This version of the form is not currently in use and is provided for reference only. Download this version of

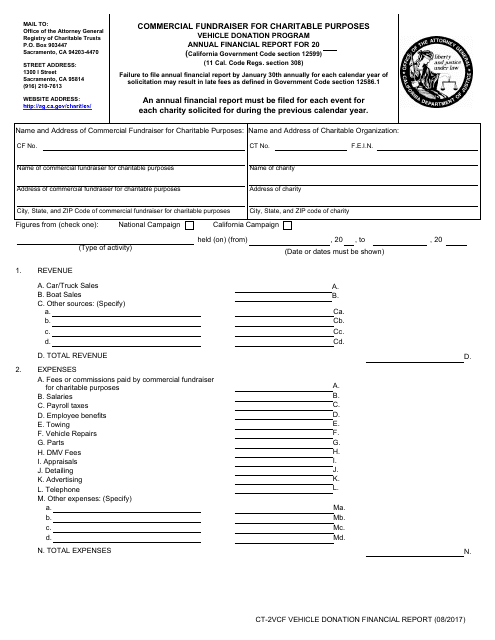

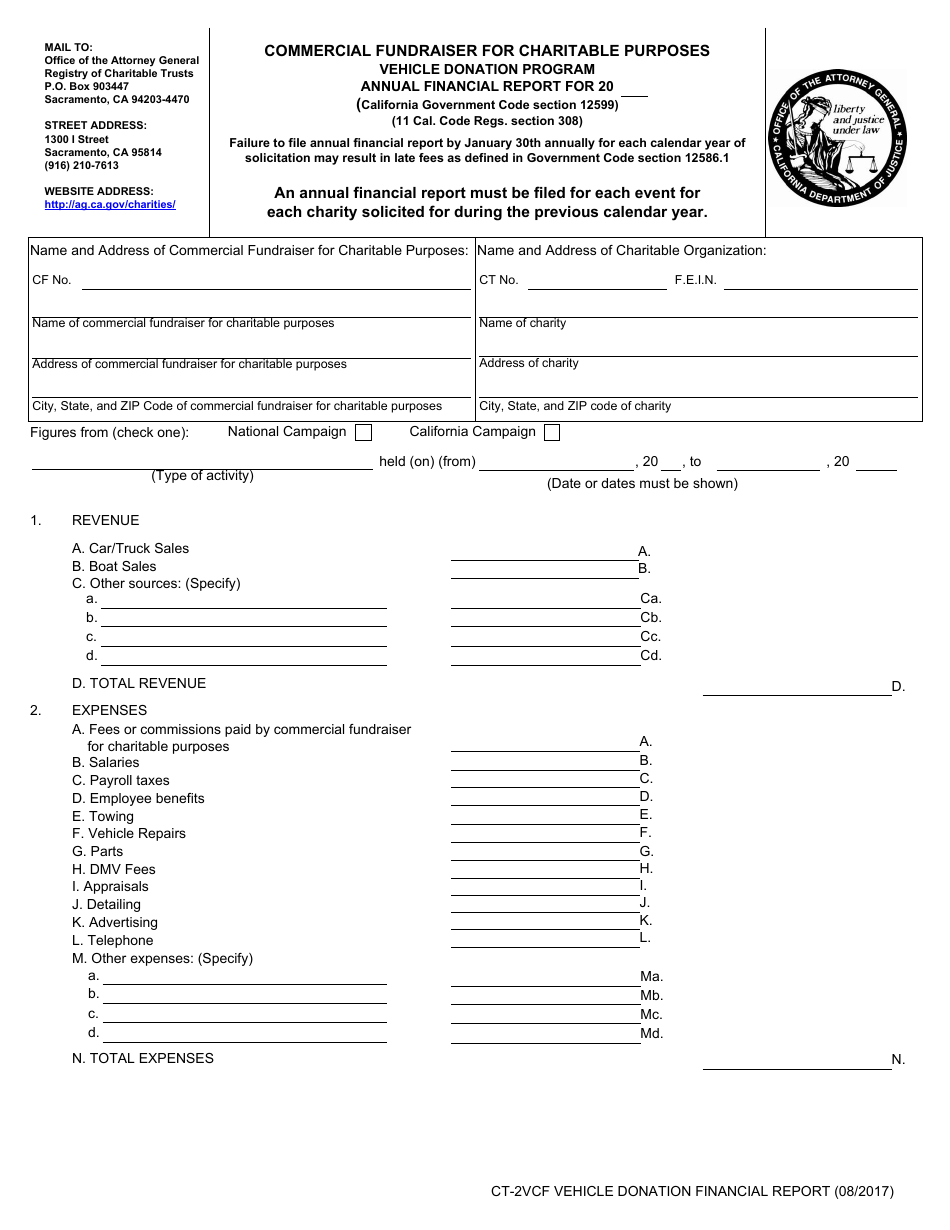

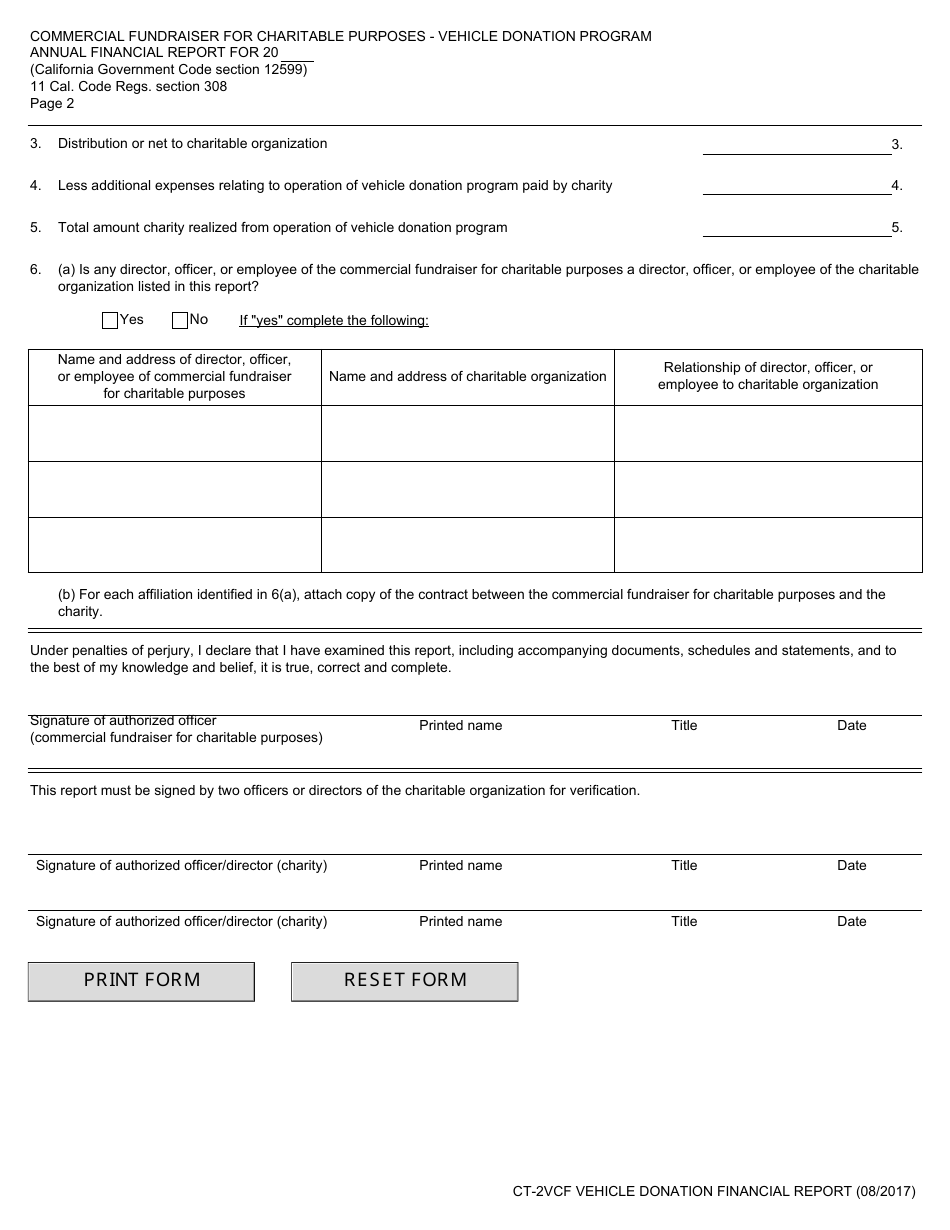

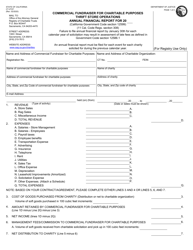

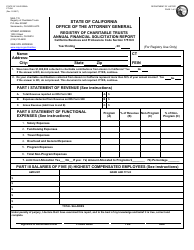

Form CT-2VCF

for the current year.

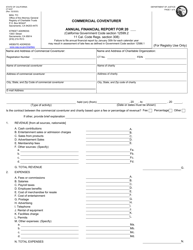

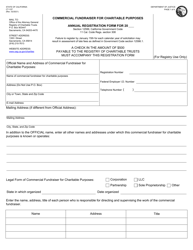

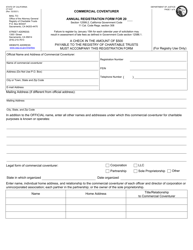

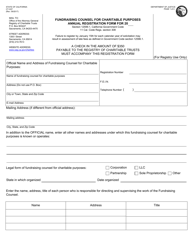

Form CT-2VCF Annual Financial Report - Vehicle Donation Program - California

What Is Form CT-2VCF?

