This version of the form is not currently in use and is provided for reference only. Download this version of

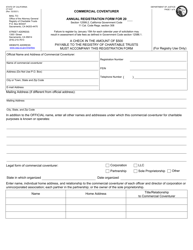

Form CT-3CF

for the current year.

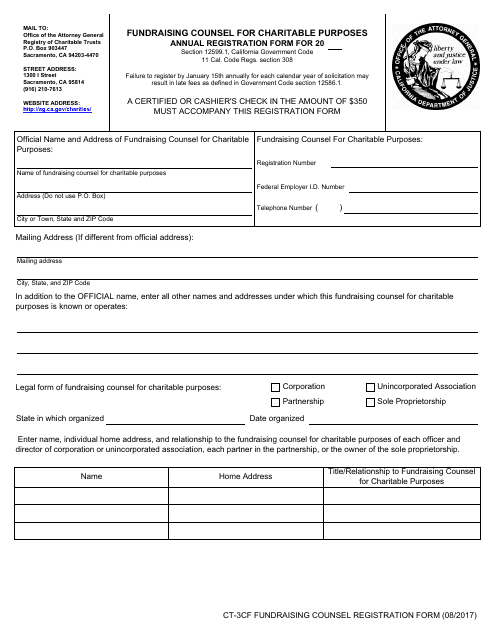

