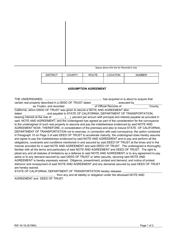

Form S-5 Agreement of Assumption and Guarantee of Workers' Compensation Liabilities for Group and Affiliate Members - California

What Is Form S-5?

This is a legal form that was released by the California Department of Industrial Relations - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-5?

A: Form S-5 is an Agreement of Assumption and Guarantee of Workers' Compensation Liabilities for Group and Affiliate Members in California.

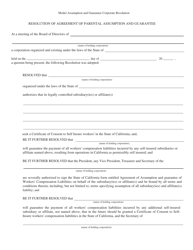

Q: What does Form S-5 do?

A: Form S-5 is used to transfer workers' compensation liabilities from a self-insured employer to a group or affiliate member.

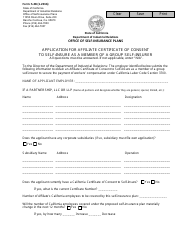

Q: Who uses Form S-5?

A: Form S-5 is used by self-insured employers in California.

Q: What is the purpose of the Agreement of Assumption and Guarantee of Workers' Compensation Liabilities?

A: The purpose of the agreement is to shift the responsibility of workers' compensation liabilities from one entity to another within a group or affiliate.

Q: What are workers' compensation liabilities?

A: Workers' compensation liabilities refer to the financial obligations that an employer has to provide benefits to employees who are injured or become ill due to work-related activities.

Q: Is Form S-5 specific to California?

A: Yes, Form S-5 is specific to California and must be used by self-insured employers in the state.

Q: Can any employer use Form S-5?

A: No, only self-insured employers in California can use Form S-5.

Q: Is Form S-5 legally binding?

A: Yes, Form S-5 is a legally binding document that transfers workers' compensation liabilities.

Q: Are there any fees associated with Form S-5?

A: Fees may be required when submitting Form S-5, depending on the policies of the California Department of Industrial Relations.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the California Department of Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S-5 by clicking the link below or browse more documents and templates provided by the California Department of Industrial Relations.