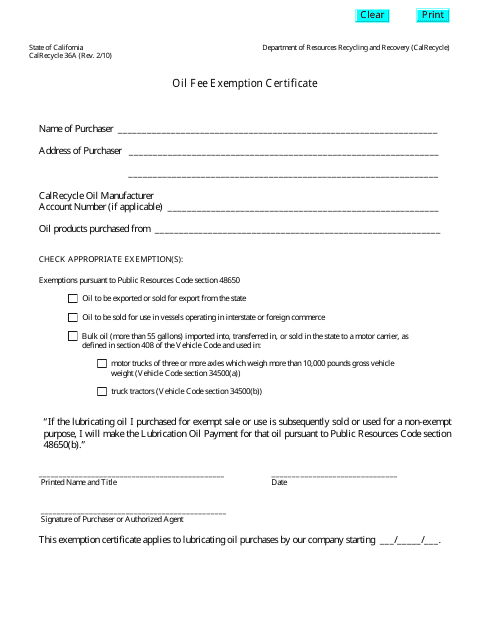

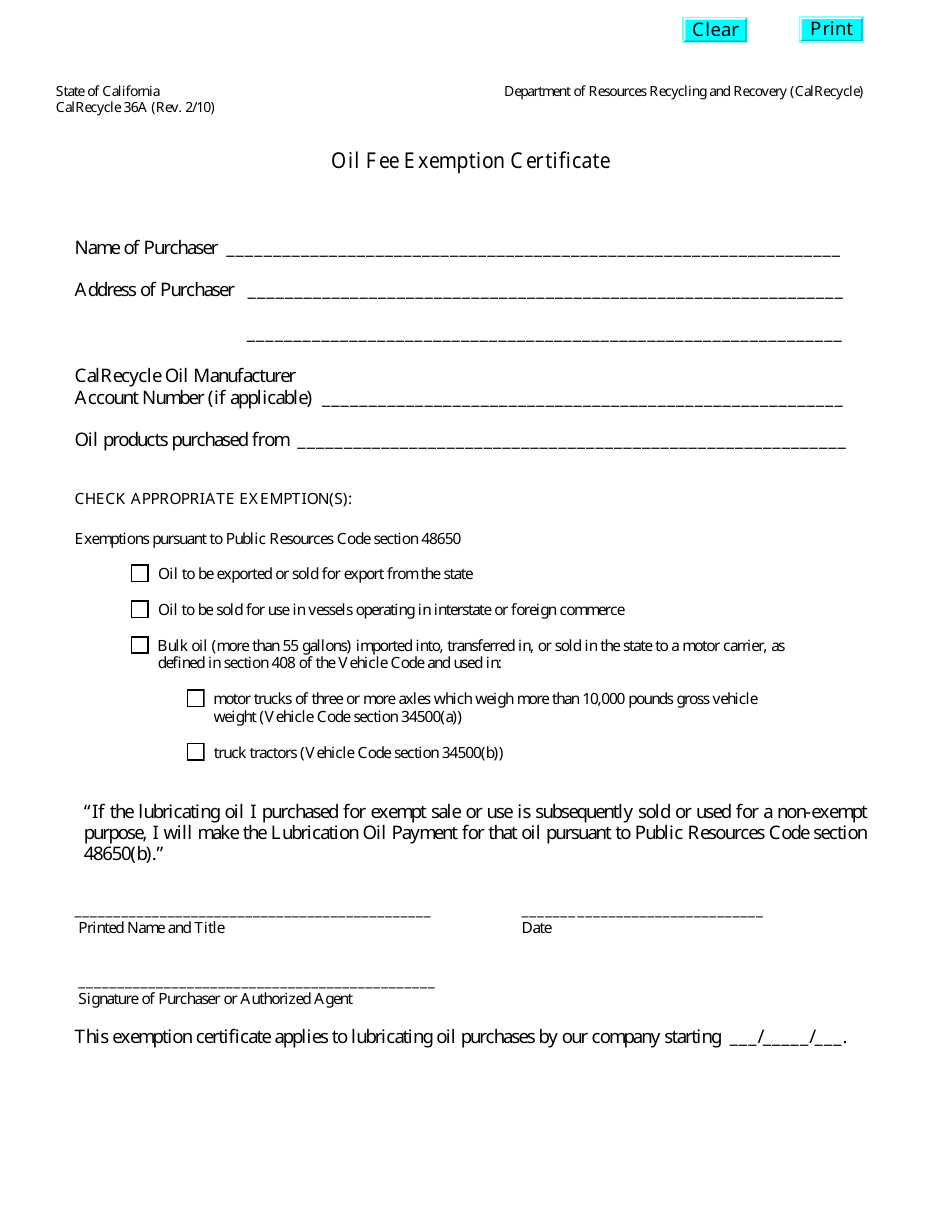

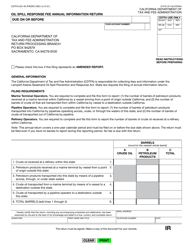

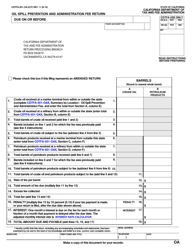

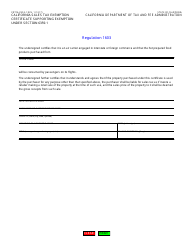

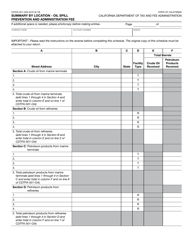

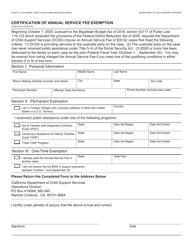

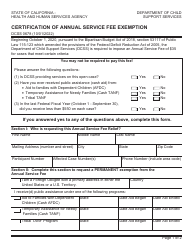

Form CalRecycle36A Oil Fee Exemption Certificate - California

What Is Form CalRecycle36A?

This is a legal form that was released by the California Department of Resources Recycling and Recovery - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CalRecycle36A?

A: CalRecycle36A is the form used for Oil Fee Exemption Certificate in California.

Q: What is the purpose of CalRecycle36A?

A: The purpose of CalRecycle36A is to exempt certain types of oil from the oil fee imposed by the State of California.

Q: Who can use CalRecycle36A?

A: Any person or entity that meets the requirements for exemption from the oil fee in California can use CalRecycle36A.

Q: How do I fill out CalRecycle36A?

A: You need to provide your name, address, and other relevant information, and certify that you meet the requirements for exemption.

Form Details:

- Released on February 1, 2010;

- The latest edition provided by the California Department of Resources Recycling and Recovery;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CalRecycle36A by clicking the link below or browse more documents and templates provided by the California Department of Resources Recycling and Recovery.