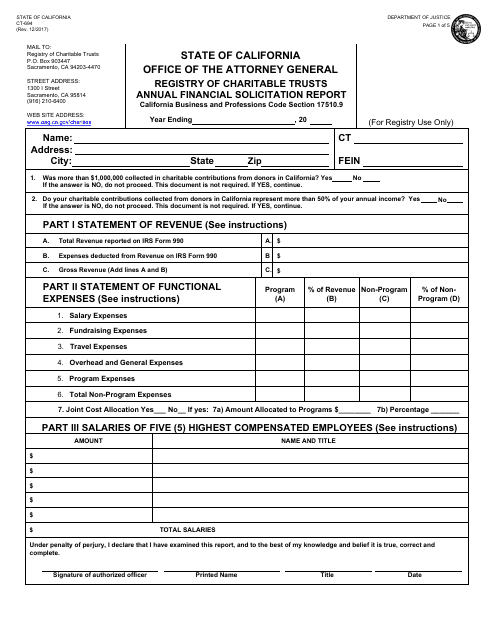

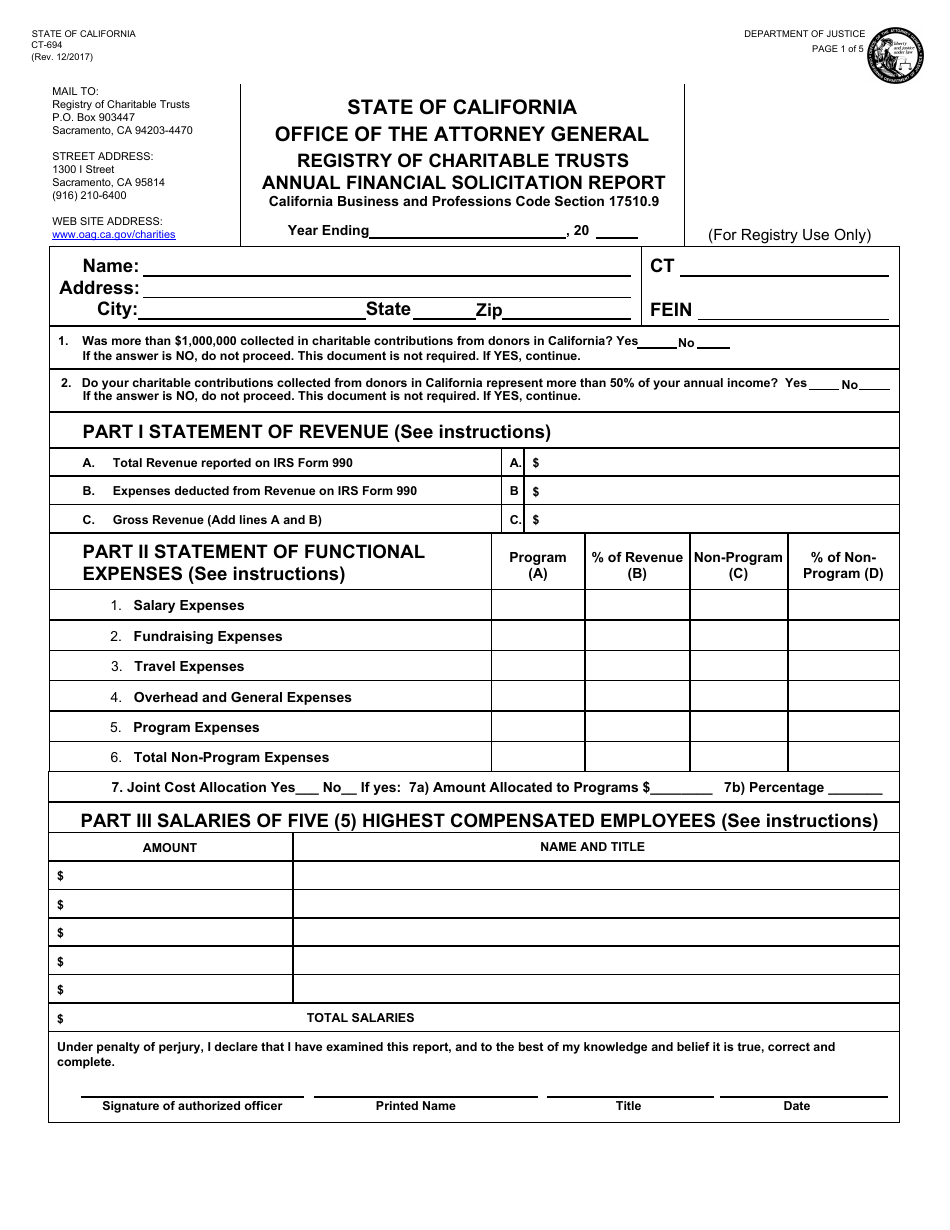

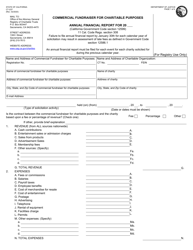

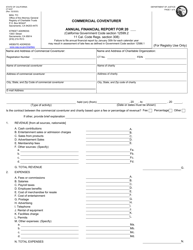

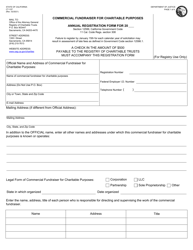

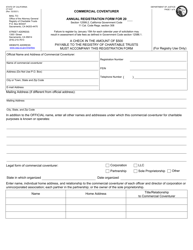

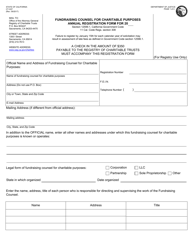

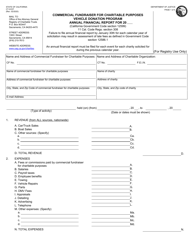

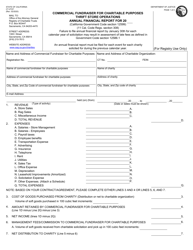

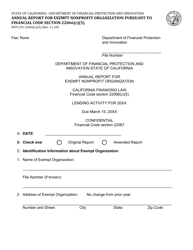

Form CT-694 Annual Financial Solicitation Report - California

What Is Form CT-694?

