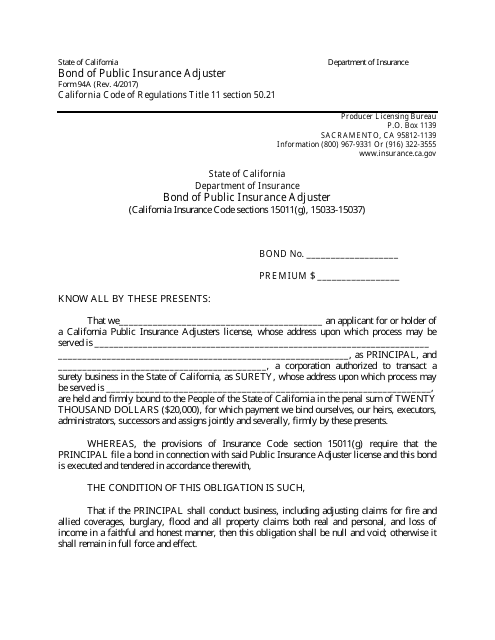

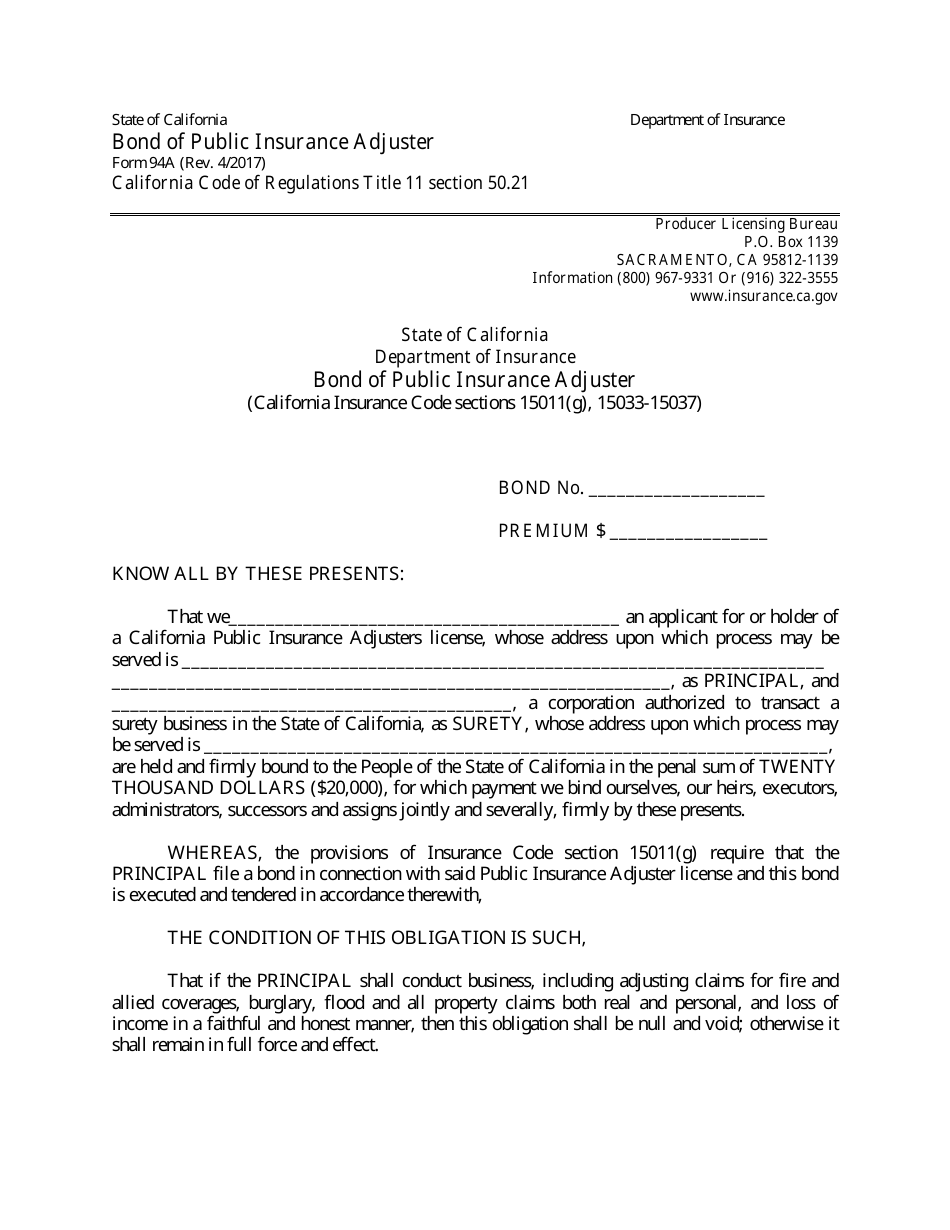

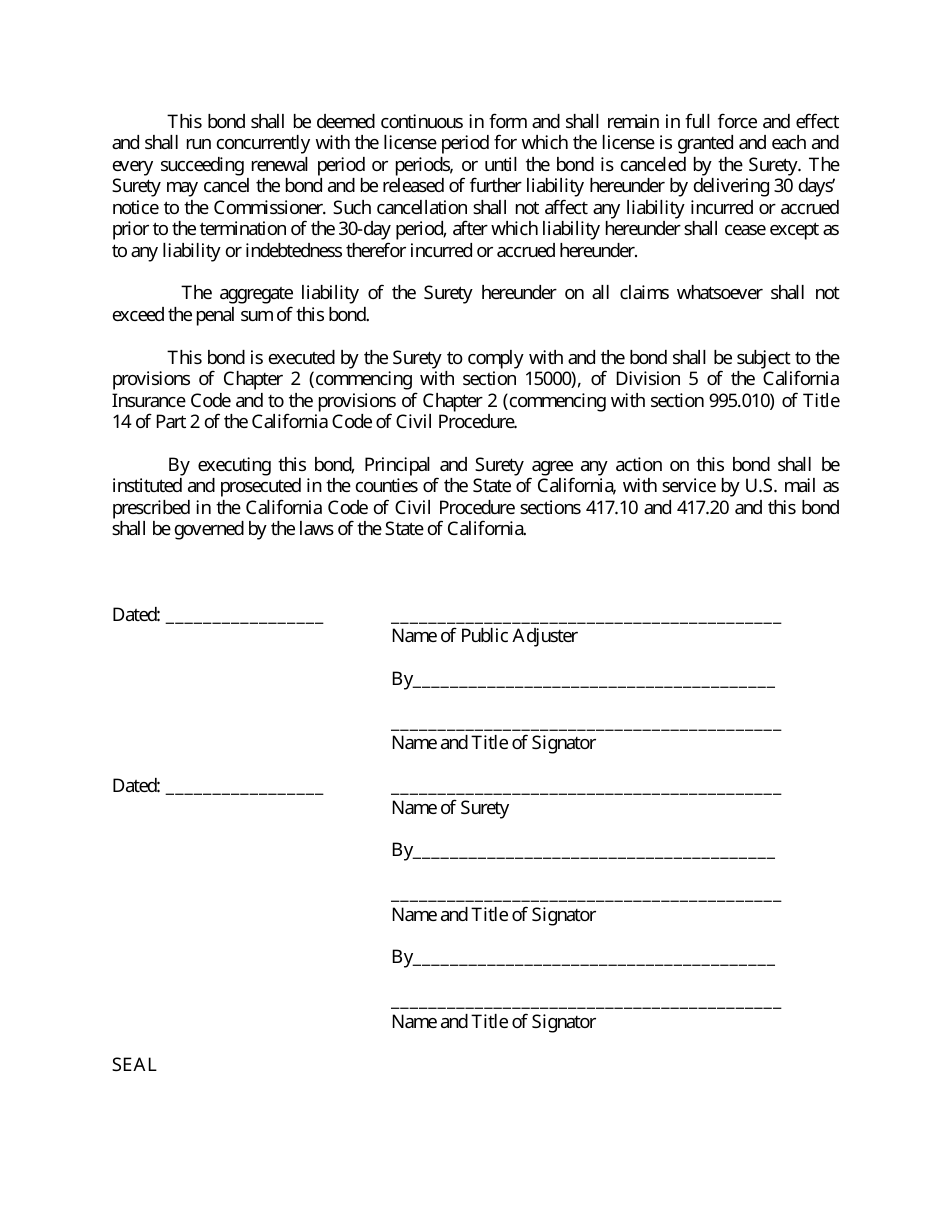

Form 94A Bond of Public Insurance Adjuster - California

What Is Form 94A?

This is a legal form that was released by the California Department of Insurance - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 94A?

A: Form 94A is the Bond of Public Insurance Adjuster.

Q: Who needs to use Form 94A?

A: Public insurance adjusters in California need to use Form 94A.

Q: What is the purpose of Form 94A?

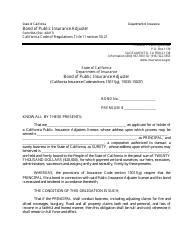

A: Form 94A is used to provide a bond to guarantee the performance of a public insurance adjuster.

Q: Are there any fees associated with Form 94A?

A: Yes, there are fees associated with Form 94A. Please refer to the California Department of Insurance for the current fee schedule.

Q: What happens if a public insurance adjuster fails to comply with the terms of the bond?

A: If a public insurance adjuster fails to comply with the terms of the bond, a claim can be made against the bond to compensate the affected parties.

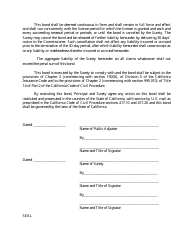

Q: How long is Form 94A valid?

A: Form 94A is valid for one year from the effective date.

Q: Can the bond amount be changed after it has been filed?

A: No, the bond amount cannot be changed after it has been filed.

Q: Is Form 94A required for all public insurance adjusters in California?

A: Yes, Form 94A is required for all public insurance adjusters in California.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the California Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 94A by clicking the link below or browse more documents and templates provided by the California Department of Insurance.