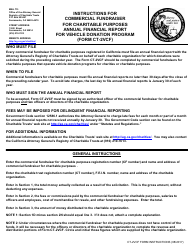

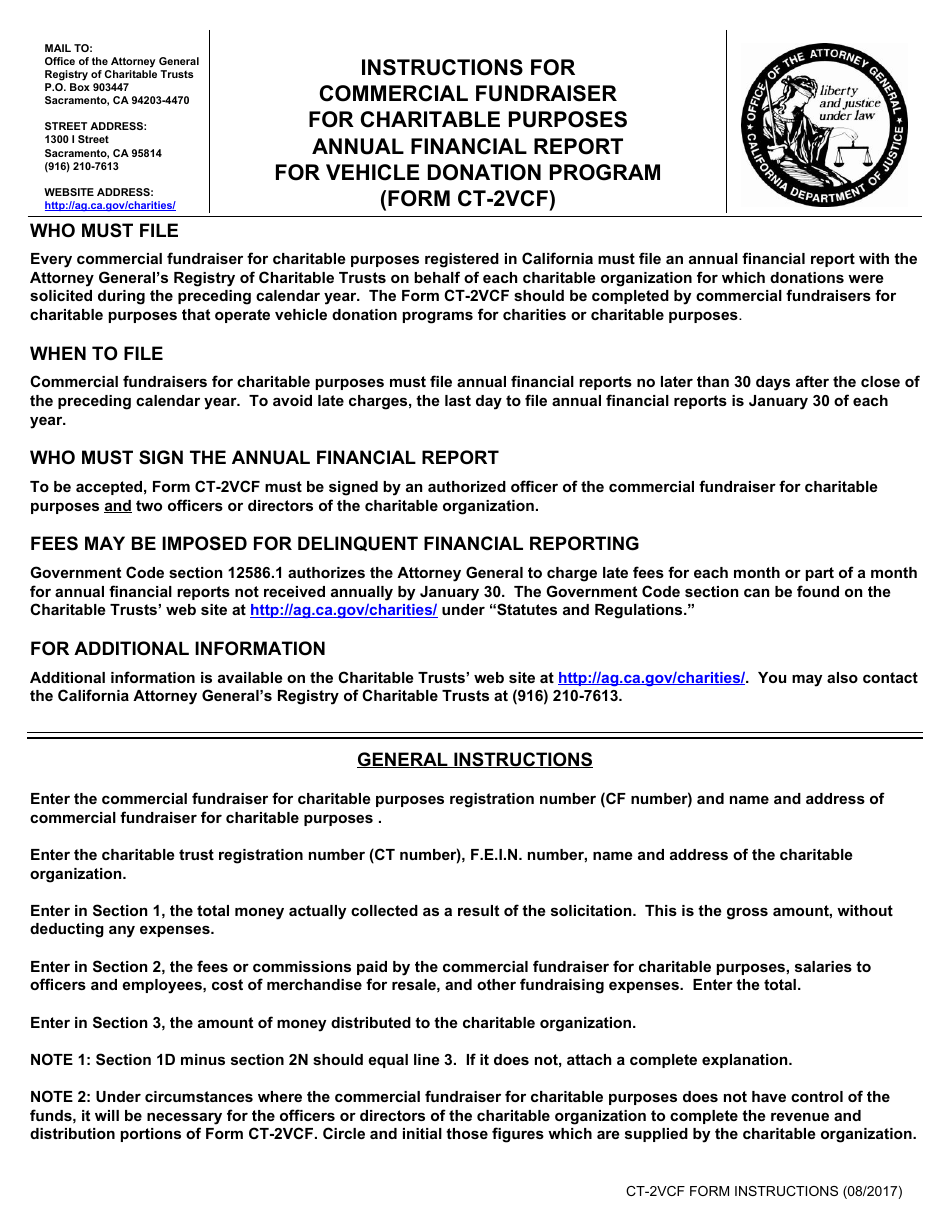

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-2VCF?

A: Form CT-2VCF is the Annual Financial Report for the Vehicle Donation Program in California.

Q: Who needs to file Form CT-2VCF?

A: Nonprofit organizations that participate in the Vehicle Donation Program in California need to file Form CT-2VCF.

Q: What is the purpose of Form CT-2VCF?

A: Form CT-2VCF is used to report the financial activities of nonprofit organizations that participate in the Vehicle Donation Program in California.

Q: When is Form CT-2VCF due?

A: Form CT-2VCF is due by the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any penalties for not filing Form CT-2VCF?

A: Yes, there are penalties for not filing Form CT-2VCF or filing it late. The penalty amount depends on the organization's gross annual revenue.

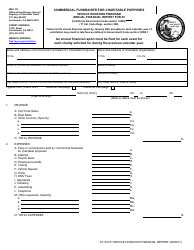

Q: What information do I need to complete Form CT-2VCF?

A: To complete Form CT-2VCF, you will need information about the organization's financial activities, including revenue, expenses, and assets.

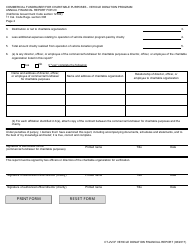

Q: Can I amend Form CT-2VCF if I made a mistake?

A: Yes, you can amend Form CT-2VCF if you made a mistake. You need to file an amended form within 6 months of the original due date or within 6 months of the date the original form was filed, whichever is later.

Q: Is Form CT-2VCF only for nonprofit organizations in California?

A: Yes, Form CT-2VCF is specifically for nonprofit organizations that participate in the Vehicle Donation Program in California.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-2VCF by clicking the link below or browse more documents and templates provided by the California Department of Justice.