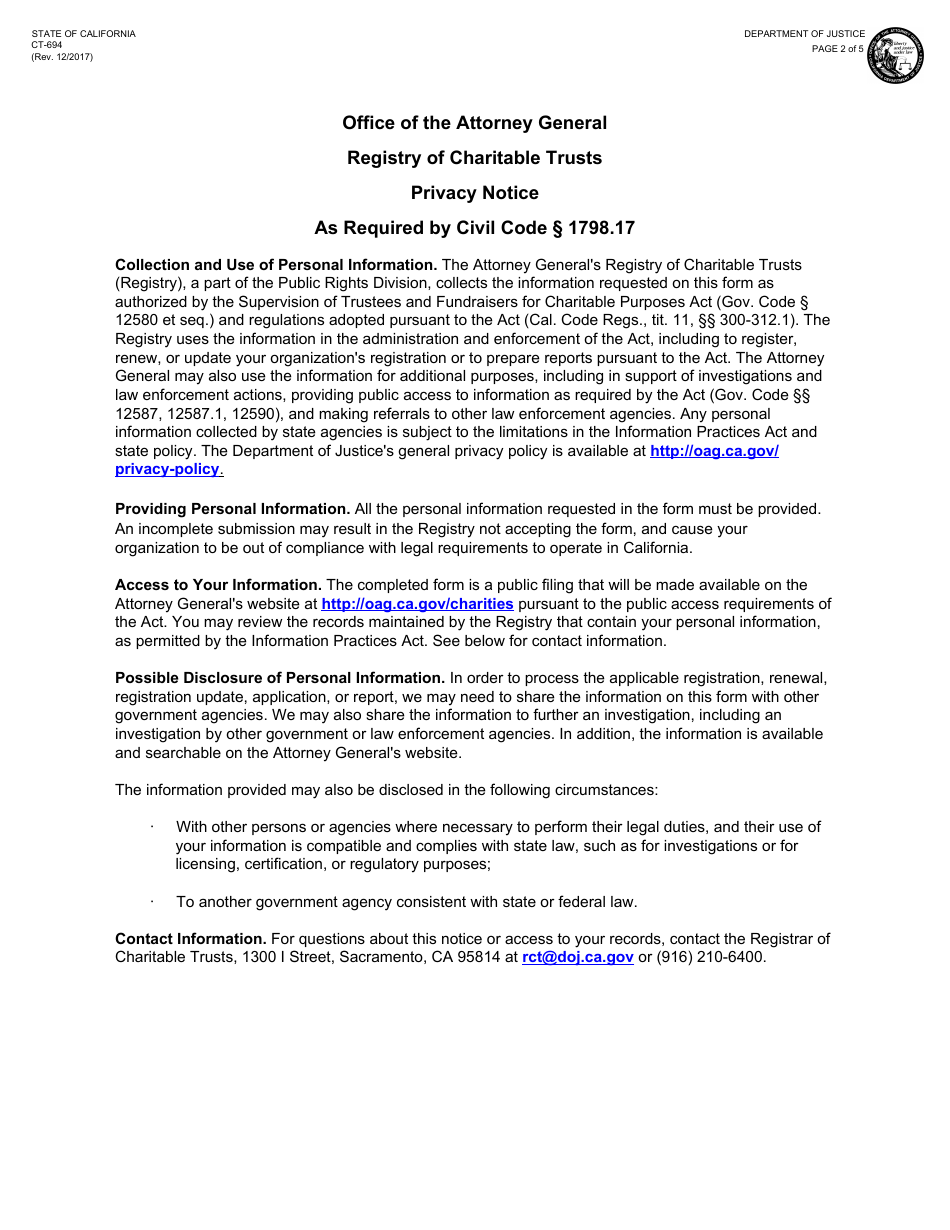

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

