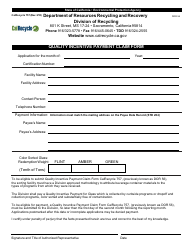

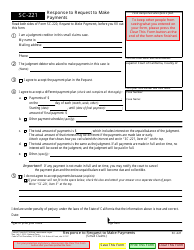

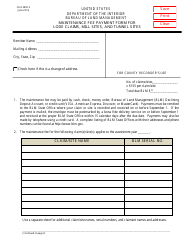

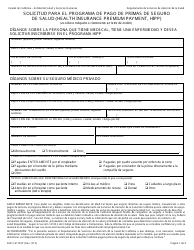

Form CalRecycle328 Used Oil Re-refined Incentive Payment Claim - California

What Is Form CalRecycle328?

This is a legal form that was released by the California Department of Resources Recycling and Recovery - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CalRecycle328?

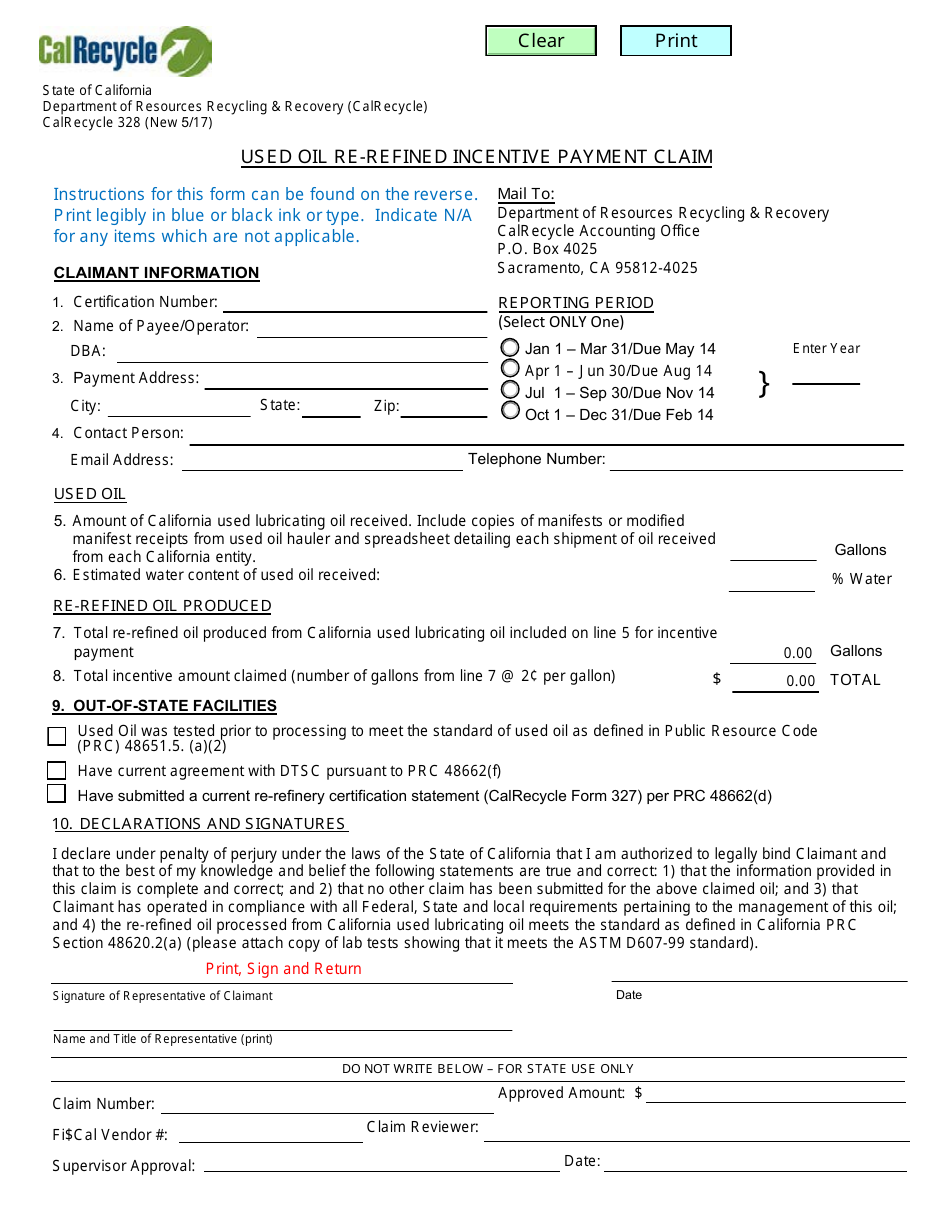

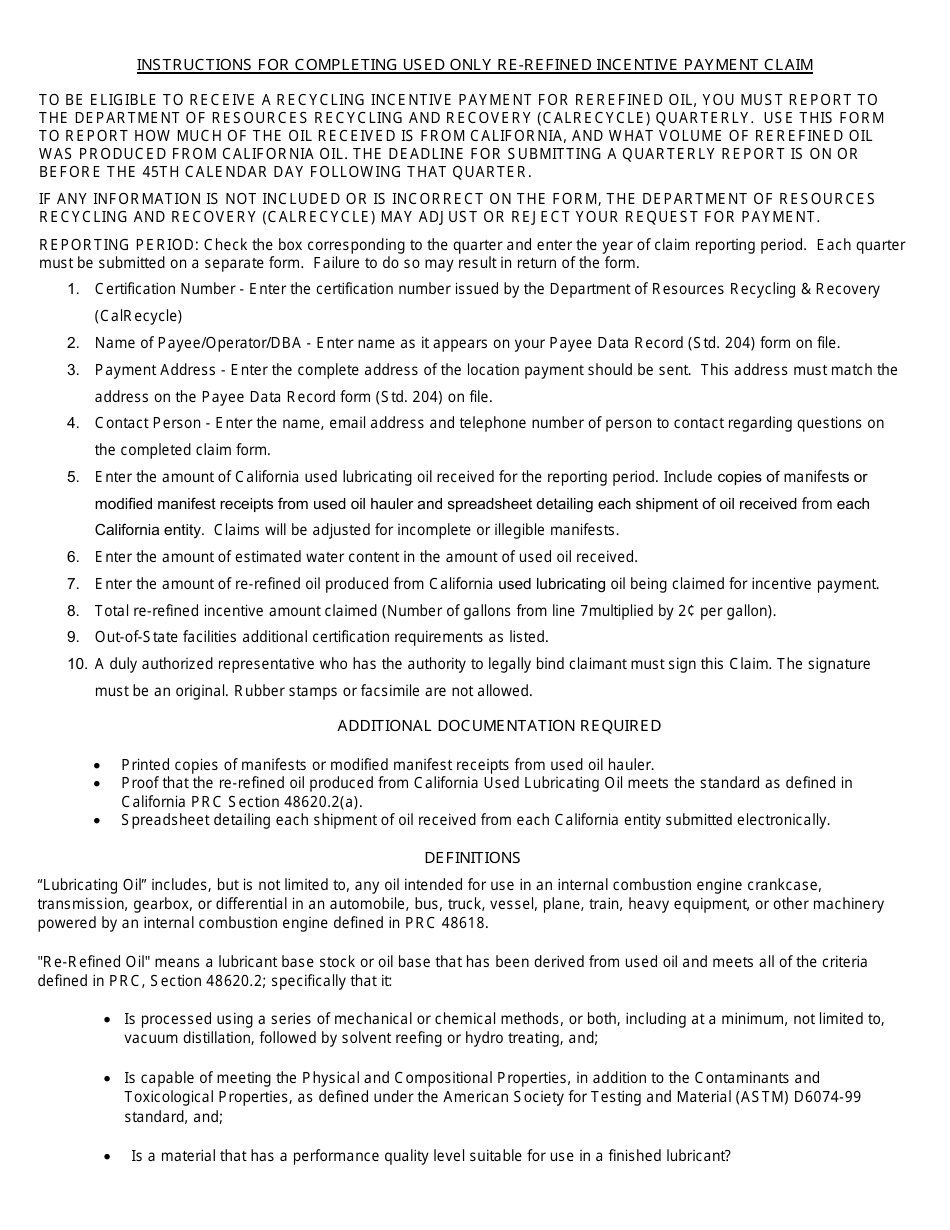

A: Form CalRecycle328 is a document used to claim the incentive payment for re-refining used oil in California.

Q: What is the purpose of the Used Oil Re-refined Incentive Payment?

A: The Used Oil Re-refined Incentive Payment is designed to promote recycling and re-refining of used oil in order to reduce environmental harm.

Q: Who can use Form CalRecycle328?

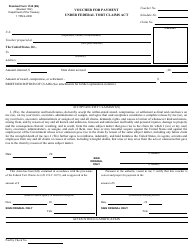

A: Form CalRecycle328 can be used by individuals or businesses that re-refine used oil in California and want to claim the incentive payment.

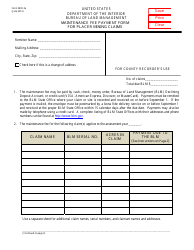

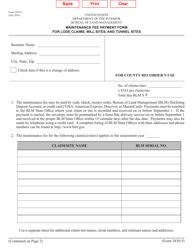

Q: What information is required in Form CalRecycle328?

A: Form CalRecycle328 requires information such as the date of the claim, the re-refining facility's contact information, the amount of used oil re-refined, and supporting documentation.

Q: Is there a deadline for submitting Form CalRecycle328?

A: Yes, the deadline for submitting Form CalRecycle328 is usually 30 days after the end of the reporting period.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the California Department of Resources Recycling and Recovery;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CalRecycle328 by clicking the link below or browse more documents and templates provided by the California Department of Resources Recycling and Recovery.