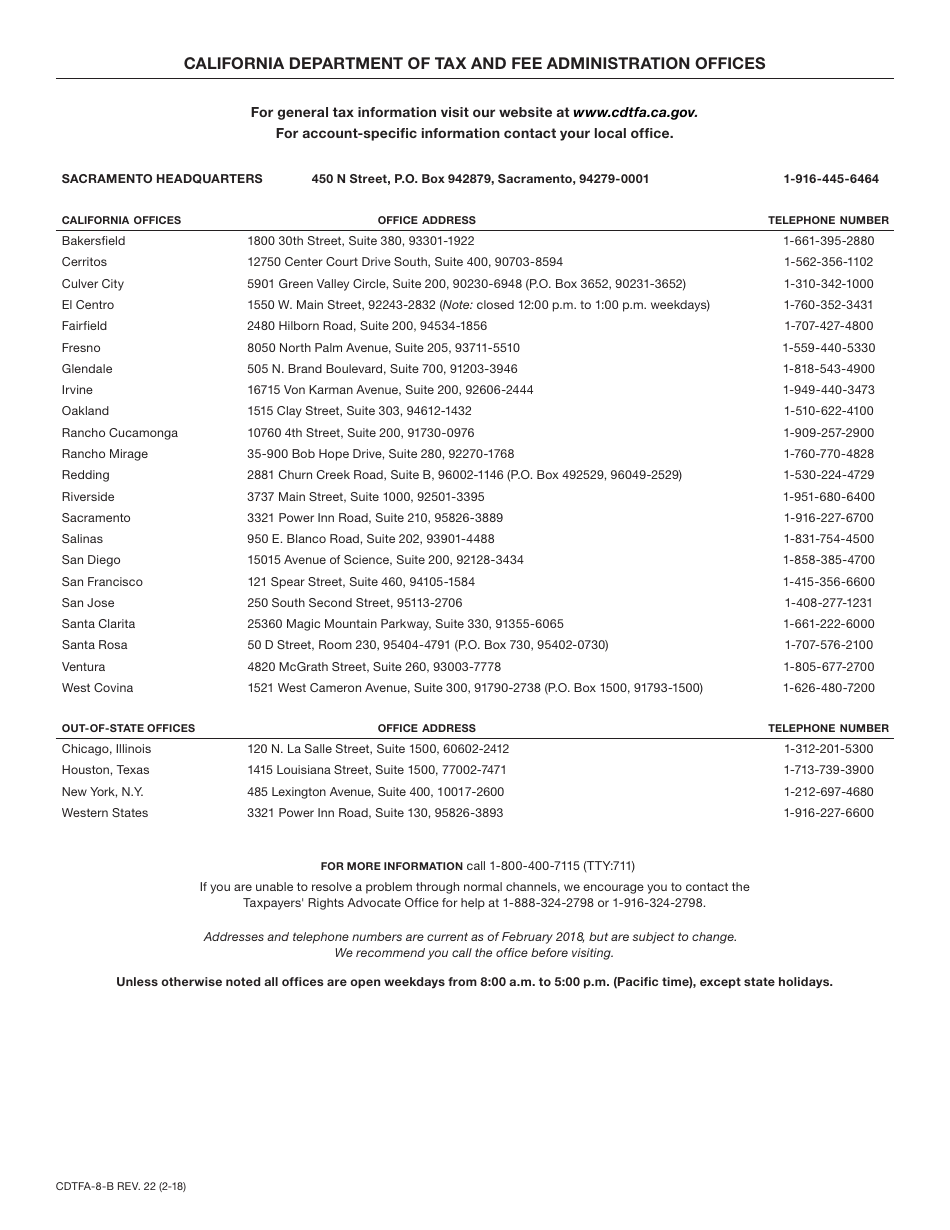

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

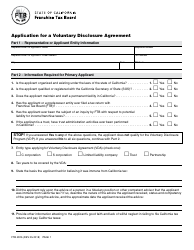

Q: What is Form CDTFA-38-I?

A: Form CDTFA-38-I is an application for in-state voluntary disclosure in California.

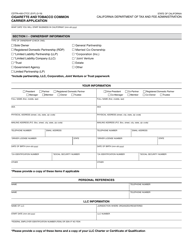

Q: Who should use Form CDTFA-38-I?

A: This form should be used by individuals or businesses that have not previously registered with the California Department of Tax and Fee Administration (CDTFA) and wish to voluntarily disclose and report any past due taxes.

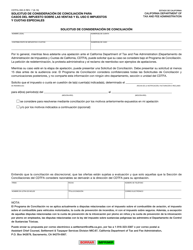

Q: What is the purpose of the in-state voluntary disclosure program?

A: The in-state voluntary disclosure program allows individuals and businesses to come forward voluntarily and pay past due taxes, while potentially avoiding certain penalties and criminal prosecution.

Q: What types of taxes can be disclosed through the program?

A: Most types of taxes administered by the CDTFA can be disclosed through the in-state voluntary disclosure program, including sales tax, use tax, and special taxes.

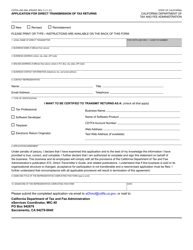

Q: What information should be included in the application?

A: The application should include the taxpayer's identifying information, a description of the disclosed tax liability, and any additional supporting documentation.

Q: Is there a deadline for submitting the application?

A: There is no specific deadline for submitting the application, but it is recommended that taxpayers come forward as soon as possible to minimize potential penalties.

Q: What happens after the application is submitted?

A: Once the application is submitted, the CDTFA will review the information provided and may contact the taxpayer for additional information or to discuss the terms of the voluntary disclosure agreement.

Q: Are there any penalties for participating in the program?

A: While participating in the in-state voluntary disclosure program may help reduce or eliminate certain penalties, taxpayers will still be liable for any unpaid tax, interest, and other applicable penalties.

Q: Can I participate in the program if I am already under audit or investigation?

A: If a taxpayer is already under audit or investigation by the CDTFA, they may not be eligible to participate in the in-state voluntary disclosure program. It is recommended to consult with a tax professional for guidance in such cases.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-38-I by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.