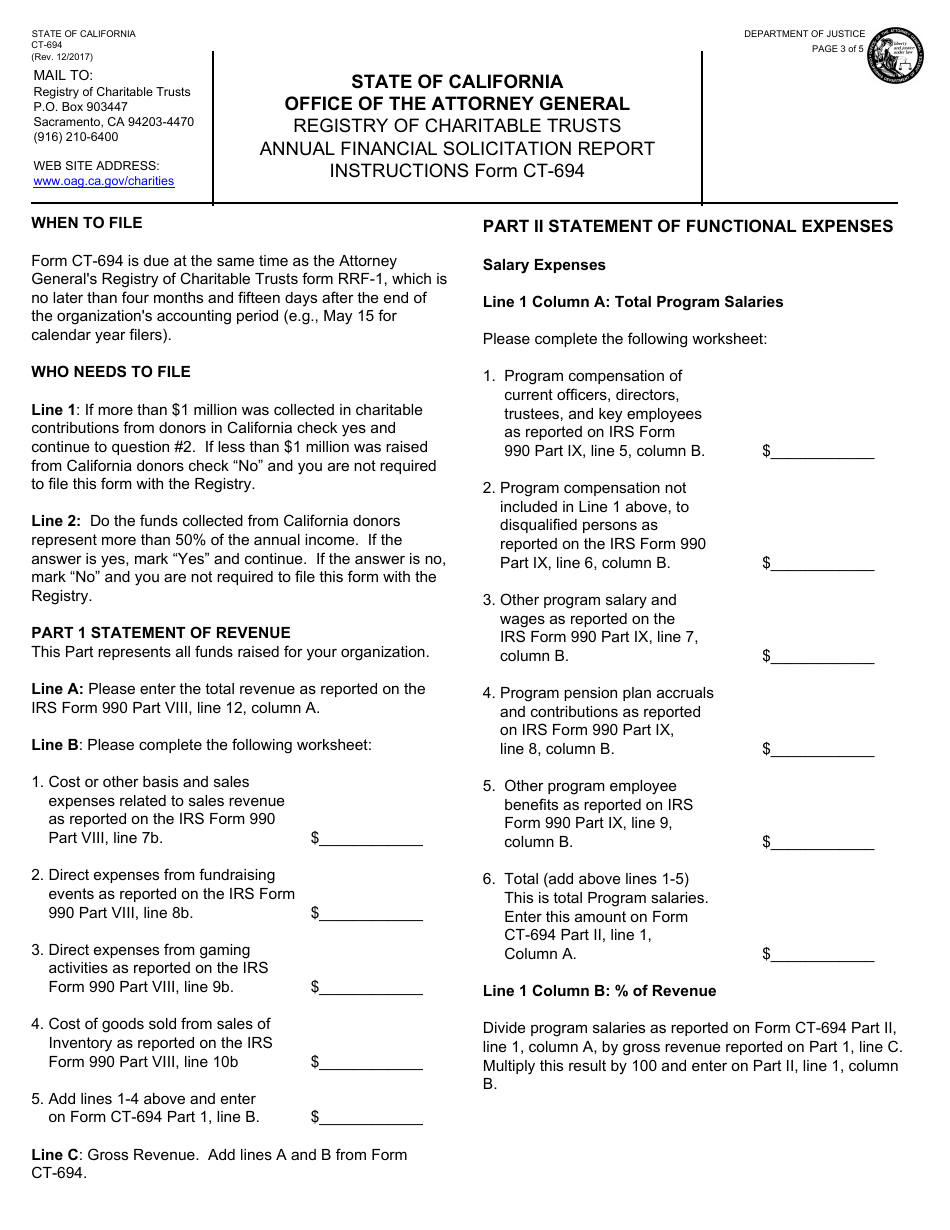

Q: What is Form CT-694?