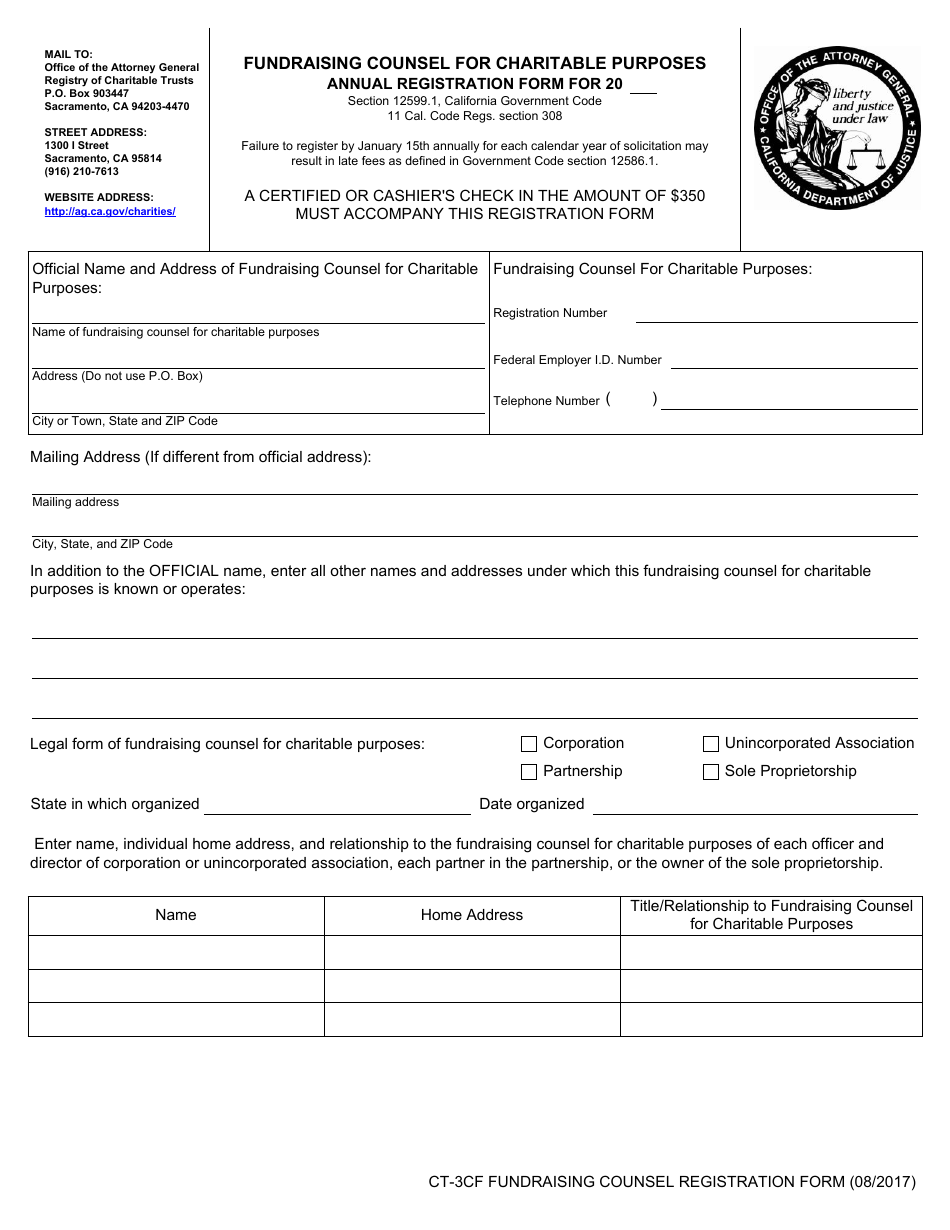

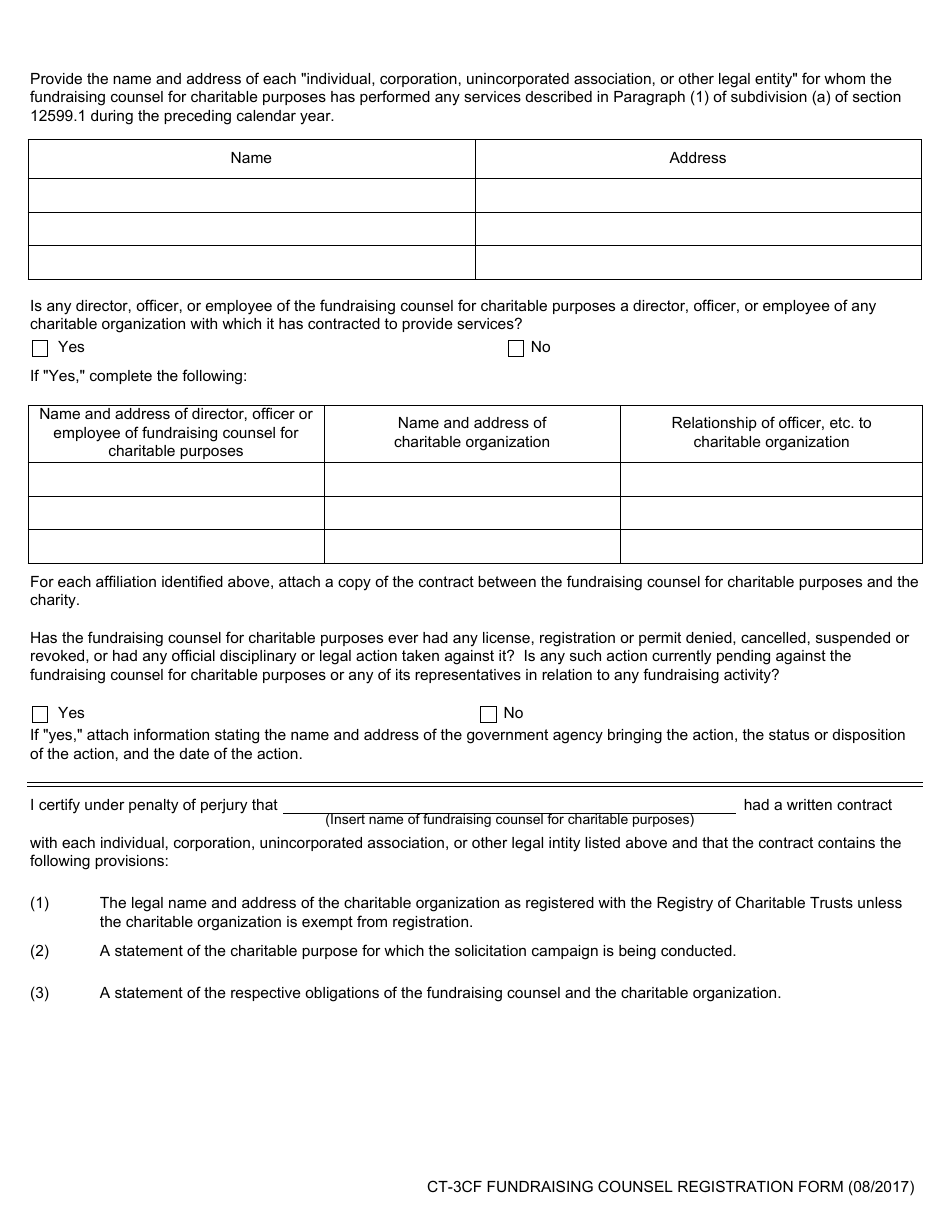

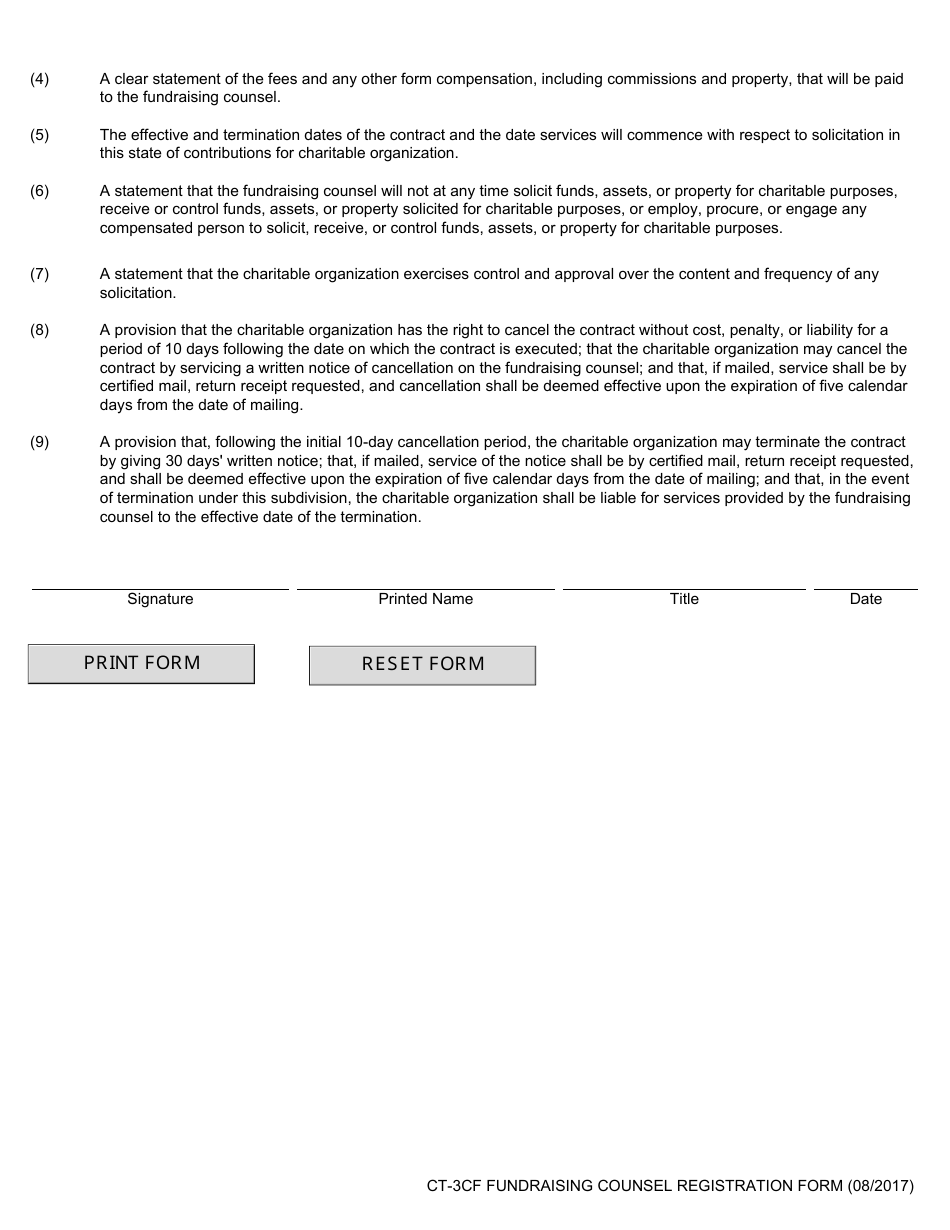

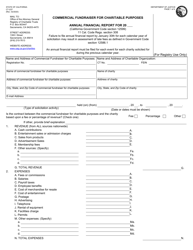

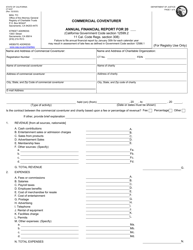

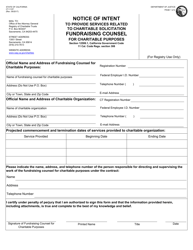

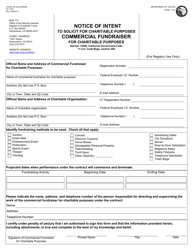

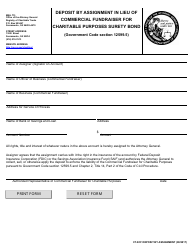

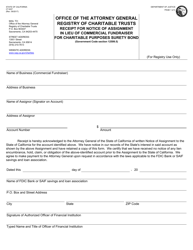

Form CT-3CF Annual Registration Form - Fundraising Counsel for Charitable Purposes - California

What Is Form CT-3CF?

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-3CF?

A: Form CT-3CF is the Annual Registration Form for Fundraising Counsel for Charitable Purposes in California.

