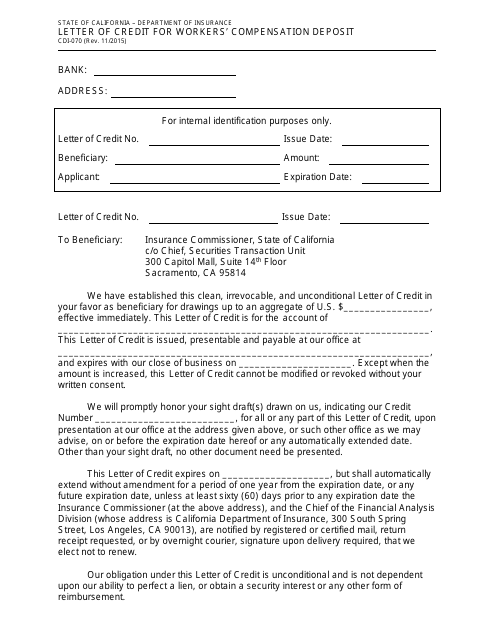

Form CDI-070 Letter of Credit for Workers' Compensation Deposit - California

What Is Form CDI-070?

This is a legal form that was released by the California Department of Insurance - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDI-070?

A: Form CDI-070 is the Letter of Credit for Workers' Compensation Deposit specifically for California.

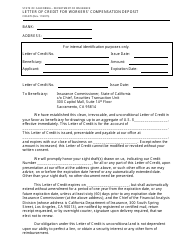

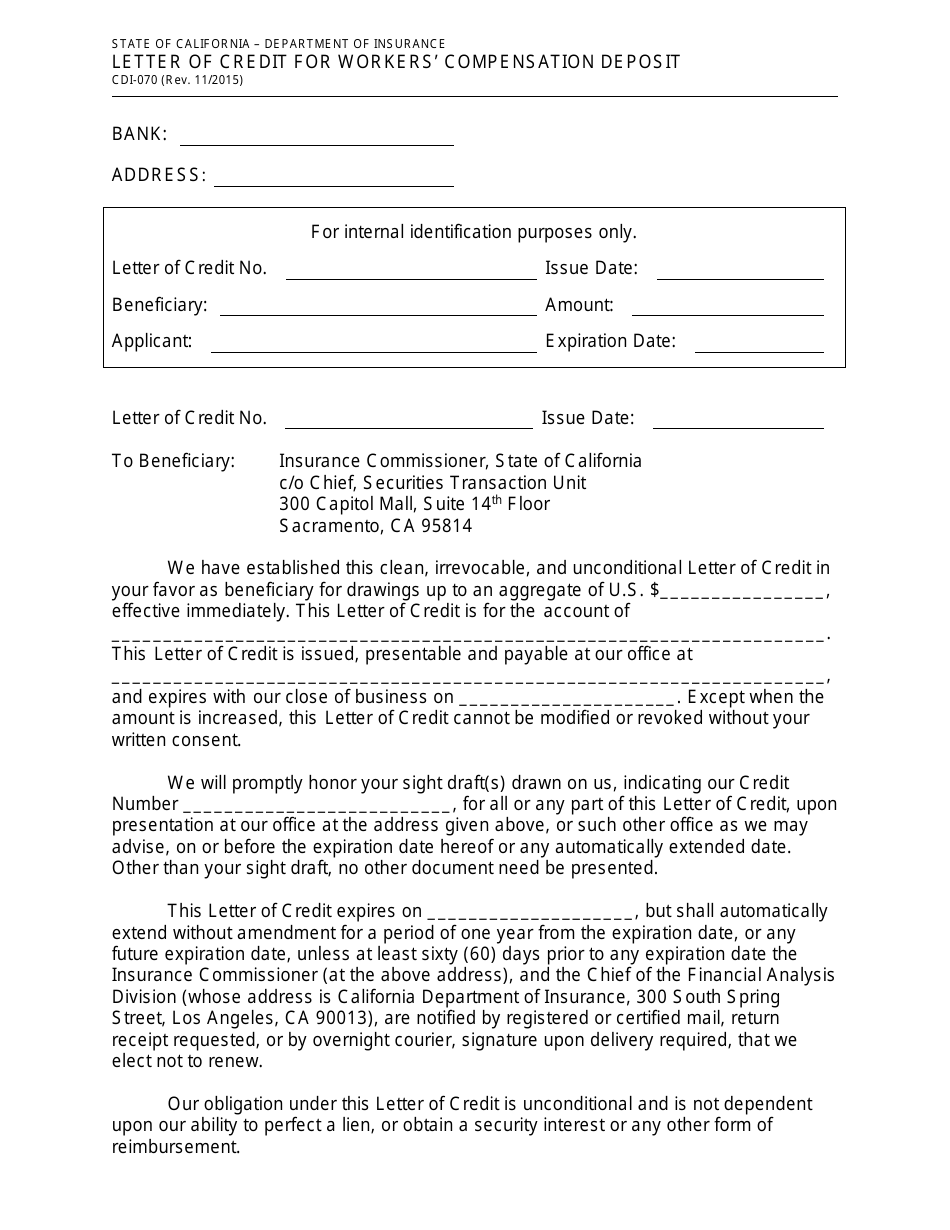

Q: What is a Letter of Credit?

A: A Letter of Credit is a financial document issued by a bank that guarantees payment to a beneficiary.

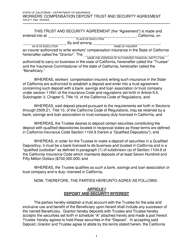

Q: Why is a Letter of Credit required for Workers' Compensation Deposit?

A: A Letter of Credit is required as a form of financial security to ensure that an employer can cover the costs of workers' compensation claims.

Q: Who needs to submit Form CDI-070?

A: Employers in California who are required to make a workers' compensation deposit may need to submit Form CDI-070.

Q: Are there any fees associated with Form CDI-070?

A: There may be fees associated with obtaining a Letter of Credit, but the specific costs vary depending on the bank and other factors.

Q: What happens if an employer fails to provide a workers' compensation deposit?

A: If an employer fails to provide a workers' compensation deposit, they may face penalties and fines, and their ability to conduct business in California may be affected.

Q: Can Form CDI-070 be electronically submitted?

A: Yes, Form CDI-070 can be submitted electronically through the CDI's Electronic Funds Transfer (EFT) system.

Q: How long is Form CDI-070 valid for?

A: The validity of Form CDI-070 varies and is typically determined by the California Department of Insurance.

Q: Is Form CDI-070 only applicable in California?

A: Yes, Form CDI-070 is specifically for workers' compensation deposits in California.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the California Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDI-070 by clicking the link below or browse more documents and templates provided by the California Department of Insurance.