This version of the form is not currently in use and is provided for reference only. Download this version of

Form AIS-F

for the current year.

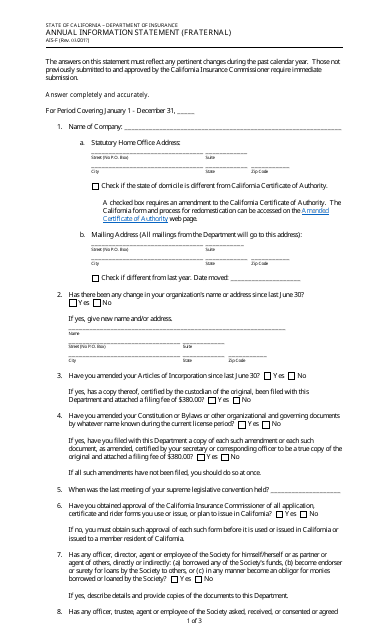

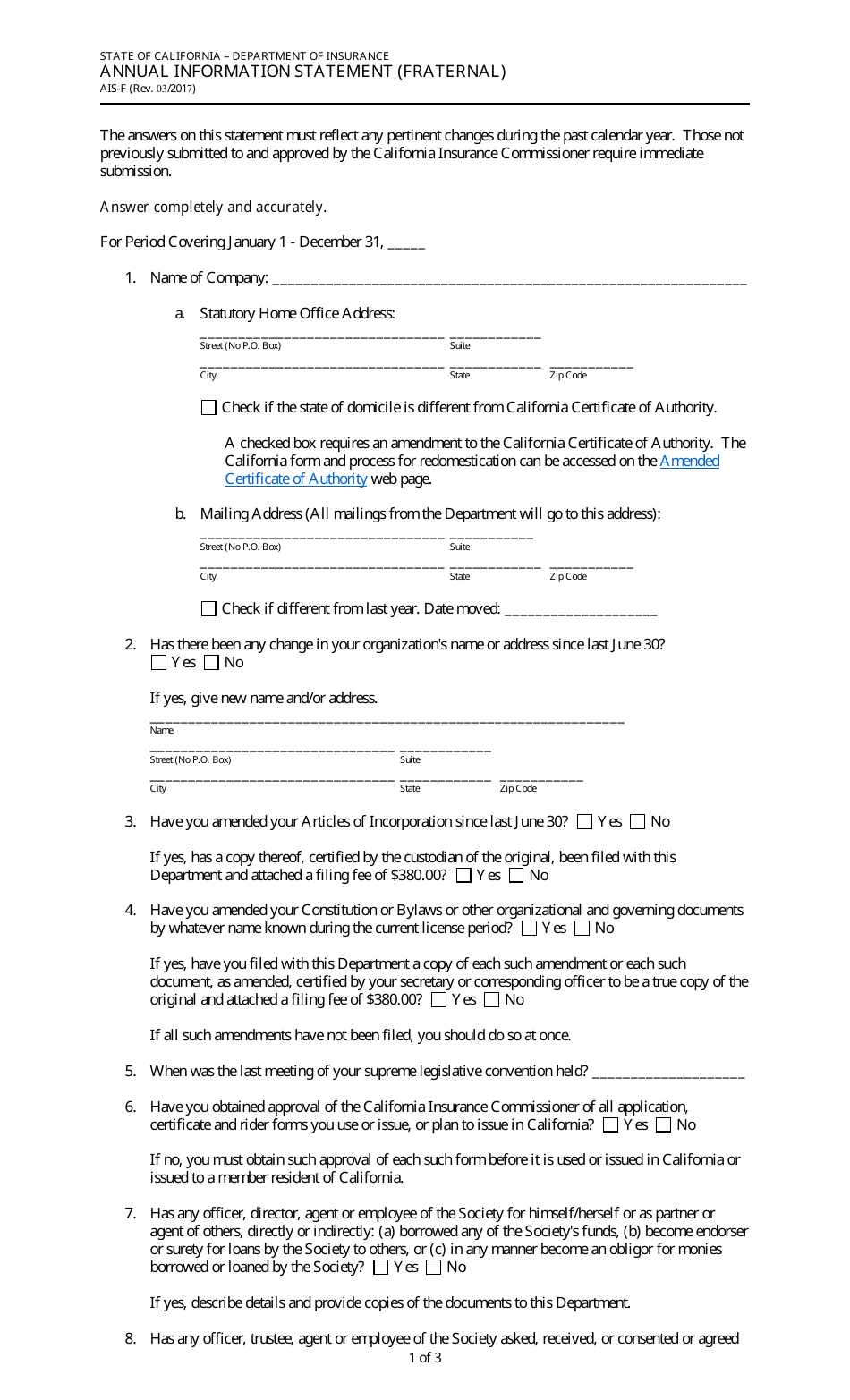

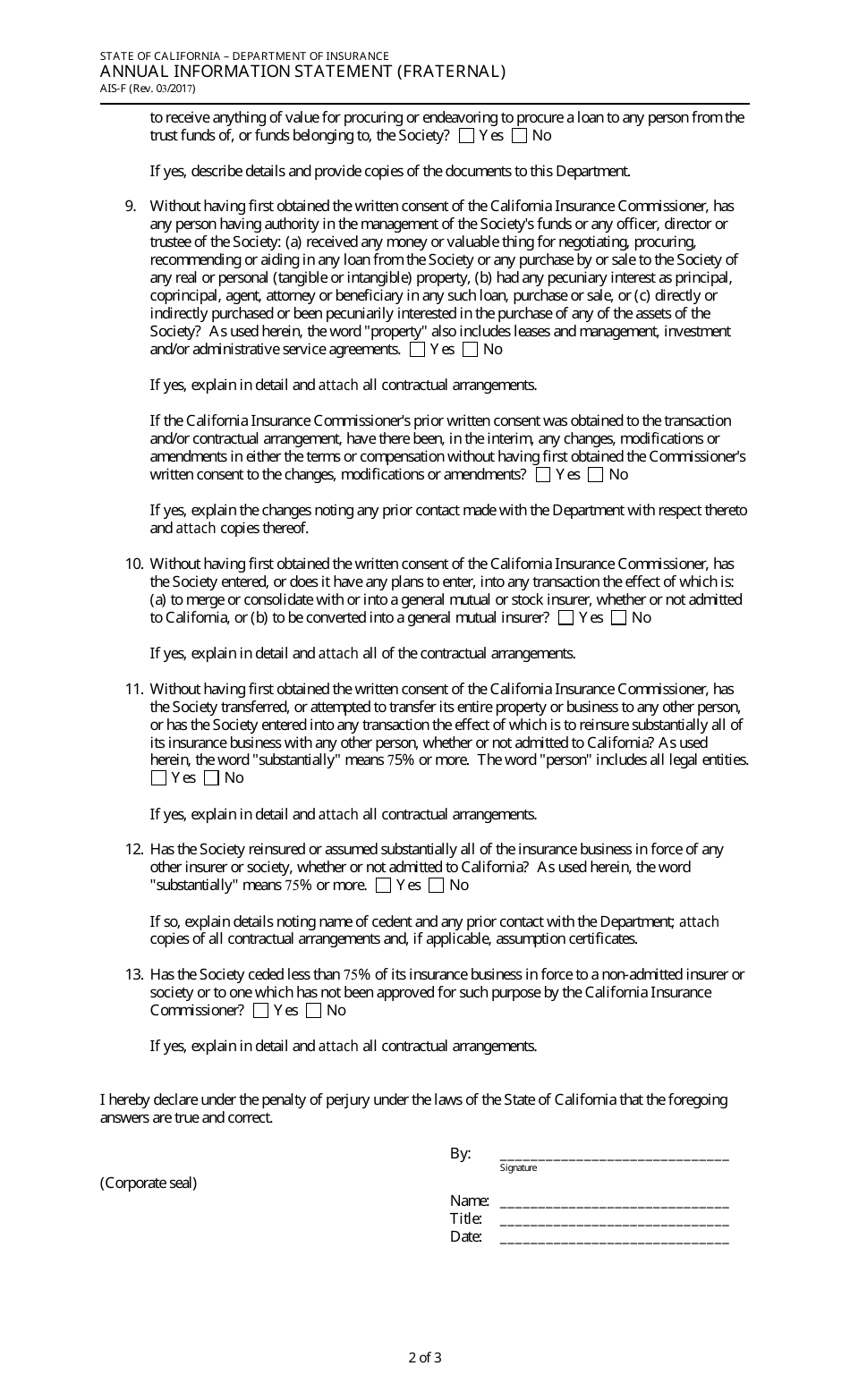

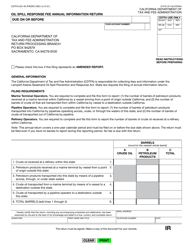

Form AIS-F Annual Information Statement (Fraternal) - California

What Is Form AIS-F?

This is a legal form that was released by the California Department of Insurance - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an AIS-F Annual Information Statement?

A: The AIS-F Annual Information Statement is a form that fraternal organizations in California must file to provide information about their operations, financial status, and charitable activities.

Q: Who is required to file the AIS-F Annual Information Statement?

A: Fraternal organizations operating in California are required to file the AIS-F Annual Information Statement.

Q: When is the deadline for filing the AIS-F Annual Information Statement?

A: The deadline for filing the AIS-F Annual Information Statement is typically the 15th day of the fifth month after the close of the fraternal organization's fiscal year.

Q: How can I obtain the AIS-F Annual Information Statement form?

A: The AIS-F Annual Information Statement form can be obtained from the Franchise Tax Board in California.

Q: What information is required to be included in the AIS-F Annual Information Statement?

A: The AIS-F Annual Information Statement requires information about the fraternal organization's financial activities, membership data, charitable contributions, and other relevant details.

Q: Are there any fees associated with filing the AIS-F Annual Information Statement?

A: Yes, there is a fee associated with filing the AIS-F Annual Information Statement. The fee amount may vary.

Q: What happens if a fraternal organization fails to file the AIS-F Annual Information Statement?

A: Failure to file the AIS-F Annual Information Statement may result in penalties or the loss of the organization's tax-exempt status.

Q: Is the AIS-F Annual Information Statement different from the Form 990?

A: Yes, the AIS-F Annual Information Statement is specific to fraternal organizations in California, whereas Form 990 is a federal tax form for tax-exempt organizations.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the California Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AIS-F by clicking the link below or browse more documents and templates provided by the California Department of Insurance.