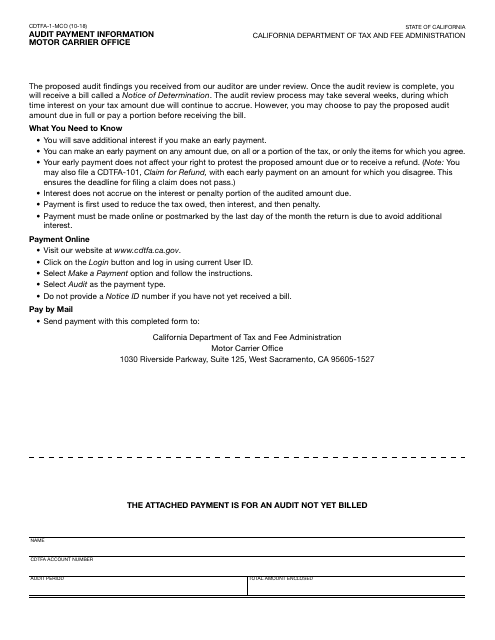

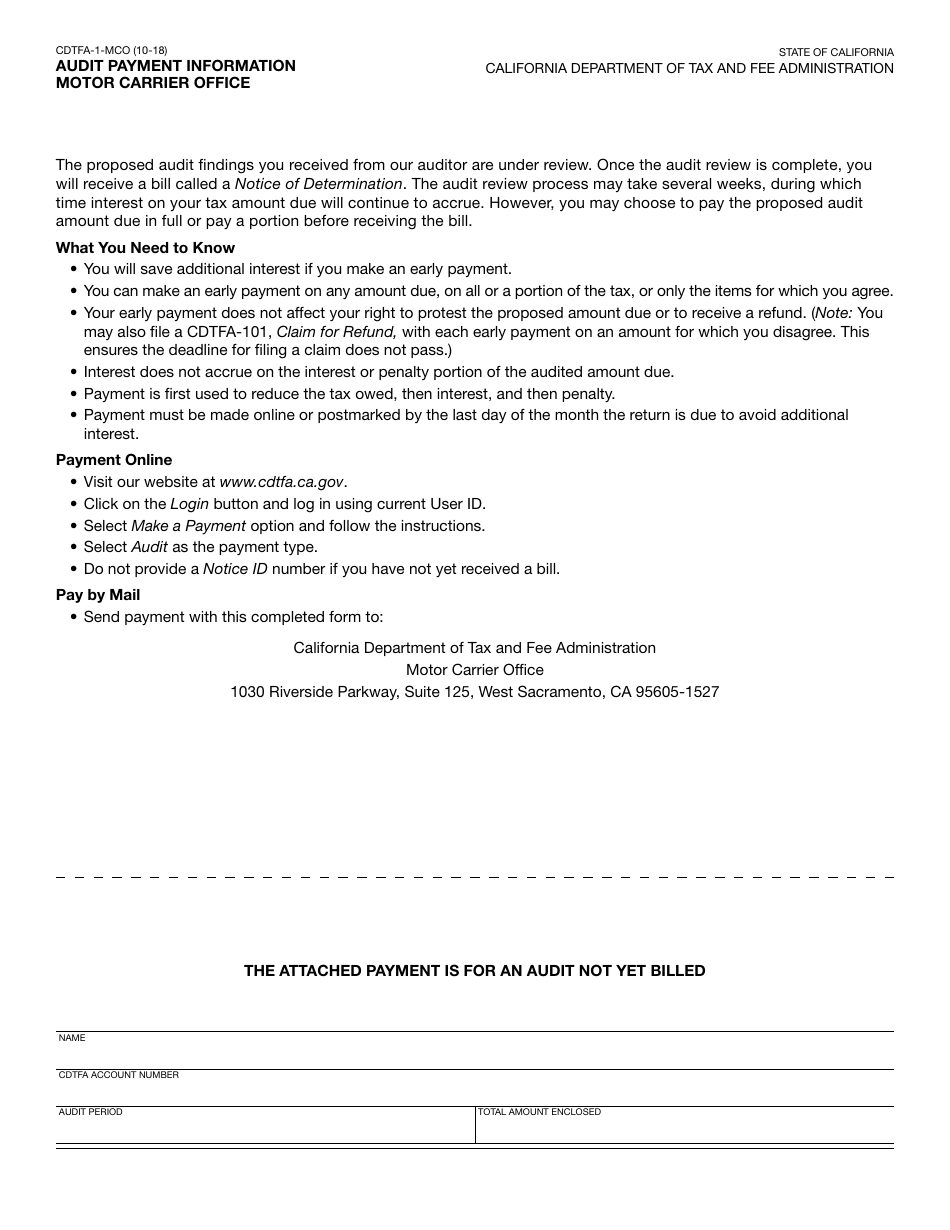

Form CDTFA-1-MCO Audit Payment Information - Motor Carrier Office - California

What Is Form CDTFA-1-MCO?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-1-MCO?

A: Form CDTFA-1-MCO is a form used to provide audit payment information for motor carriers in California.

Q: Who uses Form CDTFA-1-MCO?

A: Motor carriers in California use Form CDTFA-1-MCO.

Q: What is the purpose of Form CDTFA-1-MCO?

A: The purpose of Form CDTFA-1-MCO is to provide audit payment information for motor carriers.

Q: When is Form CDTFA-1-MCO required to be filed?

A: Form CDTFA-1-MCO is required to be filed by motor carriers in California when providing audit payment information.

Q: How do I fill out Form CDTFA-1-MCO?

A: You can fill out Form CDTFA-1-MCO by providing the required audit payment information for motor carriers in California.

Q: Are there any fees associated with Form CDTFA-1-MCO?

A: There may be fees associated with Form CDTFA-1-MCO. Contact the California Department of Tax and Fee Administration (CDTFA) for more information.

Q: What happens after I submit Form CDTFA-1-MCO?

A: After you submit Form CDTFA-1-MCO, the California Department of Tax and Fee Administration (CDTFA) will process your audit payment information for motor carriers in California.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-1-MCO by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.