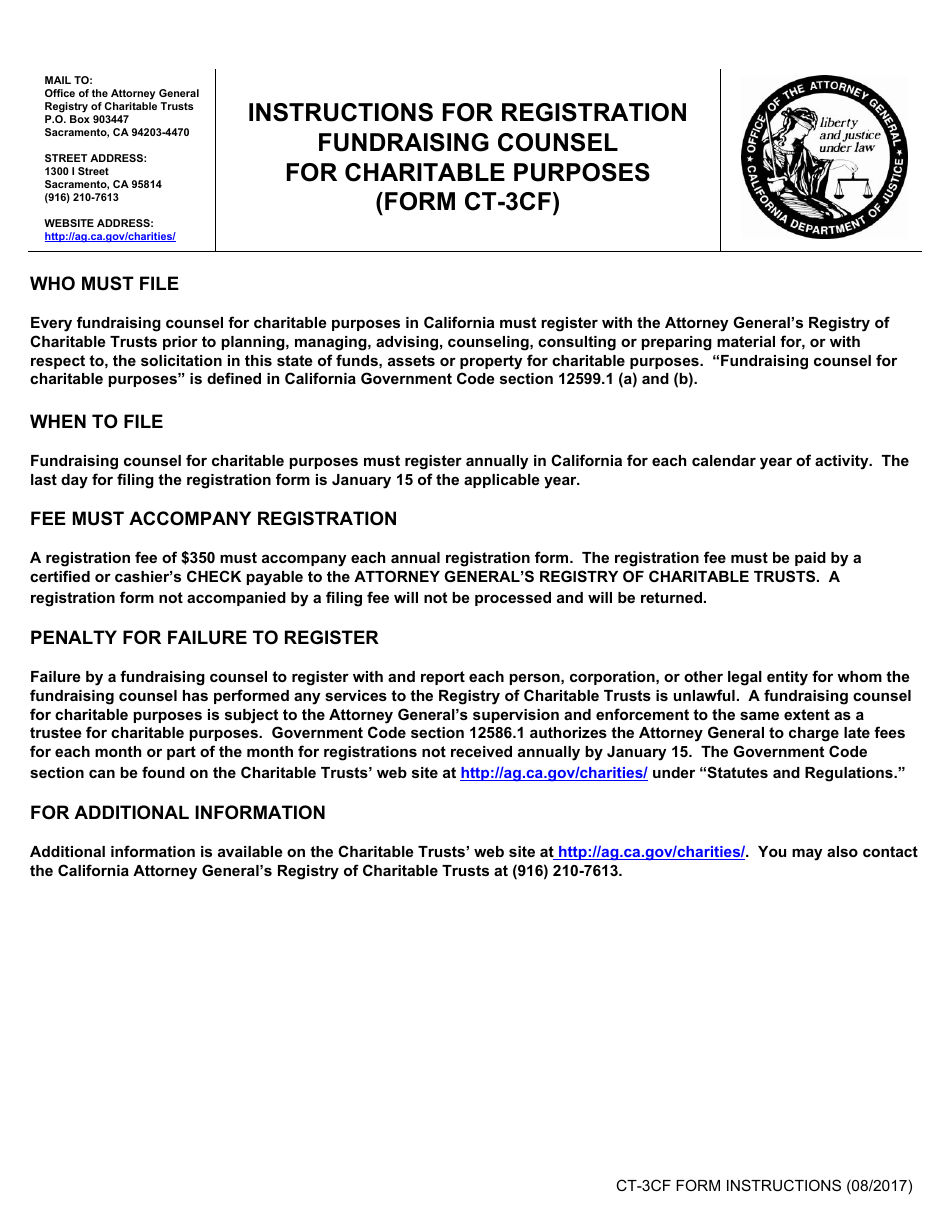

Q: Who needs to file Form CT-3CF?

A: Fundraising Counsel for Charitable Purposes in California need to file Form CT-3CF.

Q: What is the purpose of Form CT-3CF?

A: The purpose of Form CT-3CF is to register fundraising counsel in California.

Q: When is Form CT-3CF due?

A: Form CT-3CF is due annually by the 15th day of the fifth month after the close of the organization's fiscal year.

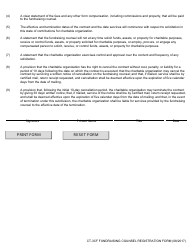

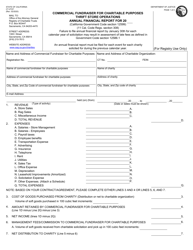

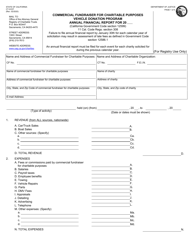

Q: Are there any fees associated with filing Form CT-3CF?

A: Yes, there are fees associated with filing Form CT-3CF. The fee amount depends on the organization's gross revenue.

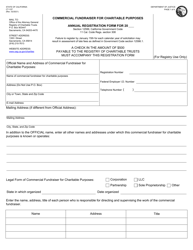

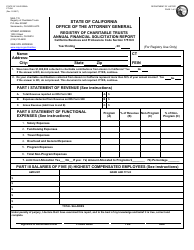

Q: What information is required on Form CT-3CF?

A: Form CT-3CF requires information such as the organization's name, address, federal employer identification number, and financial information.

Q: Is there a penalty for late filing or non-filing of Form CT-3CF?

A: Yes, there may be penalties for late filing or non-filing of Form CT-3CF. It is important to file the form on time to avoid penalties.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-3CF by clicking the link below or browse more documents and templates provided by the California Department of Justice.