A: Form CT-694 is the Annual Financial Solicitation Report in California.

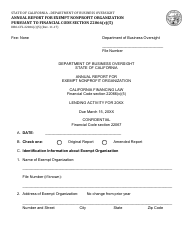

Q: Who is required to file Form CT-694?

A: Nonprofit organizations that engage in solicitation activities in California are required to file Form CT-694.

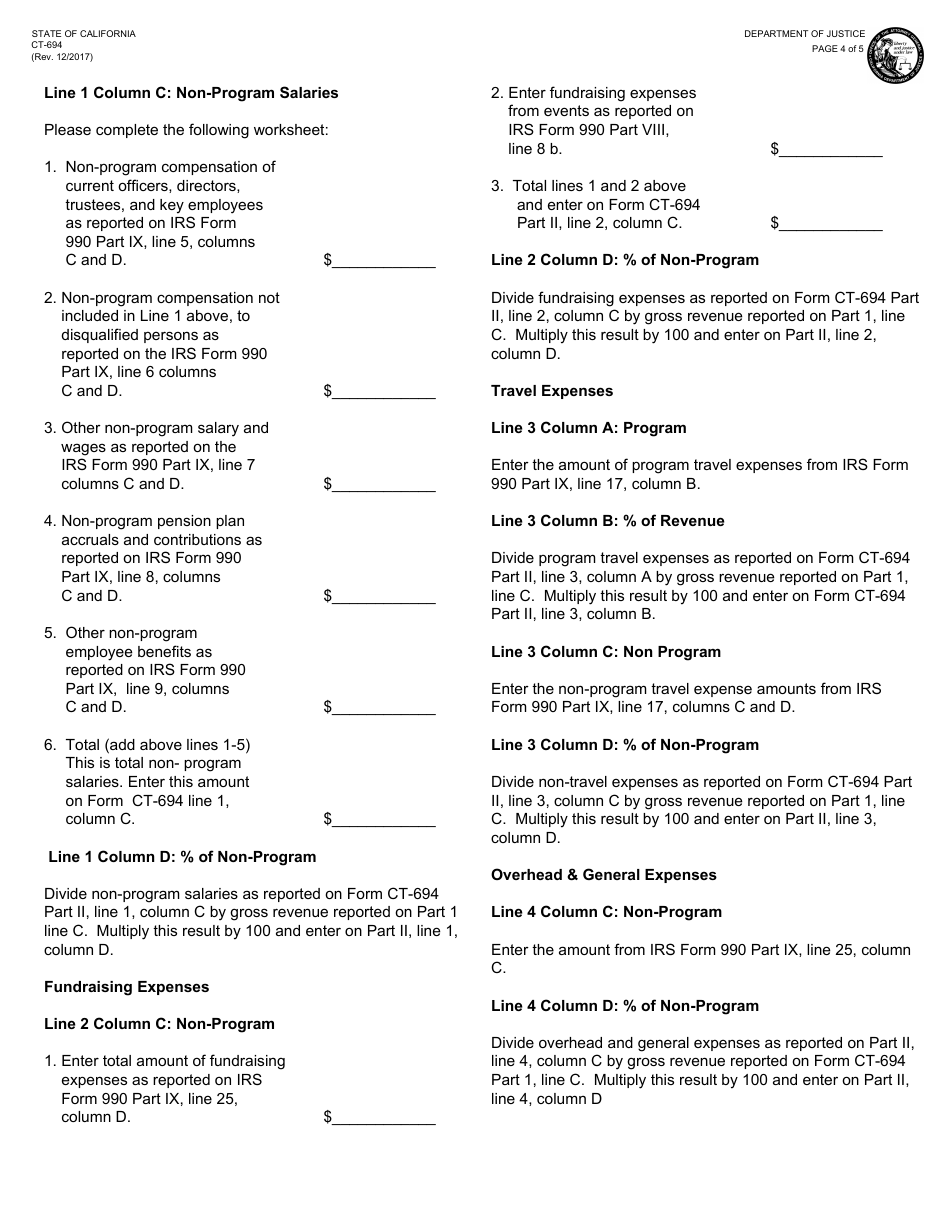

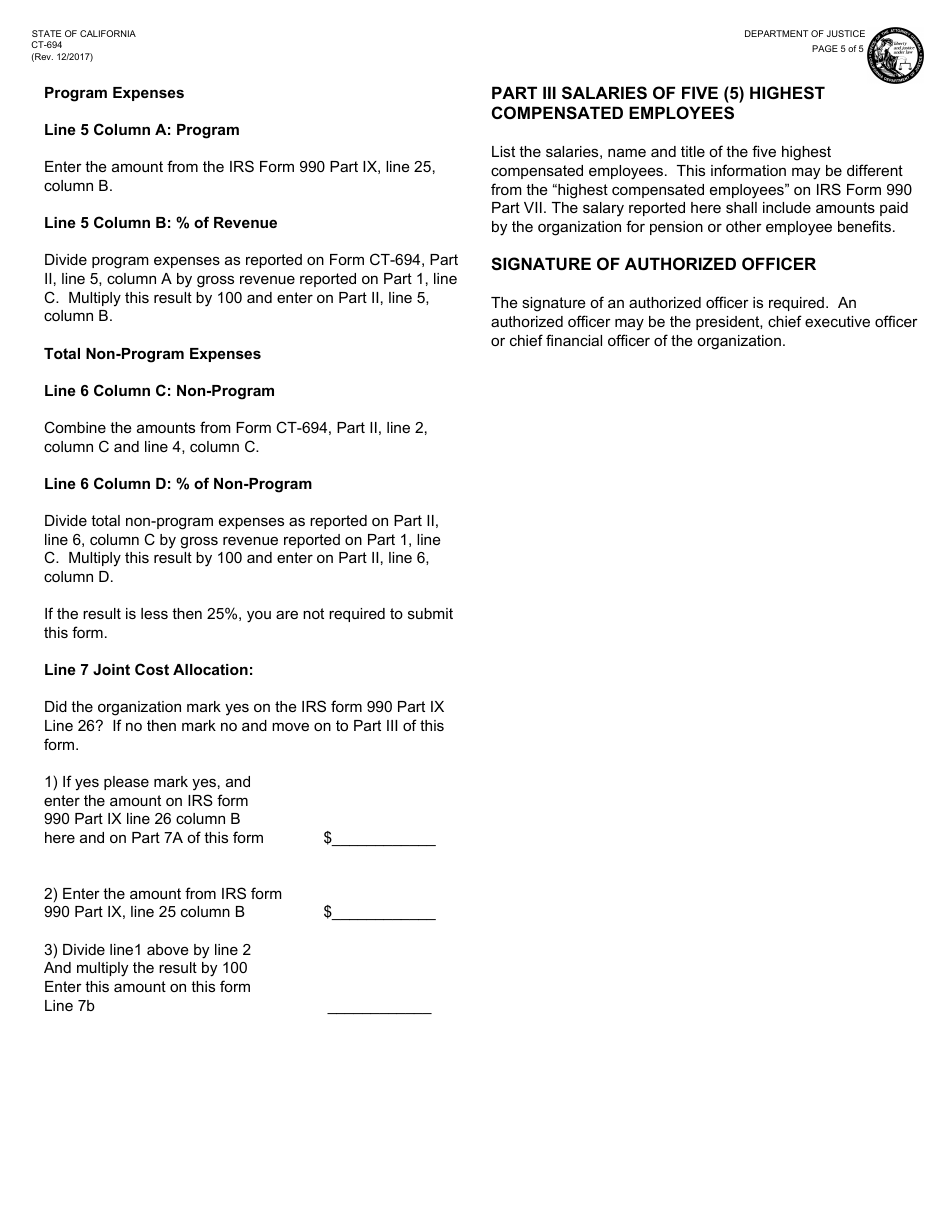

Q: What information is required in Form CT-694?

A: Form CT-694 requires information about the organization's financial activities related to solicitation, such as revenues, expenses, and use of funds.

Q: When is Form CT-694 due?

A: Form CT-694 is due on or before the 15th day of the fifth month following the end of the organization's fiscal year.

Q: Are there any filing fees for Form CT-694?

A: Yes, there is a filing fee associated with Form CT-694. The fee amount depends on the organization's gross annual revenues.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-694 by clicking the link below or browse more documents and templates provided by the California Department of Justice.